Airlines need to satisfy their frequent flyer program members or else those members may jump ship to another airline or start using a bank’s proprietary credit card. That means offering rewards customers want, at a price that’s attainable, and that’s available when members want to redeem.

They’ve become something of a victim of their own success, printing more and more miles even as airlines have held capacity in check and load factors have increased. There simply haven’t been as many empty seats to make available to loyalty program members. While demand has increased, supply has not.

I’ve argued that airlines need to make more seats available to satisfy members, even though that would mean sacrificing profit margins for programs. There’s no reason to believe that order of magnitude 50% margins for loyalty programs is sustainable in any case. Instead we’ve seen cut after cut, which would seem to jeopardize the airline’s golden goose.

For years I’ve called frequent flyer programs “the single most successful marketing innovation in history, and profitable multi-billion dollar businesses in their own right.”

- Fourteen years ago I explained the success airlines have had in creating their own private currency — no small feat.

- I’ve been writing for years about the incredible profits of frequent flyer programs, such as this piece from a decade ago. Those profits have only grown.

- United Airlines largely flew through bankruptcy to preserve their lucrative credit card product.

- Today American Airlines financials show they lose money flying passengers and only make money selling frequent flyer miles.

It’s this success that left me perplexed — why would airlines continually devalue their frequent flyer programs? These are highly profitable multi-billion dollar businesses. Yet each cut risks undermining that business.

Fundamentally frequent flyer programs are about trust. Customers are promised a future benefit if they engage in a set of behaviors today.

The move to low value redemptions, one penny a mile redemptions, and instant gratification like using miles for airline fees or toasters is a huge step away from offering customers aspirational rewards — the dream of travel that continually motivates them to accrue for a future benefit.

Customers earn miles rather than other currencies because they value travel they couldn’t otherwise afford or luxuries they wouldn’t allow themselves greater than their cost. And they’re high enough value that they’re motivating. Back when people had screen savers they’d put Hawaii, or Bali, or iconic imagery of Europe on their computers and dream about the day they could make that happen.

When frequent flyer programs delivered their loyalty was locked. When customers cleaned out their accounts they didn’t walk away from a program, they increase their rate of accumulation having demonstrated to themselves the value of their loyalty behavior. That’s why redemptions aren’t just a program cost, their an investment in future growth.

Indeed devaluations can be worse for programs than they are for members because they undermine that loyalty relationship and risk the billion dollar business. Even Delta recognized that risk which is why they didn’t go with straight revenue-based redemption when they introduced revenue-based earning.

This risk is the point that the former head of the Malaysia Airlines Enrich frequent flyer program is sounding the alarm about for his loyalty marketing colleagues. Mark Ross-Smith, who found that Cathay Pacific’s revenue-based loyalty program changes hurt its bottom line leading them to roll back those changes, warns that death by a thousand cuts to mileage programs causes flyers to choose carriers based on price and this benefits low cost carriers.

Airline Loyalty Programs sell THE DREAM – whether it’s connecting loved ones, or taking that aspirational holiday to Hawaii, Paris or the South Pacific.

The ability for airline loyalty programs to sell THE DREAM, and in the process make their points currency irresistibly desirable – is nothing short of magic.

…The ‘trick’ to all of this working – is that the currency value is opaque. The minute that the currency is worth, say, 1c per point – all of the desirable aspirations evaporate, along with desired consumer behaviour.

…Each time the programs devalue or remove benefits for members, there is a small behavioural shift in a subset of the member base. …In reality – not many airlines are using data effectively, and this can lead to missed revenue opportunities, a $1B annual loss in ticket sales, or perhaps even being blind to what threats are looming ahead.

Loyalty program executives — and their airline bosses — need to realize just what’s at stake: “As more full-service airline loyalty programs strip away benefits, devalue the currency and make it more challenging to earn meaningful rewards, the cracks in the dam will continue to grow, more rapidly, until one day the game will be over and full-service airline loyalty programs, and their billions in revenues – begin to wash away.”

“why would airlines continually devalue their frequent flyer programs?”

that’s easy; because the vast majority of customers simply don’t know how to deal with them. i have friends that have over 1,000,000 BA Avios and they STILL keep using their BA credit card collecting more!!! I have hounded them to get another credit card but they just can’t be bothered. I have tried to explain miles, points, credit cards, etc. to many many people but they just don’t get it.

so people get all starry eyed thinking that they’re earning all these wonderful miles that will jet them around the world in luxury for free and they never actually get around to a reality check. i don’t understand it but that’s the answer to your question.

