I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Update 11/1/24: The Bask Bank Mileage Savings account now earns 2 miles per $1 saved annually.

Note: The offer in this article expires August 31, 2024

I haven’t written about Bask Bank since last summer, even though it’s one of the best ways to earn miles without actually spending money.

The Bask Mileage Savings Account awards 2.5 American Airlines AAdvantage®️ miles per dollar saved annually. It’s a savings account that awards miles instead of money. This is one of the highest returns possible, and there are attractive tax reasons to like this as well.

20,000 Mile New Customer Bonus

Right now, they have a new customer offer of 20,000 bonus miles for $50,000 in deposits held for 6 months. That’s in addition to the current 2.5 miles per dollar saved annually that you earn on those funds.

- After 6 months with that $50,000 deposit, you’ll have earned 82,500 miles (62,500 miles plus 20,000 bonus miles). That’s enough for one-way business class between the U.S. and Australia on Qantas.

- Or leave the funds in the account for a year, and you’ll have 145,000 miles. That’s more than enough miles to qualify for a roundtrip business class award on Qatar Airways or Etihad between the U.S. and the Mideast, India, or even the Maldives. Roundtrip business class between the U.S. and Africa on Qatar Airways is 150,000 miles.

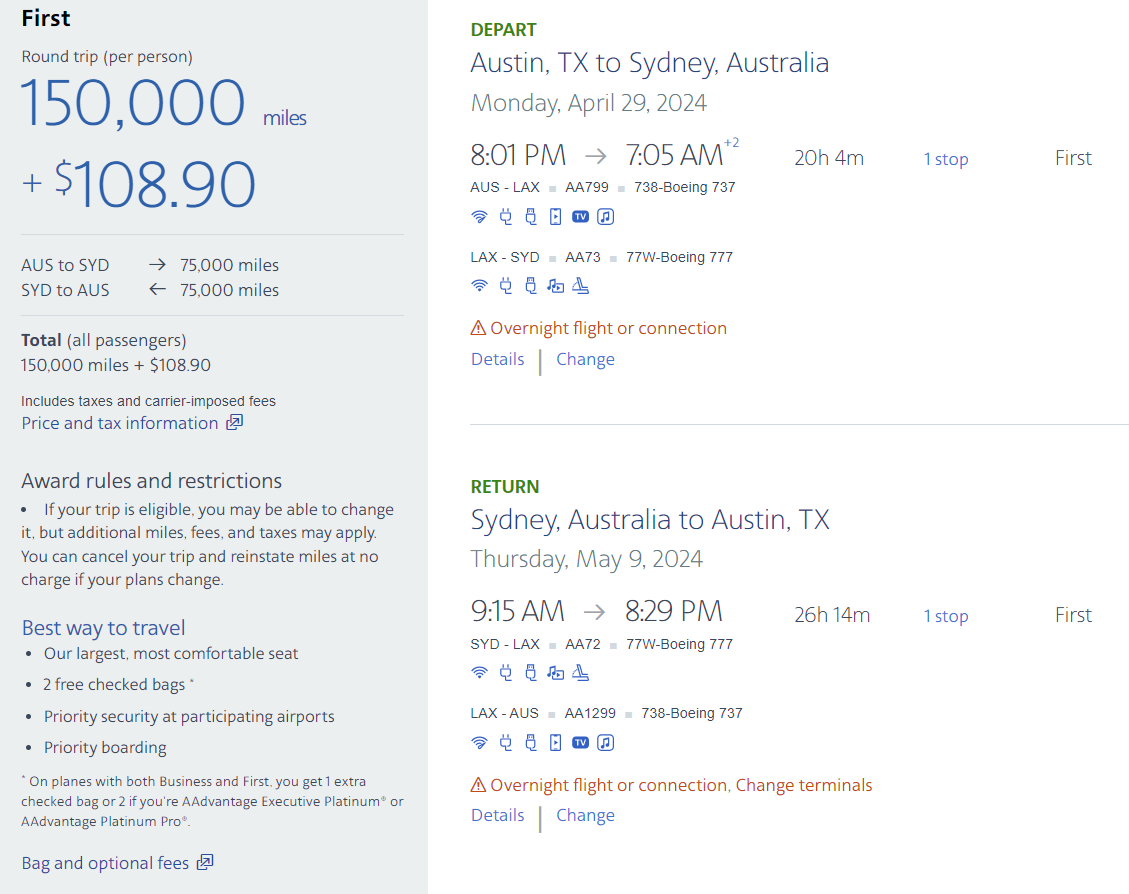

Or add the 145,000 miles to 5,000 already in your account, and book roundtrip first class (not even just business) to Australia.

Here are key details of the new customer offer:

To qualify for this offer, you must be a first time Bask Mileage Savings Account customer, open a Bask Mileage Savings Account between June 1, 2024 and August 31, 2024, fund your Bask Mileage Savings Account within 15 business days following the initial account opening and maintain a minimum daily account balance of $50,000 for 180 consecutive days following the initial account opening.

Close to travel, the cost of American’s premium cabin Australia awards have been dropping a lot in my searches.

American Airlines Flagship First Class

Qantas First Class Lounge, Sydney Accessible When Departing American Airlines First Class

Why This Can Beat Other Places To Park Cash

If you value American AAdvantage miles at 1.5 cents apiece then earning 2.5 miles per dollar saved annually is a 3.75% return.

