I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

There are offers to earn up to 120,000 points on the Chase Southwest Airlines small business cards: Southwest® Rapid Rewards® Performance Business Credit Card and Southwest Rapid Rewards® Premier Business Credit Card.

There have never been bigger offers, and completing one of these fully also mean earning a companion pass.

- Sometimes there are card offers where the companion pass is earned as part of the initial bonus. You’re earning fewer points, but you get a companion pass!

- This is even better. You earn the most points we’ve ever seen, and those are enough for a companion pass also.

- 120,000 points will buy you around $1,500 in travel – and with a companion pass you can bring someone along for just the cost of taxes. That means you can double the value of those points, getting around $3,000 in value from this card’s bonus offer. That’s almost unheard of.

A Southwest Airlines Companion Pass requires 135,000 eligible points earned in a year, but co-brand credit card customers get a 10,000 point boost towards the requirement.

If you earn 120,000 bonus points, after the required spend you’ll have earned 135,000 points at a minimum – and the boost gives you 145,000 points towards a companion pass. More than enough to earn it! The pass lasts the entire remainder of the calendar year in which it’s earned and the full next calendar year.

Here are the offers:

- Southwest® Rapid Rewards® Performance Business Credit Card has an offer to earn up to 120,000 points. Earn 80,000 points after you spend $5,000 on purchases in the first 3 months from account opening and an additional 40,000 points when you spend $15,000 in 9 months.

Ongoing earn is to earn 4X pts on Southwest® purchases; 3X points on Rapid Rewards® hotel and car partners; 2X points on rideshare; 2X points on social media and search engine advertising, internet, cable, and phone services and 1X points on all other purchases. These points count towards earning a companion pass.

Cardmembers receive 9000 bonus points each year after cardmember anniversary; a statement credit for Global Entry or TSA PreCheck fees every four years; reimbursement for four upgraded boardings per year (A1 – A15 boarding purchased at the airport) when available; plus inflight wifi credits. That’s a package that makes the card’s $199 annual fee well worth it for a Southwest flyer.

- Southwest Rapid Rewards® Premier Business Credit Card has an offer to earn up to 120,000 points. Earn 60,000 points after you spend $3,000 on purchases in the first 3 months from account opening and an additional 60,000 points when you spend $15,000 in 9 months.

Ongoing spend will earn 3X points on Southwest Airlines® purchases; 2X points on Rapid Rewards® hotel and car rental partners; 2X points on rideshare; 1 point per $1 spent on all other purchases.

The card has a $99 annual fee and comes with 6,000 bonus points after your cardmember anniversary and 2 EarlyBird Check-In® each year. And the card lets you earn unlimited tier qualifying points towards A-List status.

In my view the bonus offers are really quite similar, since they only make sense if you’re going to go for the full amount. The higher annual fee Southwest® Rapid Rewards® Performance Business Credit Card makes sense for a regular Southwest flyer. With these points and earning a companion pass, you should be one. But if you don’t see yourself that way, then the Southwest Rapid Rewards® Premier Business Credit Card has an annual fee that’s $100 lower.

Chase’s 5/24 likely applies to these cards, where they may only approve you for these offers if you’ve had fewer than 5 new cards in the past 24 months. The good news is that being approved for a Chase business card generally should not add to your 5/24 total.

In addition, you’re only eligible for a given card if you don’t have it and haven’t earned an initial bonus from it in the past 24 months. I do not currently have a Southwest business card. It’s been almost two and a half years since I’ve earned a bonus from a Southwest consumer card, and four and a half years since I’ve earned one from a Chase business card.

