Bilt Rewards has a new program that rewards you with 1 point per $2 spent on the purchase price of a home, for working with a real estate agent they refer you to.

Already Bilt rewards members for paying rent. They also help build credit, with rent reporting on credit reports. And then when members buy a home that can be a points-earning purchase, too. A $500,000 home translates into a quarter million points can that can spent at 1.25 cents apiece through their travel portal or transferred to travel partners like Alaska Airlines, Hyatt, and Air France KLM Flying Blue.

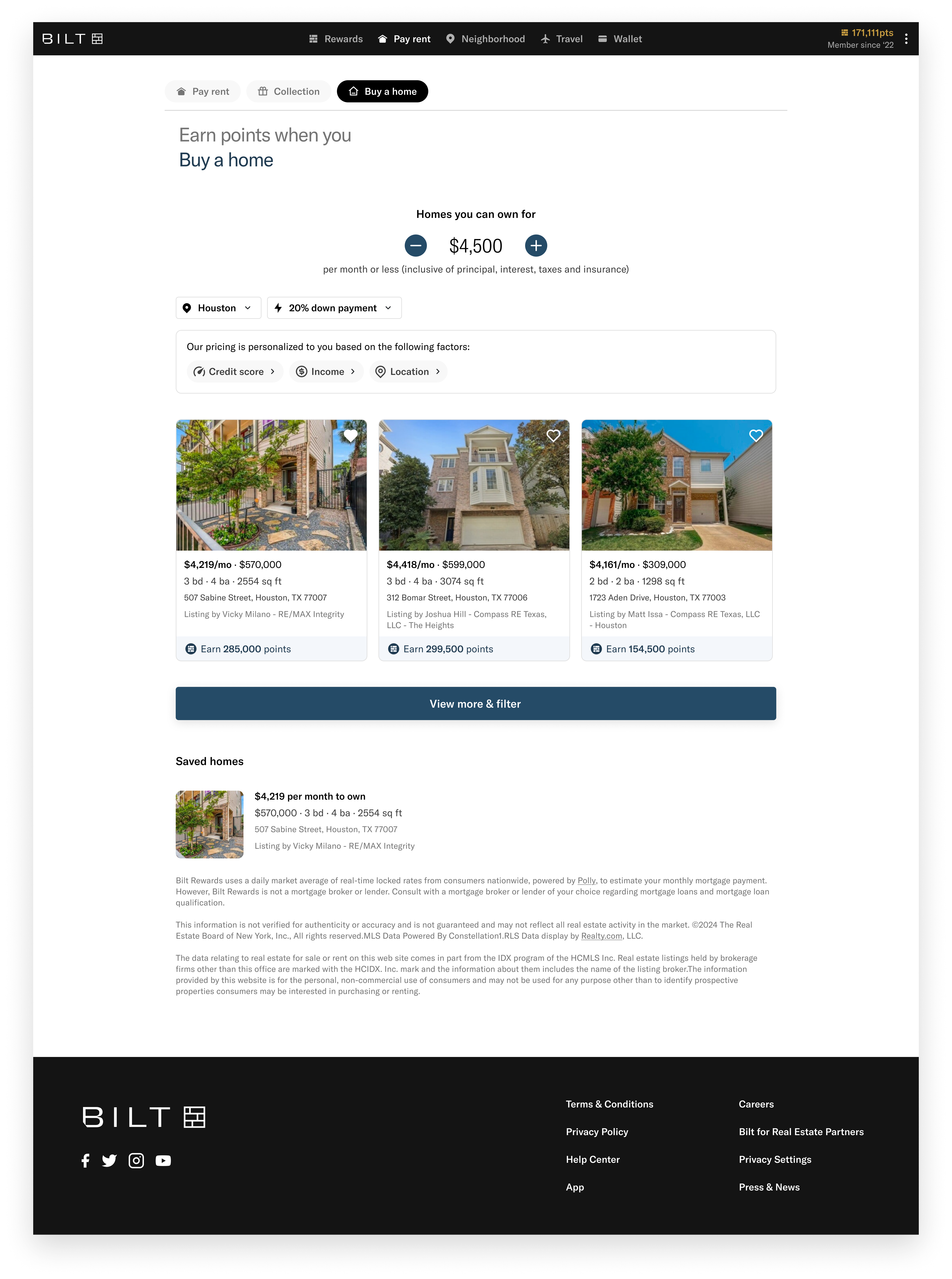

This is all wrapped with first-time homebuying tools like mortgage, down payment, property tax and insurance cost calculators that help educate members. Their tool integrates the affordability calculators with real estate search:

I have to think the mileage-earning potential will grow here over time, since they only offer it on the real estate transaction today – but not on the mortgage (or, for that matter, hiring a mover or refinancing).

One point per $2 spent is a strong return. Most offers have historically been around 1 per $5 or 1 per $3, though we have seen up to one mile per dollar.