However, you need to adjust this for taxes. Bask Bank has reported the miles I’ve earned for tax purposes at a value of 0.42 cents apiece. Assuming that doesn’t change over the next year,

- Earning 82,500 miles (worth $1,237.50) saving $50,000 for 6 months would generate a 1099 tax reporting form showing a value of $346.50.

- If you pay taxes on those miles with a hypothetical combined federal and state income tax rate of 47%, you’re paying $162.86 in taxes. That means netting $1,074.64 in value after taxes.

- Compare that to a hypothetical 5.50% APY. I do not know of any savings account in the country paying 5.5%. That same $50,000 saved would yield $1,375, $642.25 in taxes, and a net of $732.75.

- You’re coming out better than 46% ahead with this offer over the six month promotion period!

That’s a lot of numbers to say that this is a really aggressive offer to open an account and hold a large deposit with Bask Bank.

American Airlines in Providenciales, Turks & Caicos

A Good Place For Even Small Deposits, Too

Even very small deposits are worthwhile with this account, since there are no minimum balances and earning even a single mile regularly can extend expiration of your miles.

Texas Capital Bank launched Bask Bank in 2020, offering online savings accounts that earn American Airlines AAdvantage® miles. I love that they’ve continued to improve the value proposition since then, increasing earning from the original 1 mile per dollar saved annually to 1.5 miles per dollar, then 2 miles per dollar, and now 2.5 miles per dollar saved annually. They clearly want this to be a very attractive value proposition.

I’ve been a customer of Texas Capital Bank since July 2003 when I first opened a checking account with them. I’ve been with them for over 20 years.

This is a great way to save money and a great way to earn miles. It’s free, quick and easy to sign up, and earning miles for your savings is a better deal than you’ll find from most savings accounts.

My primary way I’ve used my savings account is to put away money for my annual property taxes. That’s one of my biggest expenses each year. It’s something most people don’t earn miles for. Bask Bank helps me set aside the funds and earn miles for it at the same time. It’s an account I’ve kept for the past four years, and the current offer is a good time to open one.

Texas Capital Bank d/b/a Texas Capital is a member of FDIC. Bask Bank is a division of Texas Capital Bank.

Mile awards are subject to change at Bask Bank’s sole discretion. Please see Terms and Disclosures for details.

