I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

I’ve been looking forward not just to earning a big initial bonus, but to making the most out of all of the credits that come with the Citi Strata EliteSM Card (See rates and fees.) I’m a new cardholder so I’ve been diving into the specifics of the benefits. So here’s what to expect.

$200 Splurge Credit

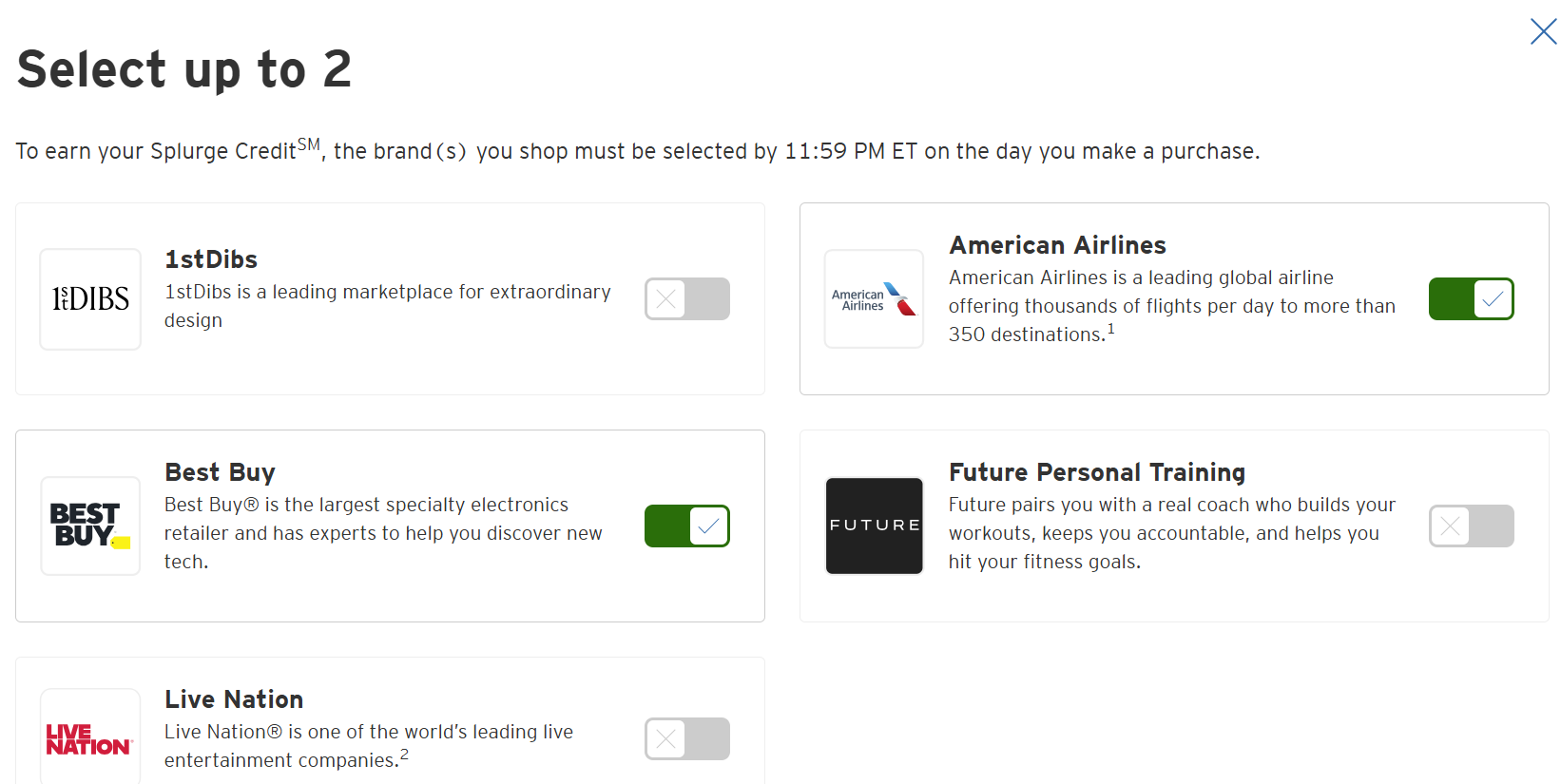

The Citi Strata EliteSM Card offers an annual $200 Splurge Credit. You receive up to $200 back on retailers including 1stDibs, American Airlines, Best Buy, Future Personal Training, and Live Nation.

This benefit is on a calendar year basis. So during your first cardmember year you can actually claim it twice – once during the remainder of 2025, and again at the start of 2026.

You can redeem it across one or more transactions. You don’t need to try to max it out in a single transaction – you won’t simply lose the remainder.

In order to use the credit you first need to register for it and select up to two merchants at a time you’d like to use the credit for. The selection applies immediately (in fact, as of 12 a.m. Eastern time on the day you made the selection.) It may take up to to billing cycles to receive the credit.

The credits can be used at two of 1stDibs; Live Nation; Best Buy; American Airlines; Future Personal Training. Bear in mind that some transactions won’t qualify – it’s based on the merchant of record:

- American Airlines or American Airlines Vacations needs to bill for the splurge credit to count. If you book related products and services with a different merchant of record (which even includes AAdvantage status renewal) those won’t count.

- Live Nation purchases need to be made at livenation.com or ticketmaster.com- – and for events held in the United States – third party fulfilled purchases won’t trigger the credit.

