Spirit Airlines and its fat margins from low fares and significant fees were once the darling – and envy – of the airline industry. Six years ago now-American Airlines CEO Robert Isom laid out why Spirit and Frontier were the airlines to model at American:

[T]oday there is a real drive within the industry and with the traveling public to want to have really at the end of the day low cost seats. And we’ve got to be cognizant of what’s out there in the marketplace and what people want to pay.

The fastest growing airlines in the United States Spirit and Frontier. Most profitable airlines in the United States Spirit. We have to be cognizant of the marketplace and that real estate that’s how we make our money.

We don’t want to make decisions that ultimately put us at a disadvantage, we’d never do that.

All that has changed. Consumers haven’t wanted what Spirit and Frontier have been selling. Those airlines have struggled. They’ve responded by shifting the routes that they fly, and the products they sell. Frontier has upended its fares and now sells a premium product with both extra legroom and blocked middle seats. Now Spirit is moving in that same direction.

Spirit Changing How It Sells Fares

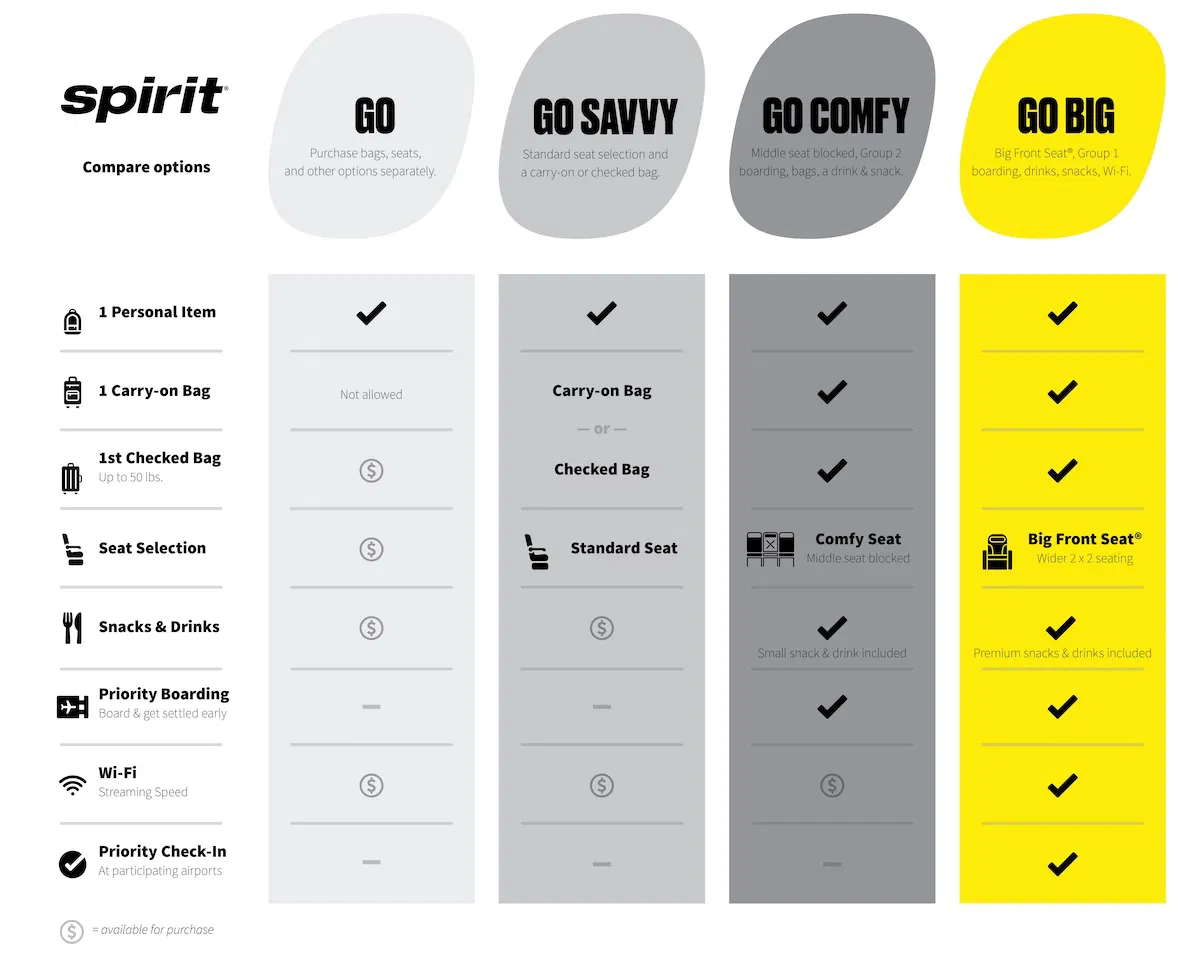

In a move that follows how Frontier has retooled its fares, Spirit is moving away from low fares and myriad fees to more bundled options. They’re instead offering four fare types:

