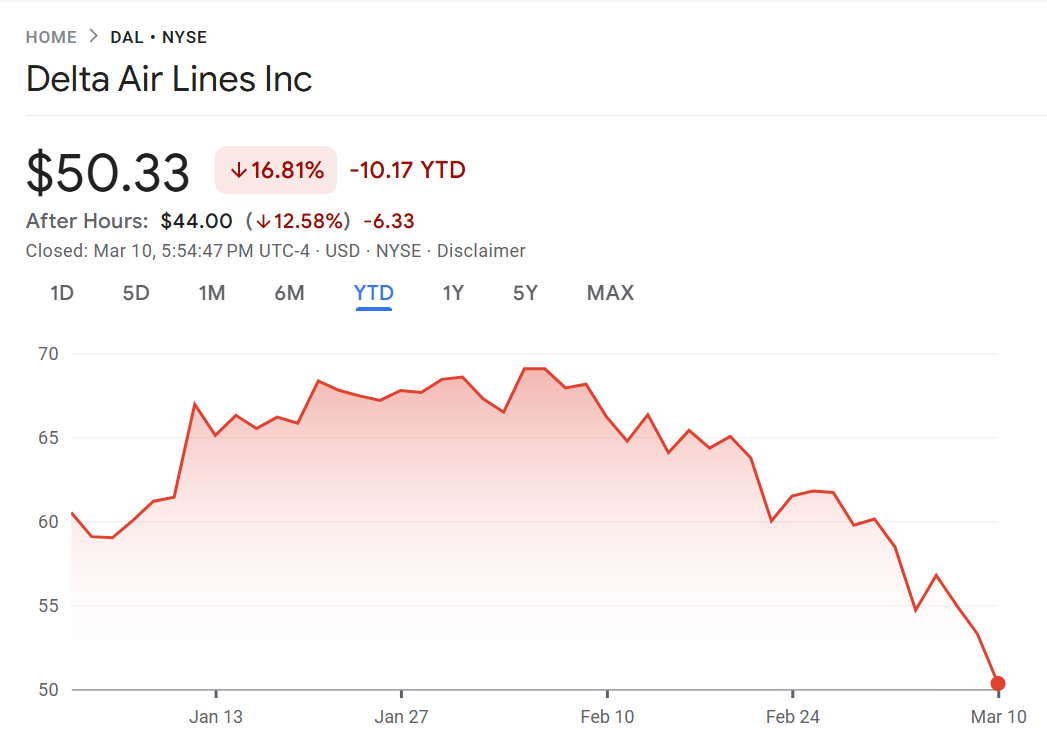

Delta Air Lines filed an 8-K this afternoon with updated financial guidance, in advance of presenting at J.P. Morgan 2025 Industrials Conference. And the news is not good. They’ve cut first quarter revenue growth in half – and earnings per share down 50% – 70%.

The outlook has been impacted by the recent reduction in consumer and corporate confidence caused by increased macro uncertainty, driving softness in Domestic demand.

Delta does say that “premium, international and loyalty revenue growth trends are consistent with expectations” which suggests that weakness is domestic but not yet affecting what they’re seeing in co-brand credit card spend from American Express. That surprises me, although perhaps there’s a lag in Delta’s visibility into consumer spending trends.

I’ve been suggesting for some time that I thought this summer’s travel would have some weakness. American Airlines launching promotions to goose March (bonus loyalty points, Flagship lounge passes for businesses) told me that things were already weak there.

Tomorrow’s conference comments – where American and United will be represented as well – should be interesting. It was this event five years ago where United’s Scott Kirby raised the urgency level across the industry over Covid, American’s Doug Parker kept largely to his status quo ante script, while Delta’s Ed Bastian struck something of a middle ground.

I wrote recently that President Trump’s tariffs could bring back the best frequent flyer deals in 15 years.

Crashing the economy is a bad thing! But it’s not equally bad in all ways. In fact there are always some beneficiaries. It just so happens that one of those is likely to be the value of airline miles.

