Reader Jim may have been too aggressive in picking up extra Vanilla Reload cards before it’s too late. And he doesn’t have anything to load them onto without waiting a month.

At least that’s his story (he may just be asking about another method to ‘unload’ them).

So he asks if it’s possible to get a refund for his card purchase, and ideally even to get the money refunded by check rather than refunded to his credit card.

And the answer is yes, maybe.

Only the store where he purchased the cards would be able to refund to his credit card. And they generally won’t issue a refund anyway.

On the other hand, Vanilla Reload itself will, but they do not have to, which means that if you have a good reason to ask and do not abuse the privilege they may be willing to just send you a check for the amount you’ve loaded onto a given card.

As it happens, there’s a FAQ for this.

And there’s a page to request the refund.

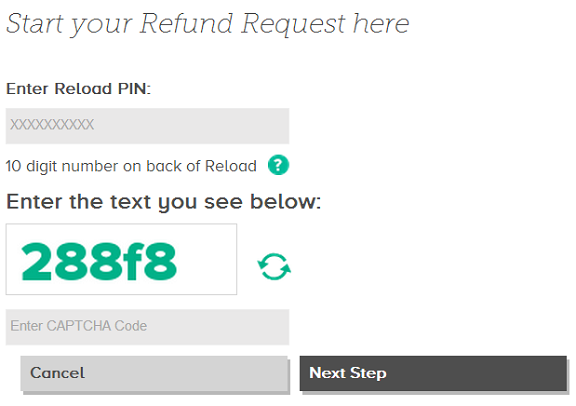

There’s a 3-step process.

You just enter the card number to begin the refund process.

Of course this is not a viable technique for getting your cash out of a Vanilla Reload card on an ongoing basis, but it’s something you can do once in a pinch.

- You can join the 30,000+ people who see these deals and analysis every day — sign up to receive posts by email (just one e-mail per day) or subscribe to the RSS feed. It’s free. You can also follow me on Twitter for the latest deals. Don’t miss out!

Since the party is close to over, I’ll spill the “beans”: I’ve done $20k+ in refunds in the past month. It took about 2 weeks for the checks to show up. When you request a refund you’re given a tracking code, which appears on the check (helps to balance). And the greatest part is that the $3.95 fee is refunded as well.

So long as you obey the float rule this is a solid fee free technique…which will be dead soon. :

You must agree to their Ts+Cs to play their ‘game’. If you don’t agree, they must refund your spend. Its very simple law.

So this is why there are no VRs left on the shelves – people buying them who don’t even want them. Come on people.

Manufactured spend Darwinism in action. Don’t have a plan for how to unload? Then don’t spend in the first place. Can’t handle the float? Don’t spend in the first place. This isn’t a game for everyone

I would say this is more a case of tragedy of the commons. If everyone had just spent 5-10K a year on these cards, to meet high minimum spend requirement for example, CVS probably would have let this go on a lot longer. However, since the benefit of buying these cards was all private and the cost all public (meaning termination of the program) people got greedy/took all the benefit available (depending on your economic viewpoint). Based just on blog reports and comment, many people bought hundreds of thousands of dollars’ worth of vanilla reload cards per year. http://en.wikipedia.org/wiki/Tragedy_of_the_commons

Is it because there is a $5000 limit on loading to bluebird and the guy already hit that limit for month of April? Why doesn’t he just get another bluebird account?

@Milenomics – I wasn’t going to spill those beans (:rimshot:) but since you did . . . 😉 Sometimes by the way you need to read me between the lines.

I have had CVS refund the entire purchase to me, including the $3.95 transaction fee (and I bought a total of $3000+). The manager on duty has the ability to pull up the transaction through their systems and verify if the charges have been approved by the credit card. The transaction was refunded to me because I couldn’t load the purchase onto Bluebird (it was either VR or BB’s issue but I have no recollection). The process was a pain in the ass for the manager but as soon as he realized that my screenshot showed $500 on the VR website and my having problems loading it onto BB, he overwrote the systems and refunded me the $3,000+ onto original form of payment. Credit card showed refund two days later. You need a very, VERY nice AND patient manager to help you out with this.

