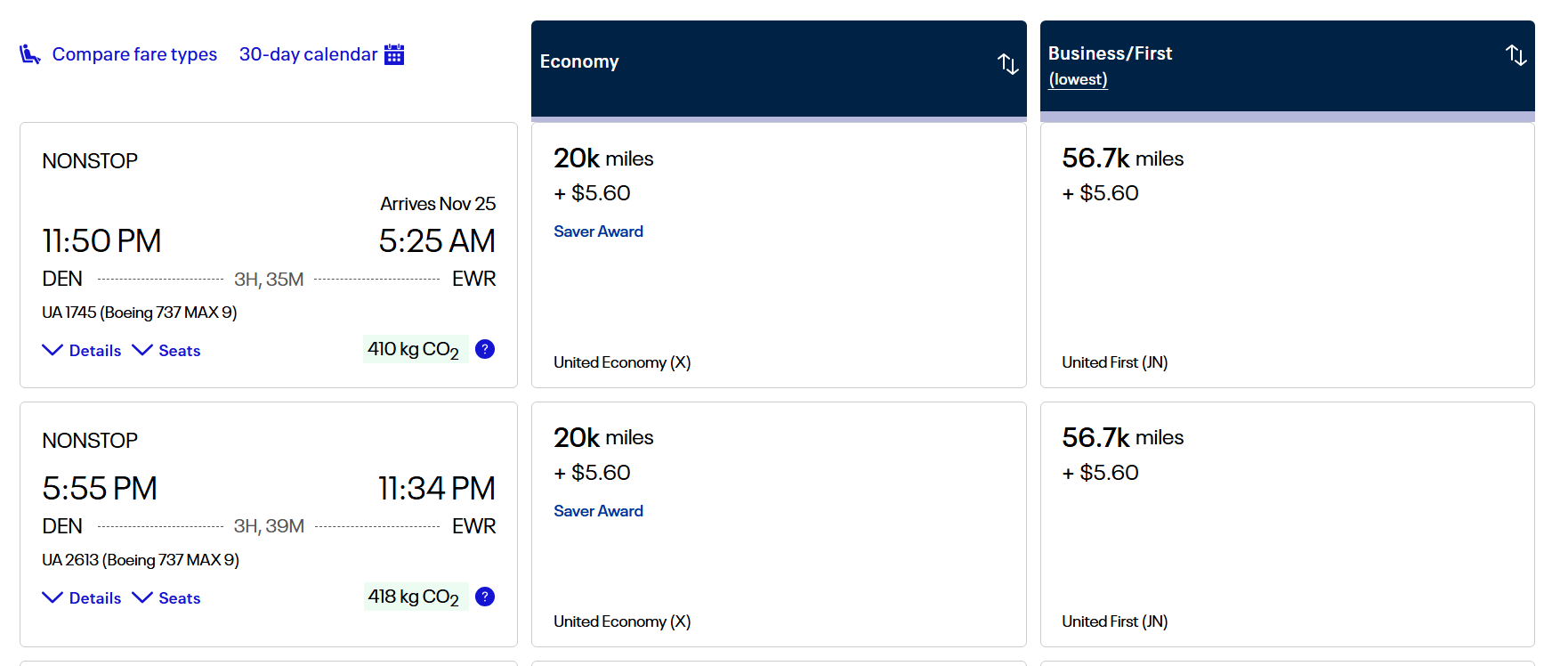

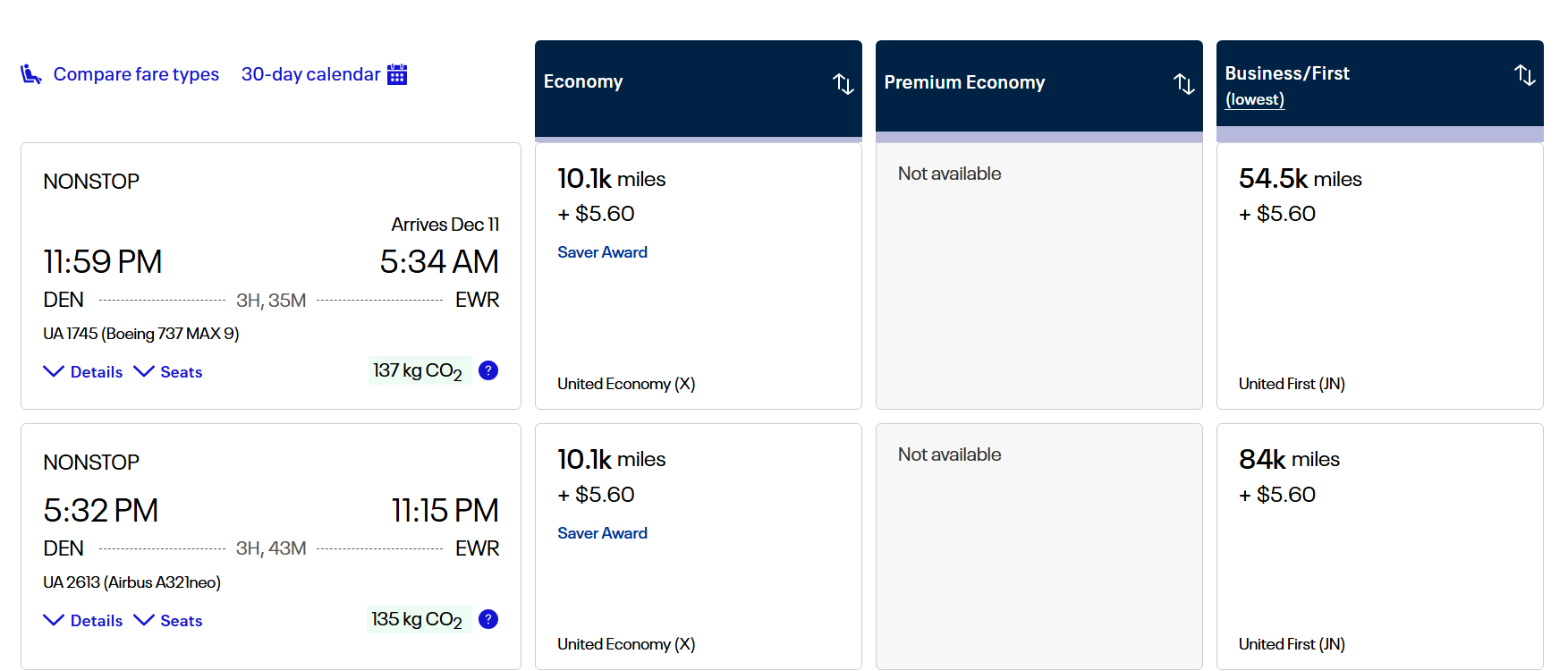

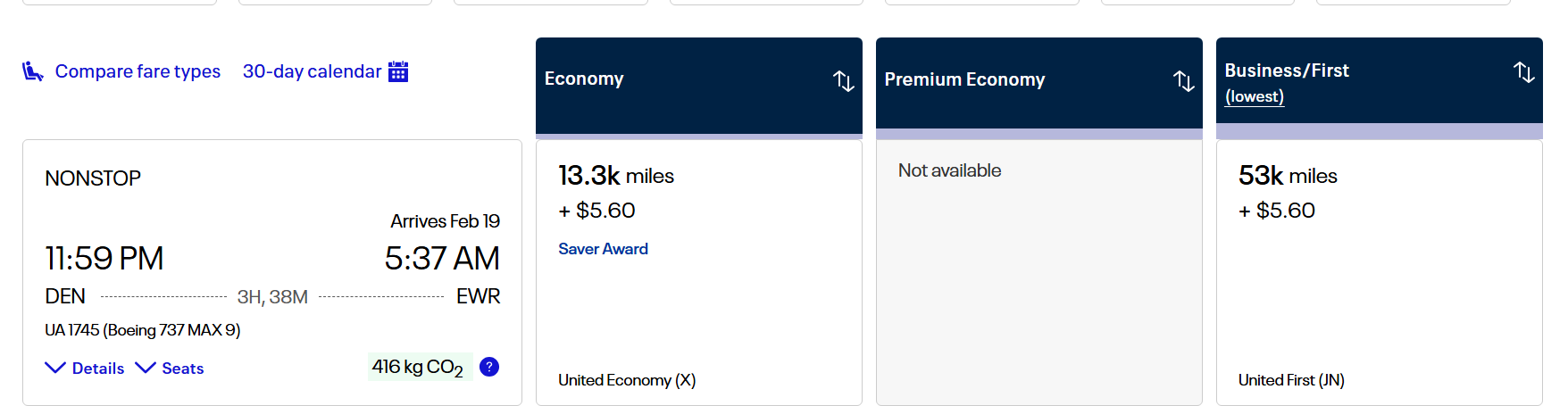