- Spirit’s entry-level fare includes a personal item and free changes. That’s akin to its (now more generous) entry fare today.

- They then offer ‘Go Savvy’ which comes with seat selection and either a carry-on bag or checked bag.

- ‘Go Comfy is a level up, with blocked middle seat for extra space (note: they can sell this twice – the passenger in the window and the aisle both), Group 2 boarding, plus both a carry-on bag and a checked bag, as well as a drink and snack. Selling the blocked middle makes sense when they aren’t filling planes, but becomes more costly (and they should adjust price up) when loads are expected to be high.

- Finally, their premium option ‘Go Big’ is a domestic first class bundle with the Big Front Seat, Group 1 boarding, as well as free drinks, premium snacks, and free wifi.

These all start with bookings August 16, 2024 and onboard features go live August 27, 2024.

Spirit Airlines First Class

Originally Spirit Airlines only offered the Big Front Seat on planes because it was cheaper than removing the seats and putting in regular ones.

It was called the Big Front Seat because that’s what you were getting – a bigger seat up front – and not the rest of the things that go along with domestic first class on other airlines. That’s all changing.

The Big Front Seat becomes a bundled product, with bags and priority boarding as well as something to eat. Wifi will be free for first class passengers on Spirit – when it isn’t on American and United.

How they’re selling the Big Front Seat – as more of a domestic first class value proposition (albeit snacks, not meals, even on longer flights) – may be the biggest change happening here since you can still buy the most stripped down Spirit fare and the seats themselves onboard aren’t changing (the tightest pitch, no recline).

Spirit Airlines Goes Premium

There’s little more small-d democratic than flying Spirit Airlines today. Even with their Big Front Seat you queue like anyone else for any service you need, and they push you to self-service as much as possible. Someone flying ‘up front’ doesn’t actually board first and pays for their checked bags.

