I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Plastiq, the online bill pay service that charges your credit card and then sends out checks on your behalf, has a new tax payment promotion where their fees are just 1.75% for tax payments made with a MasterCard.

The next lowest fee for tax payments is 1.87% from sites like Pay1040.com.

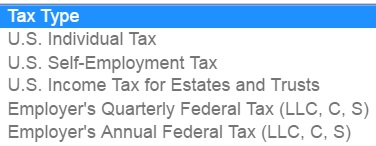

Plastiq supports several federal tax types:

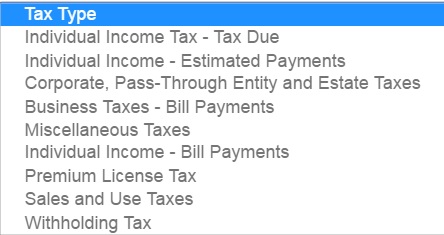

And they support several state taxes as well, which I expect vary by state. For instance, they do not support any in Texas which has no state income tax. But in my former home state of Virginia they list:

The Plastiq 1.75% promo for tax payments with a MasterCard runds through April 18 at 5 p.m. Pacific time.

I set up a few figure amount in payments when they were running a 1.5% promotion via MasterCard. I’ve asked Plastiq about the timeliness of sending out tax payments, and which ones are sent electronically and will update this point. Until then I wouldn’t likely send payments due on April 15 on that day. But for those thinking about their taxes in advance this could be a very attractive option.

Anyone know if you can property taxes as well? I live in Washington. I checked the website out but couldn’t find a definitive answer.

Thanks! Scott

just a word of warning, they are not too reliable.

Also, when I tried to use my Chase UA Club card (I have a mastercard version since it used to be a Presidential Plus Continental card) for 1.5 miles per dollar, it got declined. Chase asked me if Plastiq was a gambling company. They would not allow the transaction when I called Chase. So, it did not work for me. (this was when the rate was 1.5%)

good luck!

What about amex? We have to meet minimums on Starwood

I’ve used my SPG card a few times with them, works fine. I won’t be taking advantage of the taxes with MC I just got the 150,000 bonus AE platinum card and need to put the spend on that. Plus unless you allow plenty of time with Plastiq, I don’t think I would chance it (based on experience).

Caution: Plastiq is not listed on the IRS Pay Your Taxes by Debit or Credit Card page:

https://www.irs.gov/uac/Pay-Taxes-by-Credit-or-Debit-Card

Mathematically, how is this profitable?

If you use a miles-earning card: For a tax-bill of $3k you’ll pay $52.50 in fees to Plastic. You’ll earn 3k miles, which is less than 1/8 of the miles needed for a round-trip flight. So you need to do this 9 years in-a-row to earn a flight. $52 fees x 9 yrs = $472 you’d pay in Plastic fees. Good grief, Plastiq won’t even exist in 9 years… just BUY your flight today on your cc.

If you use Citi Double card: You’ll pay 1.75% in fees, and earn 2% from Citi. So you’ll profit 0.25%. For a tax-bill of $3k, your profit is $7.50. Too small a profit to do anything with other than the McDonalds drive-thru.

And you CERTAINLY can’t scale this deal!

@Lindy: depends on the size of your tax bill. I owe the feds $20k+ this year. Basically, it’s a cheap way for me to buy some miles at 1.75 cents a pop.

I have been trying to figure this out as well. I have a 30k tax bill i need to pay in the next few days. chase? amex? Delta Reserve? AA? im thinking chase. its 1.78% for me so the fees are 548.00 for the total tax bill

FYI I will pay it off immediately