IdeaWorks is out with a report on airline credit cards, and the role they play as part of – and competing with – bank strategy.

Airlines make a tremendous amount of money through their co-brand credit cards. In 2006, United was generating $600 million (and, I’d add, that made MileagePlus profitable when the rest of the airline was losing moeny). Now they’re generating $6 billion. That’s an amazing rate of growth.

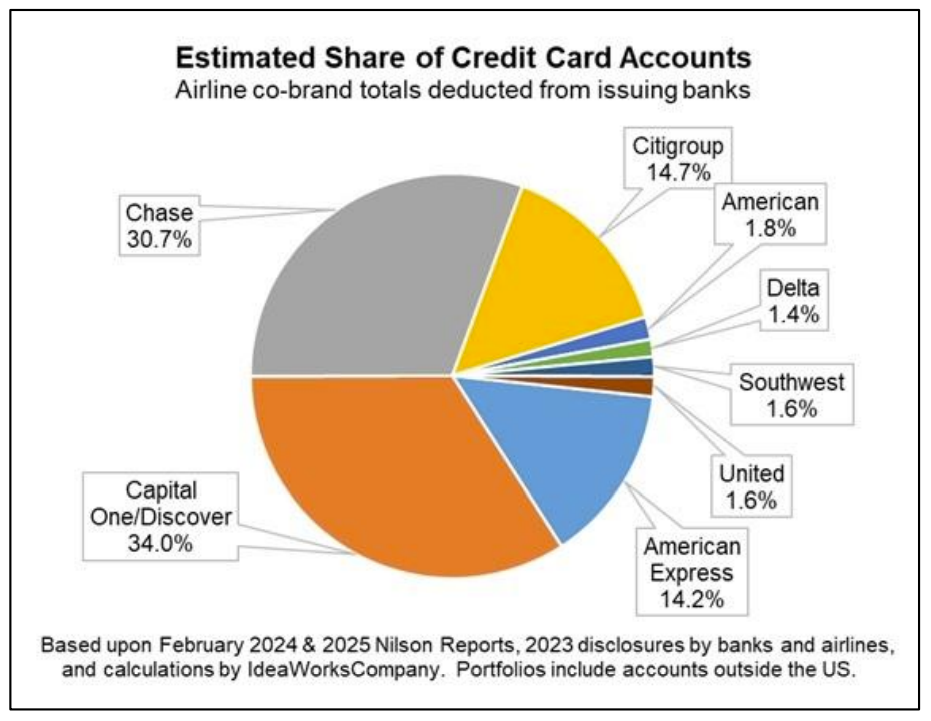

At the same time, airline cards are a small slice of total cards. It’s just that they’re at the premium end of the spectrum. The consumers with these cards are attractive to banks, and their attachment to the airline program makes the cards sticky. Backing the largest airline portfolios out from their issuing banks, they get these relative sizes:

It’s interesting that the report looks at Capital One, which doesn’t have any airline co-brands (but which has been building out a co-brand capability and, I understand, has submitted proposals on some deals). At the same time they don’t look at banks like Bank of America, which does.

However Capital One has the ‘premium card space’, competing with Amex Platinum and Chase’s Sapphire Reserve. And Citi has now re-entered that space as well. And a key strategy is lounge. (Citi relies on lounge passes to American Airlines Admirals Clubs to supplement Priority Pass, which they all feature.)

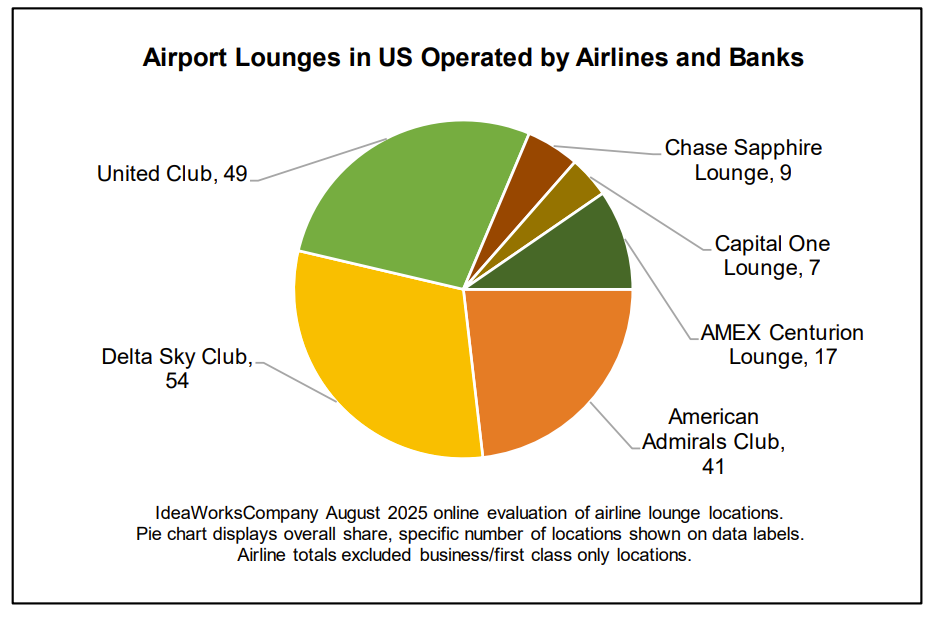

Airlines have much bigger lounge footprints than the banks do.

