I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Bilt Rewards unveiled their three new credit cards and it’s a really interesting slate.

The Bilt Palladium card is going to be my go-to for spending that doesn’t earn a bonus on other cards. It earns 2x on all spending, and Bilt’s points are more valuable than other currencies (more and better transfer partners, better portal value) and you can earn additional bonus points as a cardholder when you pay rent or mortgage.

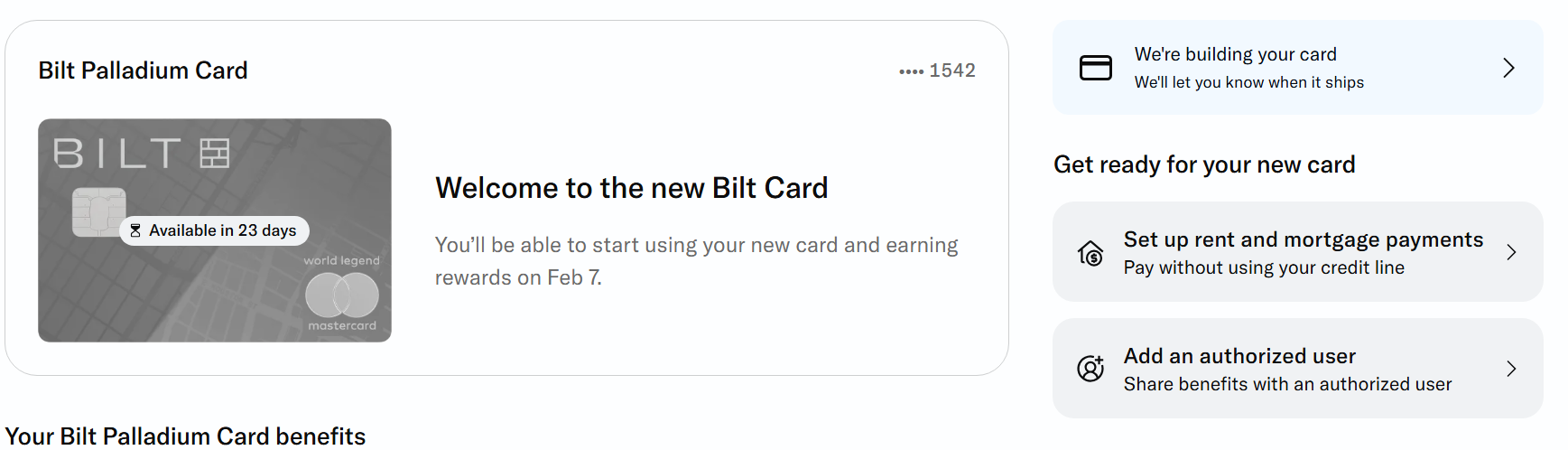

I applied for the card, it didn’t go exactly as planned, so I thought it would be useful to lay out for y’all what happened.