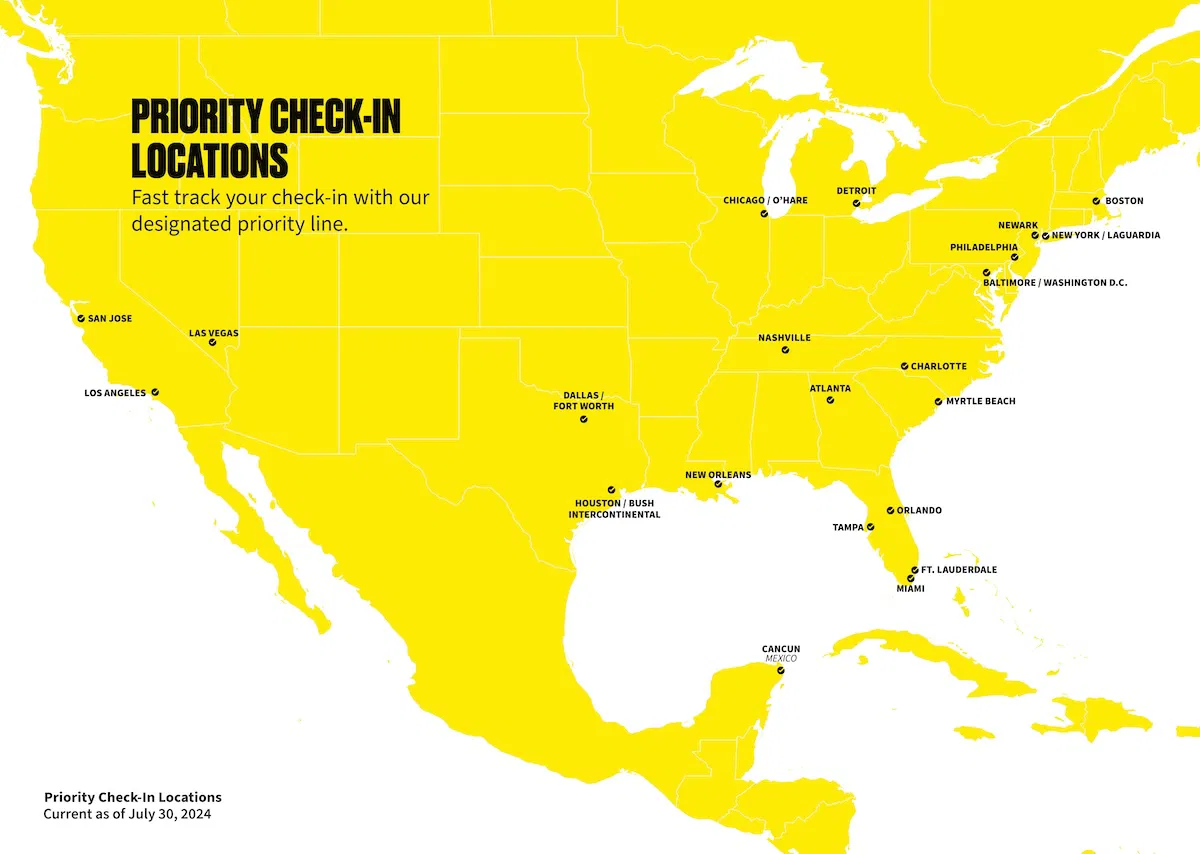

Yet Spirit is introducing priority check-in for first class Go Big passengers, Spirit Airlines Free Spirit Gold elites, and co-brand Free Spirit Mastercard customers.

This will eb offered at around 20 airports, skipping the queue for the first-available agent at the ticket counter.

In addition, a new boarding process will align with their premium offerings. They’ll have priority boarding for their two higher-fare tier customers along with elite frequent flyers and co-brand cardmembers (and active-duty military and their families).

Does Upending Its Business Model Make Sense For The Struggling Carrier?

During the United Airlines second quarter earnings call, Chief Commercial Officer Andrew Nocella diagnosed what he thinks low cost carriers like Spirit and Frontier are doing and why it doesn’t work.

- “First, when you face this type of problem, airlines generally push to grow out of the problem, but that usually doesn’t work and this happened in the previous quarters.”

- “The second step is network churn, where you think, well, we picked the wrong markets and we can fix that. But the next set of markets is usually worse than these markets you’re flying today.”

- “Then the next change is business model changes, right? We noticed Airline X is doing something different from us, let’s match. That’s really hard and slow.”

- “I think the next step is that everybody thinks, well, let’s go premium. But that’s a generational adjustment that just does not occur over a few quarters.”

- “And then the next one is let’s push capacity on good days and months but cut hard on off peak and that’s really hard to do because it’s an inefficient use of assets.”

- “And then the next one is closing schedule changes because you’re really concerned about your P&L and what’s going on. And I think we see a lot of closing schedule changes today from many of our competitors.”

- “And then the last part is you just shrink.”

Businesses have their models because they’ve believed it is the best one that plays to its strengths – its core capabilities and its opportunities – so changing the business model doesn’t really work. Opportunities may change, and they need to acquire new and different capabilities. That is hard and takes time and usually fails.

On the other hand, the model that says doing something different may work is one that says tough times may drive an airline (or other business) out of its complacency.

- It likely sticks with a model or product longer than it should, even in the face of changing opportunities.

- When there’s plenty of cash there’s no real urgency to change. In a big public company, where the managers are well-paid employees rather than owners, there’s little incentive to stick your neck out. You have a plan everyone accepts. Try to change it, step on sacred cows, and you may be out.

- But when things go badly there’s no choice but to change, to re-examine assumptions, and to take risks. You may lose your perquisites anyway.

So you cut routes that may have had political support. It’s easier to run over opposition during lean times, because you don’t have the luxury that ossified bureaucracies do of simply paying taxes to internal (or external) interests, and you have a narrative for why change is needed.

Will Spirit Succeed?