- American Express has the most bank lounges. Chase and Capital One, relative newcomers, have smaller networks.

- Delta has built out the most airline lounges. United isn’t far behind. American’s lounge footprint has shrunk over the years, and has fewer than both.

The piece offers this on just how expensive lounge projects are,

Airports are notoriously expensive construction sites due to security costs, accessibility issues, and labor union safeguards often enacted by local governments. Delta and Atlanta’s international airport announced a $33 million lounge project in 2021. The total price swelled to $92 million by 2022, which now involves additional concourse-related components. Delta recently opened a second Sky Club at Seattle at 21,000 square feet. Construction began in the 3rd quarter of 2022 with an opening on 26 June 2025. The total cost of construction, which includes a new “Club SEA” lounge sponsored by the airport, has been estimated at $126 million.

Chase’s upcoming LAX lounge was projected to cost $6.3 million in annual rent starting in year two, and cost $23 million to build. Their proposal to the airport outlined a planned $8.40 per guest in food and beverage spend.

I do think, though, that the report reads too much into the strategy of bank lounge placement. Looking at whose customers are being ‘targeted’ there’s a suggestion that banks are going after American Airlines customers most.

[B]anks may have little choice where to locate a lounge as real estate is extremely limited. Yet, it’s interesting that American is perhaps the most frequent target of the card-issuing banks. Perhaps the banks view AAdvantage members as the most poachable among the Big 3. Southwest is another interesting candidate because it does not yet offer airport lounges.

In fact, thinking around third party lounges has evolved a lot since American Express opened the Las Vegas Centurion lounge a dozen years ago.

- American Express had been losing lounges. Their Platinum card was a travel product, and the United-Continental merger cost them access to Continental lounges (as Chase gained exclusivity in a new co-brand deal). Then the American Airlines-US Airways merger cost them access to the lounges of both airlines (as Citi gained exclusivity in a new co-brand deal). Their solution was to build their own.

- The second Centurion lounge was at Dallas – Fort Worth. Initially American Airlines pushed back with the airport. But something we’ve seen is that the presence of bank lounges actually benefits the airlines! It may compete for premium cardmembers, but also drives passenger traffic. Cardmembers prefer flying through and out of airports where their card offers a lounge.

- In fact, initially American Express targeted airports where they did not have a presence. They were losing American and US Airways lounges right as they were building out their own and they focused on ensuring that their cardmembers did not lose options. That explains the heavy American Airlines focus.

- American Express had Delta lounge access for its cardmembers, and initially did not build out lounges that overlapped. That changed, precisely because of their deep relationship with Delta. Their cards were driving Sky Club crowding, and so they built their own nearby lounges. And those lounges supported Delta travel, and Delta premium cobrands (as the Delta Reserve cards gained access to these lounges – when flying Delta).

Banks build lounges where their cardmembers are, or where they want to compete for cardmembers, and where they can access space. Older airports often don’t have the space for lounges, while newer terminals are being built to accommodate them.

Airlines often have first priority over lounge space under use and lease agreements, and airports were often fearful of these lounges driving down retail sales (of which airports generally take a cut) since passengers would be comfortably ensconced inside and not shopping or buying food. But banks have had an almost unlimited appetite to pay airports for the space! And they even do attract passengers to connect through the airport (which itself generates fees).

The interesting thing about bank lounges is how they’ve helped drive up the quality of airline lounges. First, they offered better food (when Amex lounges first opened their food was far better than it’s been in recent years). Second, they showed how nice lounges could attract customers and banks – through their cobrands – have helped fund improvements in airline lounge offerings.

When American Airlines had to up its food game, they first just introduced guacamole and then avocado toast. That was being prepared for each customer – by an employee wearing a Mastercard apron. The cobrand role here was explicit.

To attract the premium cardmembers, the product needed to be premium, but back then American Airlines would only spend the money Mastercard was giving them. With the refresh of the Citi Executive card, alongside an increased card annual fee, we got a bigger investment in food.

