I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Citibank’s American Airlines small business card, Citi® / AAdvantage BusinessTM World Elite Mastercard®, has a limited time offer to earn 75,000 American Airlines AAdvantage bonus miles after spending $5,000 in purchases within the first 5 months of account opening. The card’s $99 annual fee is waived for first 12 months. ![]() [See rates and fees]

[See rates and fees]

It comes with first checked bag on domestic American Airlines itineraries for the primary cardholder and preferred boarding on American Airlines flights as well.

Earning is 2 AAdvantage miles per $1 spent on eligible American Airlines purchases, and on purchases at telecommunications merchants, cable and satellite providers, car rental merchants and at gas stations; 1 AAdvantage mile per $1 spent on other purchases; 1 Loyalty Point for every 1 eligible mile earned from purchases.

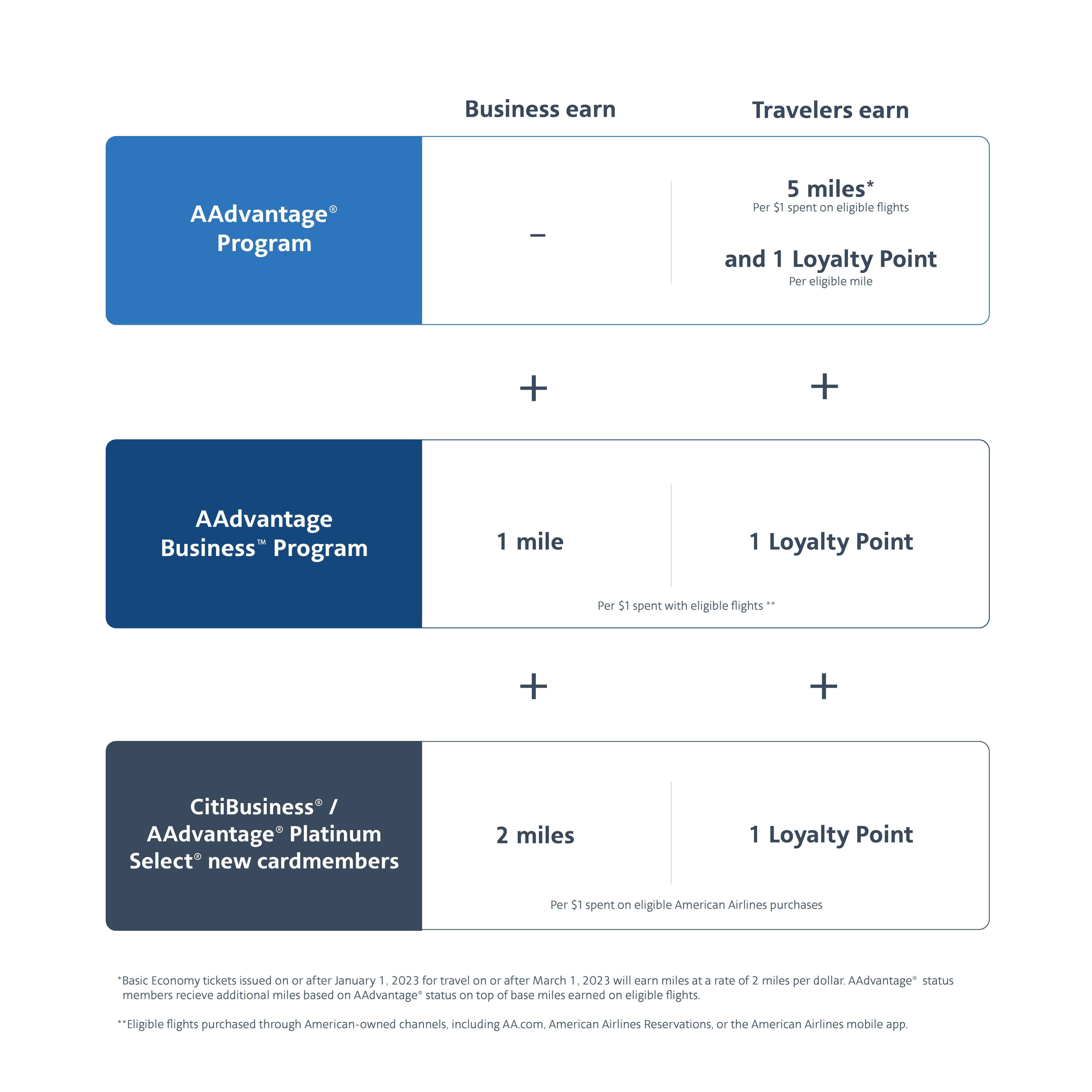

Here’s how the card works with AAdvantage business.

