Chase is relaunching their Sapphire Reserve Card with a new value proposition. They’re also doing something else today: introducing the Sapphire Reserve Business Card.

Until now they haven’t had a business version of the popular Sapphire Reserve card. That’s surprising. Amex has the Business Platinum. Even Capital One has Venture X Business. Yet Chase’s small business cards focused on the entry-level Ink and the mid-tier product that was closer to Sapphire Preferred.

Since Sapphire Reserve was so revolutionary in the card industry, at some level that’s surprising. On the other hand, Sapphire Reserve struggled to make money even though it was popular with customers. Revamping the card value proposition, and re-engineering the economics, paved the way for growth. And one way they’re growing is to offer it to small businesses – far fewer cardmembers, but a lot of spend per card.

In most ways this card mirrors the consumer version, but there are different spend requirements for extra benefits and the merchant partners they offer credits with are different.

- Earning: 8× Chase Travel, 4× direct air/hotel bookings, 3× social/search ads, 5× points on Lyft rides, 1× points on all other spend

- Redemption: Transfer to travel partners, redeem at 1 cent in the Chase travel portal or up to 2 cents per point with Points Boost

- Credits: $300 travel credit, $500 The Edit hotel credit (2× $250 windows per year; two-night minimum stay), $400 ZipRecruiter hiring credit (2× $200 windows), $300 DoorDash ($25/mo) + 1-year DashPass, $200 Google Workspace, $100 Giftcards.com (2x$50 windows), $300 DoorDash ($25/mo), $120 Lyft ($10/mo), $120 Global Entry / TSA PreCheck / NEXUS every 4 years

- Benefits: IHG Platinum status, access to Chase lounges and Priority Pass for the primary cardholder with two guests, Chase’s Exclusive Tables on OpenTable (Visa Dining Collection).

- Additional benefits with $120,000 annual spend: IHG Diamond, Southwest A-List, Southwest $500 credit, $500 Shops at Chase offering products from brands like Baccarat, Dyson, and TUMI.

- Annual Fee: $795, employee cards $0 but those do not receive lounge access

Existing Ink cardmembers can apply for a Chase Sapphire Reserve Business Card. However, it is not possible to product change from Ink Business Preferred to Sapphire Reserve Business.

These credits are near worthless IMO. Basically it’s a difficult to use coupon on overpriced hotels.