Fewer seats sold mean more empty seats in the short run, and programs often liquidate those seats as saver inventory through their frequent flyer programs and try to goose incremental business by offering loyalty program bonuses.

Even Delta does this – though when they do it doesn’t seem like a deal compared to other programs, only compared to the miserly approach they usually take with the SkyMiles program.

As of this writing, Delta’s stock is down over 12% in after hours trading. United’s and American’s are down around 10%, assuming that what Delta is describing represents macro trends being felt across the airlines.

Markets broadly today, though, were down sharply as well. The Atlanta Fed’s GDPNow model predicts -2.4% growth for this quarter. When the model was suggesting negative growth initially, there were arguments that lags and anomalies were driving the number. It has recovered from even lower numbers. But the economy does appear to be in negative territory – bad for airlines, but airlines usually suffer when everything else does, too.

Zero sympathy for me all around.

Gary,

A number of retail companies and others have “sounded the alarm”. This isn’t new news except for impact on future earnings for DL ;and likely other airlines). Personally I’m fine with a recession and correction (or even a bear w over 20% reduction from the highs). Yes it hurts to see my portfolio go down 6 figures in a day but I’m a buyer, not a seller, at these prices and don’t need to cash anything out for quite a while. The market needed to reset, blow off some of the froth and form a base for the next leg up

Delta gets it. Anyone who isn’t willfully ignorant gets it. And no, a recession is not worth the potential deals, Gary.

@AC — Bah! Nice attempt at sane-washing. What happened to the ‘price of eggs’ and fixing everything on ‘Day 1’—now it’s ‘give Him time’ and other excuses. Your ‘team’ is wrecking the economy yet again. It’s His idiotic tariffs. But, but…He’s a ‘stable genius’!

@runningjock-

You’re right, we have zero sympathy for you.

Or did you mean “from you?”

Haha autocorrect

@AC.

Like you, I’m not happy seeing my portfolio down the past week or so however 25% of my portfolio is in cash (fixed income) ready to be deployed.

That being said, I’m not so sure I’ll be deploying it too quickly as I believe the market is still over-valued, not to mention all of the uncertainties, etc.

Regarding Delta…eeks!

1990’s TDS is showing again. As anyone economist I can tell you this has everything to do with the polices of the last 4 years not weeks. Go seek therapy immediately.

I was under the impression, based on the writings of one of your regular commentators, that Delta is the world’s only PERFECT airline. If an airline really is perfect, would it have to cut its investor guidance? Asking for a friend. LOL!

@DesertGhost — Macroeconomics vs. microeconomics. Delta realizes that the overall economy is going to shit; and that as a result, it’s going to negatively affect their bottom line as a company. Tell your friend!

Zero sympathy for a country that was so stupid, it elected this monster twice. The economy is headed for stagflation.

@lavanderialarry — As an American, I have sympathy for all the innocents here and around the world that will be harmed by our failure. We knew better.

Trmp-Msk-Vnce are king of this chaos economy of their making and this month’s stock market crash. They inherited a strong economy from the prior Admin on January 20th of 2025, and already they have trashed it and crashed it.

MAGA and its enablers are bad for America, and it even shows in the airlines’ financials and stock prices. AAL, DAL and UAL nose-dived even further in after hours trading.

Does this mean Ed is making fewer donations to Trump? Me thinks he’s about to have a sizable SkyMiles award “sale” on lots of international business seats.

BTW, how’s the projected corporate spending on the co-branded AMEX cards? Inquiring minds want to know…

Yep, in 2016 he promised to tax the rich more. He dropped their rates. He also promised a health care system better than Obama’s. Eight years later in the debate with Harris he said they were working on “concepts”. And as expected he’s a tool of Moscow, to our national shame. Anybody who trusts this liar is living in dreamland. (Though the worst are those who know better but go along for their own profit and power.) The only good thing will be the reaction at the polls next year, if millions aren’t disenfranchised.

Will be interesting to see how much is felt by UNITED after Delta’s loyalty debacle of 2023.

Thought something was a bit up when they rolled out a ‘earn MQDs on car rentals / hotels’ in March.

ghost,

you clearly have a deficiency in your ability to comprehend reality.

