Earning 2% cash back is pretty good, but you can do better. Bank of America will let customers who hold large deposits at the bank earn 2.625% on everything. And of course you can get even 5% cash back on some cards for certain categories of spend.

But everyday 2% cash back is boring! The modern financial era isn’t about boring and you’re certainly not going to raise Silicon Valley VC money with boring.

Robinhood didn’t democratize finance, it gamified it. They made trading feel like playing Candy Crush. There’s confetti when you buy and bright colors. That stimulation hit the same dopamine circuits as a slot machine. The innovation wasn’t zero-commission trades (those were already baked into payment-for-order-flow economics used by big brokers). The real innovation was reframing trading as entertainment.

So someone thought,

- What if we did for credit cards what Robinhood did for investing?

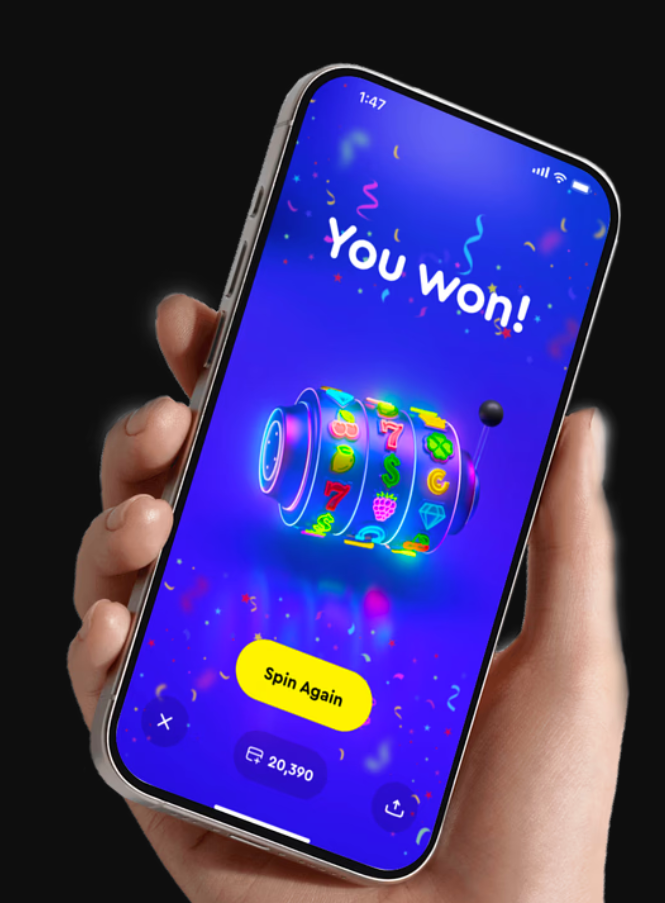

- And what if we made it an actual slot machine?

Credit: Coverd

That seems to be the premise of Coverd, which offers slot machine pulls to determine whether you get any cash back on your purchases, but offers a ‘jackpot’ of 100%.

The idea is to turn routine purchases into “win‑back” mini‑games where you can win up to 100% of a purchase amount as a statement credit. The card is projected to come out in the first quarter of 2026, but so far there’s an app where you can take a convoluted path to earning rebates on the spending you’re already doing. The card will just earn you more swipes (“risk‑free gameplay”) in the app.

They pitch it as “up to 100% back” while you “play fun games for a chance to get your credit card purchases covered.”

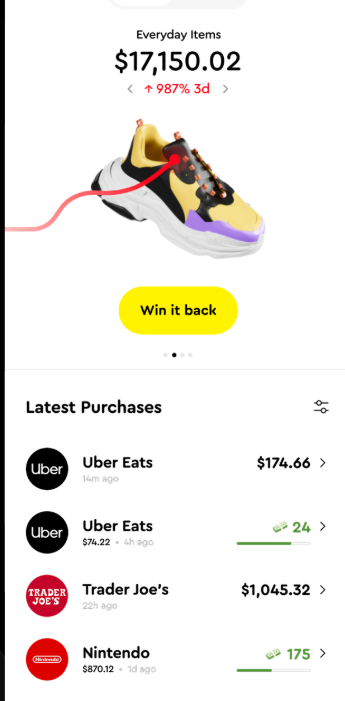

Here’s how it works today with their app, with no credit card yet.