Spirit is in the midst of several ‘bet the company’ moves. Their costs have been going up, and they can’t just grow to make up for it. So they need to bet on higher revenue. The thesis, like at Southwest, is that the shift by consumers to premium is a long-term secular trend. That may be wrong, in which case a new carrier with lower costs would have a shot at filling the gap left by Spirit (but for huge barriers to entry into the industry, roadblocks in place by both federal and local governments).

Either way, the days of Spirit’s ’69’ sale (it was exactly what you think it was) and MILF sale (Many Islands, Low Fares) are long gone.

@ Gary — Now we see why they offered the 203/2024 status match and extended it through tomorrow. We very much enjoyed our Gold benefits on Spirit, and our opinion of the airline has dramatically improved. We bought BFS every trip, and we always wondered why Spirit didn’t a) more aggressively sell discounted wi-fi (we never bought it), b) rotate any of the snack offerings, and c) utilize their flight attendants to sell more F&B (typically they spent 10-15 minutes with the cart out and then have little to do, as most people do not buy anything).

Their management clearly utilized the data gathered from their status match experiment. This is a brilliant move and another reason why Delta is a big FAIL in head-to-head nonstop markets vs Spirit. We look forward to many more trips on PREMIUM Spirit, where Premium does not equal highest prices, over-rated over-crowded lounges, arrogance and failed IT systems.

This is incredible. It could really hurt an airline like Delta, especially the blocked middle seat. Delta does not offer a blocked middle seat option in extra-legroom economy (comfort plus).

Will drinks be unlimited in the Spirit version of first-class? This might be enough for me to switch to Spirit for domestic travel. Interestingly, Spirit serves a French sparkling wine made in the champagne or traditional method. That’s actually better than what Delta serves domestically, both in Delta One and in first.

There is a segment of Spirit and SWA customers who no longer can afford to fly even LCC.

You can either chase that shrinking pool to the bottom, or remove the barriers that keep more affluent customers from buying or spending more on your product.

Biz travel isn’t back. And revenge travel is over. So the airlines are doing what they can in advance of what could be a rough winter.

@ Ralph — I certainly hope that revenge travel is over. It would be nice to go to Europe in the offseason and enjoy some peace and quiet (and lower hotel prices), like in the pre-COVID days.

This all sounds good but does it turn losses into profits? If the airline blocks a middle seat it loses the revenue possibility from that seat. Is the revenue premium from the aisle and window seat enough to make up for that and more?

Also, both Spirit and Frontier are trying to go upscale but can they actually capture that customer? Both have horrible reputations and do not have the schedule frequency of legacies. Or all the benefits that come from a legacy co branded credit card.

They can do whatever they’d like – but you still get the Spirit passenger experience.

This all seems headed generally towards the European regional business class model of blocked middle seats and not much additional pitch with no more 2 x 2 differentiated domestic first class, which in my view would be a terrible thing. I’d very much like to be completely wrong about this. Can someone please provide a counter argument?

Correct me if I’m wrong, but the Big Seat does not recline at all. Did they change that?

Spirit’s reliability remains an impediment to their consumer acceptance. Without a robust schedule, any irregular operations could mean you’re stuck in your destination for days. When the schedule works, all is fine. But when it fails, it fails spectacularly.

@Mike Hunt

I think you summed it up nicely.

Only question is whether that intra-European model will sell here.

Probably will need to work for Spirit and perhaps even SWA. And just the experiment itself may complicate profitability for those with a dedicated front cabin

@Mjonis – no change to the big front seat, no galley retrofits for hot meals, etc.

@ mjonis — BFS is still “pre-reclined” (in a fairly uncomfortable position).

Seems like a great idea. They really don’t have to do much to their hard product offerings and instead of selling the passengers in the big seats a drink and snack item they just give it to them.

I really like Spirit in some ways but I’d say their airport staff might be their weakest link. I think they should also improve some of their point-to-point routes instead of routing most people through hubs.

Its a nice gesture but Spirit’s problem is the name. They’re going to have to pull a Valujet if they ever expect to be taken seriously.

For years Spirit has s**t in their customer’s mouths and chased away the majority of higher-yielding clients who would consider a second flight on them.

The customer service needs to be brought in-house instead of these lowest-common-denominator “service” companies who’s employees serve as gate, ramp and ticket agents. They are literally temp workers with no skin in the game. They couldn’t care less whether the plane flies or whether you make it to your destination or not. This is why there are so many videos of employee freakouts, beatdowns etc. The silly yellow paint needs to go and fares as well as service need to support the longevity of the company.

