Bilt Rewards has launched a new travel portal and it promises to fix everything customers hate about travel portals. In fact, it aims to actually make travel better and easier. At a minimum, they’re building along the right lines. And their new ‘Home Away From Home’ brings luxury travel benefits like Amex’s Fine Hotels and Resorts to their members without requiring an expensive credit card.

- They’re letting you create direct bookings, so your reservations are largely serviced by the airlines and hotels themselves instead of outsourced third party agents like online travel agency sites and bank points booking portals.

- They’re delivering rewards and tailored promotions.

- They’re using what they learn about you to help find the travel choices you want most (not the highest gross margin picks).

- And they’re making expert guidance available to members at no extra cost.

Now they have launched their own premium hotels offering called ‘Home Away From Home’, along the lines of Amex Fine Hotels & Resorts. But this isn’t just a copycat – it’s online access to Virtuoso hotel bookings with full benefits and access to Virtuoso advisors complimentary. So far just available to Gold and Platinum members there’s an aim to roll it out more broadly.

Ankur Jain and Richard Kerr Introduce ‘Home Away From Home’

What’s Wrong With Travel Booking

I’ve never liked credit card travel portals before, but Bilt may have changed that. My frustration with portals is a major reason I transfer my points to airlines and hotels, even when there’s some value in booking paid travel using points as cash.

- If there’s an airline schedule change or I need to cancel, it means dealing with their customer service. And even where the customer service isn’t bad things just seem to take so much longer than working with the airline. More often, though, I run into challenging cancellation policies and inconsistent and inaccurate information, with different answers each time I speak to an agent.

- And booking hotels these are third party reservations that generally don’t earn points or elite status credit, and don’t receive elite benefits. Plus you’re often paying a higher retail rate for the room, even if it’s just a few percent (not getting the ‘member rate’).

Basically booking through rewards portals where points are just the way to pay for travel you’re really booking through Expedia or similar site. And I find that the consumer experience with Expedia hasn’t improved in 25 years.

Chase, at least, has largely solved this with their ‘The Edit’ hotel portfolio of more than 1,000 properties which are treated as direct booking (earns hotel points and status credit) and receives add-on benefits similar to American Express Fine Hotels & Resorts. But that’s a very limiting solution.

The new ‘Points Boost’ for air travel still means booking through Chase, so if something goes wrong you have a paid booking issued by a third party agency that needs to be changed or cancelled. Nonetheless, Chase now says they’re the third largest travel booking agency (so behind Expedia and Booking.com).

Yet nobody has made travel booking better, fixing the problem created by online booking in the first place. You might have gone to a travel agent 30 years ago, and they could advise on what flights to book (a specific connection might not be a good idea in winter) and what hotels best matched your personal preferences – at least a really good agent could.

Online made travel easy and accessible, cutting out agents, but also losing the tailored guidance the top ones could provide. The commissions were no longer there and charging consumers extra for the service wasn’t tenable.

Booking platforms were supposed to solve this with big data and with AI, yet nobody ever did. It’s hard. Antiquated systems don’t all talk to each other. Disparate partners are tough to work with. And bookings are low margin so the way to make money is to make service costs extremely low.

What Bilt Has Done With Their Portal

Bilt works with each airline’s ‘NDC’ or new distribution capability to make airline bookings. That means these are airline direct bookings, wherever the airline offers this, that exist on the airline’s side and that airline customer service can help with directly. No more dealing with outsourced call centers. And for completeness, the portal does still have airline inventory that can’t be booked directly. These are serviced by an agency baed in the U.K. via live chat.

What this means is there’s no add-on penalties for cancelling an itinerary. You can make changes by calling the airline. You retain credit with the airline for cancelled trips. If a refund is due, Bilt refunds your cash and then the points. In the event of a partial trip refund, they’re giving you your cash first, too.

They’re booking hotels direct, with Marriott, Hyatt, Hilton, IHG, Accor and with some smaller chains. This gives them access to member rates, so you’re paying less than booking through an OTA. And you can deal with the chain directly on your booking, if you want to do something like request a confirmed suite upgrade.

You can still use points to pay for prepaid travel at 1.25 cents apiece, which is becoming top of market with Chase’s recent Reserve changes.

Virtuoso Integration

Bilt now has their own program that rivals American Express Fine Hotels & Resorts and Chase’s The Edit. They call it Home Away From Home and in this early phase it’s only available to Bilt Gold and Platinum members. It’s access to Virtuoso rates through their platform. You don’t have to prepay (in fact, Virtuoso doesn’t currently offer prepaid rates, but it sounds like this is coming as an option so you can redeem points for them). And you get all the Virtuoso benefits at participating properties, similar to what other luxury hotels offer.