The credit is super easy to use. I’ll just use the card for an American Airlines ticket. (This needs to be booked directly, not through Citi Travel or another travel portal.) Don’t have a booking right away and you’re about to hit end of year? Avoid basic economy fares, but buy a non-refundable ticket. If you cancel the ticket you’ll retain an American Airlines trip credit for future use. Or select Best Buy and make a purchase there.

$100 Semi-Annual Blacklane Credit

Blacklane sets up car services for you all over the world. It’s mostly pre-reserved. They’re in a lot more places than Uber and you’re getting a professional driver. At airports you’ll usually have them meet you at baggage claim and assist with luggage, for instance. And you’re going to get more consistently nice vehicles and better service than rideshare. They track your flight, arrive in advance and wait for you for an allowable time (like an hour).

The card offers a $200 credit each year with Blacklane – $100 January – June and $100 July – December. No registration is required, just pay for Blacklane trips with the card and the statement credits trigger automatically.

In London, Paris and Dubai I use Wheely. Most of the time in the U.S. I’ll use rideshare. But with my family, arriving after a couple of weeks abroad, I may want a car service pickup because the Austin airport makes you schlepp across the road and through a parking structure, changing levels, to reach rideshare pickup. Pre-arranged cars park by the terminal, and the driver is there to help with luggage.

Pricing varies by airport and trip, but it’s often competitive with premium Uber services like BlackSUV.

$300 Hotel Benefit

Each year, Citi Strata Elite Card offers a $300 hotel credit for stays of two or more nights that are prepaid through Citi Travel. (Prepaid rates can still be cancellable and refundable.)

The credit must be redeemed by the primary cardmember and is by calendar year (based on when you book, not the dates of your stay). A new cardmember could use the credit now and again at the start of 2026, so twice in their first cardmember year.

$300 will be applied to your booking when you make the reservation – it’s not a statement credit that posts later. You can also use it across multiple transactions, e.g. if you had a 2-night stay that totaled only $200 you’d still have $100 to use later.

While the card earns 12x on hotels you use it to pay for with Citi Travel, you don’t earn points on the charges covered by this credit.

Consider these OTA bookings. Pricing can vary and you’re often getting the same rate as elsewhere – but not discounted rates like AAA, or member rates. You also aren’t usually entitled to hotel loyalty points, elite stay credit, or elite benefits.

Priority Pass

The card offers a Priority Pass Select membership for the primary cardmember and any authorized users (which are $75 each), valid for unlimited visits and including up to two complimentary guests.. It does not cover credits at restaurants and similar non-lounge offerings like markets that are linked to Priority Pass.

You don’t need to have your physical or even digital Priority Pass membership for access – rather uniquely lounges are supposed to accept your Strata Elite card as the Priority Pass card itself. That means, unlike other issuers, you don’t have to activate Priority Pass membership.

Marco Polo Lounge, Venice

Admirals Club Passes

The card comes with 4 Admirals Club passes per calendar year (so twice in cardmember year one, for eight passes total). Each set of four has to be used during the calendar year in which they’re issued, and expire if unused.

- They are available to the primary cardmember and include one guest 18 years or older plus up to 3 children under 18. They can be redeemed for additional adult companions as well.

- Requires same day boarding pass (departing or arriving) for an American or oneworld partner airline flight.

- Valid for 24 hours, and can be used at multiple lounges on the same day.

- The passes are deposited to your AAdvanage wallet and can be scanned by the Admirals Club front desk for entry.

- Upon card account closure, unused passes are forfeit.

Admirals Club Washington National Airport E Concourse

Applying For This Card Was An Easy Decision

Citi’s new premium card is pretty incredible in the first year, not just because of the strong initial bonus but also because of credits that are timed to calendar year rather than cardmember year. (Calendar year credits can be claimed twice in cardmember year one.)

Honestly, I feel like this was a strategic error on Citi’s part. They’ve constructed a card that is a no-brainer to get. There’s just so much value to the customer up front. I’m not sure if it’ll be a keeper long-term or a card that’s best for your everyday spend (although it is very good).

My take: apply for this card, reap the maximum benefits in year one, and then consider whether it’s right for you in the long-term.

Ordered a last minute Blacklane while on a flight to LAX ,~2 hrs before landing, and the driver was there on-time to pick me up curbside. pretty impressive

(Or, attempt the ‘triple-dip,’ open in early December 2025, pay your 1 annual fee, have the card for less than 395 days, close by late January 2027, within the 30 days of renewal to get the AF back).

Gary,

A lot of attention is being paid to the Strata Elite card, but I’m someone whose budget and frequency of travel made the Strata Premier card a better choice. I hope at some time soon you can write about the benefits of the lower priced card.

Thanks,

Rita

@rkt10 – Strata Premier is very useful for spending! Notice what I’m saying about Strata Elite (lots of attention because it’s new, lots of details of the product to flesh out) is that there’s a good up front bonus and a bunch of benefits… I actually don’t think this is the best card for most spending!

What is “rideshare”?

Are the Admiral’s Club passes transferable? Would like to give them to family members as I have a membership and don’t need them.

Admiral club passes T&C require primary card member to use one and they can use others on same visit. Mine this year will go to waste unfortunately.

The splurge works on AA gift cards, no need to buy I ticket you don’t want to use- or put more than $200 on the card for AA if you get a better return on airfare elsewhere. I just saw the meter move on a $60 gift card.