I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

The best credit card offers are the quickest, easiest way to earn a large amount of miles and jump start your travel. These are the most lucrative. There are several new best-ever and limited-time offers that have come out over the last several weeks. Many of the offers on this list are new.

Every month I post what I find are the best credit card offers out there. Some of last month’s best credit card offers are gone or changed. What excites me is that card rewards really seem to be on the upswing in a big way. Now is the time to apply.

Here’s the current up to date list of best credit card offers right now – the most lucrative bonuses available. And here are easy ways to meet the minimum spend required by some of the offers.

Here are the cards I consider to be the best credit card offers with rich bonuses right now:

- Chase Sapphire Reserve® (See rates and fees) is a $795 annual fee card comes with an offer to earn 125,000 bonus points after you spend $6,000 on purchases in the first 3 months from account opening.

On an ongoing basis, earn 8x points on all purchases through Chase TravelSM, including The EditSM and 4x points on flights and hotels booked direct. Plus, earn 3x points on dining worldwide & 1x points on all other purchases.Get more than $2,700 in annual value with Sapphire Reserve including a $300 annual travel credit as reimbursement for travel purchases charged to your card each account anniversary year and get up to $150 in statement credits every six months for a maximum of $300 annually for dining at restaurants that are part of Sapphire Reserve Exclusive Tables. Plus, get complimentary Apple TV+, the exclusive streaming home of Apple Originals. Plus Apple Music-all the music you love, across all your devices. Subscriptions run through 6/22/27 – a value of $250 annually.

And I really like access to every Chase Sapphire Lounge® by The Club with two guests. My favorites are Philadephia and New York LaGuardia, though I’m looking forward to the openings of LAX and Dallas.

Current points transfer partners include:

- Airlines: United MileagePlus, British Airways Executive Club, Air France KLM Flying Blue, Singapore Airlines KrisFlyer, Southwest Airlines Rapid Rewards, Virgin Atlantic Flying Club, Iberia Plus, Aer Lingus AerClub, Air Canada Aeroplan

- Hotels: World of Hyatt, Marriott Bonvoy, IHG One Rewards

- American Express Platinum Card® is interesting considering that you may be eligible for as high as 175,000 Membership Rewards® points after you spend $8,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Get more for your travels with 5X Membership Rewards® points on all flights and prepaid hotel bookings through American Express Travel®, including Fine Hotels + Resorts® and The Hotel Collection bookings. You earn 5X points on flights purchased directly from airlines or through American Express Travel® on up to $500,000 on these purchases per calendar year.

- More Value! With over 1,550 airport lounges – more than any other credit card company on the market* – enjoy the benefits of the Global Lounge Collection®, over $850 of annual value, with access to Centurion Lounges, 10 complimentary Delta Sky Club® visits when flying on an eligible Delta flight (subject to visit limitations), Priority Pass Select membership (enrollment required), and other select partner lounges. * As of 07/2025.

- More Value! $200 Uber Cash + $120 Uber One Credit: With the American Express Platinum Card® you can receive $15 in Uber Cash each month plus a bonus $20 in December when you add your American Express Platinum Card® to your Uber account to use on rides and orders in the U.S when you select an Amex Card for your transaction. Plus, when you use the American Express Platinum Card® to pay for an auto-renewing Uber One membership, you can get up to $120 in statement credits each calendar year. Terms apply.

- More Value! $300 Digital Entertainment Credit: Get up to $25 in statement credits each month after you pay for eligible purchases with the American Express Platinum Card® at participating partners. Enrollment required.

- More Value! $600 Hotel Credit: Get up to $300 in statement credits semi-annually on prepaid Fine Hotels + Resorts® or The Hotel Collection* bookings through American Express Travel® using the American Express Platinum Card®. *The Hotel Collection requires a minimum two-night stay.

- New! $400 Resy Credit + Platinum Nights by Resy: When you use the American Express Platinum Card® to pay at U.S. Resy restaurants and to make other eligible purchases through Resy, you can get up to $100 in statement credits each quarter with the $400 Resy Credit benefit. Plus, with Platinum Nights by Resy, you can get special access to reservations on select nights at participating in demand Resy restaurants with the American Express Platinum Card®. Simply add your eligible Card to your Resy profile to book and discover Platinum Nights reservations near you, enrollment required.

