Kevin Williamson doesn’t like the American Airlines inflight credit card pitch.

The awfulness of this is multifaceted. For one thing, there is the Clockwork Orange sensation of being literally strapped into a seat while someone screams corporate banalities at you on a loudspeaker fifteen inches from your head. That is beyond bad manners — it is positively abusive…

It is a “limited-time” offer in the sense that the sun eventually will run out of gas and become a dying star, first engulfing the Earth in fire and then leaving the wreck of the solar system a sterile plane of interstellar cold and utter silence, which will be interrupted only by some addled flight attendant screeching about the limited-time Barclays card offer.

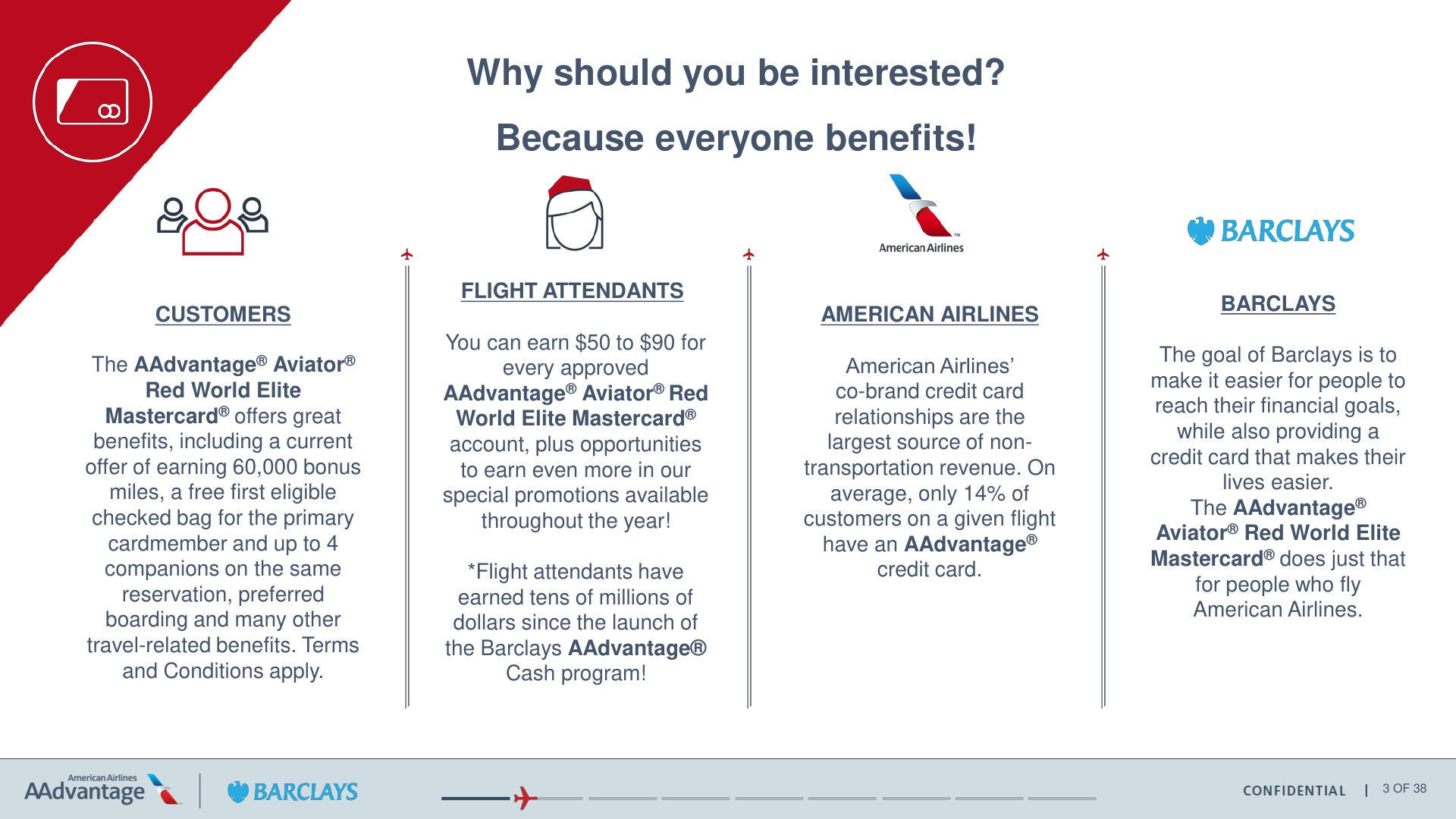

What Kevin forgets to mention is the announcement being used as a wake up call at 6 a.m after a redeye flight. Of course, according to American Airlines, only 14% of passengers on a given flight have an AAdvantage credit card. That’s a huge opportunity to grow the card portfolio. The people most likely to be interested in the American Airlines credit card are those already flying American Airlines.

And in fact since American has two card issuers, and customers can have both, the pool of potential applicants on board is even greater than American suggests (flight attendants used to regularly point out that even Citi AAdvantage customers could get a Barclays-issued card).

Inflight card pitches shouldn’t be done before 8 a.m., or on redeye flights. One good reason, by the way, for airline seat back entertainment is that the entertainment can be paused during flight attendant announcements. When people are using their own devices, they’re free to ignore card pitches. American Airlines should work with Barclays to sponsor a return of the screens.

I’ve even argued that American should increase the size of its lavatories and plaster them with credit card ads. That way a revenue stream would attach to the lavatory space, and American would no longer need to view the fact they have to provide lavs as a deadweight loss.

I look at it as an intelligence test.

Who is stupid enough to write down their SS# on a piece of paper and hand it to a stranger who does who knows what with it?