I’ve tried to teach family members and co-workers how best to accumulate and use miles and points. Their eyes glaze over. Cash-equivalent points like ultimate rewards, capital one, and southwest rapid rewards are their best option. If I didn’t get entertainment value out of gaming miles and points those simple programs would be my most cost-effective option too.

As long as a stupid Alaska credit card holders use it for everyday purchases earning 1 Alaska mile per dollar, the programs will continue to be successful.

Green Stamps for you.

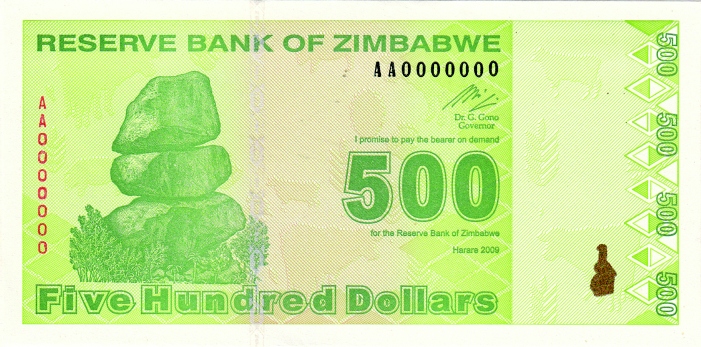

I have a $100,000,000,000,000 version of that note. Being a one hundred trillionaire is not all it is cracked up to be.

Most people, even frequent travelers, don’t fully understand the programs or how to use them. I have colleagues who are 1K elites with United’s program who have no idea what that means. They think the office travel agency is doing them a favor whenever they are upgraded. And, of course, their global and regional upgrades are going to waste because they don’t understand what they are (or care).

@ Gary — Yep, the Big 3 have already gone too far. I am now anti-loyal and resent each of them for different reasons. I hope they all go bankrupt again.

It’s definitely true that airline programs have gotten harder to use for aspirational awards. However, your and my definition of “aspirational” isn’t the same. Many of my award booking clients are looking for stuff that would be really easy for the airlines to deliver–first class ticktets from Minneapolis to Hawaii, for example.

Airlines don’t give away any seats they think they can sell (except at crazy redemption rates), the problem being that they’re ignoring that frequent flier programs *are* revenue. The financial models are broken. While it’s true that some awards represent exceptionally good value, and probably higher cost to frequent flier programs, most points are redeemed on an airline’s own metal for domestic coach flights.

An increasingly large number of business travelers I meet have given up on playing the loyalty game and just book for price and schedule. Southwest, in particular, is cleaning up in markets served by American. Why is Southwest adding Hawaii service? One of the key reasons is to provide aspirational Rapid Rewards redemption opportunities. They have learned what American, who invented the modern frequent flier program, appears to have forgotten.

“United Airlines largely flew through bankruptcy to preserve their lucrative credit card product.”

United was in bankruptcy for 34 months. One of the longest airline bankruptcies. 34 months is not flying through bankruptcy!

@JohnB

Did they fly — literally, fly their planes — during those 34 months? Then yes, they flew through bankruptcy

@johnb ‘continued flying’ not got through bankruptcy quickly.

The three big US carriers will keep it up until redemptions are worth half of the cash value….DL is already aiming for that, getting two cents or more per point is a good value for them in an award redemption. But United….they have mastered the art of fleecing their customers on award flights. They **almost** eliminated the entire saver direct flight award stock for international business class (to the EU, at least). I seems that UA has decided to make life better for award customers by increasing the number of everyday awards available, and drawing down the stock of saver awards. The only problem is the saver award was 60K OW, and now the same flight will cost you 155K OW because there are no saver awards. Now your award cents per point value is one or maybe even less. Nice job guys, you have now reduced your awards to nothing. But, you can always take a partner flight, usually with long layovers of eight to twelve hours or so, on TAP, or maybe LOT, sometimes Austrian. And for that privilege, UA will charge you 10K extra. I have even seen coach awards at 70k OW. So, some sap that has been earning points by sitting in plane seats as a loyal customer, looking at an award chart trying to get up to 60K to fly that Polaris flight to Europe is going to be sorely disappointed. His points just got devalued by 250%. Thanks for being a great customer, but if you want to sit up front you pay cash, your points just went down the crapper. So, we have a winner! UA got to the bottom of customer appreciation first. And yet people still buy their points, get their Chase card, and swear by them. I guess that loyalty programs can just be smoke & mirrors. It works for UA. And I doubt if it will get better.

Excellent blog post topic. I’d take the theory even one more step. As many of us move to flexible points like MR, UR etc. We continue to have long term exotic travel goals. The problem eventually becomes “gosh I have all these points and I don’t even have to use them to “buy” trips with airlines. I can take a cruise instead or a train trip” etc. further driving business away from airlines we had been chained to.

