Bilt Rewards is surveying cardmembers about an overhaul of their product. Today they’re the card that earns points on rent, but they’re almost certainly looking to get consumers using the card for more spending. They’ll be adding points for mortgages, which is amazing. And their points are the most valuable out there. Now we know what they’re thinking about for Bilt Card 2.0.

- The survey is out, and it reveals two possible cards at the no annual fee, $95 annual fee, and $550 annual fee price points.

- As with all such surveys, these may not be the final product (after all, that’s why they’re surveying consumers – to learn). But it gives us an idea of what Bilt is thinking.

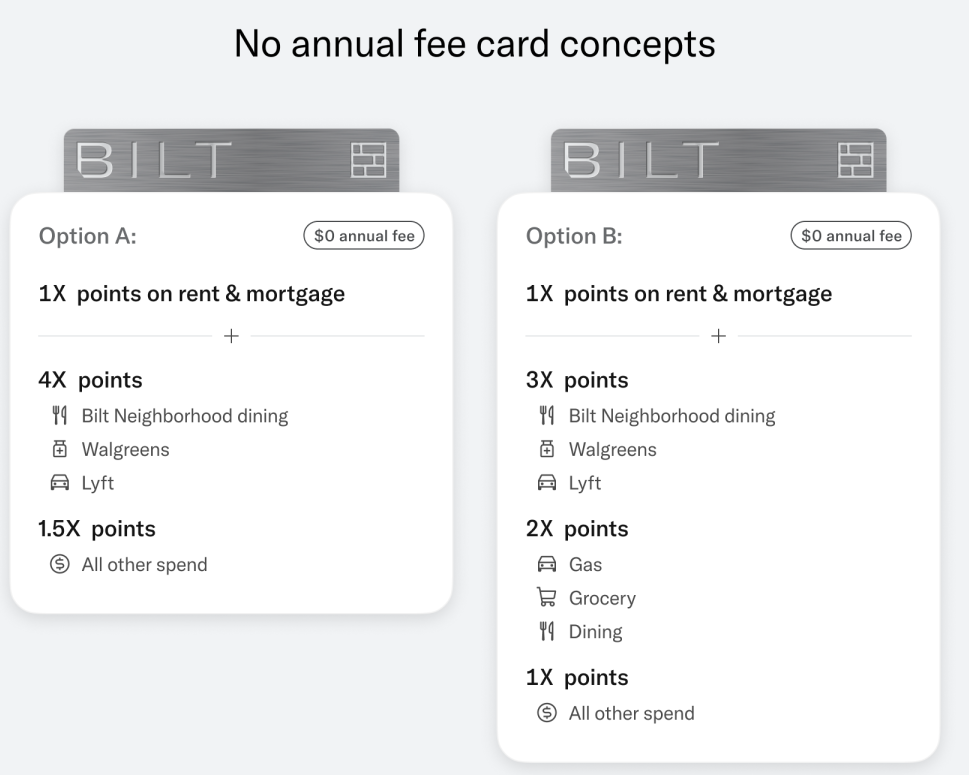

Possible New Value Propositions For The Current No Annual Fee Bilt Card

The current card has no annual fee, earns up to 100,000 points annually paying rent, and earns 3x on dining, 2x on travel, and 1x on everything else. It also earns 4x on Lyft, not counting the 1 point per dollar spent that anyone can earn through the program. (I pay with a Chase card and earn 1 Bilt point as well.)

Here are the two card value propositions being surveyed for the entry level card:

The first card earns 1.5x on everything and 1x on rent. In addition to using it for mortgage payments, this would compete for my everyday spending that doesn’t earn a bonus on other cards. Most of that goes on my Venture X card today.

The second card would see spend for my mortgage – plus whatever other transactions are necessary to qualify for earning points on mortgage. Today that’s 5 transactions a month. I could see that change (such as to minimum spend each month in other categories, or other engagement through the program). I would probably meet that threshold by making it my gas and groceries card (while my wife, who does the bulk of our shopping, would continue to use Amex Gold for groceries).