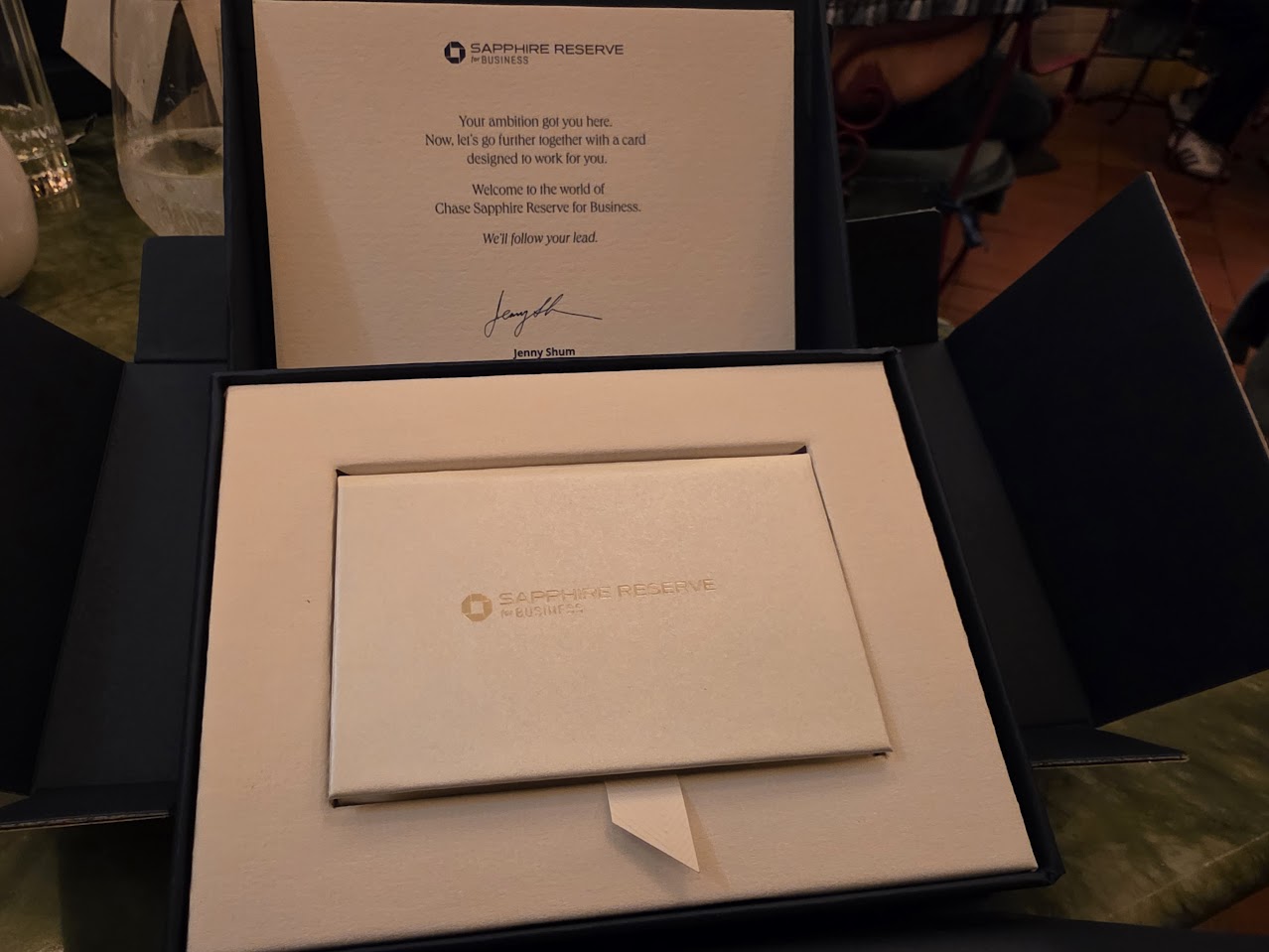

It comes in a box! Fancy!

I’m sure there are people who will add up all of the credits for the products they don’t use to justify joining the elite class of people who get their credit card delivered in a box.

Is the 3x ad spend capped?

Damn, I was hoping for something a little more different from the consumer card. I hope they don’t touch the current IBP setup.

What a Dud.

@ Gary — Yawn. Only thing good about any credit card is a GIANT SUB. What will the initial SUB be?

Is there a bonus for initial spending? If so, what are the requirements?

Odd that they wouldn’t have a bonus.

@Tom K from Seattle- yes there should be a big initial bonus coming, not yet announced (the new version of the card isn’t avialable to apply for yet)

Well, for once, I’m glad to not have a fake business just for credit card sign-up bonuses (see Gary’s go-to example of his wife’s ‘business’), because this card would simply not be worth all the extra effort to lie about it.

Will current Ink card holders be eligible for signup bonus?

The perqs may not be massive but the fee sure is. What a miserable set of coupon “benefits”: I’ve never used Doordash and don’t plan on starting any time soon, the Google whatever is of likewise no use, IHG Platinum status that I already get from my $49 a year card, the Ziprecruiter coupon is too specialized as are the overpriced hotel stays with numerous restrictions. And let’s not forget the Global Entry every four years that I already have on plenty of other cards. Then there’s the impressively poor spending bonus as well. Add on the complete lack of Chase lounge access for authorized users and the miserable 1X earning on dining for what’s supposed to be a travel card (people sometimes eat when they travel) and you’ve got an overpriced card with an extremely limited target market. I’m genuinely disappointed that you’re pushing this card rather than calling out its’ blatant shortcomings.

Will there be an elevated sign up bonus with the launch? I’m eligible for the SUB but not sure if I should apply now to lock in the current annual fee?

@JY – I certainly expect there to be

They should just round it up to $1,000 and throw a pizza party for everyone. They can get the pizza for one of those overpriced millennial joints, that should prove who’s serious. This card has become a joke just like my comment above.