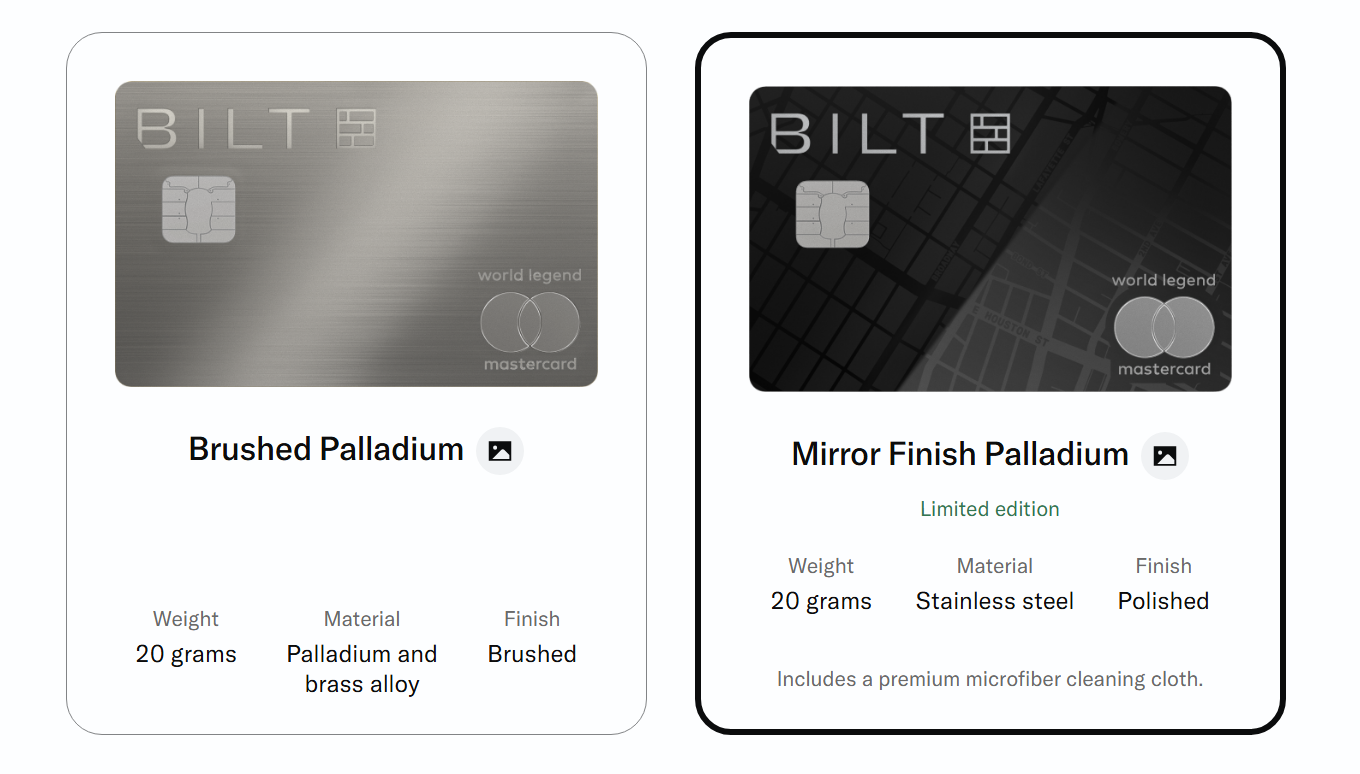

First, I was given the option to pick the mirror card. It’s actually kind of beautiful. I wouldn’t choose a card for the finish, but it’s nice nonetheless.