American Airlines reserves the right to change the AAdvantage® program and its terms and conditions at any time without notice and to end the AAdvantage® program with six months notice. Any such changes may affect your ability to use the awards or mileage credits that you have accumulated. Unless specified, AAdvantage® miles earned through this promotion/offer do not count toward elite-status qualification or AAdvantage® Million MilerSM status. American Airlines is not responsible for products or services offered by other participating companies. For complete details about the AAdvantage® program, visit aa.com/aadvantage.

Need to be clearer on the math.

1. The tax rate you specified must be the marginal rate, not the effective rate.

2. Any fed+state marginal rate under 13% comes out ahead for savers over a year.

3. But over six months, any fed+state marginal rate under 27% comes out ahead.

That’s a very different story than assuming that everyone lives in either Hawaii, California, New York, or the like.

Do these miles count toward status?

@Josephm – no, these are redeemable miles and not Loyalty Points

@roundtree – marginal rate seemed relevant for the calculation, I think, and I suspect most people in a position to benefit from large savings deposits won’t have combined federal and state marginal rates under 13%! The single filer federal rate alone is 22% for an AGI of $47,151.

I would compare to holding in a short term treasury fund like SGOV if you are in the bracket you used. Yield is 5-5.25% and treasuries are exempt from state taxes. Highest tax rate then is 37% (fed only).

That said, if you are in the highest bracket you are making +$600k per year as a single filer so I am not sure this math even matters for you.

Treasury bills are paying 5.4% with interest not being taxable by any state. Easy guaranteed money.

An annual rate of 2.5 American Airlines AAdvantage®️ miles is terrible. You are giving your readers bad advice.

@TravelCappy – why on earth would this math not matter to someone earning $600k?

Because at that income level your job likely takes up most of your time and there are far more valuable things you can do to make money on the margin than opening a whole new bank account, funding it and setting a reminder to close it.

Examples:

Move $1mm to E*trade and get $4500 (recent promo). Probably 30 mins of time once.

Make sure your cash is in a treasury fund (or as another poster pointed out directly in tbills.) vs a high yield account. At $200k of assets it would be worth +$300 a year to setup treasury direct account vs SGOV based on the rate quote in another comment. (I am using 15 bps).

Open a Citi self directed brokerage and find $1mm in stock. They will give your $400 per year for subscription reimbursements recurring plus various other perks.

Make sure you are maxing out tax advantaged accounts (hsa, fsa, dependent care, 529 with kids, etc…).

In short:

A couple hundred bucks once off isn’t worth much of your time when you are making $2k or more on average each day. (I am comparing to your HY savings, not the full AA mile value which also takes time to max out).

Thx for posting this reminder about Bask Bank. My admittedly simple mind values the 290k miles my wife and I would get from a year of $100k deposits more than the roughly $5k in interest, even before taking tax considerations into account and even considering that good premium class domestic and international mileage deals can be hard to find unless you plan trips way in advance (which we do). If I’m being foolish here, I’d welcome folks pointing out why that’s the case.

I don’t think it’s fair to compare the rewards off $1mm to what you can do with $50k.

And I beg to differ that hundreds of dollars don’t matter for something this easy to someone earning $600k.

1099?

You’re missing my point. You used the top us tax bracket. That is roughly the top 1% of earners. For someone making that much money the limiting factor on their life is often as much time as money and $600 (less than 0.1% of what they make if they are at the bottom of that bracket) is unlikely to be worth their time.

For most people, sure $600 is valuable. But then you need to use a much lower tax rate (as others have noted) and the math vs. a normal investment isn’t as clear cut in favor of this. $50k at 5.4% bill (using John’s yield which sounds right) over half a year at a 22% tax rate means is worth $1,053 after taxes, not 732 (your post tax figure). That is far less exciting of a difference.

If Bask savings awarded loyalty points too, this would be far more interesting IMO.

I did not use the highest possible tax rate (e.g. federal + NY state + NYC = 51.8%)

Someone earning $600k in NYC is doing well but isn’t among the super wealthy.

@Travelcappy One faulty assumption at the start nullifies the result. You assume $600K is the result of lots of hours put in. There are many, many people with passive income that requires little time commitment. To those this is a great opportunity.

