Delta is earning greater profits, with higher margins, than their airline peers. For several years U.S. airline executives have looked at Delta with envy. I’ve heard several executives at major airlines say that Delta is the airline they admire most.

The rebate component of Delta SkyMiles (redeemable miles) is a dumpster fire, but the airline is successful anyway. They treat elite frequent flyers as well as their competitors do. And most importantly customers choose Delta because:

- They’re somewhat more reliable than most other U.S. airlines

- Their front line employees are usually more friendly than those at other U.S. legacy carriers

Paul Jacobson, Delta’s Chief Financial Officer, presented this morning at the Cowen and Company 12th Annual Global Transportation Conference.

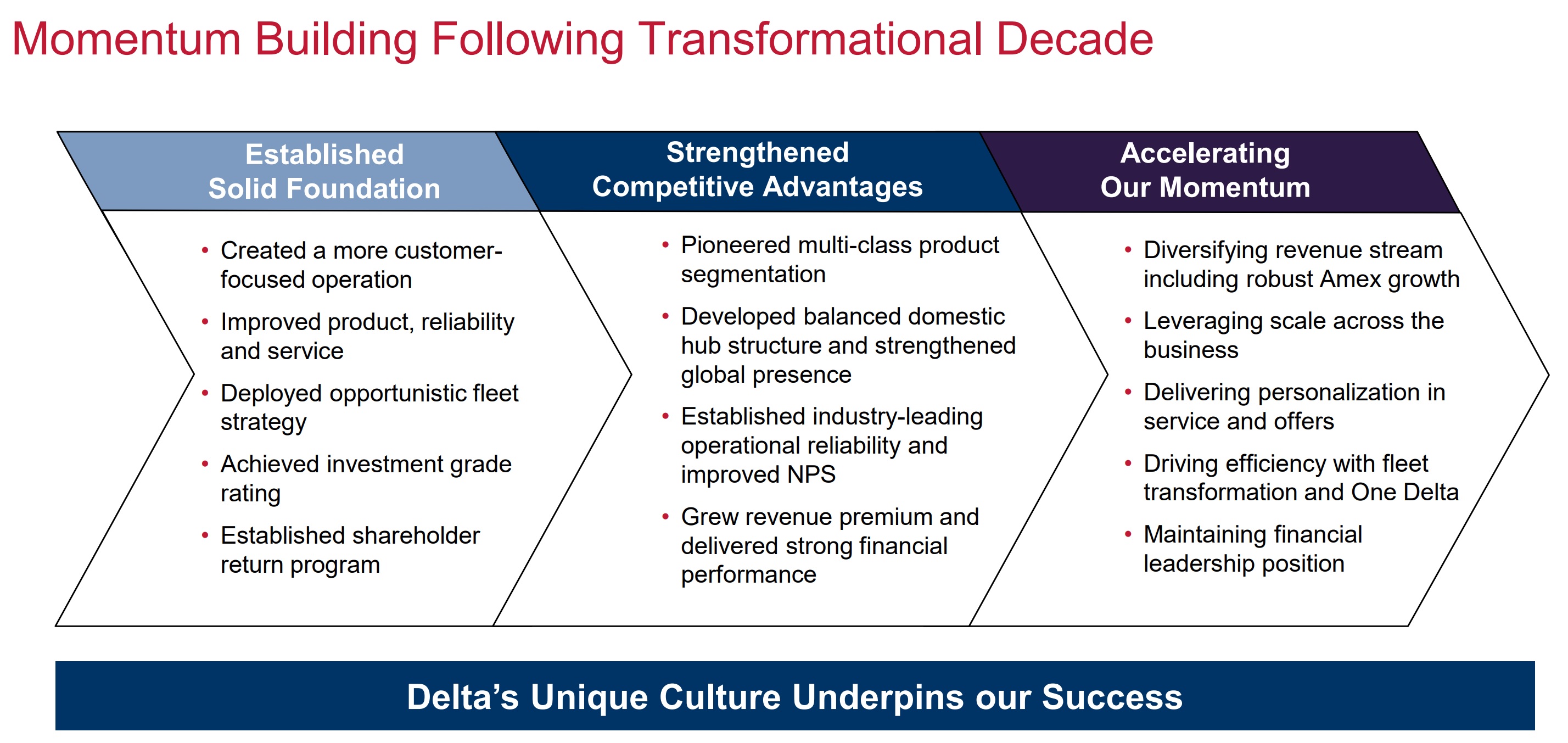

The most important point that he made is that, while executives at other airlines like to say that Delta had a head start in their merger (and by extension airlines like American should be given a pass, because their merger is only six years old), and that’s why they’re successful today.

It’s important for Delta to rebut the notion that their success is a matter of time for two reasons.

- It would suggest that other airlines will catch up, once time passes

- And also that their opportunities to continue to grow are limited

Jacobson points out that what they did after their merger mattered,

The first part of the decade really establishing our foundation. While we were growing cashflow it was still relatively small and we were deploying all of that into the balance sheet, into the product..had to make sure we were strengthening the base to build upon.

Then Delta was “able to achieve an investment grade rating…get back into S&P 500.” Jacobson argues “that foundation was what laid the path for the success we’re having today.” And that their success relies on their “focus[..] on reliability…on segmenting the customer experience, de-commoditizing…”

Jacobson argues – as he and other Delta executives have in the past – that their net promoter score drives their revenue premium. And he argues the way that they get there is buy-in from employees.

