Scott McCartney covers the new IdeaWorks study of hotel loyalty program value for the Wall Street Journal.

Anything Jay Sorensen writes, Scott covers. This study by IdeaWorks is better than similar efforts they’ve made to rank airline frequent flyer programs.

This effort seeks to determine the rebate value that your spend has with the largest hotel loyalty programs, and estimate the value of a hotel point.

They come close to offering reasonable estimates of the value of points from IHG Rewards Club, Hilton HHonors, Starwood, and Marriott (although they slightly overvalue those points).

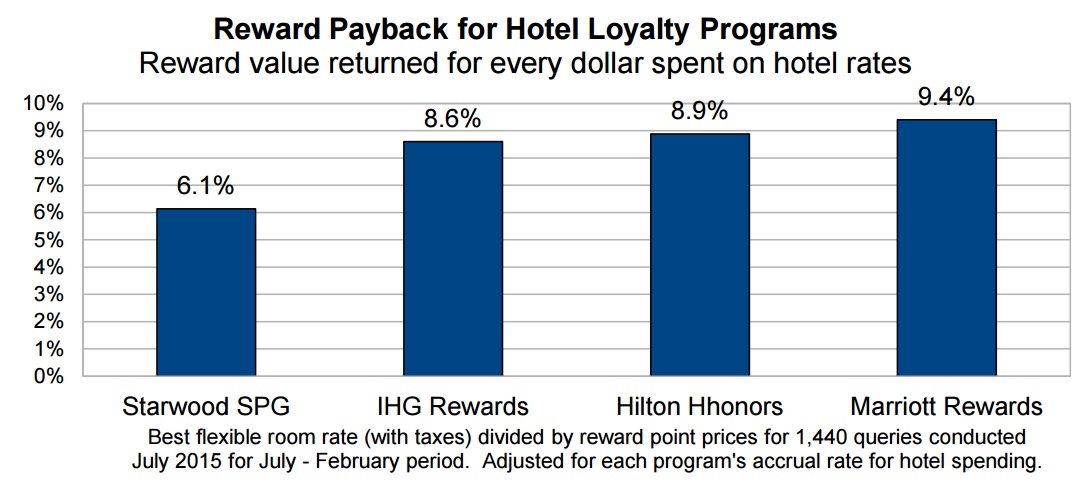

They declare Marriott to offer the biggest rebates:

The first thing you’ll notice is that they only rank 4 programs. The second thing you’ll notice is that three of the four cluster fairly close together.

Starwood has always been weakest for rebating in-hotel spend. However it’s important for a consumer to understand, though, how members intend to use their points. Hilton points are exceptionally valuable at their lowest-tier hotels. The study shows, accurately, that Marriott, IHG Rewards Club, and Hilton all offer similar return on spend. Starwood lags here, however they do have more aspirational hotels worth spending your points at than competitors do.

Fundamentally, important things missed in this survey are that smaller programs are the most rewarding. You can walk down any street and fall into a Marriott or Hilton hotel, and it takes effort to be loyal to a smaller chain so they tend to spend more on their frequent guest programs. Club Carlson, for instance, offers higher return on spend but isn’t included in the survey. I’m not sure how meaningful it is to crown Marriott tops of only four programs compared.

I ran some numbers for the base programs. I wanted to see what kind of return per dollar spent you get in the form of free nights from each of the chains using the earning tables for a general member.

- What hotel program offers a free night after the least amount of spending?

- What hotel program will let you redeem a free night in a big city after the smallest investment?

- What hotel program will let you access its most expensive, most aspirational hotels for the least amount of spending?

I then looked at how the answers change for elite members of programs (because of elite bonuses).

While Starwood is the least generous overall in terms of rewarding in-hotel spend, they have good elite bonuses that partially make up for it. Club Carlson clearly wins in terms of value even more for top elites than general members. Of course, Club Carlson’s properties need to work for you in order for this to matter.

A hotel rewards program is also not just “return on spend for free nights” – the benefits offered to members, especially members staying with a chain frequently, matter here as well. Marriott does not offer their most frequent guest promises of suites, or even guaranteed late checkout.

