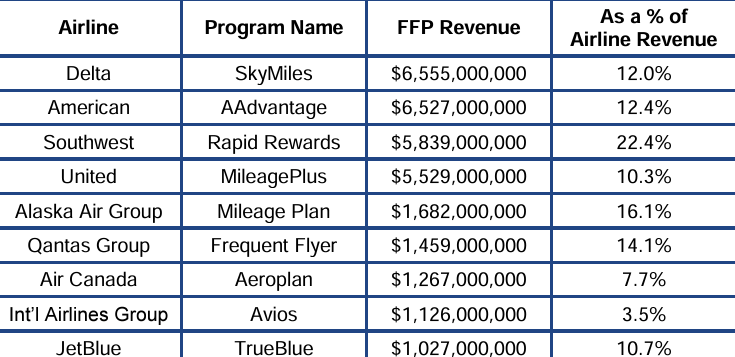

Jay Sorensen has a new report on frequent flyer program revenue which is largely revenue from co-brand credit card deals.

In 2022 he found that American Airlines actually generated more revenue than Delta from its program. That’s reversed for 2023 – but it’s close. And in some ways, Southwest Airlines is more effective generating revenue than either of them.

That’s because Southwest is generating more revenue from its loyalty program than United and that it represents 22.4% of the ariline’s revenue. They’re entirely a domestic airline. They have no premium cabin. They also have about twice the percentage of passengers flying on their planes using points as competitors. (These two facts are not unrelated.)

United did get Chase to increase how much they pay for their credit card deal just as the pandemic was starting. But it was off a low base. The American and Delta deals are richer.

At American’s Investor Day they revealed that they’d fallen to third place in co-brand credit card charge volume behind Delta and United. Six years ago they were in first place.

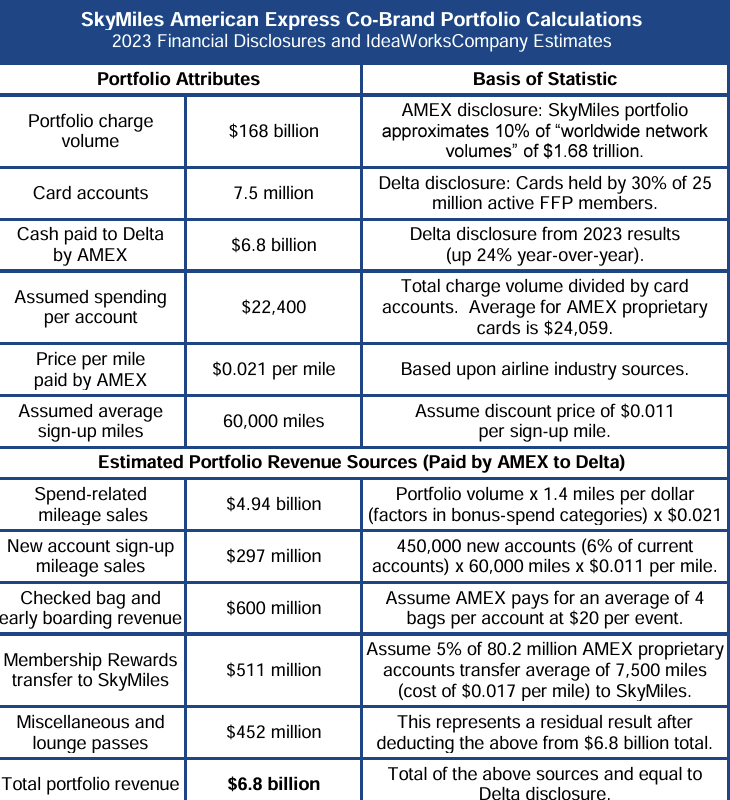

The deep dive here into Delta SkyMiles is fascinating.

- Out of 130 million stated members (everyone in their marketing database) 25 million are ‘active’ with activity in the past 12 months. 9 million members had non-flight activity.

- 7.5 million SkyMiles members have Delta credit cards. That is 30% of active members, which is an amazing number. It also suggests to me that their ability to grow the number of cardmembers may be limited out of their current member base. It’s why they’re aggressively trying to grow membership by giving people free inflight wifi if they sign up.