- More Value! $209 CLEAR® Plus Credit: CLEAR® Plus helps get you to your gate faster by using unique facial attributes to verify you are you at 50+ airports nationwide. You can cover the cost of a CLEAR Plus Membership* with up to $209 in statement credits per calendar year after you pay for CLEAR Plus with the American Express Platinum Card®. *Excluding any applicable taxes and fees. Subject to auto-renewal.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees, such as checked bags and in-flight refreshments, are charged by the airline to the American Express Platinum Card® Account*. American Express relies on airlines to submit the correct information on airline transactions to identify incidental fee purchases. If you do not see a credit for a qualifying incidental purchase on your eligible Card after 8 weeks, simply call the number on the back of your Card. Qualifying airlines are subject to change. See terms & conditions for more details.

- New! $300 lululemon Credit: Enjoy up to $75 in statement credits each quarter when you use the American Express Platinum Card® for eligible purchases at U.S. lululemon retail stores (excluding outlets) and lululemon.com. That’s up to $300 in statement credits each calendar year. Enrollment required.

- $155 Walmart+ Credit: Receive a statement credit* for one monthly Walmart+ membership (subject to auto-renewal) after you pay for Walmart+ each month with the American Express Platinum Card®. *Up to $12.95 plus applicable local sales tax. Plus Ups not eligible.

- $100 Saks Credit: Get up to $100 in statement credits annually for purchases at Saks Fifth Avenue or saks.com on the American Express Platinum Card®. That’s up to $50 in statement credits from January through June and up to $50 in statement credits from July through December. No minimum purchase required. Enrollment required.

The card has an $895 annual fee. Terms Apply, see rates and fees.

Centurion Lounge Seattle - The Business Platinum Card® from American Express

This card has an Elevated Welcome Offer: Earn 200,000 Membership Rewards® points after you spend $20,000 in eligible purchases on the Business Platinum Card® within the first 3 months of Card Membership.

- New! Get up to $300 in statement credits semi-annually for up to a total of $600 in statement credits per calendar year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings through American Express Travel using the Business Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- Make the Business Platinum Card® work even harder for you. Hilton For Business members get up to $200 back per calendar year when you make an eligible purchase at Hilton properties across the globe. Benefit enrollment required.

- Fly like a pro with a $200 Airline Fee Credit. Select one qualifying airline to receive up to $200 back per year on baggage fees and other incidentals.

- Use the Business Platinum Card and get up to $209 back per calendar year on your CLEAR® Plus Membership (subject to auto-renewal).

- New! Enroll and get up to $150 in statement credits on U.S purchases directly with Dell Technologies on the Business Platinum Card and an additional $1,000 statement credit after you spend $5,000 or more on that same Card per calendar year.

- New! Enroll and get a $250 statement credit after you spend $600 or more on U.S. purchases directly with Adobe per calendar year on the Business Platinum Card.

- Get up to $10 in statement credits per month for wireless telephone service purchases made directly with a wireless provider in the U.S. on the Business Platinum Card. That’s up to $120 back per year. Enrollment required.

- Earn 5X points on flights and prepaid hotels on AmexTravel.com. Enhanced! 2X points on purchases at U.S. construction material & hardware suppliers, electronic goods retailers and software & cloud system providers, and shipping providers, as well as on each eligible purchase of $5,000 or more, up to $2 million of these purchases per calendar year. Purchases eligible for multiple additional point bonuses will only receive the highest eligible bonus.

This is an $895 annual fee card. Terms Apply, see rates and fees.

Yquem in New Emirates First - Atmos Rewards Summit Visa Infinite card comes with a 100,000-point welcome bonus plus a 25,000-point Global Companion Award after $6,000 spend in the first 90 days. Simply holding the card each year gives another 25,000-point companion award, and spending $60,000 annually unlocks a second companion award worth up to 100,000 points. The annual fee is $395.

Earning is straightforward: 3× points on dining, foreign transactions, and Alaska/Hawaiian purchases, plus 1× everywhere else. Cardholders with eligible Bank of America accounts get a 10% bonus on all rewards, and spend also counts toward Atmos elite status (1 status point per $2 spent, plus 10,000 status points awarded on each anniversary).