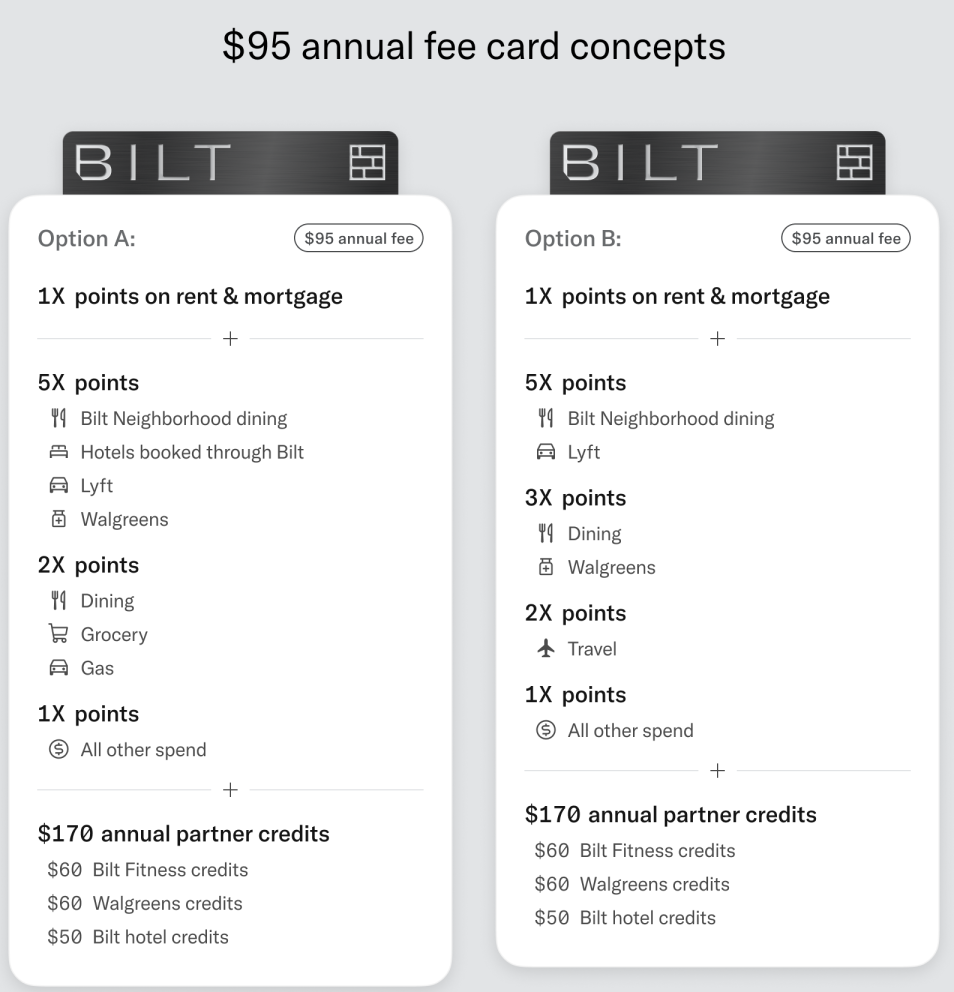

New $95 Annual Fee Card Possibilities

Bilt is surveying two $95 annual fee cards. They’re also surveying a super-premium card. I don’t see them moving to three cards right away so purely guessing I imagine they’re surveying whether to compete at the $95 price point or the $550 price point as much as which card versions work better.

I don’t find either of these cards compelling. I’m not going to book hotels through Bilt’s Expedia portal, giving up hotel points and status-earning and status recognition and dealing with Expedia for customer service, so 5x on those hotels isn’t attractive to me. Neither is 5x on Lyft, since I do better than that already with Chase.

5x at Walgreens will be attractive to some heavy card spenders, for obvious reasons. The cards aren’t obviously better otherwise than today $0 annual fee card except for the ‘coupon book’ of Bilt Fitness credits, a $50 Bilt portal hotel credit, and $60 in credits with Walgreens.

Seeing just 2x on most dining with option A is disappointing when the current card earns 3x and it’s the most frequent way I’m happy to use the card (even foregoing 4x from Amex Gold to build my Bilt balance).