I think they get the bottom line right. Marriott has best ROI for business travelers who stay in expensive rooms (10/$1 spent) not to mention lucrative Megabonus point promotions which were not even factored. SPG stays earn fewer points which are not fully offset by the lower award chart prices. However, SPG credit card points are far more valuable than any other (except maybe Hyatt) for the same reason.

For those who travel frequently the elite perks would certainly figure into the equation, but mostly for the top level elites. And this study (like the airline ones) was only attempting to value the ROI of points earned via actual stays.

Carlson may have better ROI but it is not a serious option for most of your US readership. However it was strange that Hyatt was omitted.

I have never been denied a late check out with Marriott from all the years as silver to my current lifetime platinum status.

Since you wrote that comparison article last year Carlson has gutted a good chunk of their program. The value is just not the same now

@Sean the numbers though didn’t rely on things like second night free on awards for co-brand credit card holders.

Gary the one thing you always miss or downplay is the fabulous bottom to top great beds and quality and consistency of Marriott hotels. You are focused only on dollar value of points. But focusing on availability of hotel choices globally and the comfort provided per point is a better way to value in my opinion. More complex. Marriott clear #1.

@Gary sez: “Fundamentally, important things missed in this survey are that smaller programs are the most rewarding.”

In the echo chamber that’s the travel blogosphere that claim or variants thereof is constantly made by bloggers without a shred of evidence to support it. In reality it is just a bunch of bull because there is absolutely nothing that’s more rewarding about Starwood’s or Hyatt’s program than Marriott’s or Hilton’s. This WSJ piece mentioned in this post showed SPG to be the worst in terms of reward payback per spend (it’s what I call “spend per free night” but they expressed it as a percentage, but their take is overall in agreement with my own modeling, although it’s quite generous with respect to SPG’s reward payback per spend). As a loyalty program, Hyatt Gold passport is, at best, a work in progress; at worst, a joke.

The reputable JD Power & Associate survey of customer satisfaction, in fact, has invariably shown the opposite of what that claim to be true. SPG ranked next to dead last in their 2015 survey and it made sense because it IS by far the most expensive and, thus, the least rewarding among the major hotel loyalty programs.

If you are going to keep making that statement, then back it up with some credible, quantitative evidence and not simply with your “feeling” since it is no secret that most bloggers happen to personally favor small programs.

I just read the results of the survey and I fully endorse it because the authors do “get it”. In fact, those who frequent this blog would think that I wrote the following in the report but I didn’t:

“All points are not created equal

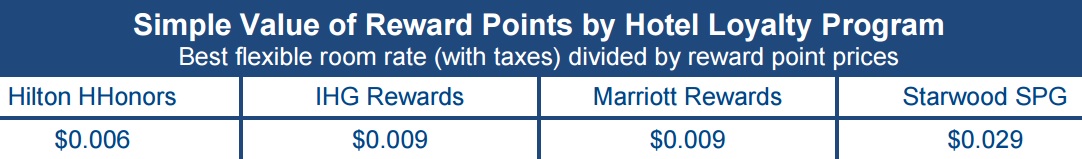

Dividing the room price (including local taxes) by the number of points per query provides a simple valuation of the point currency used by individual programs (see below table). Think of it as the room night value that can be purchased with a reward point. However, points are naturally unequal in value because of differing rates of accrual. For example, Hilton HHonors usual accrual rate is 15 HHonors Points per dollar spent at a hotel, while Sheraton SPG provides 2 Starpoints per dollar spent a hotel. Knowing the value of reward points is helpful for members who wish to assess the value of their account balances.

However, point values don’t allow consumers to compare hotel reward benefits across different loyalty programs. For this purpose, IdeaWorksCompany offers “reward payback” as a simple benchmark to measure how these programs deliver their primary benefit to everyday travelers. Think of this as the reward value returned for hotel expenditures.”

That’s right, although a starpoint was estimated to be worth 2.9 cents and a HHonors point to the worth 0.6 cent, those valuations cannot be interpreted — like ignorant bloggers do — as showing that SPG points are worth more than HHonors points, and that’s because they (the valuations) do not include the earn side of the equation. When one does include the earn side of the equation, SPG does not fare very well because starpoints are, by far. the toughest to acquire in the business….