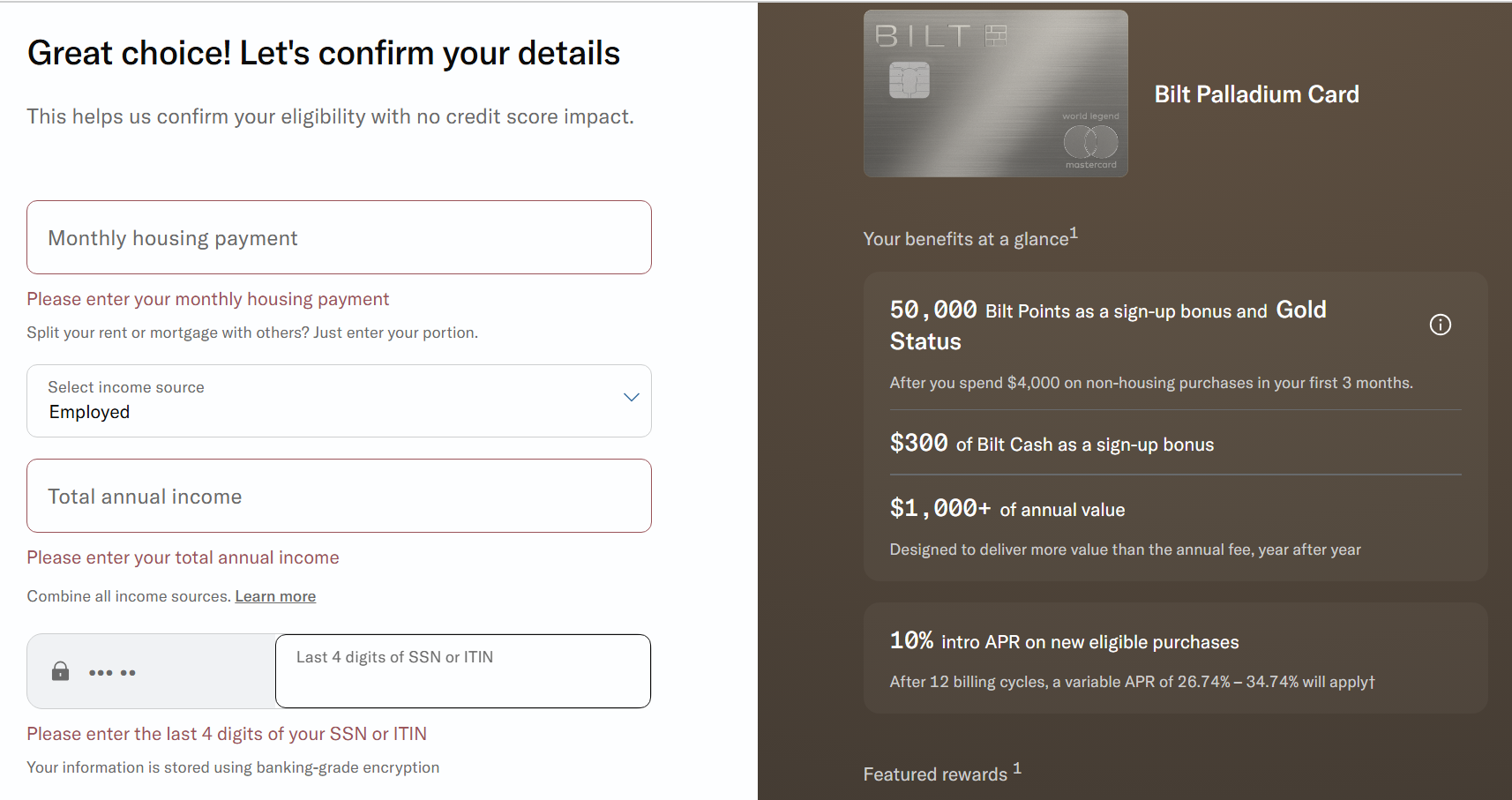

They had information I’d previously shared for my last Bilt card, and I just had to confirm it. I submitted, and the system did its thing for a few moments.

Three things happened during the application that were different than I expected.