While I think this is certainly an option, there are some considerations:

Timing it so that your existing account where you’re currently parking your $50K+ ends at just the right time might be tricky.

You’re assuming that someone is fortunate enough to be in such a high net worth category.

Finding high value redemptions that would actually make this worthwhile is quite the trick. Just for fun I just checked availability with AA miles NYC-BKK for the next year in business or first class for two people and came up completely empty. Where exactly would you practically advise that these wealthy people spend these miles? I’m pretty sure that they would not be sitting in coach seats to Asia and the richer people get the less they’re willing to compromise by flying to/from a separate airport or on non-preferable dates.

Treasury direct >5% not taxed by states – so very useful in high tax states

https://treasurydirect.gov/auctions/announcements-data-results/announcement-results-press-releases/auction-results/#noncompetitive

50,000 x 3% after tax = 1500 after tax

Tax form showing income 145k miles @ 0.42c =>609$ = Owed Tax of 46% = 280$

Total loss by choosing miles = 1500+280= almost 1800$

Miles 145k = cost of each AA mile is 0.125c

Without bonus just leaving miles there

$50k x 2.5 miles / yr = 125k miles cost about 1750 = 1.4cpm

Nothing is free

Gary: I was talking about the highest federal rate (as state taxes can be easily avoided with treasury investments). If you want to come up with an example of hitting 47% without being in the top federal bracket go for it. It probably exists with some weird combo of a specific state and filing status, but it unlikely to apply to 99.9% of your readers. Perhaps to put a bow on it, I think you really need to provide a table with different outcomes for the saver if you are going to get into post-tax benefit arguments. As an earlier commenter pointed out, there are people who have low enough rates that even all your other assumptions this is a bad investment.

Deltahater: If you are making $600k a year in passive income you are well into multi-millionaire territory and then it goes back to my point that there are a ton of places to invest your time with a higher return than this if you have millions to move around.

” I do not know of any savings account in the country paying 5.5%.”

I’ve currently got $50,000 in an 8 month CD at my bank paying 7.1%….

The miles for a one-way from the US to Australia on Qantas made me chuckle: 1. If award availability was ever available & 2. For that price, I rather fly JAL with a Tokyo layover or Cathay Pacific with a HK layover knowing that I’ll get a far better experience and product. Sure, availability may be the same if not better but the better experience is what is worth it.

Thanks for this. Would you advise this: I value AA miles above all else in my situation/award booking practices, and they’re hard to get (done all the credit cards, over and over again) Would you take $50K from another account, paying the (substantial) CG tax, and deposit it in Bask? The $50K would still have me in 0% bracket (filing jointly).

Ed. C – Which bank? Thanks.

Bask has an interest savings account that earns 5.1% APY. Seems like that would be better for a comparison.

Good news! Thanks! Once again my procrastination has won.

I’ve been meaning to get Hubby to open an account with money currently in a Bank of America Money Market account that it there just for emergency cash. I’ve been earning miles for over a year. I have a similar amount invested in a Bask savings account and use the interest earned as a measure for how much the miles cost

” I do not know of any savings account in the country paying 5.5%” <- That's embarrassing because you absolutely know this not to be true.

I know you have the link to DoctorofCredit, which you could share with readers, that shows 3 options at 5.5%, not to mention far higher rates of returns for SUBs for bank account openings.

You can't pretend not to know that (given that you've been in the game for many years longer than I have), so obviously there's another reason for pretending you "don't know".

“The single filer federal rate alone is 22% for an AGI of $47,151.”

Gary does this all the time. For his math to work, he has to use an outrageous tax rate and make everyone “single”. I’m married, like a number of people, and pay no more than 12% at the Federal level. I’m convinced Gary is on the bank’s payroll.