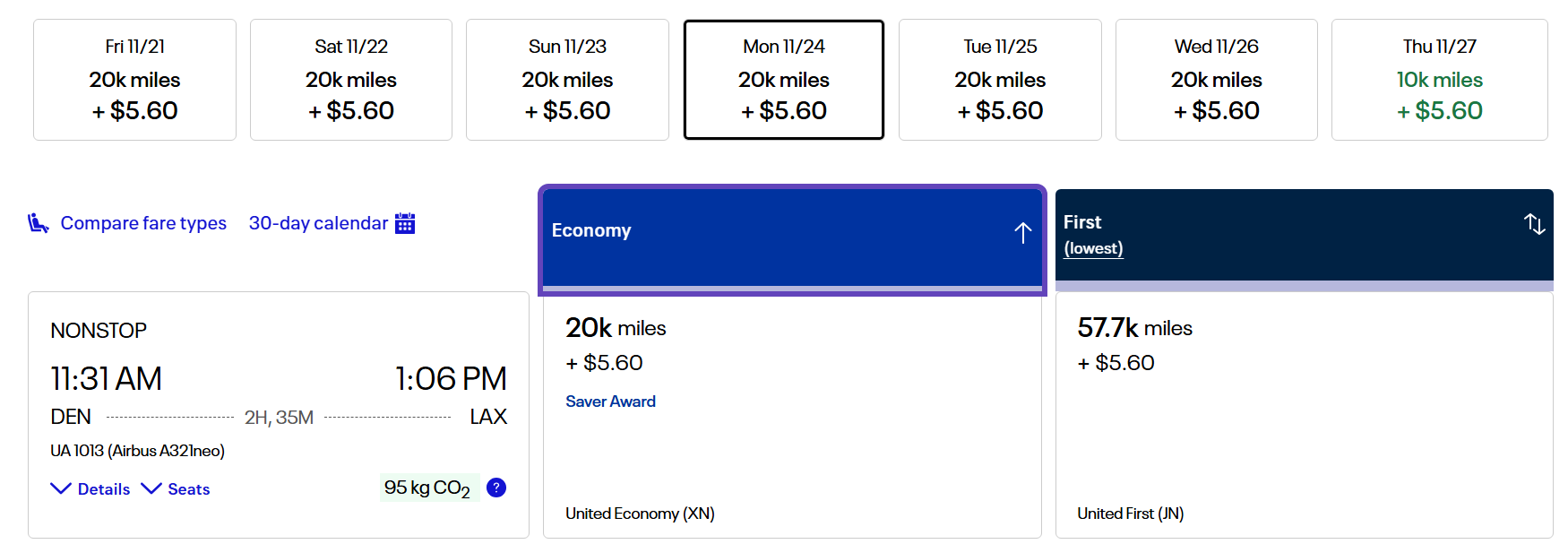

United Airlines appears to have suddenly raised the cost of award tickets when traveling within 2 weeks of booking. Many awards that just days ago cost 15,000 miles now have a new standard cost of 20,000 miles.