DL is no more perfect than everyone is out to see AA liquidated.

DL is a bellwether for the industry. Analysts were fearful that this exact scenario of weakness would develop and DL is the first to speak the truth that no one wants to hear.

given that AA and UA have already commented on government travel weakness – they are larger than DL in the DC area – and the focus of DL’s comments is on domestic weakness, the outlook for a number of weaker carriers is much worse than what the market now knows about DL

you know.. maybe AA really will be liquidated.

I wonder if this is gonna be 2008-2009 all over again.

Not due to a housing bubble, but due to large parts of the country impoverish and no longer able to pay their mortgages, let alone be able to buy food.

I’ve been sitting on the sidelines waiting for the market to drop so I can reenter. I hope it goes down quite a bit. IMO, the P/E is too high. It is still being affected by the massive spending and money injections of the Covid-19 era and it’s aftermath. For those who dislike billionaires, this should be a good thing as their wealth will take a substantial hit. Buffett has already provisioned for the market retreating.

@GUWonder:

“They inherited a strong economy from the prior Admin” -Not according to POTUS-47’s interview with Faux News’ Bartiromo. She was horrible during her time with CNBC and she’s even worse on Faux.

We have a bifurcated economy between the top 10% who are doing relatively fine (this group skews older and was fortunate enough to be able to buy assets like real estate cheaply and have them appreciate rapidly in value) and everyone else, especially generation Z (which is the first to get laid off, faces record rent prices and high interest rates, and has few good investment opportunities due to overheated asset markets, turning out of desperation to meme stocks and meme coins).

We have a mostly trifurcated airline market. The “poors” who can barely afford basic economy, the aspirational traveler on points, and the elite/corporate traveler. Over the last 20 years the airline industry has tried to promote the idea that everyone can travel with decent frequency, even if enabling this accessibility degrades the quality of the experience (TSA checks, terminal melees, stuffed planes, tight pitch and seat width, boarding group gimmicks, overhead bin space shortages, minimal food and drink, etc).

I think the era of accessible frequent travel is soon going to end. As the basic economy demand sags the savvier airlines will seek to “recession proof” the industry by changing the cabin composition, reducing cabin density and including more business and first class seats. To publicly justify this the airlines will improve their food, beverage, decor, and flight attendant dress and pitch this as a “New Golden Age” of flying. Airfare will be more expensive but the experience will be more comfortable (to justify higher margins to regulators and to assuage the public). More and more non-corporate travel will be done on points, with points accounts being pitched as a de facto “savings account” to the poor, who will have to save up for a long time to afford an aspirational flight.

“driving softness”

Just like my pecker.

Not sure what’s happened to my earlier post, but the (Warren) Buffett Indicator (or Market Cap to GDP ratio) was already primed for a reset from its recent all time highs of over 200%.

Even with the upcoming funding extension in Congress, we are fast-approaching $40+ trillion in debt with $30 trillion in GDP. Wouldn’t be surprised to see the total market cap fall another $10T to $50 trillion later in CY25.

Even in good times 500k for a business class ticket one way?

Who in their right mind would book these extortions

They deserve all their pain as they are crooks on revenue or award

People voted for less regulation.

Now awards are 500k with no recourse to the fact that they promised you something else when you earned the points, and the economy is crashing.

Enjoy

I don’t normally repost the same thing on two sites, but what the hell.

A change in consumer spend would seem to hurt Delta the most.

While Delta has a premium reputation, the reality is they lose, BY FAR, the most money flying passengers. And Delta spends THE MOST money to fly those passenger per ASM despite AA having the shorter stage lengths between AA and DL which should naturally give AA the higher casm between the two.

Delta’s profits come from other revenue like card spend. There are other things that come into CASM but they’re largely things that simply support the flying of passengers like the refinery. United does, by far, the best flying passengers at a profit.

