I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

I’m earning transferable points with no fee using the no annual fee Mesa card. You don’t even pay your mortgage with the card. You just tell them how much your mortgage is, and they award you the points as long as you spend $1,000 on the card each month. I do that in a 3x category.

There was briefly an initial bonus offer for the card. Normally you just earn 5,000 bonus points for being referred to the card. I think of the mortgage points as a signup bonus you receive every month, month after month, and not just for the first year.

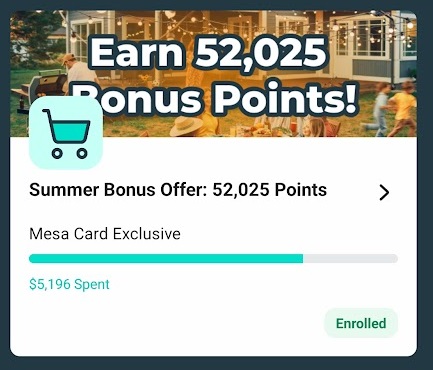

When I got the card there wasn’t a bonus, but I did receive their summer spending promotion with over 50,000 points for spend on the card over three months and I’m about to complete that.

Right now, though, there’s another 50,000 point bonus offer – open to both new and existing cardmembers.

- Refer 2 friends to the card and earn the usual 5,000 points each

- That unlocks an offer of 50,000 bonus points for spending $10,000 on the card in 90 days.

Once you unlock the offer, you’ll activate it to start the 90 day spend clock. And remember that this card earns 3x in some pretty great categories so I should be able to do my $10,000 spend all at 3x (home improvement expenses; heat, gas, electric, cable/internet utilities; home maintenance (cleaning, lawn care, pest prevention); decor and furniture; insurance and taxes; and daycare.). And if I somehow fall short, groceries and gas are 2x.

Using a referral link earns 5,000 points when getting approved for the card. And you can make money on the card, too. It’s a no annual fee card and they offer several statement credits. They’re paying for my Costco membership so that’s real value. There’s also a $30 quarterly statement credit with Lowe’s, a $200 home maintenance credit with Thumbtack (also can be used for house cleaning or Christmas tree removal), and several more.

But earning 3x transferable points on day care, insurance and taxes is just remarkable. Points can also be spent at up to 1.3 cent apiece through their travel portal; at $0.008 apiece towards gift cards; or at $0.006 apiece as credit card statement credits. They also offer redemptions for closing costs on mortgages obtained though their marketplace.

Here are their points transfer partners so far – they say they are adding more:

| Partner | Program | Transfer Rate |

| Accor | Accor Live Limitless | 1.5 : 1 |

| Air Canada | Aeroplan | 1 : 1 |

| Air India | Maharaja Club | 1:1 |

| Finnair | Finnair Plus | 1:1 |

| Hainan Airlines | Fortune Wings Club | 1:1 |

| SAS | EuroBonus | 1:1 |

| Thai Airways | Royal Orchid Plus | 1:1 |

| Vietnam Airlines | LotusMiles | 1:1 |

Their points are great to transfer to Avios, or for short haul United redemptions through Air India (which start at just 3,500 points for coach and 7,000 for domestic first class).

However Aeroplan is arguably the best Star Alliance frequent flyer program with highly accessible points and they partner broadly so wherever you have your points in various transferable currencies you can pool them here.

Gary, it seems that more and more, your posts are reflections on what credit cards do what-for-who, what frequent-flyer programs connect with others and how they interact and how airport lounges work or don’t work. All important stuff for some, I’m sure. For me, I could care less. Much more interested in hearing about aircraft and airlines. Guess I’m not your average follower!

@Michael Harrison — No ‘har,m’, no foul!

Just got the card – easy process and was approved immediately.

If anyone else is looking to sign-up, would appreciate if you use my referral link! It is: ykpcwk

I’ve been using this card for 4mo now and love it. The 3x on “home” stuff like Insurance, Utilities, Home Depot/Lowes, really rocks. Also got credit back for my Costco membership.

If you want to signup, PLEASE use my referral link: We both get 5,000 bonus points if you get approved and spend. Use my code to apply: aptmev https://mesa.onelink.me/odOT/gge86l53?referral_code=aptmev

I just had the same experience as David (I used your code, by the way). Application process took about 5 minutes and approved right away.

If anyone else is looking to signup, would appreciate if you use my referral code — n3pwv3