- Room upgrade upon arrival (subject to availability)

- Daily breakfast for two

- Early check-in and late check-out (subject to availability)

- $100 food & beverage credit (at select hotels)

- Additional benefits at select properties

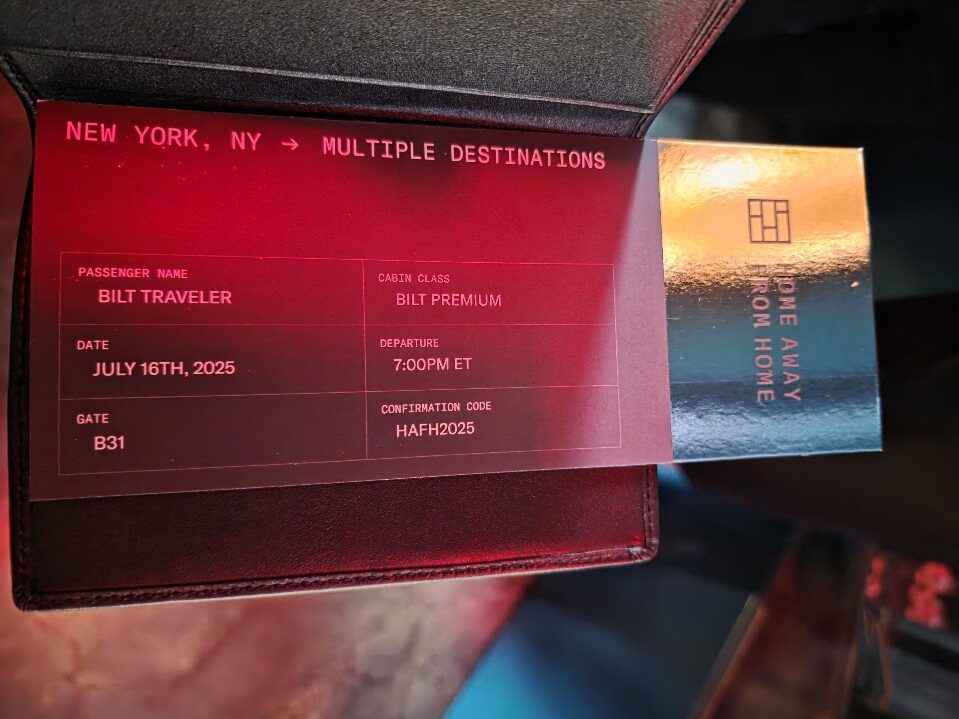

Home Away From Home Launch Event

What’s more, Bilt is going to use what they know about you – from restaurant spend on their platform to points transfers – to make recommendations. They are launching personalized neighborhood guides later this year. They’ll be able to highlight points deals in their portal that involve transfers and that incorporate Rent Day transfer bonuses, too. And they’ll be able to recommend and book activities. Bilt members will have access to travel advisors to assist with their itineraries as well, at no extra cost.

This isn’t the first time Virtuoso has been made searchable and bookable online. Classic Travel offers Virtuoso rates bookable online, along with Hyatt Prive, Marriott Stars, Rosewood Elite and Hilton for Luxury and some others. But it’s going to make things a lot more convenient, and combine these bookings with rewards into a single platform.

How This Fits Into Bilt’s Model

Bilt Rewards focuses on the home, and the neighborhood around it. So they reward rent (soon mortgage payments) and dining, getting around with Lyft, and shopping at Walgreens. Travel becomes ‘home away from home’ where they help you explore neighborhoods with sense of place, offer advice on cool spots that staples of the area and places that locals visit.

A decade ago Kimptons used to have restaurants aimed more at locals, that guests could take advantage of, rather than meeting the taste of every traveler in lowest common denominator fashion. Too many hotel restaurants serve disparate guests with milquetoast offerings. Even where the hotels offer something better, should you eat there or around the corner?

Bilt wants to be relevant, cool and rewarding to its members, and connect them with businesses that match that brand. They can be in the middle facilitating a high volume of transactions across any number of business lines.

With their latest travel offering, they are democratizing access to something American Express and Chase gate keep with annual fees pushing $800. It’s possible for anyone to book a Virtuoso hotel today, with premium benefits versus booking higher-end properties directly (and still gaining loyalty benefits where those apply), but Bilt is offering online bookings with rewards and access to neighborhood guides and advisors. Book through Bilt and you get a Virtuoso advisor dedicated to the booking, communicate over text or email (or phone if you wish) and there are no extra fees.

And Bilt will be taking what they know about each member and what they care about and customizing information about not just their home neighborhood but where they’re traveling using AI – to offer more than just a top 10 list of local things to do or places to eat (Cf. ‘The Infatuaton’) but the right place that each member will enjoy and what to try when they’re there, along with the ability to book it inside their platform.

And this really isn’t different in travel than their approach to each of their other partnerships where they offer:

- Marketplace: whether it’s Blade or restaurant bookings, easy access to commerce through their platform

- Checkout solution: card on file in their app, pay with points, FSA reimbursement integrated with Walgreens

- Loyaly rewards: Points, status benefits and offers

They’re building out an interconnected network, so that a restaurant can incentivize diners with Lyft credits or a hotel in New York can provide blade credits (just as a landlord can encourage re-upping a lease with Lyft and restaurant discounts as an alternative to rent credits).