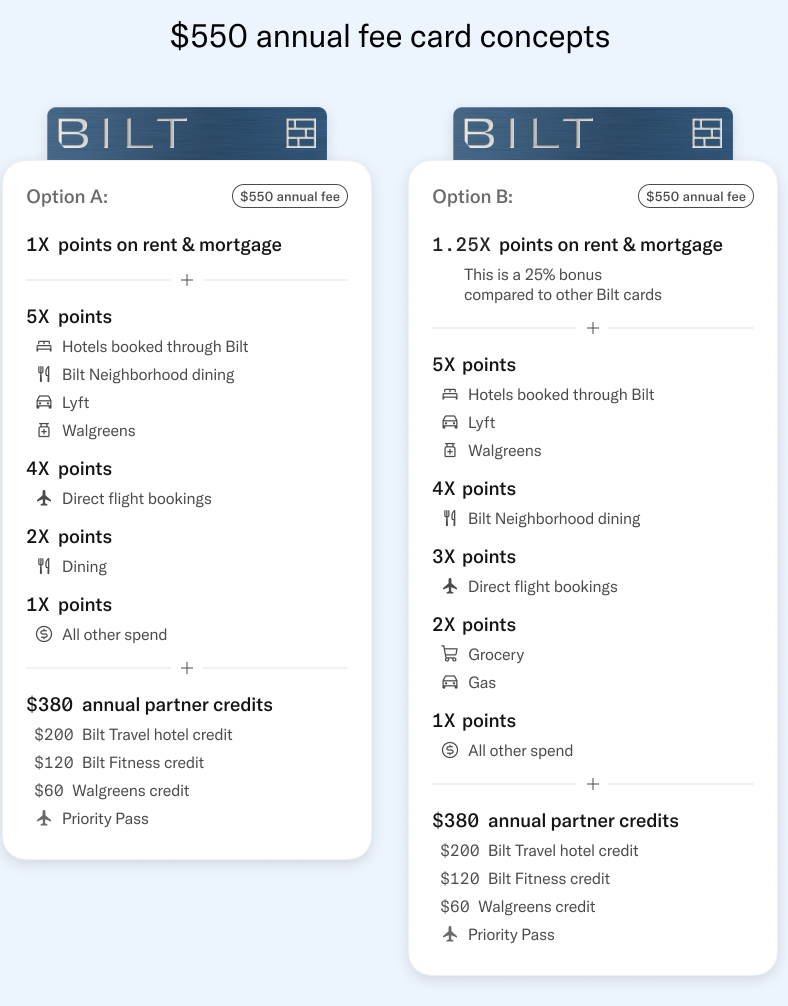

Two Possible $550 Annual Fee Premium Cards

Bilt is surveying two potential cards at the $550 annual fee price point. I don’t think I’d pay $550 for either.

There’s no real special earning here. In the version A that offers 4x on flights they might earn some of my flight bookings away from Amex Platinum’s 5x. It only earns 2x on dining, when the current no annual fee card earns 3? It would no longer even be my dining card.

So what’s the logic of $550 for version A this card? A Priority Pass and a coupon book – $200 hotel credit, $120 fitness credit and $60 with Walgreens. That’s just $380 to the consumer in the best case, but I’m not likely booking portal hotels and the lounge benefit is weaker than Chase, Amex, and Capital One at a higher price point than Capital One which gives a $300 credit for any travel and 10,000 points each year at renewal.

Version B is 1.25x on rent and mortgage. For someone spending $60,000 a year in the category, that’s an extra 15,000 points per year. That’s not nothing, but still doesn’t get me to a $550 card. Earning in other categories isn’t compelling, though at least it’s 2x on gas and groceries. The coupon book and Priority Pass is the same. This version is closer to working.

If I wasn’t the kind of customer who took $550 cards, and therefore didn’t already have a Priority Pass, it might even make sense. But Priority Passes are a drug on the market at this point. Everyone has Priority Pass. And if a customer is going to select their first premium card, is this the right one to choose?

What’s Missing From These Cards

It’s striking to me that Bilt isn’t using its elite status – which has real value – as a tool for card adoption and spend. As a Bilt Platinum I’ve had access to amazing 100% and even 150% transfer bonuses, and some fantastic status opportunities. I’m an Air France KLM Gold thanks to Bilt, which gets me free exit row seats (and bags and boarding) on Delta. I took advantage of Alaska MVP Gold. I’ve booked my free Blade helicopter transfers.

Giving some starter status the first year with an annual fee card, and a fast track to earn higher status with the pricey card, seems to be an obvious thing they could do that is unique to Bilt and where customers engaged with the Bilt ecosystem would see value.