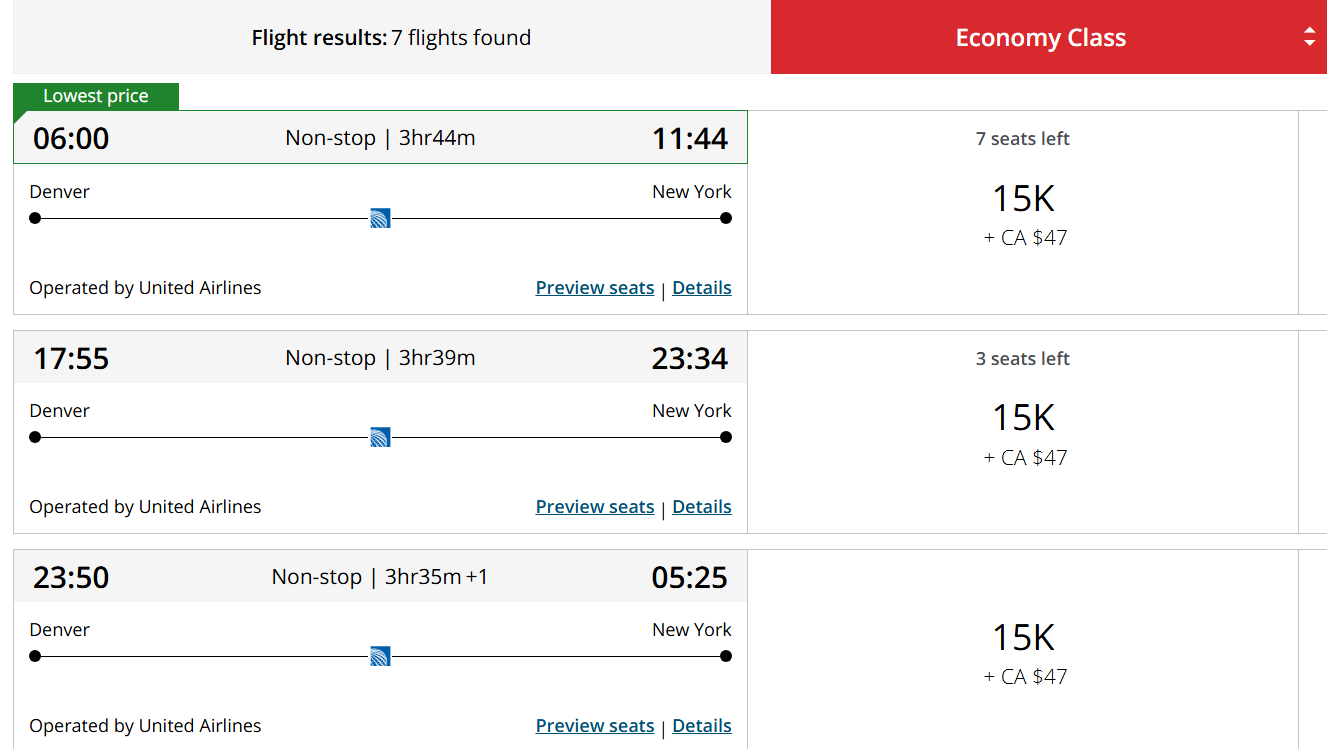

For instance, the lowest price of an award from Denver to Newark in economy within two weeks of travel has gone up from 15,000 miles to 20,000 miles. These are saver (lowest-price) awards. Those are the same seats that are made available to partner frequent flyer programs.

Once you get out past two weeks pricing looks more ‘normal’. It’s close-in travel that is bearing the brunt of changes here. And note that there’s no inherent reason why bookings within two weeks of travel ought to cost more miles, especially when saver awards are available which suggests that the airline does not expect to sell out the flights (indeed, the seat prices aren’t necessarily higher when paying with cash).