Bilt isn’t just a credit card, or a rent rewards platform, what they’re building in travel, neighborhood merchant partners, and housing is connected commerce with the same marketing tools and services help reach a desirable customer demographic – mortgage servicers and restaurants and transportation – to drive business, with easy checkout.

Considered this way, their $10 billion valuation makes more sense because they take a large, growing desirable customer base and provide them valuable rewards they’re connected to (through their home!) in an expanding market of adjacent businesses in their ‘neighborhood’ broadly conceived. That could be banking and insurance products. It could be home improvement.

I don’t know whether they’ll pull this offer, but it seems like the vision is that if they can offer attractive enough partnerships and offers, they could eat any number of verticals. Wouldn’t it be interesting if travel became their biggest business, because they finally cracked the code on online booking that’s been so stagnant for a generation?

It would be nice if your blog did anything other than shill for various credit cards. Also, after many years and more than 1.5 million miles, the cardinal rule is never to go through a booking portal, no matter how poshly it portrays itself,.only book directly with the airline or hotel. Otherwise, you’re inviting a nightmare.

If the new annual fee BILT cards have credits like $200 Platinum FHR and $250 CSR The Edit, or whatever, then I’ll “use em” because I don’t like to “lose ’em,” but as far as a comparable, I still think the ‘guaranteed 4PM late checkout’ (is that just with FHR?) is the best feature with any of these ‘programs.’ And I guess the $100 credits and ‘free’ breakfast are nice, too, but it feels like we end up ‘paying extra’ when booking via these platforms in order to compensate for those extras.

@Steven Jacoby — Oh, come on, as far as ‘shilling’ goes, Gary is tame. Those ‘fellows’ over at TPG are the shameless kind. They went so far off the deep end that they disabled comments at their site. So, once more, Gary ‘based’ for the most part, as the kids say these days.

@Steven Jacoby –

1) there’s literally not a single card link in this post, and I do not receive any financial benefit for Bilt card approvals.

2) I have promoted the “cardinal rule..never to go through a booking portal” but the point of this post – what is actually notable here – is that these aren’t third party bookings, they’re NDC bookings so that you deal directly with the airline for schedule changes, etc. You don’t have to deal with the nightmare of OTA customer service!

If Bilt can make money out of this, why wouldn’t they scale it up by including members other than gold/platinum members?

I think they plan to expand it. Make sense to launch with a small cohort first and make sure it’s running the way you expect before scaling.

Chase portal even on flights is constantly more expensive (hundreds more) than booking direct. Makes the “points boost” useless.

Bilt has the worst customer service I have recently experienced. Their inability to handle simple financial transactions that I do dozens of times each day on other platforms is inexcusable. I can’t believe Bilt has the capacity to scale and would look elsewhere for services like this.

Why would booking through NDC be any different than EDIFACT? They’re both agency bookings that the airlines will not touch, the technology has nothing to do with this.

Please then speculate but actually report facts.

@Gary –

So, to be clear, hotel bookings are usually considered direct bookings with the major chains? If so, then that would make bookings through Bilt better than going direct, as you’ll get 2 Bilt points per dollar spent.

Interestingly, when I did some dummy bookings for Hyatt, I had to agree to the Expedia terms and service. Any insight into that? How do those two co-exist?

Thanks!

Also, interestingly, when entering in my Hyatt number, there is no ability to add the letter at the end of my loyalty number, as it uses a number keypad with no letters available.

I’m confused on this new service. Is it akin to virtuoso where (1) I pay the hotel directly and not BILT, (2) I earn loyalty points/status night credit in the hotel chain’s program and (3) I am entitled to my hotel status elite member benefits or is this simply just another travel agent where I don’t get these 3 things, but am getting virtuoso level benefits?

I think you should also mention that Virtuoso rates will require booking through a travel advisor. Good benefits for the time that takes, but this process isn’t cutting the advisor out of the situation

As one of the those Virtuoso agents, I will say that a good advisor will have relationships with numerous hotels, and direct connections with countless more, that allows for a much.more personalized experience for the guest. For me it’s not what I know, it’s who I know, and that goes a long way with my clients. By all means take advantage of the benefits and amenities, but if you’re looking for something special, reach out to an advisor to really make the trip extra special.

Steven Jacoby, if you truly feel that way, why is it that you’re even on this blog?

@Jack — Maybe Steven is hooked; VFTW is addictive! Bah…

@Mark J – in fact they can be booked via the Bilt app, and you get an advisor assigned to message with

BILT isn’t booking direct for some Hyatt though and its extremely confusing. You have to click into each terms/conditions and see if they’re booking via Expedia or not.

There’s also no way to input your WOH number when booking via the website, but there is a way to input your WOH number when booking via your mobile device. However, if you have any letters, its considered an invalid WOH number.

Seems a bit more hassle than needed if these are indeed “direct” reservations.