- Download their app, and link your bank data via Plaid so they can track your transactions.

- To play for prizes you use something called “Coverd Cash” which is their redeemable currency. You can’t purchase it directly, or else that would be gambling.

- So you obtain covered cash by:

- Free mail-in alternative method of entry: send a handwritten request card and envelope and you get 25 cents in Coverd Cash credited after verification.

- Participate in social‐media giveaway contests they run.

- Purchase “Practice Coins” (a separate currency) and sometimes receive bonus Coverd Cash when you buy certain Practice Coin packs.

- Free mail-in alternative method of entry: send a handwritten request card and envelope and you get 25 cents in Coverd Cash credited after verification.

- This roundabout method means you aren’t buying slot tokens, and so you aren’t directly doing illegal gambling. Once you have Coverd Cash, that’s what you’re able to use to play “sweepstakes games” in the app for a chance to win additional Coverd Cash.

- When you accumulate enough Coverd Cash you can request a redemption into real cash or prizes, subject to a whole bunch of rules (minimums, caps, geographic eligibility – Idaho, Louisiana, Michigan, Montana, and Nevada residents can’t play because of those states’ gaming laws).

- After meeting Know Your Customer requirements and accumulating at least $50, then you can request payout which can take up to 30 days.

Credit: Coverd

Playing games, logging transactions, and linking accounts has you entering sweepstakes games. The mail-in free entry method keeps it legal in some jurisdictions. But you spend money to buy something that earns you something else that can be gambled, and they think that keeps it sort of legal.

Who knows? Sports betting is illegal in many states, but sports betting on Robinhood isn’t! They use Kalshi for futures contracts (a commodity, not a bet). That’s regulated by the Commodity Futures Trading Commission, and CFTC regulation pre-empts state regulation.

As Chevy Chase noted in Fletch “I’m not even sure that’s a crime anymore, there have been a lot of changes in the law.” CZ was pardoned!

I found this review in the Apple app store and frankly it sounds like someone in-house wrote it,

Absolutely love the app!! The app helps me track my spending habits while playing interactive challenges and it’s helping me build a WAY better financial situation. The interface is smooth, easy to use, and definitely a fresh take on personal finance.

If and when the Coverd Card ships, sweepstakes entries get automated at swipe. They also promise ‘smart spend insights’ to help you make better financial decisions. I’m not sure offering a dopamine slot pull with each card swipe is the best way to encourage prudence. But that’s empirically up for grabs.

Ultimately, they’re betting a sweepstakes and game loop is a more compelling, viral, and retentive rebate mechanism than static cashback, especially for Gen Z, and that this will drive lower customer acquisition costs and higher lifetime customer value – that you’ll prefer it even though you get a lower rebate on average than your current card.

Backed by a16z, Arbitrum Gaming Ventures, and Yolo Investments, Tusk Ventures and others they’ve raised a $7.8 million seed round. So they have some cash to get started, and the regulatory environment during the Trump administration seems favorable, although the residency exclusions certainly evince an awareness of risk going forward.

(HT: @CameronMattis who describes it as “a card rewards program designed by satan”)

Gambling is destroying us.

This set up could be a boon for reply unbonused spend – insurance premiums, doctors bills, construction etc. Really anything stuck at 2%. If you can track over a long time what your rewards are and it’s material it could be a useful tool.

Plenty of dopes-I-mean in this comments section that will fall for this one.

“That’s a no from me dawg…” –Randy Jackson.

Greg is correct as is 1990. Now that El Payaso Naranja has gutted the CFPB, we can expect anyone who pays enough money to the family to get to do whatever they want to the American people.

@Welcome to Hell – Powered by OracleMetaAmazonMicrosoft — Your alias reminds me of the lyrics to ‘The Revolution Will Not Be Televised.’

“The revolution will not be brought to you by Xerox in four parts without commercial interruptions…”