The federal government is now investigating airlines for price gouging after an Amtrak train derailed outside of Philadelphia in May killing 8 people and injuring 200.

The investigation focuses on United, American, Southwest, JetBlue and Delta.

“The idea that any business would seek to take advantage of stranded rail passengers in the wake of such a tragic event is unacceptable,” Transportation Secretary Anthony Foxx said in a statement accompanying the letter. “This department takes all allegations of airline price-gouging seriously and we will pursue a thorough investigation of these consumer complaints.”

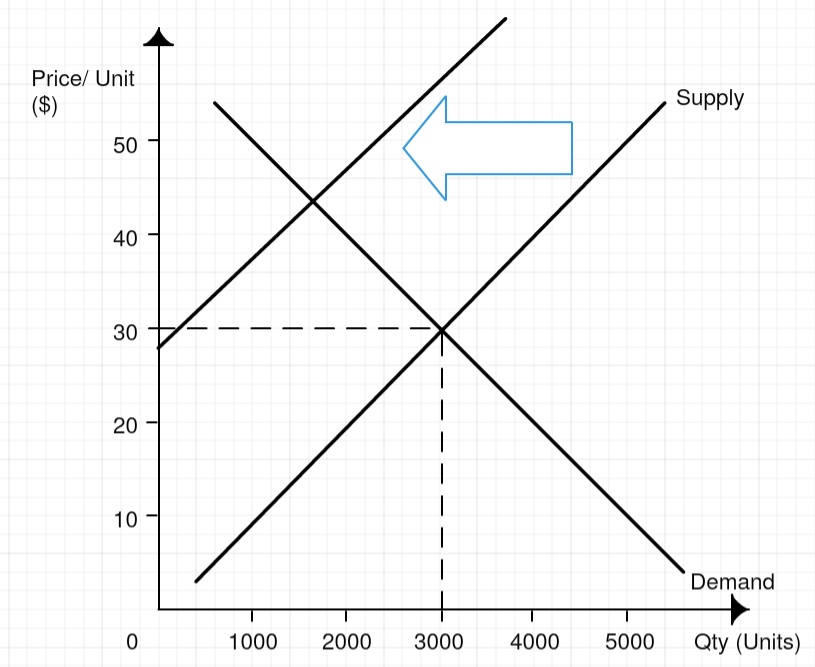

This stuff is pretty basic economics 101. When there’s a reduction in quantity supplied — or a shift up and to the left in the supply curve — you’re going to get an increase in price.

- When Amtrak stops running trains, there’s less supply of transportation in the Northeast corridor. The natural response is for prices to go up, certainly the lowest fares are gobbled up.

- If prices don’t go up, you have shortages. There’s not enough seats to go around. There has to be some way to ration seats. It can be done politically (“important people with connections” get the seats). It can be first come, first serve (you ration by queueing). Or it can be done based on willingness to pay (importance based on revealed preference).

It’s ironic that the federal government is investigating major US airlines for keeping prices too high, and for colluding to restrict capacity to keep prices too high — price gouging — at a time when the US airlines complaining to the government that Middle Eastern airlines are keeping prices too low and asking for rules against fare cuts.

Delta came out hard against the allegations.

“Following the May 12 Amtrak crash in Philadelphia, Delta Air Lines took steps to ensure affected travelers could affordably and conveniently reach their destinations. Delta did not increase air fares following the crash – to the contrary, Delta lowered its highest Shuttle prices by nearly 50 percent, to about $300 each way, for travel between New York, Boston and Washington, D.C.,” Delta spokesman Trebor Banstetter said.

“In addition, Delta honored existing Amtrak tickets for travel between Washington, D.C., Boston and New York; waived change fees for travel on Delta Shuttle flights between those markets; and increased seat capacity in the region by adding flights and operating larger aircraft,” he said.

Their position is that they took steps to balance the drop in Amtrak’s capacity with increases in their own. Ignore the stuff about dropping full fare pricing.

American said “We added capacity and our fare structure remained the same” so they too claim to have offset some of Amtrak’s reduction in capacity and didn’t raise prices (though naturally when there are more people buying tickets on a given flight, the price for remaining seats it only at higher fares even if the fares themselves pre-existed the crisis).

Do they add capacity by using bigger planes? I’m assuming it’s not possible to add additional flights at some of those airports.

Sadly, basic economics is not something that drive the decisions of politicians.