The card’s benefits are geared toward frequent Alaska and Hawaiian flyers. Perks include eight Alaska Lounge passes per year, eight Wi-Fi vouchers, a free checked bag and preferred boarding for the cardholder and up to six companions, and automatic $50 credits if an Alaska or Hawaiian flight booked on the card is delayed more than two hours or canceled less than 24 hours before departure. Cardholders also get waived partner award booking fees and waived same-day change fees on Alaska flights, along with the ability to share points with up to 10 Atmos Rewards members fee-free.

- Citi Strata EliteSM Card (See rates and fees.) has an initial offer to earn 100,000 bonus Points after spending $6,000 in the first 3 months of account opening.

On an ongoing basis you’ll earn 12 Points per $1 spent on Hotels, Car Rentals, and Attractions booked on cititravel.com and 6 Points per $1 spent on Air Travel booked on cititravel.com; Earn 6 Points per $1 spent at Restaurants including Restaurant Delivery Services on CitiNightsSM purchases, every Friday and Saturday from 6 PM to 6 AM ET; Earn 3 Points per $1 spent any other time; Earn 1.5 Points per $1 spent on All Other Purchases

Points can be transferred to a variety of frequent flyer programs, including:

- oneworld: American Airlines AAdvantage, Cathay Pacific Asia Miles, Malaysia Airlines Enrich, Qantas Frequent Flyer, Qatar Airways Privilege Club

- Star Alliance: Avianca LifeMiles, EVA Air Infinity MileageLands, Singapore Airlines KrisFlyer, Thai Airways Royal Orchid Plus, Turkish Airlines Miles & Smiles

- SkyTeam: Aeromexico Club Premier, Air France KLM Flying Blue, Virgin Atlantic Flying Club

- Non-alliance: Emirates Skywards, Etihad Guest, JetBlue TrueBlue

- Hotels: Leading Hotels of the World Leaders Club, Accor ALL – Accor Live Limitless, Choice Hotels Choice Privileges, Preferred Hotels I Prefer, Wyndham Hotels Wyndham Rewards

Many of the card’s annual benefits are on a calendar year basis so you have the opportunity to take advantage of them twice in your first cardmember year: the $300 hotel benefit for 2+ night stays booked through Citi Travel; the $200 Splurge credit (take it for American Airlines travel!), and $100 in Blacklane credits twice each year. That’s $1,200 in credits you can reap in year 1 if you’re approved now.

The list of Splurge Credit merchants is 1stDibs, American Airlines (exclusions apply), Best Buy®, Future Personal Training, and Live Nation (exclusions apply) and you have to activate up to 2 merchants at a time prior to purchase, though you can change your selection as you wish. The Blacklane credit is actually $100 January – June and $100 July – December.

It offers a Priority Pass Select Membership (as with other major issuers for most cards, this does not cover airport restaurants). It includes 2 guests. Authorized cardmembers receive Priority Pass as well. And there’s also four American Airlines Admirals Club passes each year.

- American Express® Business Gold Card will let you earn 100,000 Membership Rewards® points after you spend $15,000 on eligible purchases with the Business Gold Card within the first 3 months of cardmembership.

The card will earn 4X Membership Rewards® points on the top two eligible categories where your business spends the most each month from 6 eligible categories. While your top 2 categories may change, you will earn 4X points on the first $150,000 in combined purchases from these categories each calendar year (then 1X thereafter). Only the top 2 categories each billing cycle will count towards the $150,000 cap. Earn 3X Membership Rewards® points on flights and prepaid hotels booked on amextravel.com using your Business Gold Card.

Earn up to $20 in statement credits monthly after you use the Business Gold Card for eligible U.S. purchases at FedEx, Grubhub, and Office Supply Stores. This can be an annual savings of up to $240. Enrollment required.* You can also get up to a $12.95** statement credit back each month after you pay for a monthly Walmart+ membership (subject to auto-renewal) with your Business Gold Card. **Up to $12.95 plus applicable taxes on one membership fee.

This is a $375 annual fee card. *Terms apply. See rates and fees.