Subscribe

Gary,

I know headline writers sometimes take liberties. The results from the hotel reward value report did not declare Marriott Rewards the “Best Hotel Loyalty Program.” I was careful to indicate we found it to offer the best value among the 4 evaluated.

The same is true for the annual reward seat availability report – – it has never claimed to crown a best frequent flier program. It attempts to quantify which offers the best online saver style availability. There are a buffet of reasons consumers use to choose a program; online reward availability would certainly rank among the strongest.

Regarding Scott McCartney of the Wall Street Journal . . . he’s an excellent journalist. To date in 2015, IdeaWorksCompany has issued 9 press releases. He has covered 2 of them in his column. In other words, there is plenty I write about that Scott does not cover.

Your commentary, and that of others, is helpful and was an influence in this latest work. We do have different perspectives, I write primarily for an airline-industry audience and as a result, my work will not always have the greatest appeal for consumers and travelers.

We may often disagree on methods, but I think we do agree . . . this is an endlessly entertaining industry. I love it.

Best regards, Jay Sorensen, President, IdeaWorksCompany

@Jay, thanks for stopping by!

You’re listed as the contact on the press release for the study, so I assumed you had some hand in or at least oversight of it. The Press Release, rather than someone else’s rendition of what the study means, say “Marriott Rewards Found to Offer Best Reward Payback

Among Leading Global Hotel Loyalty Programs” and I thought it was important — since the headline is what was getting repeated — to dive into what it actually means. By ‘leading’ you mean four programs, and leaving out some of the mega-chains and certainly leaving out programs that are even larger than ones you highlight.

I love Scott. I think he’s great. But he’s got a soft spot for this stuff and if memory serves also covered your work on credit cards and not just hotels and airlines? In any case he does great work overall, and as I say I think this piece was better done than the airline one (and the credit card one is also better than the airline award availability study).

Hopefully these studies keep getting better, but if they do they may no longer align with the conclusion that ‘revenue-based rewards’ or ‘miles as money’ is a strong approach for members.

Gary,

You are indeed correct, I wrote the press release. And yes, the headline is ““Marriott Rewards Found to Offer Best Reward Payback Among Leading Global Hotel Loyalty Programs.” Which is perfectly descriptive of the analysis. I don’t how that can be read as “Declares the Best Hotel Loyalty Program.” Declaring a best program has never been my intent with any of the survey work we conduct. And any such declaration would be highly subjective.

The credit card evaluation you reference was published way back in February 2013. I don’t recall if Scott McCartney covered it. He probably has 50 pieces a year with his weekly column. If he dedicates one, two, or three to my studies I’m delighted. But that activity hardly qualifies as “anything Jay Sorensen writes . . ”

In terms of advocating a revenue-based approach, that reflects my fully disclosed bias as writing primarily for an airline executive audience. Revenue based aligns perfectly with the economic needs and objectives of an airline. And I think it also aligns with the desires of high revenue producing customers . . . which represent the most-sought-after category for any airline. Mileage-based programs will eventually become a relic of the past.

Airlines that figure out how to preserve some value for lower revenue producing passengers will enjoy double success. Co-branded credit cards will likely play a big role in this, along with other revenue-producing accrual related to retail activity. It’s probably difficult news to accept for many members, but it’s the trend I am seeing and actively pursuing in my consulting work.

Best regards,

Jay Sorensen, President, IdeaWorksCompany

@Jay, thanks for coming back by I really appreciate the dialogue. I’d love to debate you over a drink sometime this revenue based program being better for the objectives of the airline actually. I think you may not read me enough (!) if you think having a consumer [and perhaps you’d be surprised — a fairly strong industry] readership means I’m offering analysis of something other than what’s best at motivating incremental behavior that benefits the bottom line of the travel provider.

But revenue-based REDEMPTIONS are a very different beast than earning aligning with customer revenue. And that’s disastrous for the loyalty of those high revenue customers that the travel industry desires. Tune in tomorrow for more on that ! 🙂

I don’t think the role of co-brand cards, or “other revenue-producing accrual related to retail activity” playing a big role will be a surprise to readers of this blog. However, one of the controversial things I believe is that credit card rewards will play less of a role 15 years from now as interchange rates are competed down by new technologies.

Best,

Gary