U.S. hotel occupancy for the week of August 9-15 hit 50.2%, the first time it’s been over 50% since mid-March. In a normal year 50% occupancy is what hotels look like the at the beginning of the year, after the holidays but before business travel starts back in earnest.

That seems like good news, though hotel occupancy is still down 30% compared to the same time period last year. Hotel rates haven’t dropped as much as occupancy, with average rates down just 23%.

Airlines would kill for those sort of numbers, with air passengers oscillating between being down by two-thirds and three quarters year-over-year.

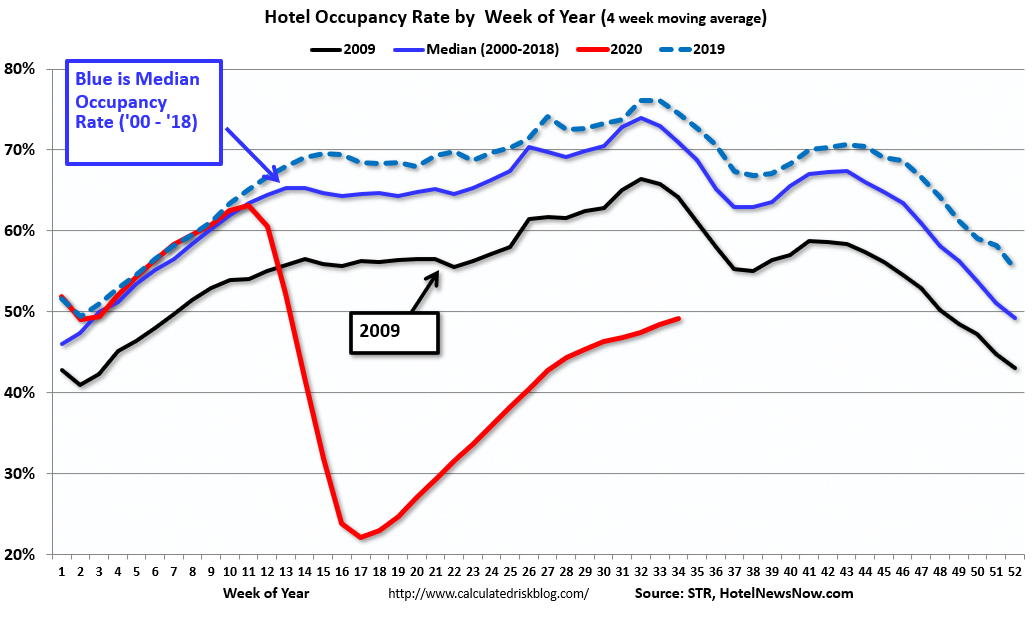

The bad news for hotels though is that occupancy usually peaks in August and then begins to decline, with a brief interruption, but largely for the rest of the year. Here’s a chart from the Calculated Risk blog comparing occupancy rates this year with 2019, the average of 2000 through 2018, and with 2009’s Great Recession.

Seasonally we’re at the peak right now for hotels. Occupancy is higher than it might be with a number of hotels still closed. And until there’s a change in the overall environment of both the virus and the economy, it’s likely all down hill from here.

In general the largest markets have lower occupancy – with the top 25 cities at just 42.2%. Surprisingly, with Disney World actually open, Orlando hotels were at just 29.9% occupancy. That’s only a little better than Oahu – where there’s a mandatory 14-day quarantine for arrivals – with a 22.8% occupancy.

Here in New York City roughly 30% of the hotels are occupied by folks from homeless shelters.

In the winter months, hotels rely on conventions, conferences, and trade shows to fill rooms. That’s not happening anytime soon. Don’t expect the historical first quarter rebound in bookings in 2021.

Gary – understand that this is reflects 50% occupancy of available rooms and not total hotel rooms in a market. There are many hotels closed/rooms not available for sale. There is a big difference between 1,000 rooms occupied out of 4,000 rooms in all hotels versus 1,000 rooms occupied out of only 2,000 rooms available because the other 2,000 rooms are in hotels that are closed.

Hotel markets driven by leisure demand tend to see the summer as their peak occupancy months which has helped push national occupancy higher as leisure demand has and will be the first to return in the pandemic environment. With families returning to school environments, you are not wrong in predicting demand to weaken as the group and individual business traveller segments still have a ways to go before demand begins to meaningfully strengthen (either vaccines in place or companies can allow their employees to travel without significant legal risks). As the national hotel occupancies begin to drop week to week, expect amplified pressure from the hotel industry to Congress to extend financial support packages (not that they aren’t trying now).

Besides room rates not dropping in proportion to occupancy, another plus for hotels is that they are often providing diminished service. Closed club lounges, reduced breakfast options, and more infrequent housekeeping are some examples of pandemic cost savings. While it doesn’t make up for the whole global pandemic it sure helps the bottom line.

@ ORDPLATAA is totally correct. This reported — as with last month’s — absolutely amounts to fake news.

We here in Seattle have >1000 rooms in the downtown area that are “offline” since March. If you don’t count that, I’m sure occupancy looks better. It is _nowhere near 50%_ even with that caveat.

I’d question the methodology more generally, but it is very clear they are not accounting for closed properties at all. They presumably call around and ask for figures. If the place is not answering the phones, they likely just exclude it from the denominator.

@ORDPLATAA – yes I note this in the post

Everyone needs to keep in mind this is an overall picture. Traditional vacation destination hotels are actually quite busy. Three weeks ago I was in Jackson, Wyoming near Yellowstone and Grand Teton National Park. The hotels were very full and the rates were outrageously expensive. The Four Season basic room was starting at $800/night without tax or resort fee. And condos to rent were basically non-existent so it all depends on where you are.

Most larger cities in Texas are ghost towns right now due to the heat and spikes of cases.

@Gary This is an interesting article, but isn’t August mostly leisure travel as people go on vacation? Do the numbers typically drop off that much as we move back into the business travel season? I would anticipate a dip anyway in the fall because I suspect companies will for financial and health reasons not wanting to be moving employees around as much as before, but I didn’t know that after August there was that significant of a drop.

@kenindfw This is likely directly the result of the virus as people want to go on vacation, but are looking specifically for outdoor destinations like national parks.

@Bill you can see it in the historical data on the chart

@kenindfw — Indeed, it’s feast or famine in the hotel industry depending on what your market is. Yellowstone Nat’l Park is actually more crowded this summer than last — and the hotels outside the park are doing crazy strong business. The same is true in most leisure markets. But urban hotels can be ghost towns and if you cater to convention travellers, good luck.