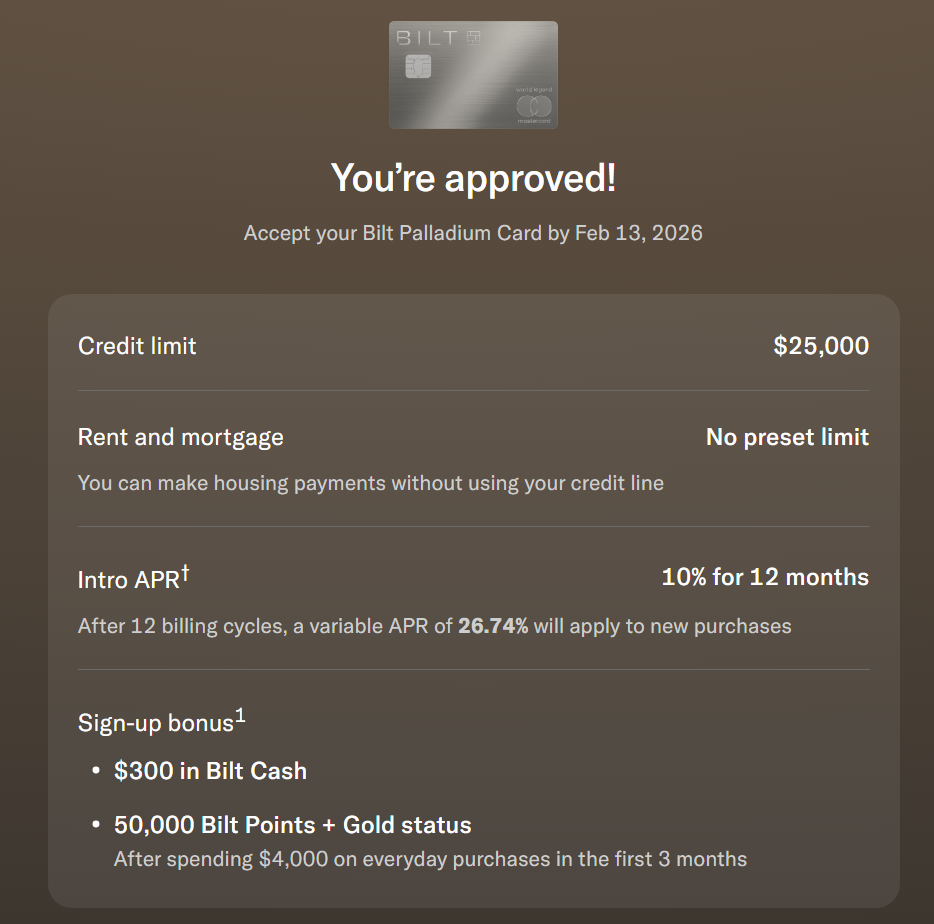

- I got a significantly smaller credit line than my current Wells Fargo card. I had understood credit lines were supposed to be matched, and they gave me half.

- I got a hard credit pull. I don’t actually care about this, since I knew I would get a Chase 5/24 strike for the application either way. I’m not worried about too many hard pulls right now. But apparently it was a glitch they were experiencing for part of the day when I applied.

- I didn’t get the offer to close my Wells Fargo card the way it’s promised. That’s no big deal. I don’t actually want a Wells Fargo Autograph card. But I’m not going to cancel it.

I plan to keep Autograph and at some point convert it to Active Cash which is basically a 2x card, that I may someday pair with an Autograph Journey card which earns 5x on hotels, 4x on airlines, 3x on dining and other travel. They just need more points transfer partners.

Introduction Of The Palladium Mirror Finish Card

Something I did not realize when I applied: they gave The Points Guy a better offer than is available in their app, and better than what’s available at the link they gave me.

The standard offer for Palladium is 50,000 Bilt Points + Gold Status after spending $4,000 on everyday purchases in the first 3 months + $300 of Bilt Cash. What they gave to TPG is 5x earn in the first 5 days, up to 50,000 points, on top of this (this appears to be an extra 3 points per dollar for a total of 5, not 5 bonus points per dollar spent).

Initially Bilt’s Richard Kerr posted that this was incorrect but later said that, indeed, using that link gets you both offers.

Frankly, I’m pretty pissed off at them for giving me an inferior link for y’all. Mostly I’m mad they did it and didn’t say they were it. I didn’t share my own link before seeing this, though.

- Some of you aren’t going to immediately put big charges on the card the first five days you have it, so it might not be super material.

- But you deserve the choice whether to use the standard offer (my link) or not. I’d get some benefit when you use my link, just as TPG generates revenue from theirs with the extra offer.

I’d love it if they’d given me an exclusive offer! So I have no beef with TPG over it. I give them credit for pulling a fast one on Bilt. It’s not like TPG wasn’t going to promote an actually-good card they’re getting paid for! It may wind up costing them applications from other sources, too.