2024 PRASM vs CASM

DL:

PRASM: 17.65

CASM: 19.30

Flying profit/(Loss) per ASM: ($0.0165)

AA:

PRASM: 16.93

CASM: 17.61

Flying profit/(Loss) per ASM: ($0.0068)

UA:

PRASM: 16.66

CASM: 16.70

Flying profit/(Loss) per ASM: ($0.0004)

Delta and Amex fit like a glove but DL is very exposed to their credit card for profitability. As consumers spend less with credit cards and as their mileage devaluation continues, Delta could see the biggest impact. Devaluation works in the short term, but it’s uncharted territory whether it works in the long term.

First there were COVID gimmies that drove consumer spending. After that credit cards for all. Credit card debt has soared to unthinkable levels and defaults are at all time highs. Then there’s student loan debt, car loans (people with $600 to $800 car payments with modest incomes) and other debt. Meanwhile the economy has been slowing for a while despite the lies.

Consumer spending is going to take a dip and airlines are going to get the dummy whammy of reduced demand and inability to race fares coupled with decline in credit card revenue.

There’s not much the current administration can do to offset this other than helicopter cash to the masses.

I expect we might see more merger activity.

@MaxPower — Well, if Delta spends more on its passengers, it shows–that’s why man of us on here fanboy for them these days. However, if your theory is that Delta’s ‘profit’ mostly comes from its credit card partnership revenues, then how is Chase-United, Citi-American, and Barclays-jetBlue any different? I presume you mean that people actually use their Delta co-branded credit cards for everyday spend, while hardly anyone one bothers with the Chase, Citi, or Barclays cards, other than for the sign-up bonuses. If so, that’s been my experience, personally, as well.

@Steven — Yeah, top 10% is doing just fine (until the stock market falls off a cliff, like it is now). Many of us here are in that category (doing fine, financially), but we still have empathy, and know that these policies (or lack thereof) are harmful to most.

@Mary — Oh, come now, people voted for all sorts of silly reasons. There’s no ‘mandate’ for anything but lowering the ‘price of eggs’ on ‘Day 1,’ and even that has proven impossible for these jabronis.

“However, if your theory is that Delta’s ‘profit’ mostly comes from its credit card partnership revenues, then how is Chase-United, Citi-American, and Barclays-jetBlue any different? ”

it’s not a theory. It’s a fact. You’re welcome to do the research it on your own if you’re just going to fanboy without knowing what you’re talking about.

It’s quite well known DL makes their profits from their credit card, not their flying. A simple PRASM vs CASM comparison just highlights it. But again, there are other items like the refinery that go into their TRASM and CASM and performing maintenance for other carriers. But things like the refinery are easily replicable by AA and UA but there’s a reason DL tried to sell it but it was unwanted in about 2019.

AA will start to narrow that gap with their new credit card deal but it hasn’t started yet. United is well behind both AA and DL in that respect.

“Well, if Delta spends more on its passengers, ”

There is not a PRASM equivalent with CASM. There’s CASM-ex EVERYTHING, but not one that directly relates to the passenger revenue equivalent of PRASM. Everything goes into CASM including their refinery. Doesn’t mean they spend the most on their customers per ASM. Though they might.

you are just as wrong on here as you are on OMAAT, Max.

DL’s credit card revenue or its international revenue or its premium revenue – domestic or international – is not at risk.

Trying to manipulate DL’s statements and the reality of how the industry actually exists because you are rooting for DL’s downfall is not only a false, cheap shot but it highlights your deeply rooted bias and inability to deal w/ reality as it actually exists.

it is actually AA which has much lower margins, AA, UA and WN which are much more exposed to DC travel and AA and UA which face much higher labor bills as they settle w/ labor post covid, and WN and the other LCCs and ULCCs that will have to fight harder for the domestic revenue which they now won’t get that are in a worse position.

Here’s hoping we get EVERYTHING we voted for. We deserve nothing less for our selfish short shortsightedness and focus on self over community. Yes, most of us in the top 10% will be fine in the long run…we have the financial resiliency to withstand downturns but we’re also decent enough to know that our success should not occur on the back of everyone else. That is not how a civilized society behaves.

@Tim Dunn — Thank you. I’m with you 100% on this.

@MaxPower — ‘Do you research’ is not a serious response. You clearly have your own strongly-held opinions–just don’t expect reality or the rest of us to conform.