And yet, despite these miles having been greatly devalued, it took three months that were filled with:

– a litany of excuses (“we can’t find your eticket numbers in our records” [in a digital era we found this “excuse” hard to swallow…and BOTH airlines claimed they couldn’t find our ticket eticket numbers despite our having purchased our tickets DIRECTLY with the airline on its web site]), or if you can’t find the boarding pass we can’t help you (just to name two of many excuses we were told in addition to other tall tales);

– blame shifting between two VERY closely aligned airlines [a domestic airline where our accounts are and its anti-trust immunized joint venture foreign partner we flew with BOTH repeatedly insisting the OTHER airline was at fault and was the one we had to turn to get this matter resolved (in paid Premium Economy, complete with a 50% class bonus for a very long haul itinerary);

– countless emails;

– numerous phone calls to BOTH airlines’ call center representatives AND the USA domestic airline’s frequent flyer program reps; multiple in-person inquiries with agents at BOTH airlines when I was at JFK Airport and could show them our eticket numbers, proof of payment billed to our credit card, dozens of emails when said airline had an IT error that resulted in $1,500 of overcharges (that we didn’t know about until we went to check into our hotel at 8:30am and the card was declined after landing from an 11 hour red eye flight that itself took nearly three weeks to resolve and wreaked havoc for the business/work portion of our trip where that card was needed after two weeks on vacation);

– and much more info such as confirmations for wheelchair assistance for my partner and bulkhead seat assignments (he had Polio as a young child) that were made with the airline – even pics of us inflight (super avgeek that I am, pics of everything from meals, to seat widths and pitch are a must!)…

You name it – we had it EXCEPT for a boarding pass for one of the two flights that were not credited to either of our frequent flyer accounts (we had the actual boarding passes for the last of our four flights on that itinerary)…

TWO Months of going back and forth with both airlines insisting the other was at fault and the neither could assist us…

Until finally, I took a more “intensive” approach with yep, you guessed it, several longish letters with attachments that would prove we were aboard the one flight we didn’t have boarding passes at the ready to submit, plus copies of the boarding passes for the other flight that was not credited, too.

And even then, the “we can’t can’t find your eticket numbers” ‘excuse’ was heard yet again…

Oh, I was even “interviewed” over the telephone for nearly 40 mins (our discussion was pleasant, and the person I spoke with certainly is very good at what they do).

But even then, and after finally receiving an email two days later that our accounts would be credited with the “missing”/“lost” miles (our two outbound flights WERE credited, and at more than 9,000 miles each way, we found the “omission” of our return flights somewhat curious as that omission easily catapulted my partner (who flies more than I do because of his work) into the land of silver status (which for him is important because bag check is ususally a necessity and not an option, perk or luxury for disabled passengers and this alone means $60 saved per round trip), and now has him maybe crossing into Gold for 2019 depending on how our upcoming trip to Asia is calculated, with me about 300 miles shy of silver (and any checked bag savings and/or other “benefits” that may come with the lowest level of ‘status’ at that airline for 2019 which will easily be eclisped on our trip to Asia next month).

So, for us, those “missing”/omitted miles very much meant something to us, if only because the $60 checked bag savings for our flights to visit family in RDU, MCO or PBI, is meaningful.

But yowza! did these two airlines make the whole process to “find” and finally post/credit to our accounts these miles gone “M.I.A.” as difficult, tedious and torturous as possible.

And even then, at first the “host” airline (the domestic USA one where our accounts are at) seemed to be only interested in posting the bare minimums of our original fare class, which was 25% of the miles and a fraction of the original fare paid even though the Premium Economy flights were upgrades that were eligible for a gaggle of bonus miles and a fare multiplier for those sectors.

Heck, I even disclosed that the Premium Economy flown for the last sector that was printed on our boarding passes was on the house instead of a paid upgrade eligible for class bonuses (we were pleasantly surprised when that happened – and definitely appreciated that gesture as it very much reflected but one of the MANY EXCEPTIONAL customer service aspects of that airline outside of its inability to quickly cancel/refund overcharges for errors the airline admitted before we boarded our 11 hours flight it was at fault for, or to take responsibility for posting our frequent flyer miles) despite being told our eticket numbers had vanished without a trace into a digital black hole and they’re possibly to being able to determine if the PE seen on our boarding passes was paid or not.

And yet, at first, the miles posted to my account were at the drastically reduced rates that would’ve (conveniently?) left me thisclose to silver status after the outbound segments for our upcoming trip to Asia, and certainly would’ve meant Gold status was completely beyond the reach for my partner instead of maybe…possible.