- On the other hand, 2% of active members (500,000) earned miles from vacation packages, hotels, car rentals, and travel insurance. There’s upside opportunity here.

- 60% of those earning miles through retailing of other travel and ancillaries were premium customers (buying Comfort+ or a premium cabin product). People who spend more for seats spend more for other Delta products, too.

- SkyMiles members spend five times as much with Delta than non-members.

Delta makes technically true but exaggerated claims about how much activity runs through their American Express cards. Delta cards push $168 billion in charge volume through Amex, but it’s not 1% of GDP.

On average a cardmember spends $22,400 per year, but that’s not interesting. What would be valuable would be knowing the median.

And I think most readers are surprised to learn that banks often pay airlines more for their miles than they would as customers (indeed, more than sometimes the airline will sell to consumers for with a bonus). Two cents a mile is actually what you should assume as a rule of thumb, though banks usually pay less for the miles earned from a card’s initial bonus – since the airline benefits from new cardmembers who then go on to spend and generate revenue for them.

Delta may have tapped out the potential of SkyMiles. With 30% of active members already holding their credit card, that explains the move last fall to push their most engaged members to spend more on their cards – or lose the benefits of status. They can’t just add more cardmembers to grow, and there’s no more money to take from American Express for existing business.

Meanwhile, American in the number three position in charge volume and generating nearly as much revenue as Delta. They can grow by pushing more spend through their cards, and this explains why they were first to move to a system where most earning – especially card earning – counts towards status. Only they’re more generous than SkyMiles. They’re generally employing carrots, to Delta’s elite member sticks.

Yes, I am surprised the banks pay so much for miles. Very surprised.

Here I thought this was how they hit a ceiling with their award prices. Guess the sky is the limit with those.

Premium

My issue w/ Delta is the cost of redeeming SkyMiles for travel. It seems more expensive to redeem on Delta than say, United

and yet Delta keeps telling investors that there is upside in their SkyMiles and Amex relationships. You don’t make billion dollar plus claims unless you have evidence to back them up.

When Delta’s loyalty and credit card revenue peaks, then you have a story, Gary.

that hasn’t happened.

Amex must be foolish. We know Chase paid UA about 0.8 c per mile in 2008 and Citi paid AA less than that in 2002. Even accounting for inflation 2c a mile is way too rich for what Amex is getting.

To compare,

to think Capital One is paying 2c a mile is extremely unlikely.

They pay customer 2 miles – transfers at 1c cost to airline miles (it cannot be 2c cost to them)

Same with Chase – they pay UA a few hundred million but UA miles are not sold at 2c

I meant Chase pays a few hundred million for the privilege of Ultimate Rewards transfers besides their regular visa cost for the UA miles cobrand cards

This is a LIE!!! You have no clue what you’re talking about Gary.

I am fed up with Delta. I now try to avoid them unless it’s Spirit and Delta only. I am trying to burn miles. I now have only 200,000 miles left. That should get me a ATL-LGA round trip in economy, ha ha. Their SkyPesos/Sky Rupiah (16000 Indonesian Rupiah = US$1) is the cause.

Amex should be livid with Delta for selling them purchase miles at 2 cents each and systematically devaluing them to less than 1.5 and closer to 1 cent each particularly by removing outlier redemptions used by elite fliers – and well below the value of AA or UA in those cases.

The carrier that partners with the highest interchange bank should be offering the highest redemption value per mile

@ Gary — This is what happens when your program becomes vastly inferior. Premium Airways may have finally devalued as much as it can. Everyone should ditch their PA AMEX cards and go with CSR and C1 VentureX. Fly Spirit for flights <2 hours and use refundable SkyMiles awards as your backup plan.

@Tim Dunn In reading the 10K and earnings announcements you will notice they Delta doesn’t put a solid number on their “Amex relationship Upside”. Exec’s make vague and nebulous statements about future growth/opportunities that don’t pan out all the time. The burden of a shareholder suit on these types of claims is very high.