Three years ago we saw ads for earning AAdvantage miles getting referred to a real estate agent running at American Airlines gates across 75 airports.

This is a real estate lead generating company. You sign up with them and they connect you to a real estate agent. That agent earns a commission on the sale of a home. They pay the lead generating company for delivering the prospect (you) and you get rebated part of the fee (points).

- You aren’t picking your real estate agent, although you don’t actually have to use the one they send you, meet that agent and see if working with them is worth the miles.

- If not, ask to get assigned to someone else at the brokerage you may like better and still earn the miles.

- Or walk away before signing anything.

When I bought my first condo in 2006 I earned United miles for the purchase price. I also got a mortgage that earned 100,000 Chase points (and they had the best rates at the time). Arguably on the commission it’s better just to negotiate a better deal with the agent directly, or a cash rebate. I also remember folks taking out home equity lines of credit for the miles and immediately paying it back and even taking advantage of multiples of each of these offers at over 100,000 miles apiece.

You can also sometimes get the agent to kick in part of their commission to bridge the gap between buyer and seller to reach a final deal. They want some commission that comes from making a sale rather than no commission when a deal falls apart. (No matter what a broker tells you they aren’t working for you, they are working for a sale if they’re paid on commission.)

This is usually best accomplished at the last minute when a deal is really close. Even if you’ve reached a price you’d be happy with, why not hold out to do 1% better asking your agent to make up the difference from their commission?

If you aren’t super self-sufficient, and actually rely on a real estate agent, it can be costly to work with a bad one. Getting one assigned randomly may not be worth the miles. Make sure you’re happy with the agent you work with. And ask to be re-assigned if you aren’t (or ditch the miles relationship entirely, but regardless don’t sign an agreement that locks you into working with someone you may turn out not to like dealing with).

On the financing side you may or may not get the best mortgage deal choosing a miles for mortgages offer, e.g. QuickenLoans is offering 25,000 United MileagePlus miles for a mortgage. Although don’t think you’re paying more for financing because of the miles — the miles are marketing expense, one way to acquire customers, something that mortgage originators incur in one form or another regardless.

If you’re in the market for real estate it’s worth exploring what kinds of rebates you can get, and being aware of mileage offers is one important form of rebate that you should be sure you’re not simply leaving on the table.

@Gary: “On the financing side you may or may not get the best mortgage deal choosing a miles for mortgages offer, e.g. QuickenLoans is offering 25,000 United MileagePlus miles for a mortgage. Although don’t think you’re paying more for financing because of the miles — the miles are marketing expense, one way to acquire customers, something that mortgage originators incur in one form or another regardless.”

Assume you are paying more. Naive to believe otherwise. Those miles have to be paid for.

I haven’t done the numbers on that deal but I did on electric bills that pay AA miles in TX. The rate was twice what you paid otherwise and the nugatory quantity of miles did not comec near to offsetting it.

@L3 “Assume you are paying more.”

No, don’t assume, run the numbers and compare to make sure you’re getting the best deal.

For the Bilt offer, though, it’s a marketing expense for the agents. For most people this will be the best current deal, but some may be able to separately negotiate something better.

@Gary: No need to run the numbers. Just run the back of the envelope. BILT offer max. value is $7,500. Buy without a realtor as a buying agent and save $15,000.

@L3: I consider myself financially savvy, and I do not feel comfortable buying without a realtor, as retail real estate is not something I’m an expert in.

Given that it’s the biggest purchase of my life (presumably), the expertise that they should provide is well-worth my money.

@L3 – not sure how you say ‘max value $7,500’ when there is no cap on points-earning under this offer?

And sure if you go without a realtor at all you can negotiate with the counterparty to save that cost. Most people aren’t comfortable doing this, and a good realtor (which you may not wind up with!) does have value even if you’re savvy. They may have a great rolodex of experts to consult as you work through understanding the challenges you may confront with an older home, for instance.

@HT: At 3% of the purchase price?

@Gary: Without a cap it is a 0.625% commission rebate. Anyone can get 1% off on a buyer’s agent elsewhere, so this is not a good deal.

This is the usual case with deals that involve airline miles as a spiff for paying for something. I mentioned electricty above, another one would be Bask Bank. The miles rate on their savings instruments is lower than a cash-paying equivalent (even with tax fraud).

“Arguably on the commission it’s better just to negotiate a better deal with the agent directly, or a cash rebate.”

Exactly. Why engage with these agents and pay them (out of the buyer’s pocket given the rule change) 3%?! Do your own homework and cutoff the buyer’s agent.

@ Gary — I’ll take 0.5-0.6% cash back through a real estate agent referral program instead, thank you.

@ L3 — Of course you don’t pay 3%. Negotiate down to 2.0-2.5% AND get 0.5-0.6% back, or negotiate down to 1.5% and skip the referral company (a smart agent would prefer this to the referral). On a $1 million house, $10,000 (1%) is probably worth not having to deal with the other party to the transaction. Anything over that is silly, but it is the crappy system we have.