Ultimately there are two ways to succeed in credit card rewards: spend more on rewards than anybody else (but that’s ultimately a bad business proposition for most) or invest in rewards tailored to your market, that your customer values at more than it costs to provide.

The first cards to really get this were the Frontier Airlines Mastercard (the fist card to count every dollar spent towards status) and the Hyatt Visa, since spend earns an unlimited number of qualifying nights and the program offers rewards for every 10 nights achieved. The cards pair well with the programs, and become highly prized by customers who value those programs as a tool for achieving the things they want.

The no annual fee 1.5x earn card is attractive to me, because I love my Bilt points. The annual fee cards, I think, need to lean in more into what can Bilt deliver for customers that they cannot get on their own? They need to become a tool that opens doors. Amex, Chase, and Capital One have lounges that they open. Bilt has a great sense of style and relationships and leveraging these for their premium members is the path towards win-win.

The Version I Hope They Choose

I hope Bilt goes with the no annual fee card that earns 1.5x on everything. I would put significant spend on the card for that. However, since that’s not even an option being surveyed for the $550 version, it seems unlikely to me that it makes the final cut? On the other hand, ‘Sapphire Preferred but a little better’ seemed like the model for the original no annual fee card, and 1.5x is a Freedom Unlimited staple so maybe?

I think the key for an annual fee product is to offer something unique in the market. What can they deliver for customers where the need isn’t already being met? I’m surprised but also not surprised to see the Amex coupon book model here. After all, it’s a successful path for getting customers to accept annual fee increases, and Bilt’s Chairman is the former CEO of American Express. Still, it’s a lot of work for a consumer to get a value proposition to make sense – and the cards then need to really be worth the work.

I just don’t think they’ve come up with a killer app yet at the $95 or $550 price points so hope the surveys tell them that. When Venture X came out, they hit a lower annual fee than comparable cards while delivering 2x on all spend and a promise of their own lounge program not just Priority Pass. Amex Platinum is lounges and status and 5x on flights. Sapphire Reserve is 3x on travel and dining, at least, and now their own lounge product too.

Don’t most mortgage services not let you pay w a credit card ?

Option A no fee or bust.

@Ren – this is like a billpay service. They send an ACH or a check like it’s coming out of your checking account.

Fundamentally, Bilt’s $95 annual fee competition is the combination of the Wells Fargo Autograph Journey (5X/4X/3X) and Well Fargo Active Cash (2X). Anything short of that is simply not going to attract me . . . and, perhaps, many others. (Before anyone rebuts regarding WF’s stable of transfer partners, it will expand.)

PS – If Bilt intends the big annual fee card to be the silver bullet card — which would need to match the two-card combo that I previously mentioned — then, yes to Priority Pass. But, if the intention is to not be the silver bullet card and not match the combo, then who needs yet another Priority Pass membership? Good gravy!

@Jack — Agreed. So much PP. Bah!

Already with Sapphire Reserve, Platinum, Aspire, Brilliant—have brought a guest but not 5-10 guests (most of them have access on their own PP anyway!). I doubt someone willing to pay $500 for a premium Bilt card doesn’t have one of those other cards already.

I canceled my AMEX Gold and use the BILT card for 3x in dining. It seems dining is getting gutted in most of their proposals.

I don’t currently have a Bilt card.

However, I do intend to jump on when they do mortgages. 5x on Walgreens and 3x on Groceries would be absolute must haves for me. 3x on Dining or 2x on Groceries would also be ok.

@Mangar — It’s actually a fascinating pivot for BILT, from younger renters, to more established mortgage holders, and perhaps those with large co-pay spend with the pharmacy at Walgreens.

For groceries though, there may still be several better cards, like Amex Blue Cash Preferred at 6% back up to $6,000/calendar year (their no fee one is 3%), Citi Custom Cash 5% category up to $500/mo (no fee), Chase Amazon Prime 5% unlimited at Whole Foods (the card has no fee but you need Prime), or Citi Costco 2x if you stock up on food there. You probably already knew all this anyway. Good luck.