@ffi – you are definitely mistaken if you think Capital One is paying 1 cent per mile on all of their transfers. Banks pay more than you think they do for miles.

@Greg I can assure you Delta has not thrown Amex for a loop or done them dirty. SkyMiles is a pretty worthless loyalty program, but it’s a worthless loyalty program because Delta and Amex work so closely together making customers want more miles, spend more, and devalue it together.

There are fun times to joke about Delta, but everything they’re doing with Amex is no surprise in any terms to amex.

I don’t understand why anyone would value SkyPesos (we may need a new term with the AM JV ending… perhaps SkyReais could work…) in any way. But that’s on the individual consumer to not research how little value they receive from that currency…

eds,

DL makes statements about how much the Amex and SkyMiles relationship is expected to bring to Delta and says $10 billion – which is considerably more than it is bringing today.

Gary writes headlines as fact when they are nothing more than his opinions.

I said in the UA earnings thread that Gary refuses to admit that the reason why DL’s earnings are so much more than UA and the gap isn’t closing because of DL’s much higher non-transportation revenues.

And so Gary trots out this article, positions it as fact and actually contrary to what DL execs have said.

Gary is into selling pageview… Facts and accuracy are the casualty of those goals.

Not surprised. Moved my big card spend $$$ to another program last year.

After I conclude my upcoming trip, will be downgrading my DL card from Plat to Gold and only keep it around for bags.

Did it to themselves. Their awards rates are insane.

@Gene

I’m 100% with you. I’ve looked at Delta so many times and been tempted to jump on their treadmill, but the outright abuse and ongoing disregard for their loyalty members has kept me on the sidelines. It’s become an annual event for Delta to destroy value in their loyalty program, and then “give back” 20% of what they destroyed to the cheers and applause of the frequent flier loyalists. I’m astonished by the willful blindness on the part of the bloggers in particular who don’t see the obvious, shameless, self-serving game Delta is playing. This year was enough of an embarrassment that I’ve gone from “on the outside wondering if I’ll ever jump in” to “you’d have to drag me kicking and screaming to invest any time or energy into Delta”.

True, but its a premium ceiling nonetheless.

An arrogant and corrupt DL (I know that for fact because I live in Atlanta area) has long been a “leader” in screwing over their loyal Skymiles members with obnoxiously high level of their award travel, especially in international markets. This exactly the reason why about 4-5 years I completely stopped getting new Amex/DL cards with so called “lucrative”offers.

DL’s CEO Bastian and his minions obviously don’t understand how to nurture and support their loyal customers (they promote “free WIFI” on their flights -big deal…when you can’t use your miles to have a family vacation, because of sky-high award tickets requirements.

As Gary one correctly pointed out, obviously DL (or for that matter Amex as weel) have not been punished financially because the main hub, Atlanta, mostly serve domestic travelers. (Why the hell Atlanta airport has a name “International” beats me…)

I skipped reading the entire article and scrolled to the bottom to see what Tim Dunn thinks.

Delta could get more credit card users if AmEx made it easier to be approved for a sign up bonus. I still have a very old no-fee AmEx Hilton, but my last Delta AmEx card was closed in 2019. Just last month I tried again with AmEx and received the pop up that I wasn’t eligible for a bonus.

@Gary Leff: “Banks pay more than you think they do for miles.”

I think Chase/Citi/Amex pay between 1.2¢ and 1.5¢. Please cite a source to prove me wrong.

“Gary is into selling pageview… ”

And he thanks you for all of yours and especially those from all the clones who mock your foolishness.

@ Tomy — Delta could get a lot more credit cardholders if thery would stop theire never-ending devaluations. Shocking to see that 15OFF was accompanied by a 20% increase in miles cost. How Delta of them to rip-off customers!

Tim is certainly buying Gary’s pageview. He’s here every day, religiously, breathlessly waiting to get his drivel in.

If it weren’t for Gary and a few others Tim wouldn’t have a life.

A Premium Failure by delta.

