News and notes from around the interweb:

- Where airline and hotel loyalty programs are going with perspectives from the heads of Hyatt’s, Marriott’s, and Wyndham’s program. I offer framing at the beginning and end:

“Business travelers are ‘hurt less’ by frequent-flyer program changes, but not ‘better off,’” says Gary Leff, founder, View From the Wing. “Awards are more expensive, especially premium cabin international awards, and upgrades are harder to get than ever. Basics, such as extra legroom, are now being marketed as ‘upgrades.’”

..“The need to recognize and reward doesn’t change. When the economy is good, programs are less generous, and when it is bad, more so.”

- Which banks will re-open a closed credit card. I’ve done this when Citibank customer service closed down an account by mistake (!) a few years ago.

- Azerbaijan really wants to develop tourism. Is it high on your list?

- Egypt is blocking airlines from pulling money out of the country. We’ve seen this before, airlines are always shocked when regimes do this but those regimes also lose a substantial portion of their international air service.

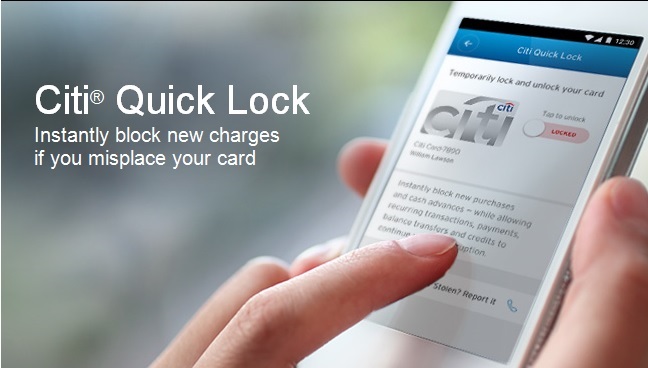

- Citibank will now let you lock and unlock your card accounts, for instance if you lose your credit card you can lock it so charges will be declined — and then unlock your account if you find your card in the cushions of your couch.

- Aussies feel domestic fares between rural airports are too high. They think there ought to be more competition, just like American Samoa unrealistically wishes for.

- Expedia has replaced Switchfly to power the backend of Marriott vacation package search. Marriott may not like it when you don’t book direct but has developed a frenemy relationship with Expedia nonetheless.

About time! Discover has had the lock card feature for a couple of years now – they call it “freeze account”. It makes so much sense I’ve wondered why other card issuers haven’t added this until now.

In the end it should save the issuer money. Without it, consumers may be hesitant to call to replace a missing card thinking it’s just misplaced when it’s actually stolen, so the bank has to deal with increased fraud costs. And on the other side, for the cautious consumer who does report a misplaced card as lost, there’s the cost of card replacement and mailing.

How do I unlock my citibank carc