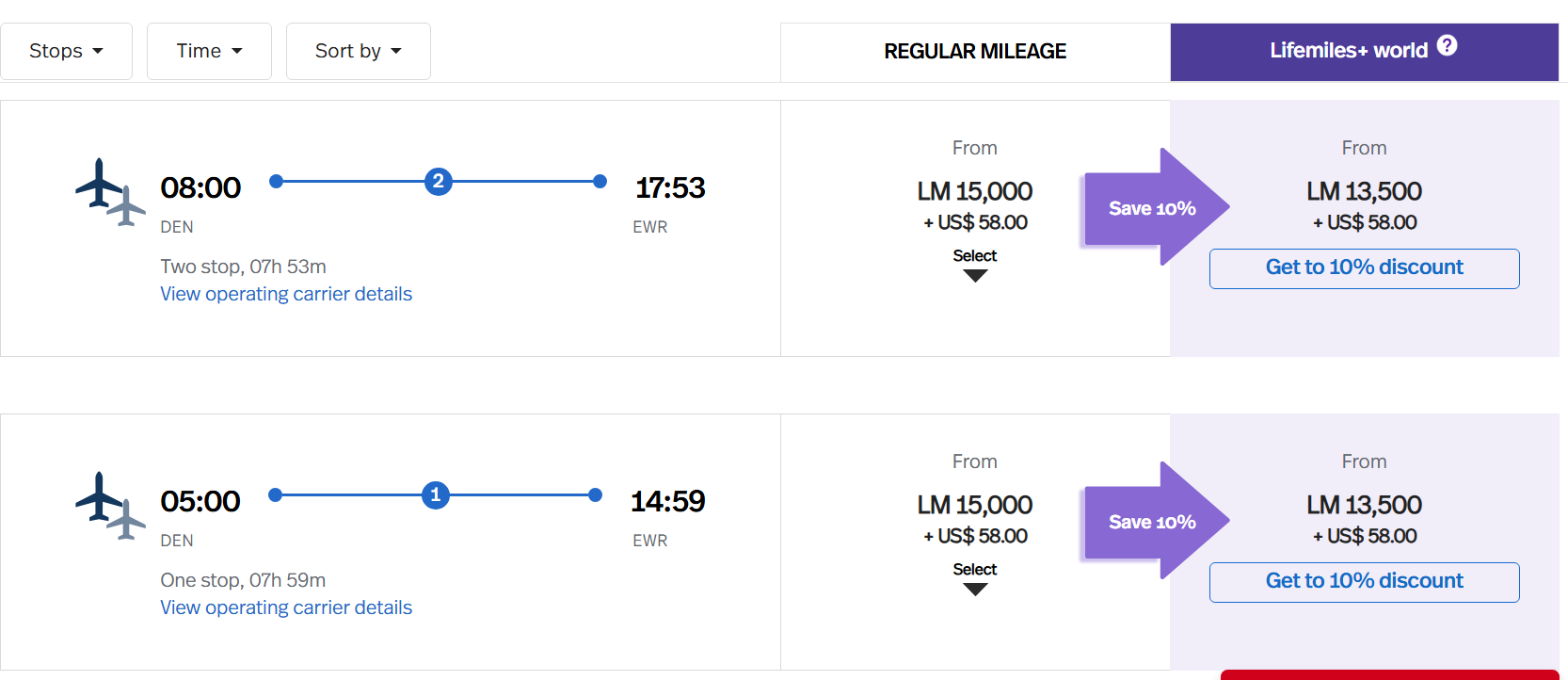

Air Canada Aeroplan and Avianca LifeMiles charge 15,000 miles one-way for these same United flights. Air India charges just 7,500 miles for the same United flights (and they’re a Rove and Mesa transfer partner).

Here’s another example: Denver – Los Angeles within 2 weeks of travel has gone up to 20,000 miles. Right after that it drops down to 12,500 miles and as low as 9,200 miles.

Short haul flights like Washington National – Newark can be lower. For instance they can be 15,000; 20,000; 18,400 or as little as 11,600 miles – though once you hit two weeks out from travel pricing is often 6,800 miles.

What United keeps doing is making clear that:

- MileagePlus is not a good store of value

- The miles you collect become worth less, the longer you hold them

- Thus it’s not a trustworthy place to bank your points.

The number of devaluations we’ve been through with United’s MileagePlus the past few years has been truly astonishing. It’s easy to just be numb to it.

To some extent all programs do this. The points prices aren’t going up when or because airfares are going up. They’re not tied to ticket prices here. It’s just too tempting to reduce the liability on their books, and they think customers aren’t smart enough to figure out that their credit card products are returning less value to the customer as a result (and therefore consumers should move spending away from them).

I largely stopped having any real commitment to United’s MileagePlus in Spring 2019 when they made it clear the direction the program was headed. And I have not regretted that decision, with consistent devaluations throughout the pandemic and since.

United CEO Scott Kirby told investors that the airline will double MileagePlus profits by the end of the decade. He promised a doubling of profits in 2021 but failed to achieve it. The strategy then appeared to be cutting redemption costs by raising miles prices. The strategy now appears to be raising miles prices. What is it that they say is the definition of insanity?

I think there needs to be government intervention to prevent them from doing this. They already make enough money, why are they pretending like they’re scraping by just to scam customers even more? Product over profit every day.

Time to switch to AA for short-notice award travel. Their award sale ending today is excellent.

@Brain: Under what grounds?

@Brian — Thank you. It’s gotten out of hand. Meanwhile, corporate shills like @Tim Dunn will attempt to convince us that SkyPesos are doing ‘just fine,’ and that we should ‘let the free market decide,’ yet, clearly, it isn’t ‘just fine,’ when it requires 400,000-1,000,000 points to get anywhere.