And it was only after I sent a terse reminder that after the “interview” where I was asked what I was seeking, and replied “exactly what were were credited for our outbound segments – nothing more; nothing less” (which is when I also voluntarily disclosed our last flight in PE was comped and our fare class was economy, just as it was for our first flight where our miles and spend were drastically reduced) that we saw later that day that our accounts were FINALLY credited in full – as was promised at the end of the interview, and in a follow up email received two days later from someone else at the airline.

So, my point is this: if these miles are so devalued and worthless, why was the whole process so grueling and require so much effort?

In fact, during the terse email I reminded the airline of every ounce of effort required, that in the end took more than 100 hours over the span of three months.

Because if these freakin’ miles are THAT worthless, BOTH airlines sure did make it seem like they’d rather exhaust me by playing a very well honed game of “dragging & stalling” than simply saying something like “oh, yes, even though we ‘lost’ your eticket numbers and you can’t provide boarding passes for one of the flights, it’s more than obvious based on the other detailed information you provided that you flew these flights exactly as you have described them to us!”

Nope. Not even close.

It was like running a grueling obstacle course where it sure did seem to us like both airlines had no interest whatsoever crediting our respective frequent flyer accounts.

Oh, did we forget to mention that in researching our respective frequent flyer accounts we discovered that NONE of our past international flights on partner airlines within that airline’s alliance were ever posted?

NONE.

Whether taken together or separately.

And in premium cabins, too…

But, as they were beyond the eligibility period to claim miles for those trips (all medium to long haul), we left that off the table this time.

But, we sure did find ourselves both gobsmacked and scratching our heads at just how perfectly matched for our flights taken together, or his taken without me for work, all had one thing in common:

A whole stack of miles and spend credits that somehow managed to simply be “lost”.

Just sayin’… 😉

Well the Federal Reserve manages the world’s most valuable and only (for now) reserve currency & look at what they have done.

Given the computing power and database systems and programmer capabilities, the legacy airlines could easily make award charts unique to each customer. New customers earning new points would pay based on new rates.

Or airlines could increase your points balance to offset the devaluation. This would incentivize people to transfer their UR and MR into a specific airline.

But the banks may restrict that based on their agreement with the airlines?

Maybe the airlines have less leverage than we think.

Finally, to address Howard Millers post, the airlines need to have their FF programs audited by a certified public accounting firm. Along with who customers can complain to when points or etickets go missing.

Banks are regulated by the state, the feds, and the Federal Reserve. They also have physical branches. Airlines should hold themselves to the same standard or else social media will expose their patterns and coming out of bankruptcy may not be guaranteed. Right PanAm, Eastern, TWA, Braniff, etc.

It is obvious customers when they are paying don’t care about anything other than cost. So what the loyalty programs do is get business travelers to choose an airline based on the rewards they get. If they devalue these then people will just choose the direct flight when flying for business.

Due to Airline consolidation their isn’t much choice when flying out of an airport. 90 percent of the flights are on one airline. I fly mostly on Southwest and American Airlines and I have to say Southwest is the worst. But what can you do they control the local airport. So if I am flying domestically or the Caribbean what choice do I have? None.

The major fault of the alliances is individual major airlines have no skin in the game. They can cut thier own availabity and charts as long as their partners offer the availabity. Be the lowest of the low and take advantage of other partners

Customers still focus on accumulating the miles because of partner availability that becomes scares and puts the burden for all on the few. Fast forward and it will dry up and collapse as the greedy short sighted mongers take advantage and screw the business partners they tried to work with to make 1 + 1 provide greater value than 2.

More and more the primary value of US based airlines is on partner awards. I fly every year to Europe with a family of 4 with awards and get zero Business Class availability from AA and in the last few years UA too. Thier miles are nearly useless to me except for partner awards. Ok, UA is worthless now as they screwed Luftansa too much and Luftansa now limits their availability to alliance airline members. Only BA left with AA miles even with the surcharges. I just wish they would have another business class revenue sale at $1200 for the summer and I’d pay instead of using miles. It’s crazy…AA and UA are nearly useless to my wife and I even though we have over 4M miles with them..

I even burn AA miles over BA miles now. Get rid of the crappy miles where it is prudent and GIVE THEM ZERO REVENUE… Please go bankrupt AA and UA… I’d be happy to forfeit my miles if carriers like you closed and we’re replaced by airlines like you were I the past….

@Chris J….

Excellent post on UA….

Three years ago I value them highly and now see they are nearly useless

What an EVIL short sighted CEO I feel they have .. IMHO…

Heck, is that the one who published everywhere that he gave up his first class seat? Jackass marketing jerk… Using that to try to show he is nice. Bull crap….