I know that not many of the folks reading this stuff love Delta management, but they really seem to have done the right thing here by flying stranded Amtrak passengers FOR FREE after the accident in Philly. And for that they get investigated? WTF? Are these regulators simply incompetent? This seems to be government at its worst.

http://www.reuters.com/article/2015/05/15/us-delta-air-lines-amtrak-idUSKBN0O02FH20150515

Not sure that opening an investigation equals “going after” the airlines. Such a description would be more apt if or when the government actually were to seek action against one or more airline. The investigation could result in no action at all.

Lest we think the airlines are saints in this case, they were not. My GF was supposed to take the train on Thursday after the Tuesday crash. One way tickets were well above $300 each way ($350-$450 one way as I recall) which frankly is still pretty darn high for that route. And in this WashPost story, their own research found tickets nearly $1,000 at the time. Sure it’s supply and demand – and when there’s no supply, they zoom up the prices – probably through algorithms, which they should have put on hiatus and doesn’t take days to do (they seem to fix mistake fares quickly). Gouging? Illegally? Who knows. But bad actors – yes. Surprise? No.

http://www.washingtonpost.com/news/local/wp/2015/05/14/trying-to-get-to-new-york-airlines-and-bus-companies-add-trips-to-meet-demand-after-amtrak-crash/

“Both airlines say they have not increased their prices as a result of the unexpected rush of customers. Still, a search online shows that booking a last-minute flight from D.C. to New York could cost upwards of $1,000.”

And for those Delta fans, they started offering to take Amtrak passengers on Friday, 3 days after the crash, and really, that was probably an effort to fill planes that are – I’m willing to bet – pretty empty on the NY-DC shuttle during the weekends. And Amtrak had said at that point it was trying to restore service by the end of the weekend. Finally, what does waiving change fees do for train travelers? Or the plane travelers who already were not taking Amtrak? That makes no sense. Sorry, they ain’t saints.

While we’re at it, any updated thoughts on the TSA?

Where’s that guy with the mustache to say : “The fare is to damnnn high”!

Eric nails it. “Going after” is an overstatement (but it made me read the story!) Some complaints prompted an investigation. There is no more to it that that.

I had to drive from LA to San Francisco the day Asiana 214 crashed because my flight, was cancelled and I didn’t want to wait the 3 days for my rebooked flight.. That is also a situation where economic theory would say that increased demand should have increased rental car rates and one way fees. But guess what, Budget responded by waiving the one way fee and offered extremely low pricing to me, a walk up customer. Total cost for the car rental $25. That is how a good corporate citizen responds to a disruptive situation

Another day, another supercilious article suggesting any form of regulation or restraint demonstrates ignorance of economics and deserves contempt.

Price gouging (as distinct from normal shifts in response to supply and demand) is illegal. It’s that possibility that’s being investigated. Telling the difference between the two is hard, and requires economics slightly more advanced than the 101-level education you so sarcastically trot out.

@Mike make an argument that the airlines have done something here warranting a federal investigation, and no “price gouging” that is hard to “tell[..] the difference” from ordinary pricing isn’t obviously bad at all.

It’s an investigation, not a guilty verdict, and no evidence has been presented publicly. As you say, mere shifting prices are not evidence of anything. Without a whistle blower, teasing out proof of gouging can be difficult or impossible. Nevertheless, ‘He said the initial review of pricing by those four airlines after the crash gave the administration confidence to move forward with the investigation. “We have sufficient information to be concerned,” Foxx said this morning. “But part of the investigation is drilling down into what the fact are.”’

Gary, this very article points out how venal and dishonest and hypocritical the airlines have been in their attitude towards government intervention in their market over the years. And this ruling (which, I remind you, is nothing more than “let’s take a closer look”) has been reached by a group of trained economists and lawyers with graduate degrees. Your assumption that the airlines are simply responding to supply and demand and the problem here is that the government doesn’t understand economics 101 is therefore as generous as it is baffling.

@Mike The airlines are absolutely hypocritical with respect to government intervention. They love to use it for their own ends and hate it when it turns around and bites them in the butt. I call them out for that constantly, such as in their complaints about competition from the Middle East carriers. And it’s tempting to then throw up hands and say “you sewed the wind, now reap the whirlwind.”

But a price gouging investigation is silly. Airlines saw the opportunity to profit by adding capacity and selling tickets to people that would otherwise have taken the train. The train really has overtaken flying as the means of travel between New York and DC. You used to have now only the Delta and US Airways shuttles but even a third competing shuttle operated by American. Now Delta and US Airways are operating smaller planes on the route. And if they not only added capacity but also rationed that capacity based on price? The higher prices still did their job — made more seats available to passengers during a tough time without the trains. That’s a good thing.