- “Culture is not something you put in a memo… it’s ultimately borne out of the culture of the company”

- “Compensation is but one element.. the core value proposition is: am I satisfied coming to work, do I enjoy what I am doing, and am I getting paid for results”

- Distributed “over $6 billion in profit sharing in the last 5 years, something no company on the planet can say.” That’s a “strong statement about how we think about everybody’s ability to drive profitability.” (In contrast, in 2014 American’s CEO Doug Parker said profit sharing is “not the right way to pay 100,000 employees that don’t have that much impact on the daily profits.”)

Jacobson suggests that the “classic finance training” is to “look at people as a cost center – pay less for something or have less of it, and that’s not at all how we want to look at.” Instead, “every employee is a revenue ambassador for the company.”

Pointing to areas of continued upside for the airline, he offered:

- Delta has “the most complex fleet in the U.S.” and they have upside as they simplify their fleet.

- More segmentation, and making different offers to different customers based on willingness to pay. Jacobson suggests they’re “still in the early to middle innings on passenger segmentation.” Their ‘pay with miles for upgrades’ rollout exceeded expectations without much marketing. They’re going to do more marketing, “personalize marketing where appropriate,” and learn more about pricing.

- Improve revenue management. Their systems are “learning, how the Comfort+ cabin looks over time, post-purchase buying upgrades” once they have a “good core history for demand for products not just point of sale but post-purchase” they’ll be able to optimize prices to fill cabins at the highest total revenue.

- Continued rollout of international premium economy, “we feel good about growth rate in premium cabin, it’s been at double digits for awhile now.”

- They believe they can leverage American Express’ brand in markets where Delta’s isn’t as strong, getting customers from Amex not just the other way around.

Aside from the core story that Delta’s relative profitability comes from things they’ve done, that are unique to Delta, and that they continue to have upside, there were three tidbits I found interesting from the discussion.

- They can’t run planes completely full. The “right load factor is less than 90, less than what it was this summer” because while “on a perfectly sunny day can you fly at 90% every day” bad weather, the need to re-accommodate passengers, diminish the customer experience when there’s no availability.

- Delta benefits from misery at United, Southwest, and American. Around Delta’s second quarter earnings call they were pushing back against the notion that they were benefiting materially from the grounding of the 737 MAX (which they don’t operate, and so haven’t had to cancel flights). Jacobson says “we ended up picking up additional passenger volume” from the ground.

- Abandoning Tokyo Narita won’t hurt their balance sheet. They won’t have to write anything off their books when they abandon their Tokyo Narita hub and fly only to Tokyo Haneda without connecting flights.

Years ago we combined Paciifc operations, route and slot values, what we’re really doing is shifting our hub network from Narita into Seoul. …what we’ve done is formed joint venture with Korean, moved many of those connecting to Incheon where we have more connectivity than we’ve ever had.

Delta’s core values and their bottom line shows that when you take care of your people, they take care of your customers.

All of Delta’s staff at Minneapolis, Detroit and Cincinnati, as well as its new “focus” stations, should look at what’s happening to Delta staff in Tokyo to say nothing of all the Asian flight attendants and Delta staff at stations across Asia. All of them are losing their jobs. In some cases with only a month’s notice. Most of the staff won’t move to Haneda. Most are done. Delta could easily do this to Minneapolis, Detroit or Cincinnati. After all, just 4 years ago Delta said they were 100% committed to Narita and flying intra-Asia.

Since the Richard Anderson days, DL has started to lose ground IMO. AA has a better hard international product for sure. The fleet is a bigger mess now than it was back then (yes, even with DC-9’s still in the air) and they continue to be weak compared to AA and UA on the coasts (yes even in NYC). MPS and Detroit have nothing to fear as they make money hand over fist in both those cities and Cincinnati is already a focus city, not a hub.

The inflight service is the best of the US main carriers, but the ranks are growing restless. Money doesn’t buy happiness (ask Doug Parker) and the FA’s will look to revised work rules or a union could be back. The Pilot also don’t love them right now.

You all on this board think DL can do no wrong. They do a lot right, but have some major weakness and some seams are starting to show. Domestically, they are the best of the best right now, but internationally, AA and Oneworld network has the better (except for Lufthansa and ANA) airline and travel partners. AA will soon have fleet advantage (DL has the same offering and pitch, except for seat back screens Woop!) and UA is building better hub network. I think the next 5 years will be interesting. 10 years ago, DL was NOT a great airlines and AA was, could the tables tip again . . .we will see.

inflight service best of the US carriers? I’ll take Alaska any day over Delta.

Besides… their ontime record is overrated. They pad their flights with so much extra time that anything short of a thunderstorm and they’ll make it to their destination on time.

You’re insane if you think MSP or DTW staff have anything to worry about.

They collectively move about 72 million passengers per year, the vast majority… on Delta).

and are both Fortress Hubs

Our State Senate and Metropolitan Airport Commission have been dying to increase competition at MSP

But Delta is guarding MSP with an iron fist.

@ Gary — Future profits will come from the devaluation of miles, just like recent profits. Once the miles have little value remaining, Delta will lose money again.

@ Gary — Now that I’ve actually read what the guy said — he is delusional. Nothing a good recession can’t fix.

One of main reason Delta is so far ahead of its competition is because of it’s mainly non Union workforce. Unions do NOTHING but protect the LAZY / disgruntled Workers from being fired who then provide lousy customer service.

One of the main reason Delta is so far ahead of its competition is because of its mainly non unionized workforce. Unions do NOTHING but protect the Lazy / disgruntled workers who then provide Lousy / no customer service. Their is a reason Delta’s profit sharing is the best of any company in the world and wouldn’t be if Delta was all Unionized!