LoungeBuddy is selling lounge passes 20% off if you purchase by 11:59pm Central time on Friday.

- You book for a specific trip, and you can make your booking up to 2 months in advance

- They have a network of ~ 200 lounges to choose from

I haven’t ever purchased a lounge pass through them, I get my lounge access from credit cards mostly. However one reason I’m passing this along is because they have a unique set of lounges not covered by other programs in many cases.

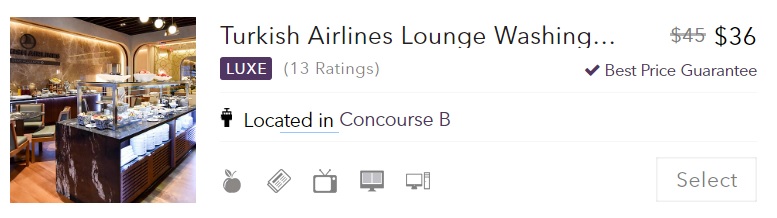

I had no idea for instance that you could pay-in to the excellent new Turkish Airlines lounge at Washington Dulles! (United Airlines Gold members and above can access this lounge free with their membership card and same-day United or other Star Alliance boarding pass by the way.)

You can buy access to the Lufthansa lounge at New York JFK. And you can buy discounted access to the Minute Suites at DFW airport. And the No.1 lounge at London Heathrow.

And I’d gladly use this deal to pay just $23 to access The Haven by JetQuay in Singapore! It offers showers, good food, and private sleep rooms (at additional charge). This one is actually accessible with a Priority Pass, and is one of the better Priority Pass lounges.

The deal is no-risk because they offer a best price guarantee on access, and will let you cancel and refund your booking up to 24 hours in advance.

Question: Are they one-time/visit passes or day passes where you can re-enter the same day after a round-trip flight?

It’s not showing up on my app.