There could well be a gotcha “hey let’s raise prices and take advantage of these consumers” email. So what?

You’re repeating how supply and demand work, but you’re still ignoring the fact that there are circumstances when “hey let’s raise prices and take advantage of these consumers” is a perfectly fine thing to do, and there are circumstances when we as a democratic country have decided that it’s illegal. Perhaps this was covered in Econ 201?

If you don’t like that price gouging and cartels are illegal, write your congressman about those laws. Don’t blame civil servants for investigating their possible violation, or assume the only reason they’re doing so is because they don’t understand supply and demand.

Your argument is like saying “it’s silly to investigate this man for murder. People die of natural causes all the time and no crime has been committed if that happens.”

@Mike – I’m saying that the facts on the ground, and normal airline operations, explain things — and they worked very well. I’m saying that there have been a spate of recent ‘investigations’ of airlines that are on-face silly, like the collusion probe (when 80% of price hikes fail, the opposite of what you’d expect in a collusive environment).

This investigation came at the behest of a politician’s complaint, not because of some dispassionate study by learned men. And it’s easy to beat up on airlines for bread and circuses.

The facts on the ground explain the things *you’ve seen*. These civil servants have conducted an investigation, seen some things you haven’t seen, and concluded that there is enough doubt to investigate further.

Of course if you’ve seen the detailed, preliminary evidence these people have seen and you’ve come to the conclusion no crime has been committed then I take it back.

@Mike what data are YOU aware of that supports something untoward?

In fact, what terrible thing do you even suspect happened?

The history of how this came about was as a political complaint from a Senator.

Certainly the facts don’t support investigation of anything that OUGHT to be a crime.

I have absolutely no evidence you don’t also have. And the headline public facts (prices went up) are consistent with both illegal and non-illegal explanations. Normally I’d be happy to assume the non-illegal explanation. But a (probably grandstanding) senator was not, so there was a preliminary investigation. We presumably agree to this point.

Following that investigation, the economists and lawyers of the federal government are asking for more information.

I guess this is where we part company. You seem to have concluded, based on their not laying out a detailed case for your benefit at this stage, that they don’t understand economics 101. You don’t conclude from this, just as an example, that they saw price shifts enough outside the normal range implied by supply and demand and the dreaded economics 101 that they thought it deserved a closer look.

I guess I’m happy to assume an economics education above that found in the comments section of blogs in my government economists. If you’re not then fair enough.

Economics 101 tells us that so-called price gouging often benefits consumers in precisely the way the facts played out here. They brought more supply into the market. The only scenario in which ‘economics 101’ wouldn’t serve as an argument against such charges is where supply is fixed in the short term.

Sorry, Gary, I disagree with you on this one. I practiced antitrust law for about 38 years, retiring in 2011. It was (and still is) my view that DOJ hit the nail on the head with their complaint against the American/USAir merger, and that the merger should never have been allowed to be consummated. A three-firm oligopoly is far easier to coordinate than a four-firm oligopoly for domestic travel (and cabotage rules preclude easy entry by the logical potential competitors — foreign carriers such as Etihad. Unfortunately, the political winds caused DOJ to back down (remember, Doug Baer reported to Holder, who reported directly to Obama) without regard to the merits of the allegations in the complaint.

Now, this investigation looks to me like DOJ wants to take a mulligan. I’m not sure this is directly related to the Amtrak crash, but is more of a wide-ranging inquiry into capacity constraints, capacity signalling, and other potentially collusive actions.

Rug Merchants.

Hey Retired. nice to see somebody who has real world experience chiming in.

My thoughts are the following however, I agree that there’s some questionable “legality” etc etc etc.

but we’re going to be faced with the question eventually of ,

“What’s best for everybody going forward?”

And since this will drag on for a bit, as you well know having been in the middle of such things, I wonder what the end result of this all may be.

If it gets some people in management who certainly should have been kicked to the curb years ago, well then I guess that’s progress.

Not that this will have any bearing on the legal issues involved in this matter, because legally it’s completely insignificant, but in my travels all over throughout the airline ‘web’, I encountered multiple employees and members of management whose opinion simply was that well “you’ve got to fly somebody” , oh please just stay out of “our” way.

That’s not the way a competitive business is supposed to operate.

And at no point in any of the transactions was it ever about a paying customer being “out to get” a tenured employee.

The entire industry needs an attitude adjustment. I realize when you deal with the public, it’s very hard to understand this when you’ve worked very hard.

But without a doubt, the attitude of an incredible amount of people involved in this enterprise is entirely inappropriate.