What next? “But I don’t have the MasterCard I charged those $100k of reload cards to that I don’t need – can CVS just refund me and credit to this nice, shiny new (debit) MasterCard?”

Gary: Perhaps not enough of a different kind of bean for me this morning (coffee). I’ll be reading a little closer to the screen from now on 😉 Still getting used to this whole blogging thing.

@Milenomics Nah, you didn’t do anything wrong 😛 Sometimes you need to read me about hermeneutically. I’ve occasionally joked that certain posts require a Straussian frame as well to fully get. People think I give away the store, and yet…. 😉

@Gary, “People think I give away the store, and yet…. ;)”

FWIW, I’m not in the inner circles of Manspendom, and I’m still able to see some of the ways you contort yourself to not give away the store. I think some of the self-proclaimed High Wizards of Manspendom just don’t want anybody else to know their magic tricks. In many cases they’re no better than a street corner three-card monte player, but they like to think of themselves as on level with the White Wizards of Middle Earth. In any event, I appreciate the service you provide your readers.

@Milenomics, I hadn’t seen your blog before today. You’re off to a great start with the blogging, whether you feel used to it or not!

Let’s be honest, the VR shutdown at CVS was due to illegal/fraud/theft activities. CVS could give a crap about MS folks. I work in Pharma industry and know CVS well, their business model is about getting feet through the door. This is why you find multiple CVS locations within tight geographies. It’s not huge money for them, but they are accustomed to making a few pennies on each of a bazillion transactions.

Buying VR just to process as a refund strikes me as just unethical. There’s plenty of cards to try to cash out.

I don’t see how it’s any different than the old costco buy and return and goes over the line for me.

Gary or milenomics: did you do these individually or is there a way to do several from a purchase at once? ie: milenomics 20k would be 40 submissions, 40 approvals, 40 checks.

I disagree that buying and seeking refund crosses “the line”

I’d like peoples’ opinion on getting an auto loan so that it can be immediately paid off with a mileage debit card, then doing that over and over with different banks. You stiill have one car loan at a time.

Same would be true, and even easier , with a home equity loan that can be paid with debit card. These generally don’t have upfront costs, and I fail to see any illegal purpose. I do see how it could be seen as unethical, but it’s the bank that makes the loan prepayable with no fee. they don’t have to do this.

I’d think Suntrust would likely shut you down rather qickly but UFB has their 120k AA mileage limit and $2500 per day payment limit (starts at 1500). I can’t see how this is anything other than taking advantage of an offer.

After all, Precash (evolve) has been interviewed saying they don’t have a problem and know what’s going on.

I might just have to pay off my 50k car loan 3 or four times in a year to get the 120 k aa miles, but haven;t considered the interest cost due to the fact you can only pay 2500 per day. aT 4% interest, paying 2500 per day, you could pay the loan off in less than a month and interest would be maybe $150 for the 25k AA credit (1 mile for 2 spent). I do like the home equity idea better as you can borrow small amounts.COMMENTS? iS THIS WRONG?

Getting a refund may be more difficult than you think. I put in several requests on April 4 and 5. I still haven’t gotten a check, despite over a dozen calls and a complaint to the regulator in my state. I finally got to speak with someone in compliance, who characterized my request for a refund as a “misuse of the product,” but who ultimately agreed to the refund. It may take as many as 10 business days to get the refund.

I tried to reinstate several cards for May 1, when I could have loaded them, but once a refund has been requested the card is deactived and I was told could not be reinstated.

I would like a refund for a my vanilla personal reloadable prepaid card. I purchased it from Walmart and have not opened the card or registered it. I just want the money. It isn’t the correct card that I wanted and it was a gift. I have the sales receipt for proof of purchase. Could you help me? I have called every number that I can find to be able to talk with a human. Please get back to me ASAP. The card expires 12/17. Thanks Sharon Matson