Its going to be expensive and it won’t happen overnight but they’re going to have to grow up. In reality, what chance do they have? Their financials are atrocious and merging (at least for now) is not an option.

With some serious changes, yes, some of their passengers will just have to go back to riding the hound.

If they can pull it off, then they may……just may start to persuade some of the people who they’ve pissed off in the past to give them another shot.

The $29 crowd is not going to be this company’s survival.

This is such a smart and easy thing for Spirit to do. They’ve got the bigger seats and can easily ad-hoc block middle seats at any time. I’ll personally take more width versus more leg room any day.

This is a smart move. As they are not eliminating their lowest tier, they can always manage inventory as the market needs.

They are many steps ahead of Frontier who does not have larger seats. They can ‘only’ block middle seats. Advantage: Spirit which can do larger seats AND blocked middles.

Now, as someone else said, if they can only work on the airport staff.

@Gary- Quick typo which could be accidentally picked up by a bot, you said, “goes live on August 27, 2014”, so that’s probably in 2 weeks and not 10 years ago. 🙂

-Jon

@ CHRIS — You are spot-on. They have to raise fares to survive, and they need to invest some money in customer service. I’m certainly no IT expert, but some seemingly simple to chnages to the website would be nice, like being able to save your travel companions’ information so that you can search for flights much more easily.That cannot be that difficult. Oh, and the employee uniforms look like vomit.

Spirit, JetBlue ,Frontier, and Southwest. It may be trite but it’s all about, reliability, frequency, the experience, and price. AirTran effectively competed with Delta on all four out of Atlanta. None of Spirit, JetBlue, Frontier, and Southwest compete on any of them. It’s a rare leisure traveler that is truly indifferent to these factors. The AirTran acquisition should never have been approved.

People also don’t want to be nickled and dimed or gamed. There’s a reason airlines hate transparency regulations.

I think it’s mistake for low cost airlines to attempt going mainstream. Look what it’s done to JetBlue. As for first class, I doubt many first class flyers would pick spirit over a main line, unless there were significant savings. I suppose it could be an incentive for their loyalty program elites (If you can refer to anyone flying Spirit as elite).

I like the clarity that chart provides. I have always avoided Spirit (haven’t flown them to date), but that chart lays out exactly what I would get with each booking class. In contrast to Ryanair, where it seems like page after page of add-on options that bury the total fee till you get to the end.

This is smart. And given the right route and timing, I wouldn’t rule them out.

the pure hypocrisy of UA”s consistent ragging on ULCCs is that the big 3 spent most of the past 50 years of the deregulated era playing underdogs to the ULCCs and LCCs in the US.

The script is flipped now but UA wants to act like the rest of the industry will fall away leaving only UA.

Life ebbs and flows.

The ULCC and LCC sector will reinvent itself.

@ James Cameron — Spirit isn’t competitve on price with Delta? You’re nuts if you believe that. I have flown more than a dozen sgemnts in BFS on Spirit. The cost is usually 60-70% less than standard coach on Delta.

Spirit needs to do something to survive and this makes sense. However, it has a lot of work to do to rebuild the trust of people who will buy these upscale fares. I’m intrigued by the idea, but then I remember Spirit runs an appalling operation. Why would I care about getting a great deal on Euro-style business class if the flight is cancelled or 5 hours late?

@Gary will we still be able to purchase the Big Front Seats ala carte or will they only be available as part of the new bundle after August 16? I usually purchase just the BFS without all the add-ons. If they throw in all the additional perks for around the same price (or a small mark up) then it sounds like a good value proposition for the customer. If on the other hand it forces the customer to pay almost full price for all the bundled add-ons (many of which they may not need) and makes the new “first class” tickets comparable in price to short haul domestic business on American or United, then I’ll just fly American/United.

Spirit’s current approach to selling the Big Front Seat doesn’t seem to work well in actually filling those seats. For most of the Spirit flights I’ve taken over the last 2 years, I’ve received an email in the week prior to departure offering to let me bid on the remaining Big Front Seats. You can frequently win the auction with the minimum bid (something like ~$18 on shorter routes), or something a couple dollars higher.

Given that they don’t seem to be reliably selling the seats with the current strategy, it makes sense to try something different.