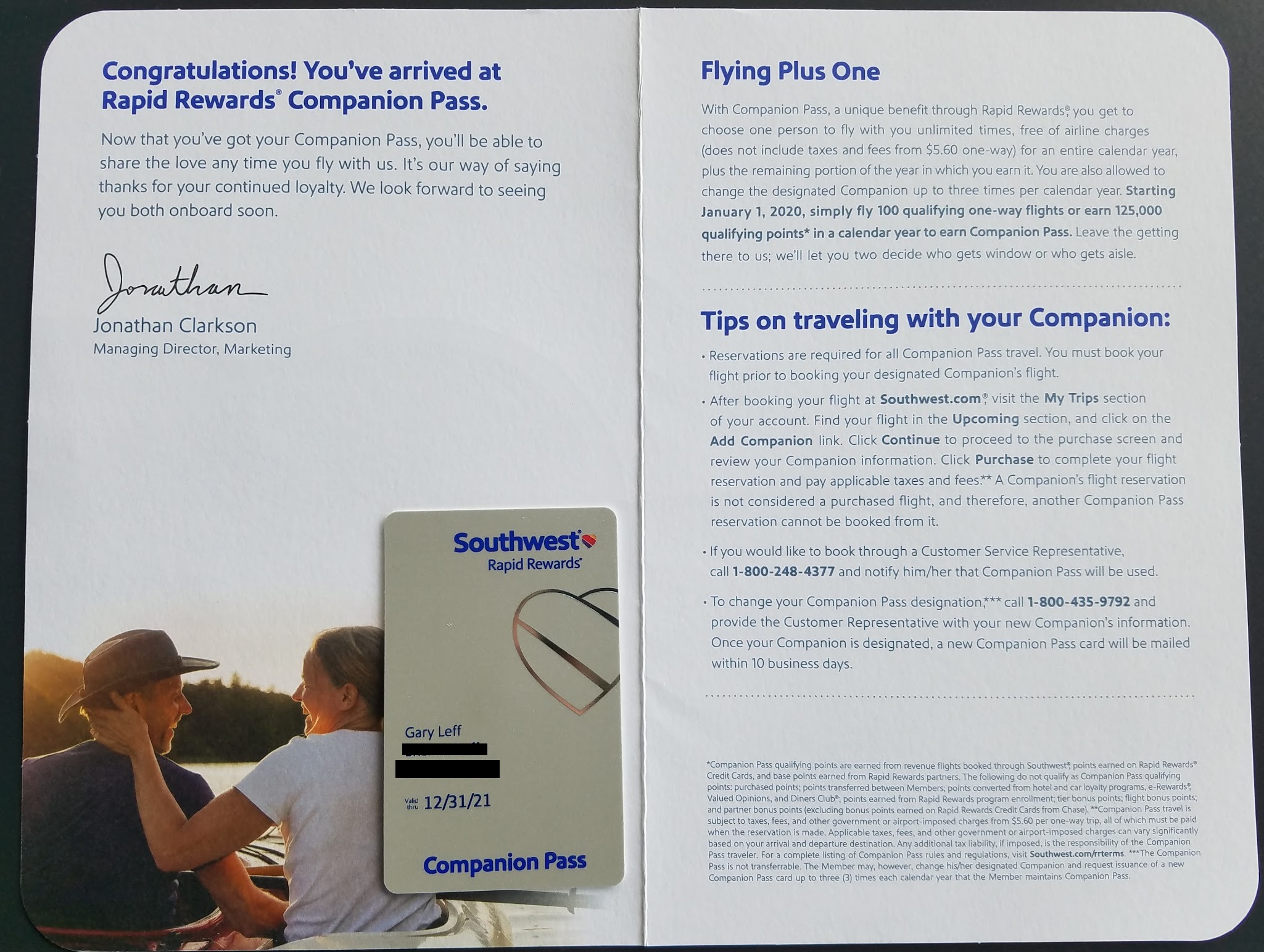

My Companion Pass lapsed December 31, 2023 after nearly four years. So I find the Southwest® Rapid Rewards® Performance Business Credit Card especially tempting.

You couldn’t pay me to get on that god awful airline. No assigned seating. No premium seating. Fights daily over seating. Dozens of wheelchairs per flight with fake disabled people. For the extra $20-50 RT I’ll take the premium economy seat with free drinks and my pick of seats at booking,

I fly SW all the time for years and years (as well as other airlines). The bang for your buck with the Companion pass, free bags and ability to change and cancel flights and even change flights and get point difference back in account is great. I figure in the future they will go to assigned seating, just for law enforcement purposes if nothing else and seating families together.

I currently have the Premier Business Card. I am eligible for the Performance card bonus?

I absolutely love Southwest exactly like it is. My wife and I have had companion passes most of the past 4 years and our current one which we qualified for January 2, 2024 is good through December 31, 2025. By using points from our credit cards we have only paid cash for the $5.60 for each flight. With various Southwest credit cards we use the early bird check in and upgraded boarding positions. In addition we have assigned our Amex Platinum cards $200.00 airline benefit to Southwest for additional money towards upgraded boarding and earlybird check in positions. We generally sit in the first 5 rows of each flight.

Funny while we have seen some obvious abuse of the wheelchair use, I have never seen more than a handful of people doing it. Ever. I love the very simple and organized way they board the planes. I am sure I would feel different if I was in a C boarding group and only the middle seat was available.

I fly several times a year internationally and I depart those flights generally from New York or San Francisco. Flying from those cities with foreign airlines is generally less expensive with superior service. I fly a day early on Southwest and enjoy another city before my departure internationally.

The experience is so much more positive flying Southwest with having much more leg room than on economy and also for the most part very positive and friendly flight attendants.

Yesterday I flew from DAL to LAX and from LAX to KOA. On each flight two wheelchair passengers boarded early and they appeared old. The flight attendants made each totally full flight a very pleasant experience with repeated drink service.

For me I love to fly out of DAL as opposed to DFW. If I have to fly out of DFW I need to leave my house at least one hour earlier. The small DAL airport is so much easier than navigating DFW. I also love the ease of rebooking my flights when the price drops saving me miles for my future trips. I also love that I can check two bags free each flight.

I am amazed how many of the same people constantly complain about Southwest and seem to advocate they be just like any other miserable US airline. Funny they give their reasons why they will never again fly Southwest. It does not appear Southwest is missing their business. For me Southwest works great and allows me to afford to travel for a fraction of what I would pay on other airlines.

If they change like other airlines they will ruin what has been for most of their life a very profitable and successful airline.