A good side business for a FA is to collect the numbers and sell them earning a lot more money than the airline’s spiff:)

Got a second pitch while deplaning today because “some folks were asleep when we made the first announcement”. Just when I thought I was out…

My mom found out the hard way the inflight Aviator red card doesn’t even come with the companion cert,,, instead it gets 500 points one time. She had to fight to have it added to her card.

Perhaps the best way to put an end to credit card pitches, obnoxious in-flight rules, and, perhaps, airlines thmselves, is to require at least a private pilots license to complete secondary school. Only a little tongue in cheek as I partially grew up in Alaska.

American Airlines credit card issuers should consider printing their credit card application on the aircraft lavatory toilet paper rolls. I think passengers would enjoy not hearing another verbal credit card PA announcement. Also, many customers full of poop will appreciate a hygienic, biodegradable credit card application during the COVID-19 pandemic.

“The people most likely to be interested in the American Airlines credit card are those already flying American Airlines.”

Are you sure about that? Do you really think that people flying American Airlines are going to be interested in something that will motivate them to make the same mistake again?

Every time they do their pitch, take an application, write “We hate in flight credit card pitches, please stop” in huge letters inside, and drop it in the mail. Maybe if they get enough of them they’ll get the message.

The ads in the lavs could even have a catchy phrase, “Don’t piss away this solid opportunity.”

On my AA flight last week, the flight attendant announced that our flight had been “specially selected” for passengers to receive 50k AA miles when signing up on board for the card. So we had been “specially selected” to receive the exact same offer that any random person can get by going to Barclay’s website? And that’s on a bad day since it’s usually been 60k or even 65k for years. I’d say that kind of announcement is borderline dishonest.

Drug smuggling through KCM just doesn’t pay what it used to!

I’ve read that flight attendants receive a commission for successful applications. With several FAs working any given flight how do they decide how the proceeds are divided or if one of them gets to keep all.

This is soo cheap and it cheapens out the airline to such a low level that’s not even funny. Stop this nonsense immediately!!

Well…given that AA makes more of their overall profit from their credit cards than they do from actually flying planes, what should we expect? No one really likes these pitches and its telling that only 14% have (or want) one of their cards. I sure don’t.

Maybe they should sell the planes and just become another bank?

THE INFLIGHT OFFER IS BETTER THAN PUBLIC WEBSITE OFFERS as a case in point the flight yesterday I was on had 50k miles after making one purchase. Compare that to the public website offer of 50k miles after spending thousands of dollars.

I take a credit card application if the flight attendant is good looking. When I hand it back I remind them I wrote down my phone number somewhere in there. I have enjoyed trysts with more than 20 flight attendants using this method. Obviously, it helps that I myself am very good looking and wear an Hermes belt.

I fly UA pretty much unless I can’t get somewhere on them (like tomorrow, where I’m connecting to DL at MSP to get to GFK, where only DL flies into). But I don’t own a Chase-branded credit card for UA, despite the fact that I bank at Chase. I also don’t have an Amex Platinum, a CapitalOne Venture X, or any of the CCs that help Gary earn enough from here to keep it a great resource for us avgeeks. I can get them. I have Amex and CapitalOne cards already. I just don’t. No, I’m really not the target audience for this website.

(And as for the hotel cards and bonuses, my primary criterion for a hotel stay is a smoking room. That doesn’t fly at the hotels that Gary shows here.)

One big reason is that I have an aversion to any card that charges an annual fee. None of the cards that I carry have one. For instance, if I went for any Chase United card, it would be the Club card, since I love me a United Club. But every time I think of getting one, I throw up in my mouth a little at the thought of $595 per year. As for the bonuses, I don’t need miles. I work all of the time. The only vacation I’ve had in the last four years has been when I was off a week for getting Covid. I do need PQPs to try to maintain my 1K status, but the PQP bonus on this card has ridiculous amounts of spending attached. $12000 to get 500 PQPs when 1K now requires 18000 to maintain? The only thing I spend my miles on is 52500 per year to get United Club membership, which negates the need for the card.

The other branded cards are equally as sad and definitely not fit for me and my spending patterns. When the FA heads down the aisle with the credit card applications, it’s time to crank up the volume on my earbuds and focus more intently on the book I’m reading. Sorry, but no.

What’s even worse is the blatant lies these pitches tell. American’s in-flight pitches frequently say 50,000 miles are “good for two free domestic round-trip tickets.” There aren’t even any qualifiers (e.g., “may” or “up to”), just a flight statement of value. Anyone who has recently tried buy tickets with American miles knows the best 25,000 will get you is the occasional three-leg all-day itinerary for a route AA flies direct. It shocks the conscience that they’re able to get away with such a bald-faced lie.

Perhaps you should examine AA Advantage more closely. Of course, if you want to book a flight on a holiday or tomorrow, the necessary miles might be double. The same happens on Uber surge pricing. But if you plan accordingly, you can schedule 2 round trip domestic tickets. The Points guy blogger values each mile at about 1.5 cents. So the months 60,000 miles are offered equals a $900 value. If the offer that month is no annual fee the first year, then for charging one dollar the first 3 months you’re getting $900 in travel rewards. You may be in a privileged income group where that is insignificant. But to many others, that offers a compelling opportunity. I pay an exhorbitant amount for cable TV, but still must endure commercials every few minutes for controlled substances and car sales. I also endure endless billboards on my drive to work marring the scenery. It’s called capitalism. Before you accuse anyone of “blatant lies” perhaps you should fact check yourself, or start taking a bus to your destinations. The income from credit card partnerships has helped all major airlines remain solvent if only barely so. So strip them of extra income opportunities and your ticket price will rise even more or perhaps you will remember rapid air travel as a nostalgic memory.