I’ll keep sharing the card, though, because I’m genuinely excited to be earning 2x Bilt points on my spending plus points for the amount of my mortgage payment. The card also comes with Bilt Gold status, which means continued 1:1 points transfers from the Rakuten shopping portal, as well as their Home Away From Home hotel booking program (similar to Amex Fine Hotels & Resorts).

Gary

How is it possible for the TPG exclusivity be that tightly held? Are you surprised Bilt didn’t solicit exclusivity offers from other large affiliates. In your opinion, what $ amount would be fair for an average affiliate to pay for exclusivity?

Also had a poor experience with Bilt transition. Instantly approved the wrong card (application glitch or my human error) and unable to reach support which is chat-only with multi hour wait or “X” — I have no idea why they are using “X” for support.

Looks like the TPG offer is gone- no longer on their website

The points guy is a BILT investor I believe.

how/where to the link/language for the additional 50k in 5 days deal? i dont see it in the tpg link

Gary so you are happy paying 3.3 cents per bilt point to get those points on your mortgage?

You are the target “great user” high monthly spend, high monthly housing cost, love Hyatt, and have little use for the “other uses of bilt cash”

For you this becomes a 3.3x Hyatt play up to 75% of your mortgage.

But most people are NOT you.

If one pays rent, you can pay rent with an Atmos card (thru Bilt) and effectively buy Atmos points at 1 cent each.

If you churn cards for signup bonuses they will generate a much better return than the 2x on everyday spend (and probably you wont spend $495 for the privilege)

The hotel portal is overpriced and the 2 nite minimum both locks in that high price and costs you when a loyalty program is cut out of the picture. So what works is independent hotels, rocket miles seems to be better at this.

What is left is three maybe good things:

Guests on Priority Pass access

Direct uses of Bilt Cash

Potential large transfer bonuses for Gold and Platinum

The uses (and limitations) of Bilt Cash are so far not disclosed. Since Bilt Cash is the “heart” of Bilt 2.0 the lack of upfront disclosure is a red flag and quite the potential risk.

There has been NO confirmation that the Gold/Platinum transfer bonuses will continue.

Now the downsides:

Cardless has HORRIBLE customer service. The bank being used has NO customer service. So Bilt Card users need to pray/hope/believe that they will never need customer service.

Bilt 2.0 counts against 5/24

The credit limits from Cardless seem to make little sense.

Many Gold and Platinum high spend on Bilt 1.0 are being declined for specious reasons (yes me included). Ankur and crew are mystified (to use their word in emails to me) as why this is happening.

Richard Kerr as a spokesperson has been caught telling flat out untruths and spitting out word salad. That is no way to have “bilt” trust and given the risks above trust is essential.

I dont use Hyatt and I live in Boston so United is fairly useless. I use Atmos points.

I am switching to Venture X and paying rent with Atmos.

I am effectively only losing access to Aeroplan transfers. In return no risks no horrible customer service and not having to deal with Bilt Cash.

You as a Hyatt person should do what you are doing. The non Hyatt amongst us should think twice.

Wake me up in a few months when Bilt has more of a handle on what is going on. Whole thing just seems like a mess.

Is there value in a 50k SUB for $495 plus Gold status for 1:1 Rakuten transfers? Sure . After this roll out am I prepared to trust them with paying my mortgage plus shifting non-bonused spend over to get some points? No way.

Further compounding my concerns – not that I would expect to use Bilt Cash for anything other than the $3:100 points unlock for the mortgage, but if you can’t even tell folks what the Bilt Cash program looks like at launch, I think that speaks to the possibility that something is perhaps rotten in the state of Denmark (and I’m not talking about Greenland).

For now, I’ll enjoy the 2/15 and 5/15 1:1 Rakuten transfers, and I’ll think about whether or not I want to engage further with Bilt in June.

I had no issues using the Bilt app application

Gary you are aware Brian Kelly is an early Bilt investor. Of course he will get an advantage.

I come back to making this simple: For heavy spenders who use Hyatt its a great card. For heavy spenders who use United or Aeroplan its an ok card. For everyone else: eh at best.