I am indeed a fan of Delta, and not for no reason–based on my countless experiences with them and their primary US-competitors. I’ve been a Diamond, a Premier 1K, an Executive Platinum, and even a Mosaic with jetBlue, for many years… Delta treated has me the best. Without question.

Passengers used to be the customer. Now, it seems, many airline executives think of shareholders before passengers (or workers or anyone else). This is short-sighted. I’m glad Delta is at least *trying* to treat its passengers well, even if it costs them a bit more, apparently.

As ever, Tim. Just showing the data. If you don’t like 10-Ks that show PRASM vs CASM and Delta’s performance on the metric vs AA and UA, that’s your issue. Feel free to respond with data rather than your usual attempts at misdirection with NO DATA whatsoever.

If you think lowered consumer spend won’t impact carriers dependent on credit cards for profitability, then you’re simply wrong.

With the new guidance, Delta is worse than AA’s change in guidance despite little exposure to the DC government market, like AA has.

@1990. You’re welcome to “do you research”. If you know so little about credit card profitability of the US3, that would be a good place to start. There’s plenty of material for you to look into it.

Facts are just facts. Respond with some if you don’t like what they say from a 10-K or 8-k

“With the new guidance, Delta is worse than AA’s change in guidance despite little exposure to the DC government market, like AA has.”

To be clear, Delta’s “delta” is worse than AA’s “delta”. AA still has the lower absolute guidance.

Even I could have fun picking at my PRASM vs pure CASM look. But it is still a fact that DL is, by far, the least profitable at flying passengers per ASM.

@MaxPower I think the traditional PRASM vs CASM discussion is somewhat misleading. The reason most customers use the Delta credit card is because they like Delta flights, so the credit card revenue is really directly related to Delta operating its flights. American and United are a different story to some degree due to their lucrative travel partners (such as American’s partnership with Qatar).

@Steven

There are plenty of ways to attack a simple PRASM/CASM look like I mentioned.

No disagreement.

I don’t know that your argument is one I’d personally subscribe to, but it’s just a comment forum full of folks not busy enough in their normal jobs today (looking at myself) and just banter.

But it is still a fun fact that DL loses the most money flying passengers per ASM 😉

everyone except you knows that what is on the bottom line matters.

AA will lose money in the first quarter – more than DL will make – but you and only you wants to argue about the magnitude of change in DL’s guidance.

It doesn’t matter how badly you want to deny that DL is and will be the most profitable US airline -this quarter and next

You cherrypick and manipulate data more than anyone else because you desperately can’t stand to admit that DL still sits at the top of the industry.

everyone can see through your insecurity and need to try to tear down those that are actually delivering on the bottom line.

@MauiNowie — I missed this earlier but since someone mentioned ‘TDS,’ so I’ll remind them of their usual animus towards #44, you know, ‘ODS,’ which sounds like ‘odious,’ how they often act.

@MaxPower — Nice pun, ‘Delta’s delta.’ And no, I will not complete your ‘assigned reading,’ professor. Current and annual reports are not the full picture of a company. I’m with Gary–Delta’s 8-K update is more about negative macro trends, rather than about this airline specifically. Except for Crowdstrike, passengers seem to prefer Delta over American or United–and if that is because Delta spends more on their passengers, then I think that’s wonderful for us–and I’ll keep bringing them more business.

1990

Just a reminder that Delta made more money in the quarter that Crowdstrike happened than any other airline

We heard the same thing about the financial hit to Delta last year but obviously other airlines had bigger hits from other things

@1990

“Current and annual reports are not the full picture of a company.”

ok… you’re useless to respond to. If you believe this when the topic is a financial one, then your comments are useless. Though I admire your honesty that you truly don’t care about financial statements on a financial topic. Few people are willing to yell about their own ignorance so freely.

” And no, I will not complete your ‘assigned reading,’”

If you don’t want to know about how credit card deals contribute to profitability, then don’t comment on the topic. I could care less if you research it. Your purposeful ignorance is your own issue.