- Miles earned on the card (including the initial bonus) accrue into your AAdvantage Business account. If you don’t already have one, they open one for you, and you access it with your AAdvantage account number and password.

- Those miles can be transferred from your business account into your personal AAdvantage account, or into the AAdvantage accounts of any travelers you register/attach to your AAdvantage Business account.

- Normally companies need to meet $5,000 spend and 5 traveler minimums to transfer points out of an AAdvantage Business account, but cardholders have these minimums waived.

- While any authorized employee cards accrue miles into the AAdvantage Business account, Loyalty Points towards status from card spend accrue to each traveler’s own AAdvantage account.

- When travelers flag their solo trips for work when booking direct with American they also earn an extra Loyalty Point per dollar spent on tickets – as do you – so Citi® / AAdvantage BusinessTM World Elite Mastercard® cardmembers earn AAdvantage status faster.

- Earning in the AAdvantage Business program is three times as fast for those with this card provided that tickets are purchased with the card: base earn in AAdvantage Business is one mile per dollar spent on travel, while cardholders earn an additional two miles per dollar spent on travel credited to that account.

Getting the card historically hasn’t added to 5/24 (for getting approved for Chase cards), according to most reports I’ve seen. You can have this card even if you have a Citi or Barclays consumer card, and even if you already have a Barclays AAdvantage small business card. And anecdotally I’ve found the card easy to get, with readers reporting great success.

You can generally only receive an initial bonus on a Citi card every 48 months. I recently got this card again because I wanted to use an AAdvantage Business account, and because I realized it had been a little over four years since I’d had it previously. Note of course that this limitation applies to the same specific card, not to card families. I also hold a Citi Executive card, and that didn’t get in the way of being approved or earning a bonus. I also have a Barclays Aviator Silver card – you can have a Barclays AAdvantage card and Citi AAdvantage card at the same time.

Earn this bonus and you’ll have a minimum of 80,000 miles. 70,000 what it costs from the US to the Mideast, India or Maldives on Qatar. You can even fly Qatar’s Qsuites, which may be the best business class in the world. Flying business class from the US to Southeast Asia also costs 70,000 miles — and you can fly carriers including Japan Airlines, Malaysia Airlines, and Cathay Pacific.

AAdvantage miles are great if you want to redeem for international first class because they have some of the best airlines in the world as their partners, airlines that offer an international first class product, and that make first class available to partners on points. I’ve been fortunate to regularly redeem my miles for Qantas first class, Cathay Pacific first class, and Etihad first class (tougher to get than it used to be!) — not to mention that first class is available on Japan Airlines, and British Airways.

Miles you earn from this offer aren’t the end of the story. Citibank has a personal AAdvantage card too and American also partners with Barclays for its co-branded credit cards. As I’ve frequently heard flight attendants remind customers on flights, you can get AAdvantage cards from both Citi and Barclays. That’s four cards you can get earning the same mileage currency. And readers have reported to me great success in getting this card even when other issuers haven’t wanted to approve small businesses.

75k miles? Haha I just booked a flight from Bangkok to Dfw on aa.com flying Japan Airlines and it cost me 110k miles….35k more.

Is 75k possible?….sure I guess. But realistically that will not happen…

@ Gary — Really? Good luck finding those awards.

It’s OR not AND in the headline. Duh.

When is the last time you saw much QR award space in business from the US? At least not to AA. Isn’t QR giving AA/AS limited inventory while letting B6/BA and their own program more inventory?

While technically possible, like on a random Tuesday in August, there might be a single, one-way, business class award on Qatar or JAL for 75K AA points, but it won’t be Qsuite or long-haul. The ‘good ole days’ are over on those deals. Too good to be true.