- Capital One Venture X Rewards Credit Card has an offer to earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel (See rates and fees)

The card earns unlimited 2X miles on purchases – and 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel.

You’ll receive a $300 annual credit for bookings through Capital One Travel. And you’ll get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary. With this card you can access the Capital One Lounge as well as Priority Pass lounges.

Capital One Lounge Washington Dulles

Capital One Landing Washington National - Capital One Venture Rewards Credit Card will let you earn a one-time bonus of 75,000 miles once you spend $4,000 on purchases within the first 3 months from account opening, equal to $750 in travel. (See rates and fees.)

The card earns unlimited 2X miles on every purchase, every day, plus 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel. You can use your miles to get reimbursed for any travel purchase-or redeem by booking a trip through Capital One Travel. Plus, transfer your miles to your choice of 15+ travel loyalty programs. It has a $95 annual fee.

Etihad First Apartment - Citi® / AAdvantage BusinessTM World Elite Mastercard® For a limited time, earn 75,000 American Airlines AAdvantage® bonus miles after spending $5,000 in purchases within the first 5 months of account opening.

[See rates and fees]

[See rates and fees]

The card offers first checked bag on domestic American Airlines itineraries. There’s preferred boarding on American Airlines flights as well.

Earning is 2 AAdvantage® miles per $1 spent on eligible American Airlines purchases, and on purchases at telecommunications merchants, cable and satellite providers, car rental merchants and at gas stations; 1 AAdvantage® mile per $1 spent on other purchases; 1 Loyalty Point for every 1 eligible mile earned from purchases.

American Airlines Boeing 787-9P Business Class - Mesa Homeowners Card has no annual fee and you earn points for your mortgage and don’t even have to pay the mortgage with the card. (You just tell them how much your mortgage is, and they award you the points as long as you spend $1,000 on the card each month.)

Right now, through October 15, there’s an offer of 50,000 points after $12,000 spend within 3 months when you apply and use promo code SEPT50.

There’s a lot of value in the statement credits they offer (like for Costco membership and at Lowe’s), which is pretty much unheard of on a no annual fee card. The card earns 3x with home improvement expenses; heat, gas, electric, cable/internet utilities; home maintenance like cleaning, lawn care, pest prevention; decor and furniture; insurance and taxes; and daycare. Groceries and gas earn 2x. $12,000 is big spend but insurance, taxes and daycare will make it possible for many of you.

Here are their points transfer partners so far – they say they are adding more: Accor, Air Canada, Air India, Finnair, Hainan Airlines, SAS, Thai, Vietnam Airlines.