@Timmy

“You cherrypick and manipulate data more than anyone else because you desperately can’t stand to admit that DL still sits at the top of the industry.

everyone can see through your insecurity and need to try to tear down those that are actually delivering on the bottom line.”

Oh Tim… if you hate delta’s own guidance and their own SEC filings, that’s your own issue.

It’s just a fact that Delta loses the most money flying passengers in a PRASM vs CASM comparison. The irony is it’s a pretty easy thing to push back about but you don’t even have a basic understanding of financials to push back. It’s a very well known fact that DL has, by far, the most lucrative credit card deal based on consumer spend. Your usual stupid insults don’t change that. Nor is it a bad thing or an insult. My point was sustainability when their PRASM gap to CASM is so large relative to AA and UA.

speaking of insecurities. “Hey Pot. You’re black”. The idea of you accusing others of weird insecurities over an airline. what a load of nonsense. You have spent THOUSANDS of paragraphs defending delta from even the most innocent of trip reviews. Get a life. The guy who CONSTANTLY tried to redirect when presented with actual data to find a new topic to move to. There’s a reason you’re banned from so many websites and why other website owners like Cranky have said it’s useless to reply to you.

@Tim Dunn — Delta was honorable to reimburse expenses for alternative transportation following that incident. At least some companies still try to do the right thing, even if it costs more. People notice. People matter. And to some extent, the passengers are still the customer, even if some would argue it’s the shareholders or the credit card partners, but without the actual airline operating, none of it exists.

@MaxPower — ‘Sir, this is a Wendys.’

In all seriousness, let’s try not to get lost in the weeds here. See the data for what it actually is—a warning that the entire economic outlook is not good, for Delta or for most of us. We know the underlying cause—it’s the unnecessary tariffs and our President’s betrayal of our former allies and trading partners. That specifically harms the travel industry. Canadians and Europeans are practically boycotting the US now.

So, if you want to call us names and argue over trivial details, that’s sounds delightful. Do continue, professor.

Also, Tim, I’m a big fan of your insights on this post and others. So, your efforts are certainly not in vein. Keeping doing whatever you want here and elsewhere.

If other blogs are censoring you or anyone like you, of all people, then that’s bull crap, because I’ve never witnessed anything inappropriate from you. Not once.

I’m also grateful that Gary is supportive of free speech, and that he does not micromanage the comments at VFTW. There are some (like OneTrippe) who regularly call for banning or muting others—and Gary seems to know better than to appease them.

Ideally, we’re all respectful, but as I’ve said before, we can choose to ignore or engage. I certainly prefer to troll the trolls—getting them worked up makes my day. I feed off their silly names for me. Nom nom nom.

1990

lots of people would love to censor me, esp. when I accurately point out that they are manipulating data.

DL said its revenues were down for the 1st quarter.

They said nothing about 99% of the nonsense that others want to make.

DL is and will still be the most profitable airline in the US – and that makes some people very upset.

@Tim Dunn — Apparently, it does. I mean, I get that many cannot view the world through anything but winners and losers, but that zero-sum outlook is not always accurate or helpful. In this case, even if Delta is the top of the pack among its peers, there’s still trouble on the horizon. I’m confident they and we will weather this storm, but it could get turbulent. Hoping for the best, preparing for the worst.

So the good news is I can get a saver award flight, but the bad news is that since I only travel to leave this country, the weakened dollar will make everything more expensive when I travel.

@1990.

Despite the usual Tim ramblings and incoherence, I don’t view the world through winners or losers. I don’t wish Delta ill, whatsoever. There are plenty of great people that work there (I know many of them; Tim used to before he left unceremoniously) and it’s a well-run company, but the idea that something as simple as PRASM vs CASM or updated revenue guidance can’t be discussed without a certain Tim Dunn losing his mental stability over it…

I do have an issue and wish ill to those so obsessed with a public corporation.

It’s a public company. To use catch phrases like yourself, “She don’t love you back” and Delta never will. It’s not a charity. It’s a public company driven by profits. One need look no further than the absolute uselessness of their mileage program to ascertain that.

All the best.