I’ve had pilots tell me point blank, “nobody wants to take people back and forth within the US”.

“That only matters on international routes”

“What did you expect ….. ‘ eh Airlines ‘ FROM SOMEBODY wearing the uniform of AN AIRLINE? ”

Hilarious.

Nobody’s perfect. Some people make a bit more of an effort than others.

@Retired Lawyer – You’re actually making my point.

* DOJ is making political decisions

* Legal constraints prevent competition (like foreign airlines entering the US market)

Nowhere do you suggest that there was anything plausibly wrong with the US airline response in the aftermath of the airline crash. Instead you suggest that mergers are a problem. Although you cite “A three-firm oligopoly is far easier to coordinate than a four-firm oligopoly for domestic travel” when in fact what we have is four major carriers domestically (United, Delta, American, and Southwest) plus several smaller players like Spirit, Alaska, Frontier.

“Economics 101 tells us that so-called price gouging often benefits consumers in precisely the way the facts played out here.”

Are you saying that price gouging is legal? It’s not, in plenty of circumstances. If you don’t like the laws, write your congressman. Be sure to mention you took econ 101.

@Mike there are many idiotic laws, and I can criticize them here. If you’re going to defend them you need to do more than say you assume there are very smart people knowledgeable about economics who must agree with the actions being taken.

Ah, so your points all along were (1) laws against price gouging are bad laws because econ 101, and (2) the government agency charged with investigating possible violations of laws should not bother with the bad laws.

Right.

I didn’t realise you wanted me to defend the law.

I seriously thought all along that your point was that the law has not been broken, which is why I was leaning so hard on the “smart people say there’s a case worth investigating” argument.

If you want me to defend the law then I’m afraid I can’t because I didn’t take econ 101.

@Mike I wasn’t offering a legal analysis I was saying that airlines hadn’t plausibly done anything wrong, in fact they apparently took steps that benefited both passengers and themselves, and it was SILLY to pursue this.

So you’re saying the airlines have done nothing wrong, not that they’ve done nothing illegal.

You can see how that distinction might be lost on the federal prosecutors charged with investigating violations of the law.

@Mike prosecutorial discretion not to waste time and resources being value destroying in search of violations that probably don’t exist

Gary:

Don’t think I have. First, you, and several other bloggers, have conflated two different investigations. One is the DOJ investigation into collusion by the four major U.S. carriers. This has nothing to do with the DOT investigation into price gouging in the wake of the Amtrak crash by five major carriers servicing the Atlantic corridor. See, http://www.washingtonpost.com/business/transportation-chief-4-airlines-probed-for-price-gouging/2015/07/24/5c355e2a-3209-11e5-a879-213078d03dd3_story.html.

The DOJ investigation is potentially more far-reaching. @Montana Mike: I don’t want to hazard a guess as to what the outcome would be. My suspicion is that this will take several years to come to some sort of resolution. In any event, I am fairly well certain that the CEO’s will be well insulated by their counsel, and little will happen to them personally.

Gary: The fact that there are several minor players in the U.S. domestic market is not particularly significant in a Section 1 (Sherman Act) case. If there is collusion (for example, regarding “capacity discipline”) found with respect to the three legacy carriers, or with respect to the four majors, that would be determinative.

I’d love to see the mass of airline e-mails that the government will need to review. But, I won’t, so I can’t predict anything. Consciously parallel conduct is not unlawful. One must look at the contacts, the results, the external economic and business factors, and many other issues.

Gary, I have been a strong critic of the Antitrust Division’s handling of the American/USAir merger. Comparing the Division’s complaint, which alleged significant anticompetitive effects in eliminating discounting done by USAir in hundreds of city pairs across the country, with the remedy ultimately obtained, which included no remedy concerning discounting and only required the cession of landing slots at DCA (thus, no remedy that affected any other market in the country), shows that the Division effectively surrendered. But I’ve also been of the view that the Division had their cojones cut off after their loss in the Oracle/Peoplesoft merger (in which I played a part), and hasn’t found them since.

But I am mindful of the difficulty in bringing a collusion case. In short, before everyone adopts Adam Smith’s aphorism that: “People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public,” I would also note that an economist colleague of mine also said, “If you see many people outside your window using umbrellas, it is more likely that it is raining, than it is that they are conspiring to use their umbrellas.”

@Retired Lawyer – not conflating them at all, I’ve written on both separately, but I do think there’s a common thread that airlines are profitable now and people hate airlines, the government takes heat over having approved the mergers, and it’s both investigations are responsive to a Senator beating a drum.