I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

When you use your Chase card to buy travel directly — instead of transferring points to miles — you have the Ultimate Rewards online portal and you have phone reps. There are some things you cannot do online, like book Southwest Airlines flights. However there’s a new thing you can do online…

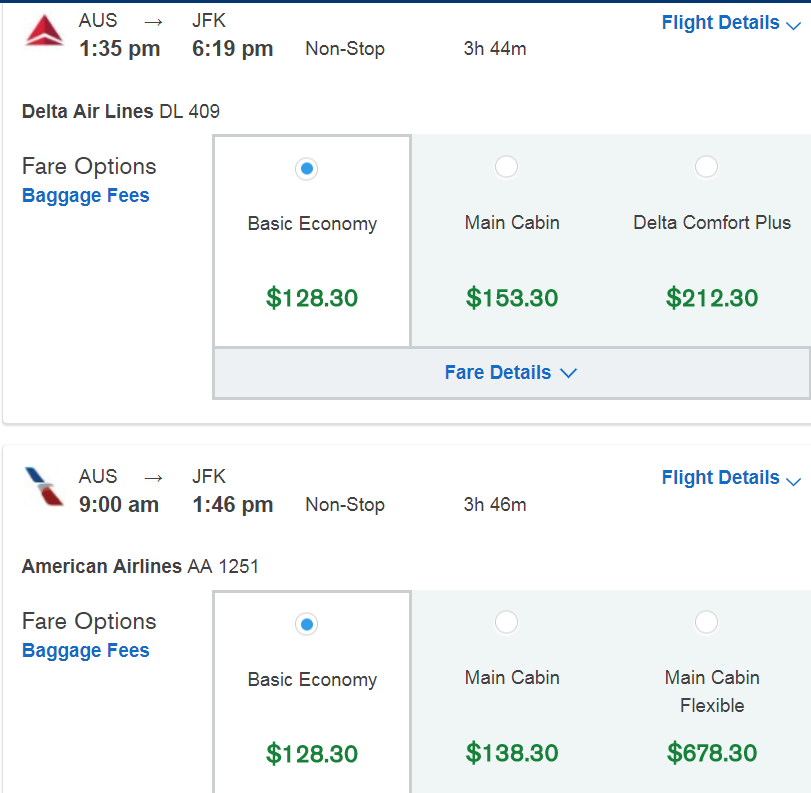

Most online travel sites present you with the lowest fare. But you don’t always want the lowest fare, at least not any more now that American and United have followed Delta’s lead with ‘Basic Economy’ fares and gone a step further by not even allowing you to bring a full-sized carry on bag onboard when booking one of these.

Sometimes it’s just an extra $10 each way, on average $20, to buy out of these restrictions — to be able to get a seat assignment at booking, to be able to make changes (for a fee), and for elites to still be entitled to extra legroom coach seats and to upgrades.

Fortunately the Chase booking portal has been updated to allow you to select the kind of coach fare you’d like to book. That includes avoiding basic economy fares and with Delta booking their extra legroom product which is considered a separate fare instead of just a paid seat assignment.

Here’s an example:

You can pick up the Ink Business Preferred℠ Credit Card and that has an 80,000 point signup bonus after $5000 spend within 3 months. It earns 3 points per dollar on travel — that’s airlines, hotels, rental cars, tolls, even Uber — and 3 points per dollar on shipping and advertising on social media and search engines, so great for anyone who advertises on Facebook or Twitter, or who spends money advertising with Google.

Bear in mind that points with the Chase Sapphire Reserve Card — which has a 50,000 point signup bonus after $4000 spend within 3 months and earns triple points on travel and dining — are worth 1.5 cents apiece when spent directly on paid travel through Ultimate Rewards. And you can transfer points from other Chase cards to Sapphire Reserve, so that those points can then be spent at 1.5 cents apiece.

If you have a Chase Sapphire Preferred Card (50,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening; $0 annual fee the first year, then $95; double points on travel and dining) those points are worth 1.25 cents apiece towards paid travel in addition to transferring to airline miles and hotel points. Transfer the points to a Sapphire Reserve card and they become worth 1.5 cents apiece towards paid travel.

And now you can book that paid travel online while avoiding Basic Economy. Although sometimes basic economy fares are so cheap they’re worth it, or more accurately the ‘buy up’ from basic economy is so absurdly high you wouldn’t want to pay it.

(HT: fanofdeja)

The best travel tip I’ve ever gotten was to transfer (nearly instant credit by BA too!) Chase UR points to British Airways Avios, and then spending those immediately on an American Airlines ticket for 40,000 points less round trip for 2 persons than if I transferred them to AA directly. It takes a call to American once the booking lands in their system to get to pick my seats and have my CitiAAdvantage card benefit of a free checked bag per person, but this still cost me fewer Chase UR points by a lot than buying those tickets straight through the portal (about 2000 fewer points per person).

@CGent you don’t have to call AA to get the seat assignment usually on Avios redemption on AA metal. Just search for the trip using your name and flight info on AA.com. You can then pull it up and most of the time pick your seats, etc. Good tip on the Avios transfer btw.

Obviously, you need to make sure that BA’s site has the AA flights you want but yes, Avios for short AA flights are one of the best ways to use UR.

One should always check points required between point transfer and using the UR portal. The latter has the benefit of counting as actual mileage towards elite status, as an example. For short flights, its worth it to use the UR portal than doing a transfer to the airline to book.

Also waiting to see if this new partnership between Alaska and Aer Lingus will mean the ability to book Alaska flights using UR.

CGent missed out on earning EQM, EQD, & award miles for 2,000 fewer points. The value proposition varies by route & distance flown. Make sure to do your own calculations before deciding one way or another.

Just be wary of using UR points to purchase your ticket through the UR portal…you have none of the benefits of your Visa CSR card. If your flight is delayed, changed, luggage lost, etc., you receive no compensation from Chase. Just had that happen to me with the last N’easter and my flight was delayed resulting in a missed connection. Chase benefits department said I had no benefits.

@RF It was 20K points, not 2K points, and that’s not an insignificant amount. I’d do the same.

@Larry W

That Chase rep was wrong. Don’t blindly trust front-line representatives and what they say.

https://www.chase.com/card-benefits/sapphirereserve/travel

Click on “Trip Delay Reimbursement” -> “Learn More”

“Provides coverage when the common carrier fare has been purchased with an eligible Chase card or with rewards earned on an eligible Chase card”

Also, here:

https://www.reddit.com/r/churning/comments/59j7ha/psa_chase_ur_portal_redemptions_provide_trip/

Just go ahead and file the claim anyway. You have nothing to lose (besides a bit of effort).

@Jay, @Larry,

I wonder if AMEX has the same trip coverage for their rewards redemptions. And, I wonder if AMEX reps are more familiar with their benefits. This report is a major strike against Chase if they want to be taken seriously. It is one thing to have so many benefits that you can’t keep track of them all. It is another problem when the customer knows more than the representatives.

Another, simpler example: I applied for the Amex SPG card, and was approved with immediate notification. With Chase, 16 months ago, I applied for the CSR card, and was left wondering for well over a week if I was approved. By the time they called me to clarify a question, I missed the $300 annual travel rebate for 2016. Chase does not get the consistency award, but the reps that answer the Sapphire phone number are pretty good.

When will one be able to book cruises through the Chase Travel Portal, rather than having to phone?