I’m surprised they aren’t falling even farther as I have stopped even thinking about them as an option for my travel. They are on the same #2 option list of avoid unless they are the last resort, the fare is that much lower or the schedule just makes more sense. Delta & United are my avoid – avoid because of their service and frequent flyer program. United and its maintenance issues are a no go and have been even before the FAA added oversight.

I can’t be the only person to say it out loud.

30 years at Delta and all Tim has left is this….

I continually have to laugh at how much people make this all about me….

none of which changes that Gary has to repeatedly resort to 3rd party assumptions to try to diminish the contribution that DL gets from SkyMiles and Amex and yet he NEVER seems capable of doing a side by side comparison of all 3 programs at the same time.

There really are just 3 programs – it shouldn’t be hard to compare ALL of the statistics including what is revealed in all of their 10Ks. If he did, it would show that ALL loyalty programs are growing, the death of any is pure fantasy, but SkyMiles has a large headstart and Amex simply is in a position to cut a bigger check to DL – which is a structural advantage which no other carrier can match with any other card.

It takes me seconds per post. I do this all VERY efficiently.

Tim – we all laugh because you’re a grown man that literally defends an airline like it’s your own sister. No one can say a word about DL without catching your ire while your rebuttals drip with disdain.

It’s just an airline blog dude. Go outside and do something productive. Maybe take a break from the blogs because you don’t really add anything to the conversations other than meaningless “DAL rocks” posts. Blog after blog it’s the same drivel. Nobody cares what you have to say because it’s so biased.

For all the complaining of Delta, Southwest devalued Rapid Rewards last year. It is how the industry rolls.

1st comment from Beachfan

“Yes, I am surprised the banks pay so much for miles. Very surprised.”

Be even more surprised. The banks get the miles for FREE. It is the small businesses that are forced to pay for the miles. When they accept credit cards, they are forced to accept all credit cards, including those that award miles. Those cards have a higher fee than non-reward cards. So much higher that they more than pay for the miles.

EXTORTION. Those that use credit cards that award miles indirectly commit extortion.

I wonder how many of the non Sky miles/Aadvantage members are in fact FlyingBlue/Avios members and get their domestic perks from alliance reciprocity.

If the banks really pay 2c per points why don’t they just give us the 2c or maybe like 1.7?

“There really are only three programs.” That makes no sense.

“All of the programs are growing.” OK, for now. People are catching on to the scam. This trend won’t last much longer

skyguy,

I defend truth.

Delta simply gets more revenue from SkyMiles and Amex than any other airline in the world.

I strongly suspect that the reason is simply that Amex charges more to retailers and so can pass along more to Delta – but that is a structural advantage that no other card issuer or the airlines associated w/ them can fix so neither Gary or any other miles and points blogger will admit it.

All of the anecdotal accounts of dumping SkyMiles cards doesn’t change the fact that SM and the DL relationship with Amex is growing – and everyone else is also devaluing.

I live a perfectly full and balanced live – but thanks for asking. I just happen to find time to efficiently comment on a few blogs and challenge with facts the groupthink that is prevalent on the internet.

“Facts.” “Fair and balanced.” Yeah, full and balanced as FoxNews. As factual as Fox News.

Try using your Delta Sky Miles for award travel. It’s almost impossible unless you want to spend 3 times the number of miles as AA or UA charge for the same trip. They are just gathering proverbial dust in my account as they are unusable.

Lewis,

All US airlines report the amount of awards they give with the total value of miles. AA, DL and UA have very similar average award levels but how those awards are granted is likely very different.

A whole lot of people here look at the highest tier awards – international business class and see high mileage redemption rates and assume that is true across the board but that is simply not the case.

DL has fewer business class seats and doesn’t upgrade into business class near as much as AA or UA do. It is no surprise that business class award travel costs more.

DL grants plenty of domestic and international coach travel at competitive rates which is why the program keeps growing.

Those that continue to filter reality through their anecdotes are the ones that continue to come away disillusioned only to run to every other airline and face exactly the same thing.

@Tim Dunn – there’s a slight Amex interchange advantage, and Amex claims a benefit to closed loop network when assessing lending as well. But Delta’s cobrand underperformed prior to 2015 when those ‘structural advantages’ existed. Costco pulled its business from Amex for a more lucrative deal from Citi and Visa [more lucrative outside Amex!].