I wonder:

On a $550 card

1x mortgage and rent, 1.25% if platinum status

Bilt Silver Status for Holding the Card (and 20% lower status thresholds or something similar)

1.5x everything

3x travel, dining, streaming

5x Walgreens, Neighborhood Dining, Fitness, Hotels Through Bilt

coupon books

PP (with PP restaurants and experiences unlocked at 100k of annual spend, also getting those restaurants to join the Neighborhood Dining ecosystem in the US).

I’ll get one when I can get points for mortgage payments.

I took the survey. One of the options should have been, “None of the above”.

@Mike P — Bah! Thinkin’ outside the box. This guy…

Needs a signup bonus for me to get into it.

@Johosofat — Sometimes it is not just about the SUB.

With BILT, i’s not an easy one, like, Barclays AAviator, where a single $1 purchase got you 70K AA points for the low cost of the $99 annual fee. I wish.

Instead, BILT offered 5x points for the first five days of card opening, with a limit of up to 50K of their points total, so $10,000 spend for $500-1,000 in value, depending on where you transfer to (better value to partners like Hyatt, like their redemptions are often 2 cents per point at breakeven). You had basically know that in-advance, and have some major ‘spend’ ready to go.

If you pay rent (or some equivalent), you earn 1 point per dollar, up to 100K points/year, so depending on your total ‘rent’ costs, it’s been like getting up to $2K in value each year. Keep in mind, hardly any other product offered this option without an expensive 1-3% convenience fees. Usually, we’re sending ACHs for this, earning nothing.

Then there were the Rent Day 2x points, which used to be up to 10K bonus, now just 1K, so that’s diminished a bit. But those were the real sweet spots, and so far, earning on ‘rent’ is still worth it.

You do you.

All of the options above are terrible. I hope they grandfather current customers. If there are no bonus categories that don’t involve purchasing something through Bilt then the card is useless.

For those who already have other premium cards, I like the No Fee option best.

How about:

1.25x on Mortgage

3x on Dining, Gas, and EV charging

2x on Grocery, Walmart, and Amazon spend

1x on everything else

No PP, no junk stuff, don’t build lounges (we’ll use our $500 saved in fees to buy into those)

I’d pay $95 a year for that but less would be even better.

Honestly if they remove 3x dining from their free card I’m going to just spend the minimum 5 transactions per month to get my rent points. Today this is one of my go-to cards for dining.

And 100% agreed that priority pass is a snore of a benefit. Not only is it offered by too many cards, but the lounges have become unusable because of that so it’s been a very long time since I’ve stepped inside a PP lounge. I’m disappointed they are surveying that instead of something much more outside the box, which is what I would expect from some of the people at the helm of their rewards program.

@ Gary — Yawn.

For option B $550 annual fee card. All they have to do is add Staples to the 5x category( that will knock off Chase from my wallet), Add gas and grocery to the 4x category(knocks out Amex Gold and biz gold from my wallet) and 2x spend on everything else (that will knock out venture X). Then I will have one card that rules them all. I can dream. With gamer in chief Richard Kerr himself at the helm….maybe its possible.

If the PP includes restaurants, that could move the needle some for people who regularly use airports with PP restaurant options.

If they want everyday spend, the $550 card should merge more of the multipliers into a one-card solution. 1.5x everywhere, 4x/5x Lyft/Walgreens/Bilt portal, etc.

Right now all the premium cards are either 1x outside category or 2x everywhere with no multipliers. Bilt’s transfer partners may be good enough to get away with 1.5x instead of 2x, but if they offered everywhere *with* bonus categories they could get some traction.

But of the ones listed above, I don’t see anything other than using the 1.5x 0 AF card instead of my CFU.

@Agent355 — ‘Don’t be afraid to dream a little bigger, darling…’ Add in 6x for groceries and streaming services (Amex Blue Cash Preferred), 5x flights/dining + 3 night free at all hotels (Citi Prestige), and why not open proprietary lounges at every airport and stadium in the world. $1,000 AF. Done.

I had the survey, there were other questions about fast track status and which items/categories were most important to you so they covered a bit of what you mentioned that isn’t shown just from the card offerings you discuss. They also asked which you’d ultimately pick and I put the $0 card – as per your review I didn’t really find any one of them compelling enough to upgrade to a paid card – I rarely go to Walgreens, my apartment complex has a gym so the fitness credits are worthless to me, and amex already give me decent credit towards the very few cab rides I take. Will be interested to see what they come out with I guess.