News and notes from around the interweb:

- With United restarting Washington Dulles – Miami service, American is dropping the route.

- United will launch three times weekly Washington Dulles – Tel Aviv service May 22, 2019.

- An inside look at rebranding a hotel (HT: Ian B.)

- 500 free American Airlines Business ExtrAA points for taking a quick survey on what kind of member communication you’d want. That’s nearly enough points for a confirmed domestic segment upgrade, and more than enough points for a club pass. (HT: One Mile at a Time)

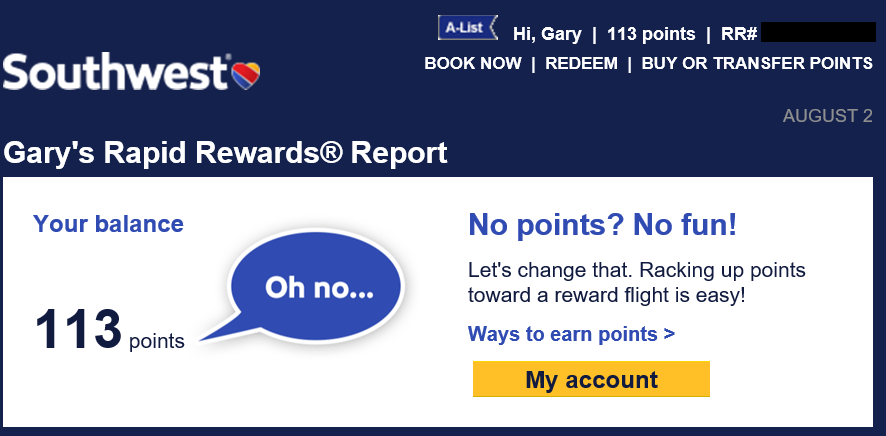

- One of the really nice things about Southwest Rapid Rewards is no change fees, I can make speculative bookings (for instance to connect to international awards I’m redeeming with another frequent flyer program) and then cancel if award space opens up on the other airline that I can include for free. My Southwest points balance is often very low. And I rather enjoy their way of pointing that out to me,

- Flight attendants unions at United and Southwest want the federal government to regulate the temperature of aircraft cabins.

- Interview with the CEO of Chase Card Services on this year’s new cards, fighting fraud, and the $330 million hit (“is what it is”) from faster redemptions than expected. As far as whether Sapphire Reserve is profitable, it “takes years to really understand the returns associated with that product.” She then pivots to the “brand equity that is really hard to quantify” and the “potential for profitability.” In other words it’s not profitable.

Why publish articles about how chase is losing money on us? If they are out there saying publicly that they are not then I am fine with that. Start pushing the narrative that they are losing money and you may generate people looking at chase and demanding it be looked into and a subsequent devaluation in benefits. I don’t see how that would remotely benefit your readers.

Airlines seem not to adequately appreciate the value of locking the customer in offering an expensive credit card with comprehensive set of elite-like benefits. The card itself need not be profitable.

I got in on the 100k Reserve bonus. I only put dining and travel spend on that card (and most airfare goes on the Amex platinum). I have the Freedom, but only spend for the 5x bonus categories, and no more than the max. All balances get paid in full. They’re probably losing money on me on both of those cards. But probably making it up on my Freedom Unlimited, which gets most of my unbonused spend. The Chase cards I keep for the other benefits (Hyatt, IHG, Marriott) are probably close to a wash. They don’t get much spend, but I cannot imagine Chase is paying more for the free night certificates than the annual fees. Chase also gets all my banking business, and treats me well.

If it wasn’t for the Reserve, my unbonused spend would go to Amex.

She did flat out say Sapphire Reserve is profitable. When she said “they are and can be very profitable” she was addressing the part of the question that asked about “cards like those very high end cards.”

And that part about it taking years to understand the “returns” she is just pointing out that while it is profitable now, when they analyze over a longer period they may realize that the reserve is more profitable than they thought if it does things like get people more interested in the other sapphire cards, banking products etc.

@Hepworth Interesting. I have the freedom unlimited and CSR (along with a number of other chase products). However I put all my non-bonus spend on my amex business blue plus which is giving me 2 pts per dollars. You think I would be better off taking the 1.5 points with the freedom unlimited or you don’t have the 2 pt per dollar amex.

I got the feeling the whole interview was scripted in advance . The questions and the answers just came too readily . Regardless , interesting insight into Chase plans and attitudes .

Did anyone notice that Chase travel will not let you book airline tickets more than 270 days out? This is a recent change – it used to be you could book the whole booking window out (typically 351 days). To me this devalues the CSR card dramatically.