That was Amex’s biggest cobrand and the Street flipped out. Amex was put in a position of needing to lock in their next-largest cobrands, Delta and Starwood, and began an industry trend of overpaying for partnerships because the cost of an individual partnership isn’t disclosable while losing a partnership would be such a huge hit.

Delta gained tremendous leverage, and one real capability at Delta is dealmaking with leverage. Remember they pressured a reluctant Korean into a JV. In a 50-50 split Delta takes the hyphen. Playing hardball is a core capability in Atlanta.

They’ve also been creative in dealmaking with Amex to make the economics, which while they squeeze Amex, still marginally work there (eg giving Amex the interchange on their fuel purchases).

Delta charge volume was behind AA as recently as 2018. Now they and United have both surpassed AA in spend volume.

– Delta has renegotiated terms more recently than AA has as well

– And United’s deal with Chase was simply on the cheap, United accepted terms from Chase they shouldn’t have after Amex-Costco, and they’ve improved those terms with a mid-contract renegotiation (United had the leverage of Chase transfers) but still has terms that lag AA and Delta, but they’re locked into not being able to change that for a few more years.

It’s *possible* though not yet certain that AA could get terms close to Delta, but Citi is weak and rumor is they’ve been considering offloading their consumer card business. It’s more of a troubled company so tough for them to do a premium deal, and Barclays is just too small to swallow the whole thing.

Point is though there’s nothing more to gain on the contract terms really (though that’s locked in until 2029), Delta is actually behind projection on revenue from the deal and impressively so once factoring inflation, and with 30% of active members already having co-brands (that’s impressive penetration!) there’s probably little more they can do adding new cardmembers – this is why it matters so much for them to grow the pool of members through free wifi though these members aren’t likely to convert at the same rate.

And that’s why Delta needs to push current cardmembers to spend more, shift wallet share and give them all their spend, because it’s the lever they’re really left with to still move the needle on co-brand revenue. Otherwise they’re topped out. That’s how you can understand what they tried to do in the fall, but they shit the bed pushing members too hard too fast and clearly saw the writing on the wall of backlash that would’ve hurt spend volumes.

Here’s another hit for you Gary.

“It takes me seconds per post. I do this all VERY efficiently.” Well yeah, because it’s the same bullshit. Anyone can pretty much cut and paste.

@Chaim, many credit cards give you 1% or 2% on your purchases or even 3% on certain purchases. Some even give more on certain purchases. So if you want cash, those are the ones to use. If you want miles or points, certain cards with deals with airlines can give you those and you may be able to use them effectively for what you want. Miles and points seem to devalue over time.

Gary,

thank you for your thoughtful reply.

in so much as what you state as fact, I don’t disagree.

My pushback is when you and others state your expectations of what MIGHT happen as fact; your reply has plenty of MIGHT and COULD and, insomuch as there are clean distinctions between facts as they actually exist and personal expectations, then we are on the same page.

Delta’s financial leadership in the industry is because it sees much further down the road than its peers and has evaluated lots of options and then consistently executes them. DL’s growth in its portfolio is coming from its growth in the major coastal markets – it had tapped out what it could do in its core hubs w/ Amex. It recognized along time ago what UA is now realizing – that you must have a strong domestic system in both small and medium as well as large markets in order to tap into the maximum revenue that comes from a credit card program. AA thought they could offset their network weakness w/ revenue strength but I said correctly that cc revenue is not enough to offset operational losses. DL manages to make money at its coastal hubs even if with smaller margins than its core hubs. Its Amex relationship is probably stronger and has more potential in its coastal hubs than in its core hubs.

Amex does have some structural advantages and they don’t have to share those – which is probably why they lost Costco. DL is a very tough negotiator as evidenced by the willingness to wait a year for their A350-1000 order but DL ended up with the MRO rights they wanted all along. DL sensed the same need w/ Amex and jumped when they did.

