I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Chase’s no annual fee Ink Business Unlimited® Credit Card is back with its best-ever initial bonus offer: $900 after spending $6,000 on purchases within 3 months of account opening.

It’s a stellar card. The Ink Business Unlimited® Credit Card earns unlimited 1.5% back on purchases. Chase points are immensely valuable. And seeing such a big offer is highly unusual on a no annual fee cards This is something to jump on if you are able.

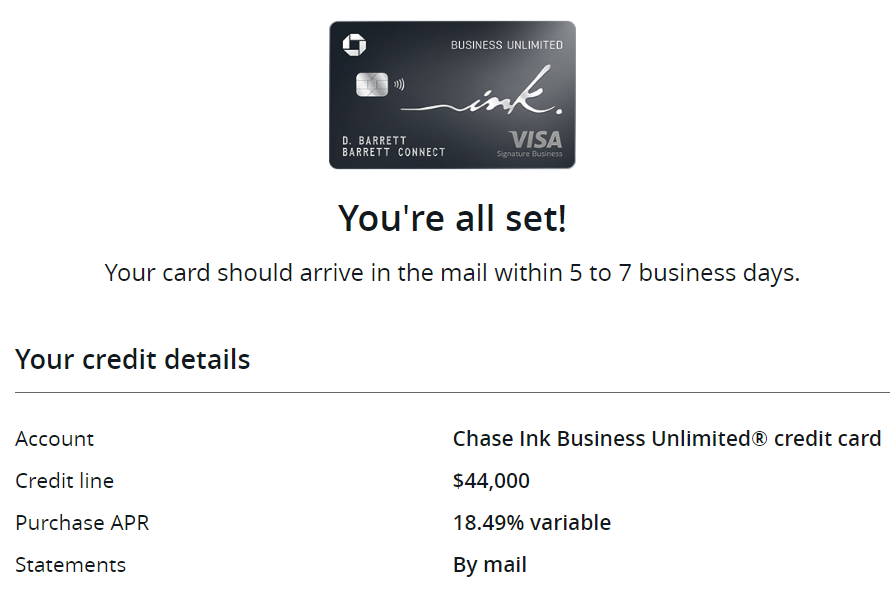

I did, and I was instantly approved. I recommend the offer, but it can be helpful to know that this is advice that I follow myself.

The reason why this is so valuable is it isn’t ‘just’ $900 or 90,000 Chase points as an initial bonus that you can earn.

If you have an Ultimate Rewards card whose points transfer to airline miles and hotel points (like Chase Sapphire Reserve® then you can combine the points from your Ink business card into your Sapphire Reserve account. Then you’re able to transfer the points to any of Chase’s airline and hotel transfer partners, or redeem them at elevated value through the Chase travel portal.

Current transfer partners include:

- Airlines: United MileagePlus, British Airways Executive Club, Air France KLM Flying Blue, Singapore Airlines KrisFlyer, Southwest Airlines Rapid Rewards, Virgin Atlantic Flying Club, Iberia Plus, Aer Lingus AerClub, Emirates Skywards, Air Canada Aeroplan

Singapore Airlines A380 Suites - Hotels: World of Hyatt, Marriott Bonvoy, IHG One Rewards

Free Globalist Room Service Breakfast At Park Hyatt Abu Dhabi, Where I Redeemed Points

The same idea works if you have a Chase Sapphire Preferred® Card or an Ink Business Preferred® Credit Card.

What may also be interesting to know is that I really like the Ink suite of cards, and I think each one has a purpose. I was approved for the Ink Business Unlimited® Credit Card on top of already having open:

- Ink Business Preferred® Credit Card which has an offer to earn 90k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. It earns 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year.

- Ink Business Cash® Credit Card which is has valuable 5x earning categories: earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year; earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year; earn 1% cash back on all other purchases.

I also already had an open Ink Business Unlimited® Credit Card for the same business. It’s a no annual fee card and I like keeping different expenses on different cards. It just keeps my expense tracking straight!

I still have my Ink Business Unlimited that I applied to in February of 2023 and received the bonus. Are you saying I can apply for a 2nd one and still receive the 90k bonus? I don’t need to cancel the first one?

Need to be under 5/24 to get approved?

@Bonnie – Yes. If you want to improve your chances of automatic approval, secure message Chase a week before to lower the existing credit limit. I do this because Chase will only extend credit limits up to a certain amount (based on your income) and that frees up credit which makes automatic approval easier. It’s worked for me a couple of times recently. After you get the signup bonus, secure message Chase to close the old card.

They let you get the sub again even though you had an open card of the same flavor?

Was it a different business name?

Odd they would let you open a second card of the same type for the same business.

Incredible rewards for a no-fee card, especially if you have a CSR already which for travel makes the rewards half again as valuable. Maybe my defunct DBA needs yet another Chase Business card.

Gary, is it the case that the only way we can accrue points with this card (as opposed to cash back) is in conjunction with one or another Chase Sapphire card?

They let you get the sub again even though you had an open card of the same flavor?

“I needed another card to keep my expenses straight”

lol

You don’t have to lie to us points junkies. We’re not the Chase reconsideration like.