I had been waiting on Bilt Rewards to add mortgage payments. But that was dumb. You’re going to be able to double dip, earning through Bilt and with a Mesa card.

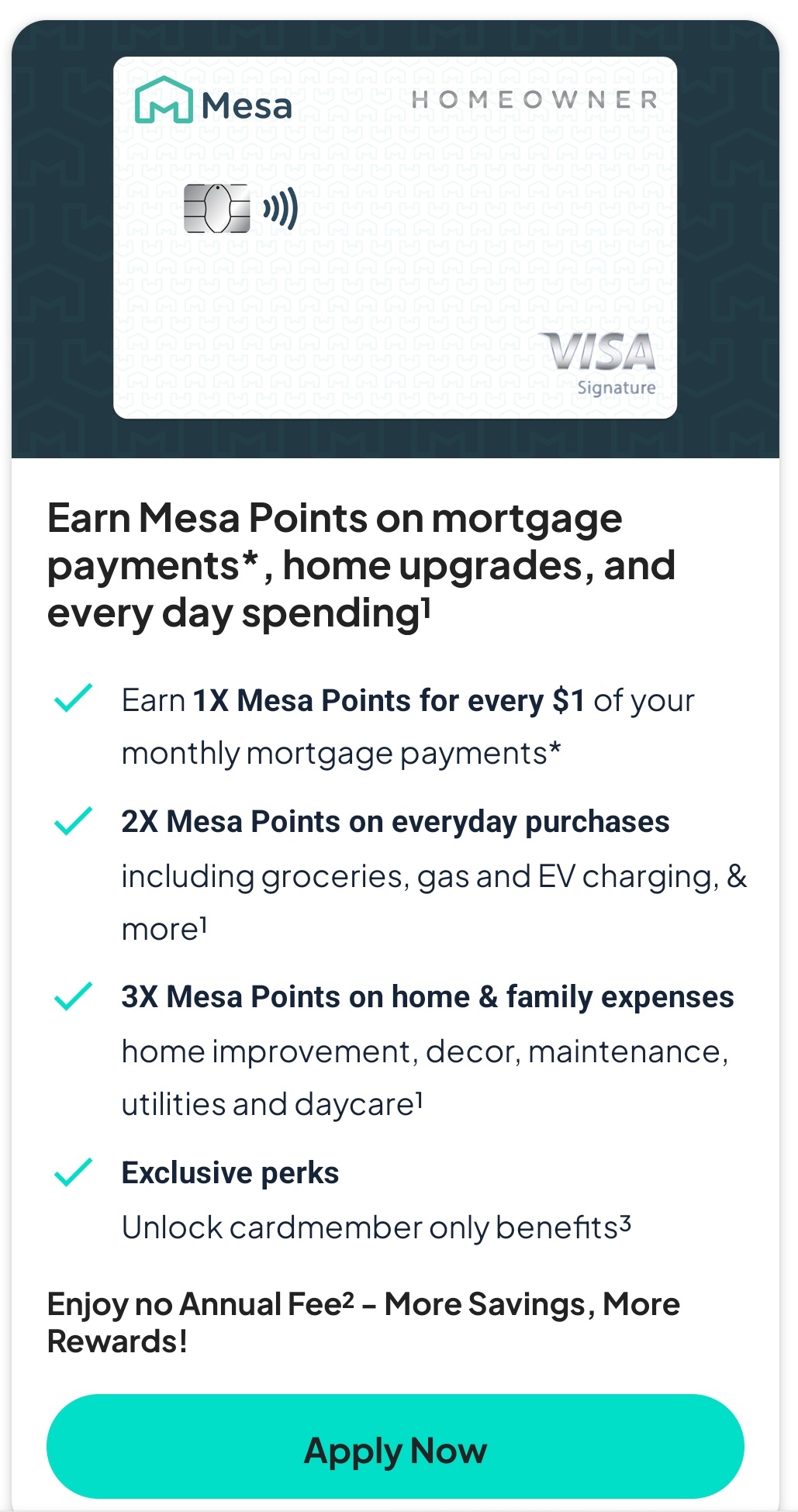

That’s because you do not actually pay your mortgage with Mesa. This is a bit weird. You enter your mortgage payment into the Mesa app, and they give you that number of points each month (up to 100,000 annually). You don’t pay your mortgage with the card. (This also means they are not generating any card swipe fees to fund those points.)

To apply for the Mesa card you need to download their app. Check out their 3x points-earning categories because many of you will zool

m in on three points per dollar for daycare (MCC code 8351 which is childcare services).

And they insisted I upload a photo of both my driver’s license and passport. Nobody has ever asked me for this before in over 30 years of applying for credit cards!

I was approved the next day with a $20,000 credit line. My first-ever card from Celtic Bank. And there are some pretty interesting benefits.

- $30 per quarter statement credit with Lowe’s

- $65 big box membership statement credit annually (Sam’s Club, BJs, Costco);

- $200 home maintenance credit with Thumbtack (also can be used for house cleaning or Christmas tree removal)

- $100 statement credit on Armadillo home warranty purchases

- $10 per month statement credit with Wag!

- $10 per month statement credit with Farmer’s Dog dog food

Points can be spent at up to 1.3 cent apiece through their travel portal; at $0.008 apiece towards gift cards; or at $0.006 apiece as credit card statement credits. They also offer redemptions for closing costs on mortgages obtained though their marketplace.

Here are their points transfer partners so far – they say they are adding more:

| Partner | Program | Transfer Rate |

| Accor | Accor Live Limitless | 1.5 : 1 |

| Air India | Maharaja Club | 1:1 |

| Finnair | Finnair Plus | 1:1 |

| Hainan Airlines | Fortune Wings Club | 1:1 |

| Thai Airways | Royal Orchid Plus | 1:1 |

| Vietnam Airlines | LotusMiles | 1:1 |

Finnair Avios Redeem For British Airways – Or Transfer To Avios

Now, the Mesa card has no initial bonus offer. Think of the mortgage points-earning as the bonus. If your mortgage payment is $4,000 a month that’s sort of a hefty ‘48,000 points after $12,000 spend within 12 months’ parceled out monthly, but that you earn every year. Maybe that’s not impressive? But you do it with one card!

And if you can do all of the spend in a unique accelerator category – like 3x earn on daycare! – that’s going to be amazing, actually. So far I’m thinking of the points as Avios, or short haul United redemptions through Air India (which start at just 3,500 points for coach and 7,000 for domestic first class).

By the way you should be signing up free for Bilt regardless because of all of the double dipping opportunities. You just add a credit card to your account, and eligible transactions earns points even when you may be earning through a different program. For instance, you can earn with Lyft and with Walgreens on transactions even if you don’t pay with a Bilt card. And you can now earn for rent payments regardless of what credit card you use (the fee is waived with a Bilt card, but you can earn Bilt points on top of rewards from your preferred credit card paying with a different card). So, no brainer.

I plan to pay mortgage via Bilt, so I’ll earn Bilt points once that’s available, and also earn Mesa points for the same mortgage.

Left out that you have to put $1000 in spend on it monthly to earn points, exclusive of mortgage.

And since mortgage doesn’t actually go on the credit card (this makes zero sense?) – who is to validate that you do or do not have a $4000 or $10,000 mortgage?

I don’t get it. Where’s the benefit to this tech company?

I answered my own question. They use Plaid to harvest your data and verify your mortgage payment.

How is that a double dip? Mesa gets to see your bank account to verify your mortgage payment. Does it show up as a line on the Mesa monthly statement that Bilt will recognize as a credit card transaction? I’m thinking not.

I can’t figure out who this card is targeting.