The market continues to evolve and DL has stayed at the front of the pack because it adapts even as competitors make gains. No one has said that AA and UA won’t see gains in their cc relationships but that DL will adapt and figure out how to keep the gravy going as well. Given that mgmt still guides for up to 50% upside in Amex revenue this decade, they have yet to hit the ceiling.

again, thanks for your reply.

@Tim Dunn – you begin by criticizing playing out scenarios based on current facts on the ground as too speculative – that we should only look at today – and then conclude with “Given that mgmt still guides for up to 50% upside in Amex revenue this decade, they have yet to hit the ceiling.”

However that’s just 7% annualized growth off of last year’s number, and if inflation falls to 3% and stays there then nearly half of that work gets done automatically.

And that’s a projection. Airlines do not always hit their projections. Delta did not hit their projection for 2023 *even with inflation’s help*. In 2017, American predicted that they would always generate $3 billion to $7 billion annual in profit. Despite ~ 25% inflation since then, they no longer stand by even the bottom end of that range. They now consider the top bonusable achievement for their CEO to be $2.5 billion profit.

We’ll see what sort of Amex revenue growth Delta achieves in real dollars. My suggestion here is that there are real challenges to overcome to avoid stagnation in real terms.

Gary,

of course companies sometimes don’t meet their plans.

My word is simply not to blow a single datapoint or even two and draw decades long conclusions.

Companies can see data and restrategize.

Just be sure and let me know when published data – not back of the envelope assumptions – show that SM and Amex are no longer the largest loyalty and card programs in the industry.

LOL! Some years ago, DL gave us a glimpse of the future. It’s here now, all around. Do you remember? You should….

635k. PHL. FCO. One way. Not all of it in J.

Yeah that was in 2010.

So how can they squeeze more from the stone that is their customer base?

At leAAst AA gives some vAAlue…like their recent 5k one-way tix from US to various CentAm and Caribbean destinations. So I load hundreds of thousands of $$ of spend on AA’s cAArds for this reason. Let me tell you it’s epic ,….I don’t even need to pay to fly AA ever, as ExP my UG’s clear routinely even on these 5k PHX-CUN/PVR/SDQ awards that I stack up because I have bucketloads of LoyPoi. Onboard they even call me “one of their best customers” but really I’m “one of their best churners” and to them, it’s literally identical.

And by the way let’s go back to the alltime classic of PHL.FCO.

AA 19k one-way for some sale dates this fall yes that’s 2024. Ok that’s Y…but still….

I say… FAAbulous!

And – Gary, readers – you know what, just for your edification and because you haven’t heard it enough of late, meantime DL remains, incontestibly….incontrovertibly…..yes…

*LO MEJOR EN SU CLASE*

🙂

RTS

@Tim Dunn – quite recent that they’ve been largest, we’ll see how long it lasts!

As long as delta continues to ask for extremely high redemption rates for flights, people will move their loyalty. For example, in looking for flights jfk to Jnb for late June, it was 40k/42.5 k on aa/virgin for one way economy. Delta wanted 120k. Even if you pay more because of using lhr transit, delta redemptions are absurd.

@Larry

Thanks for the laugh. That was really funny. Everyone should go back and read what you said!

I would say it was really adroit! Ha!

If your travels take you to California, please consider a premium Delta flight to LAX.

Spirit has got to try harder with a new credit card product and even a lounge. There’s no need for a low cost carrier in the US anymore. They should increase their prices to get themselves out of the hole they are in. Rebrand big seats as first class and people still need to get to places.

@jns i was mainly referring to the SUB. Chase just gave 100k ua points for the united business card, did they really pay 2000$ for that? I certainly don’t know of any card that gives 2,000$ for 5k in spend if you do please let me know which one

Dropped my DL Platinum Amex card this, after many year of having and previously a gold. Going directly with Amex and their Platinum have the option of using it on other airlines with lower redemption levels. Most of our points were accrued by spending on various retail, not by actual flying. Virtually the only DL trips were international and even flying business class,with a DL Platinum doesn’t grant SkyClub access on all legs, not to mention a charge. As for domestic, I’d rather take my time and drive. Flying has become an utterly miserable way to travel. Used to love it.