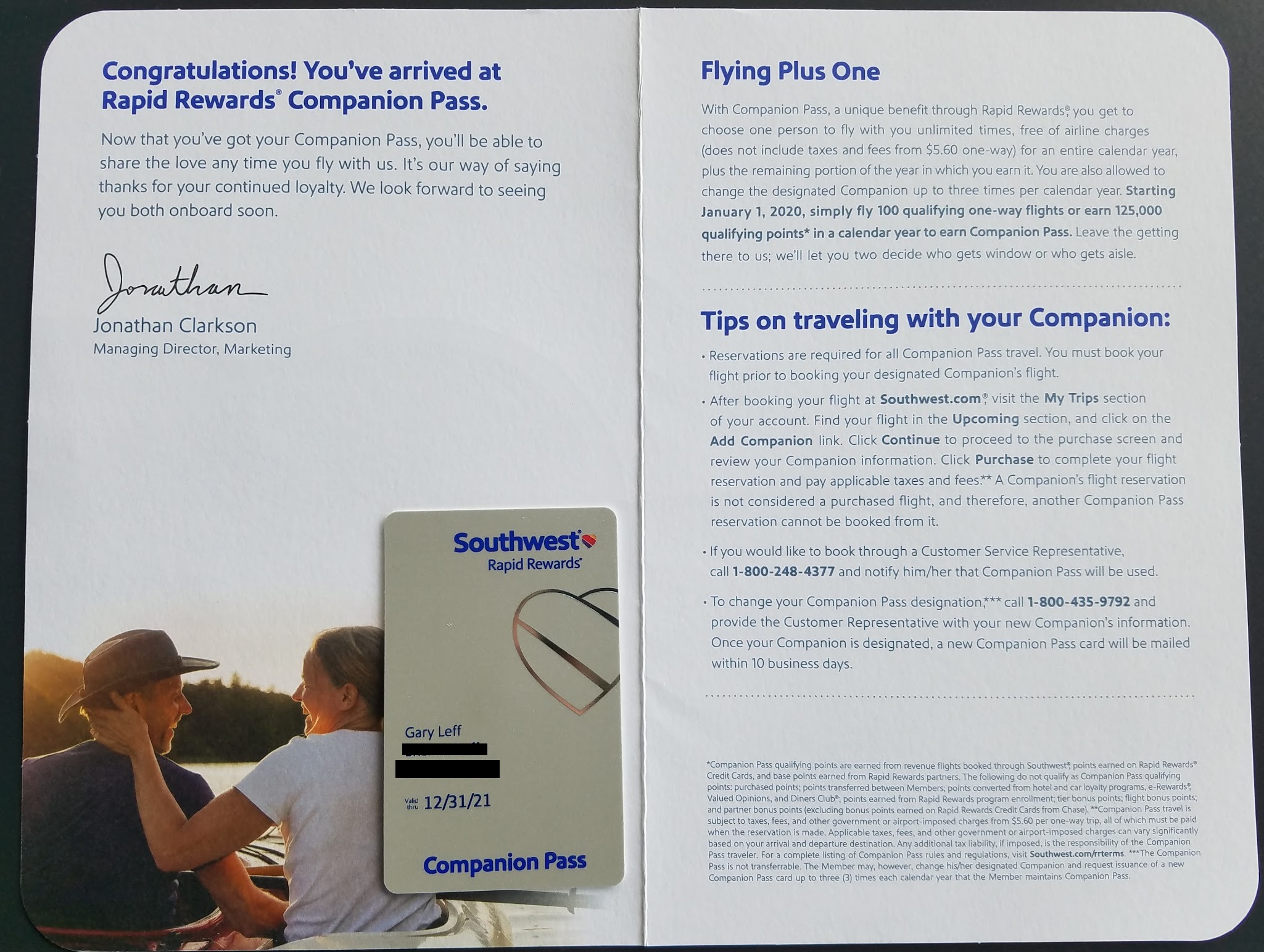

- Southwest® Rapid Rewards® Performance Business Credit Card (See rates and fees) is offering a massive 120,000 Rapid Rewards points after $10,000 spend in the first 3 months. At $299 annual fee, this is an unusually rich welcome bonus that — if you play the timing right — can deliver almost two full years of Companion Pass.

When you earn 135,000 qualifying Rapid Rewards points in a calendar year, you get Companion Pass for the rest of that year plus the following year. That lets someone fly with you for just taxes whether you’re paying cash for a ticket or redeeming points.

This is the single best deal in domestic air travel if you fly Southwest with a partner even a few times a year. Holding a Southwest credit card gives you a 10,000-point head start each year, so effectively you need 125,000 more.

Apply for the offer in October, while the offer is still available. You’ll need $10,000 spend, making sure it doesn’t hit until a statement that closes in 2026. That way you it Companion Pass at the start of 2026, so it lasts for the rest of that year and the full next year (so, through December 31, 2027).

Think there’s a card that belongs on this list of best credit card offers but isn’t here, leave a comment!

For rates and fees of the American Express Platinum Card®, click here.

For rates and fees of The Business Platinum Card® from American Express, click here.

For rates and fees of American Express® Business Gold Card, click here.

Half of this article is very bold, quite literally!

I think a post summarizing the various issuer rules (5/24, etc.) might be a good companion for those chasing SUBs.

Likewise the order in which you might get cards with each issuer if you are chasing SUBs (If in Amex land, Green->Gold->Plat for instance?).

That was ‘bold’ of you, too, @Peter!

Ah, looks like Gary fixed the ‘bold’ issue. Anyway, has anyone opened the Atmos Summit yet? Curious about the 3x on the foreign purchases, if anyone has gotten it, and whether that has been relatively straightforward, as in, like, all purchases overseas (and/or with foreign currency) has posted properly. Just got the card (bit of an app-a-rama) and have some upcoming trips planned.