Gary, thanks for the heads up. The math is obviously compelling for those in the higher tax brackets. Ignore the whiners. Thanks again

Gary,

In addition to all the discussion about tax rates, you’re including the initial bonus miles for Bask while ignoring the potential sign-up bonus for other banks. I’ve seen offers in my junk mail of as much as $600 and I bet I could find higher if I were to look. The math looks very different if you include those. Mileage savings was very attractive at 1mile/$/year a few years ago when interest rates were low, but less so now even at high tax rates.

Your math is wrong 82500 miles – 350$ = 2.5% of 50k in lost cash (both pre tax)

So 82500 miles – 350 = 1250 (pretax)

So 82500 miles = 1250+350 Pretax = $1600

High earners tax is 37% in treasuries + don’t forget they pay an extra 3% penalty >400k

Post tax at whatever rate say 40% in treasuries

82500 miles is 960$ approximately for the first 6 months = 1.15c cost

AFTER that, 62500 miles is 960$ = 1.5c each

For low earners with 50k lying around, this is NOT a good idea.

At 10% tax rate the lost cash is 1440 ($1600-160 tax)

First 6 months = 82500 miles = 1440 = 1.75c

After 6 months 62500 miles is 1440 = 2.3c each

I know rich people also read your blog, but you are helping a scam for most Americans telling them to keep it in this bank when interest rates are this high for treasuries.

As they say, the devil is in the details

The math doesn’t really add up. 145k miles @.02 (a higher valuation than most blogger) =$2900.

Simply put 50k into an FDIC insured account paying 5% (I have several) = $2500. Or perhaps invest in tax free Treasuries or muni bonds (similar returns).

No deval.risk with the latter and no hassle to spend your $2500 on airfare plus earn EQM and RDM. No risk that Bask aka Texas Capital aka whatever goes bust one day and your money is tied up for a while (recall SVB customers who couldn’t make payroll).

Finally nobody wants to go to antisemetic Maldives anymore so you ought to remove them from your wishlist.

I just checked Austin to Sydney for mid-June and AA has it at 365K ome way in Business. AA has some terrible redemptions!

If one redeems AA points at 1.4 cpp, then 2.5x gives a return of 4.5 percent per year. That’s not great but is reasonable relative to prevailing rates. But, as Marlon Brando asked, what’s my motivation? If AA granted 1 LP per dollar, perhaps. Otherwise, meh.

I guess my comment pointing out the clear similarities between the peddling of Bilt and of Bask Bank hit too close to home and won’t be seeing the light of day…

82500 miles – 350$ in a 1099 int = 2.5% of 50k in lost cash (both pre tax)

So 82500 miles – 350 = 1250 (pretax)

So 82500 miles = 1250+350 Pretax = $1600

High earners tax is 37% in treasuries + don’t forget they pay an extra 3% penalty >400k

Post tax at whatever rate say 40% in treasuries = 40%

For people with money in a savings account add 10% for state taxes = total 50%

82500 miles is 800$ after tax for the first 6 months = 1.0c cost

AFTER that, 62500 miles is 800$ = 1.3c each

For low earners with 50k lying around, this is NOT a good idea.

At 10% tax rate the lost cash is 1440 ($1600-160 tax)

First 6 months = 82500 miles = 1440 = 1.75c

After 6 months 62500 miles is 1440 = 2.3c each

For most Americans telling them to keep it in this bank when interest rates are this high for treasuries or even a high interest savings account, it is a bad idea.

For rich people in high tax states then it is a great idea.

As they say, the devil is in the details

You have to love the irony of an article on how to earn AA miles next to one that describes the poor service being provided by AA flight attendants.

Flagstar Bank is offering 5.55% APY for 4 months…

AA miles are (on many international routes) the best currency in the world.

In the past 2 years, I’;ve travelled Qatar biz class 6 times, and Etihad FC once, all thanks to AA miles.

Only Tim thinks Delta offers good international biz class redemptions. United has decent redemptions, but has nothing comparable to Etihad or Qatar.

How do all y’all have $50,000 liquid just laying around?!