Airline lounges in the U.S. have gotten much better. When I started going to United Clubs at the turn of the century I pretty much just expected Tillamook cheese in shrink-wrapped packages. Now I can enjoy an entire buffet at a Delta Sky Club, or a legitimate celebrity chef sit down tapas dinner at Capital One’s restaurant in lieu of lounge at National airport. On the whole the best lounges in the Middle East and Asia Pacific trump the best lounges here, but the average has gotten far better.

Great addition to your ‘airlines are credit cards with wings’ post. Yet, those airlines still need to actually operate their flights (reliably, comfortably, etc.) I will say, on lounges, Amex was the OG, Chase has done a decent job (LGA is excellent), and C1 is catching up (but is so restrictive with approvals, I’ll probably, personally, never get to see one, especially not once they charge for guests starting 2026.) Yet, Citi really dropped the ball on this (no lounges.)

Very interesting and thanks for reporting on this.

I feel like C1 is gearing up to make a real play for United. The United/Chase expires in 2029 (and who knows if United has an out before then – could pull out of UR on X date perhaps). C1 is slowly building out a network of quality premium lounges which in a few years could be a comparable network to the CSR network for United Club overflow. Of course Chase as the incumbent is the most likely to retain the business, but it would be a real coup for C1 and they may force Chase to overpay in one way or another (which may not be particularly good for consumers).

Amex/Delta partnership isn’t going anywhere (too lucrative for both parties) and AA seems to have Citi over a barrel (and I have to imagine they got a lot from Citi for giving them exclusivity). Given how much someone is going to overpay United in a few years, makes the cards associated with the United ecosystem a harder long term play perhaps (although the reality is we all should be burning our miles earned within 12-24 months anyway – miles certainly do not go up in value).

@Peter — That’d be a big deal, if it happens. I doubt Chase wants to give them up, though, note that the $75K spend benefit on the CSR ain’t going towards United… (Southwest, eesh.) “AA seems to have Citi over a barrel…” Bah! Yup, bout right.

Fascinating read Gary, thanks for sharing your insights. And very interesting idea @Peter! That’d certainly be a game changer .

@1990 — 🙁 at C1 approval. As soon as the LGA landing opens up later this year (knock on wood) I’m going to plan a visit – swing on by and I’ll get you in!

@1990- I found the lack of anything relating to United on the CSR relaunch very telling. But I hear WN is premium now, so no problem… can use the LGA TB CSR lounge before your WN flight to, uh, Houston I guess.

I see The Points Guy in that AMEX lounge picture!

@L737 — Don’t cry for me, Argentina. I gots my Strata Elite and Alaska Atmos, locked and loaded. *pew pew* 3x foreign transactions *pew pew* 6x dining Fridays & Saturdays after 6PM *pew* (I would literally book a cheap flight at Terminal B and take the Q70 just for the Landing!)

@Peter — For now, the Sapphire lounge at LGA is the best there (in Terminal B, at least). Yeah, WN from LGA can get you into some nice 2nd-tier airports… DAL (not DFW), HOU (not IAH), MDW (not ORD)… and both sides of Missouri (MCI, STL)… but they’re swapping ATL for OMA (I guess Warren B got to them!)

@1990 — How wonderfully decadent! And the “don’t cry for me Argentina” reminds me of one of my all time favorite VFTW comments, when you said that in response to someone who spoke of seeing his love interest for the last time in Buenos Aires — I felt bad to laugh but classic!

Gary: Figure 1 is meaningless. Is that the number of cards. $ profit from cards? $ revenue? $ fees.

@L737 — Fantastic memory! I wish VFTW had better search abilities for the comments, because I can’t recall which specific article that was from, but, yes, I believe I said something along the lines, ‘so, in your case, more of a….do cry for me Argentina?’

@1990 — Yes! That was it, so good. Just looked it up, it was from “Elite Singles are Using Airport Lounges and Precheck to Filter Dates But Crazy Still Gets Through” on July 28, 2025. Felt like longer ago.

@L737 — Epic find. “Sounds more like a ‘(do) cry for me, Argentina’ situation.” I wasn’t too far off from mere memory above. Wow, yeah, July 28, both feels like yesterday, and also, feels like a decade ago. That was back when ‘Erect’ was still frequenting the site under that alias. He’s mostly over at Ben’s site these days (allegedly). Looking at the old posts, I see the comments ‘close’ after a while; I wonder what the time-frame is; seems like maybe after a few weeks. (I keep meaning to finish Futurama Season 13, but the new Tame Impala album released, so I’ve had that on loop.)

Ah yes, the “Erect” era. Seasons do move quickly here to use the TV reference.

In the time you’re taking to finish S13, I am already on S7 on my rewatch in the background while I do other things, ha. But what’s the rush – I think you’ll particularly enjoy the season finale!