You gotta love these premium moves by United. Maybe they could enshrine this cavalcade of devaluations with some pertinent slogans like “Giving our loyal customers less because that’s what they want.” or “We love to show our most loyal passengers what we think of them by increasing award prices without notice or just cause.”

@Common Sense — For all your claiming to be ‘common sense,’ I wish you’d actually have some.

The DOT has the authority to regulate unfair and deceptive practices in air transportation under 49 U.S.C. § 41712. This includes investigating frequent flyer programs.

>“We love to show our most loyal passengers what we think of them by increasing award prices without notice or just cause.”

@Christian: United increased the prices “just ’cause”.

Quick check didn’t see any changes for partner international flights on a few routes.

Yet

1990: My name can just be an indicator of what I want (and other people) to have.

In any case, that would just preclude on the fly devaluations (if we’re lucky). Nothing would preclude raising prices at all if given enough notice to use the miles you earned under the conception of old rates.

It’s just a holiday hike

Try B6 for klose-in UA flites. Aeroplan and their cc are ever more appealing.

United’s MDE-IAH-LAX-FAT was 30,000 miles for a long single day one-way booked in Nov 2024 for flights in early Feb 2025 flight. AA was 15000 miles for a longer MDE-MIA-DFW-FAT but with a comfortable 12 hour hotel overnight stay in MIA. I had planned to fly UA and purchased the 30,000 mile award ticket. What a mistake! The departure flight from MDE was so delayed that I cancelled and purchased a last minute AA flight for 22,000 or 23,000 miles. The long overnight in MIA leaves me well rested upon arrival in MDE or on my return to FAT if that requires an overnight stop too. Just purchased flights to MDE for this Feb 2026 for 10,500 miles with an overnigt hotel next to MIA and 15,500 miles to return to FAT by 6:30 pm the same day. AA has been kicking UA’s ass on award ticket mileage cost for a while now.

Too bad, I was enjoying the reasonable value of closer in awards recently and it took away some of the bookings that went to AA. Now AA will get more of it.

That said, that reasonable close in pricing seems like it was a more recent development. For a few years before it felt like close in domestic awards were rarely good value, often 25k or more.

My hope is the recent govt shutdown disruption to travel patterns and transition out of that messed up their algorithm and this is a temporary patch. One can hope.

How does this impact the availability of the special cardholder only rates? Are these no longer showing up for close in bookings?

Before declaring the end of the world, let’s see what happens to the prices in January. This could be temporary for the holidays.

Interesting. HNL-DEN and HNL-IAH isn’t impacted. Same 25k saver economy near in.

The shocking thing is they are trying to be predatory to their members

Unfortunately it just shifts all business where possible to it’s competitors

In the old days they had close in ticketing fees close to departure

This is just a new fangled version

I already have for the most part avoided United for years this just continues the tradition

Who knew United could be as friggin creepy as Delta?

Last week

I had an AS SNA-SFO canceled 6 hrs before takeoff during the political theater.

I jumped on UA and booked the same segment for 15k less 10k voucher.

This saved me, even though it annoyed me it was 15k for a short flight, it was better than cash $300.

Now that seems it would go up. Yuck.

Rotten bastards.

@Common Sense — Sure, airlines, like United, will inevitably attempt the ‘rug pull’ on our (technically, ‘their’) points, regardless; though, adequate ‘notice’ is still important for consumers. I haven’t forgotten the good ole days of ‘award charts,’ only to be replaced with the ‘dynamic’ pricing (SkyPesos!)… At these there was some warning before those changes. That seemed appropriate. These days, it seems like the companies are emboldened to just change whatever on a whim, no notice even. So, yeah, I’d rather know that prices are set to increase in say, 30 days, then burn all my points (shouldn’t be ‘hoarding’ them anyway), instead of no notice at all. These rules and protections are not stopping United or any airline from operating profitably either. Generally, regulations are never perfect, but they are often better than nothing.

V sad for those of us based out of iad who want intl Polaris.

Obscene amount of miles handed out to OPM flyers = people who are willing to spend obscene amount of miles since their acquisition cost was zero anyway.

So how does this fit into the article about Scott Kirby on the road to Damascus?