I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

A reader whom I will not name (we wouldn’t want to tip his hand to a future potential spouse) asks,

Hi Gary,

Love your blog! Though I’m a relative novice to the points game, I’ve learned a ton from you.

Question: I’m getting ready to buy an engagement ring, which will be the largest purchase I’ve ever put on a credit card, and I’m looking for advice on how best to maximize point-earning.

The ring I’m likely to buy will probably come in in the $10,000 to $13,000 range and will be purchased from a small jeweler. They take payments by PayPal, in case that’s useful information.

My main airline loyalty is with American …and my main hotel loyalty is with Marriott…

My main spending right now is on the Citi AAdvantage Platinum Mastercard and an American Express Everyday card, which I just picked up recently for the bonus. I also have Barclay USAir-turned-AA card, the IHG MasterCard (also recently picked up for the bonus) and the Marriott Visa.

I had but canceled my AA Citi Executive card earlier this year. I’d love to get the bonus again, but figure that’s unlikely. I also have had and canceled the BA Visa twice now, so that may be out too.

Any advice on how best to make this big purchase?

Thanks very much —

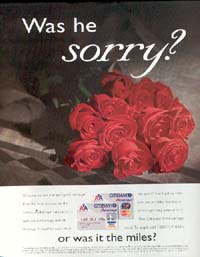

In the mid-1990s the Citi AAdvantage credit card launched an ad campaign, the first iteration of which was a diamond ring and the question, “Was it love… or was it just the miles?” I don’t have a copy of that ad, but I know that Randy Petersen does because he put it up on screen at the 2003 Freddie Awards before he asked his wife Julie to marry him.

Here’s my second favorite ad from that series:

Of course, some were known to buy diamond rings online at costco.com with a visa and then return them in-store. You want to give one to your hopefully future spouse.

I’m not sure how I feel about the whole idea, though I did it myself. Historically diamond rings represented a substantial portion of the man’s net worth as so the expense meant they were likely to be able to give out only one, ensuring they’d be marrying only one person, and since the’re so valuable the rings served as a hostage to help ensure fidelity. I’m not certain they fulfill either role any longer.

That said, let’s assume that you’re going to do this, and at that price point as well.

- If the jeweler will take Paypal, where they’re paying ~ 3%, they’re likely to give you the 3% back to not use paypal so consider whether it’s worth paying by credit card.

- Nonetheless I do like credit cards for large purchases as it gives you extra security over what you’re buying.

- Comparison shop, most jewelers will negotiate on price but there are plenty of online vendors as well who may participate in shopping portals where you’ll earn miles or rebates for the purchases, independent of the points earned via credit card.

Assuming you’re not going to earn any spending category bonus for the retail purchase, your most leveraged play is using the purchase to meet the signup bonus for a newly acquired credit card.

- You’re not going to be eligible for another bonus on the Citi Executive card if you’ve cancelled within the past year. You note you’ve had the British Airways card twice, but not how recently, I’ll assume you’ve gotten a bonus on the card within the past two years and so you’re not eligible for that one again either.

- You mention 7 different cards. If you haven’t gotten had 5 new cards within the past 2 years then Chase Sapphire Preferred would be at the very top of my list. Their 40,000 point bonus after $4000 in spend within 3 months would be easy to meet.

- More generally it’s hard to tell you what points to focus on because I don’t know your reward goals, whether you’ve got a honeymoon planned, and if you already have all the points you’ll need. I like Sapphire Preferred because of the flexibility to put those points into different programs.

With such a big purchase the most important thing is getting a quality product and getting that product at the best price.

Another tip that my now husband used when he bought my engagement ring was buying it in person then “shipping” the ring of state. Since there was no brick & mortar store in Colorado where his sister lived, there was no taxes on the purchase. This saved him hundreds of dollars.

Good luck!

LOL. You hit the trifecta this one.

AMEX, Chase, and Citi.

Nice job!!!!!!!!!

I went to T store in Portland and used United Club card as well as US airways when 1.5 miles/dollar promotion was on this May. So I earned 50% more miles plus 8% off because of tax free.

I used Blue Nile website and went through American airlines shopping portal along with my Citi Exec credit card. American and Marriot portals give 3 points per dollar spent plus you get points for the credit card which met my 10k spend on the Citi Exec for 100k points. Total take was 148k American points for the one purchase.

Sign up for multiple cards and spread payments across the cards for the bonus. So $3000 on the Sapphire. $3000 on the Ink and so on. Meet the minimum spend on mupltiple cards for the sign up bonus on multiple cards.

Seriously consider spending only $100 on a good fake. You won’t feel bad if it is stolen or lost, no one can tell the difference – best test is by weight. It will look the same and you will both have money to spend on a house, car or wedding or travel.i bought my wife of 21 years a diamond and upgraded after 7 years but it is a financial waste. She also has a nice fake for travel. I/we will never see a return on the value of a real diamond. Just wanted to give a different perspective

@Marriott I think that’s the greatest idea so far. I may buy a nice fake one on alibaba or next trip in HK.

http://www.limogesjewelry.com/

Fake engagement rings and 5 miles/$ through the AA shopping portal. 🙂

Funny video on engagement rings https://www.youtube.com/watch?v=N5kWu1ifBGU

USAA sells diamonds/rings at a reasonable cost with great service. And, the purchase earns reward points with USAA travel, regardless of payment method. I think the main benefit of those points is discounts off of future cruise bookings. Just another “double dip” option.

The points made about sales tax and other considerations were good ones. Just wanted to add two points:

1. I used Blue Nile and was quite happy with them.

2. A diamond expert once told me that Costco is the best place to buy diamonds. The reason is that diamond is a diamond wherever you buy it, but they have a lower margin. If it is cheaper there by even a couple of percent, that too would negate the value of miles earned elsewhere. I haven’t kept up with Costco and their credit card situation, but maybe you can also get miles purchasing thru them.

@Marty Marriott

A diamond or any fine jewelry purchase is not a financial investment in the traditional sense. I can sense the loss you are feeling. Did you buy or upgrade the ring with the intention of selling it in the future for a financial gain? Of course not! Then why feel a financial loss? The return on diamond “investing” is not financial but “happiness”. I buy diamonds and fine jewelry because it makes me happy buying it and wearing it. I am not going to sell so I don’t feel a financial loss. Stock/bonds may be an investment in the traditional sense, although some would consider it gambling too.

While I’m not aware of a current bonus category for jewellery from a credit card, I see AMEX sync offers. As well, this was from 2013, but Birks was offering one million Aeroplan miles for a $100,000 purchase:

http://www3.aeroplan.com/BirksMillionMiles.do

When I bought the engagement ring for my fiancé I focused on cash back and miles. I bought Costco cash cards at a slight discount (usually 1-2% off face value) over the course of a few months whenever they were available with a Citi ThankYou points earning card I had a 3x TYP per dollar retention offer on. Then I purchased the ring in store and got another 2% cash back from my Costco Executive membership. All in all I saved about 3.75 percent in cash back and earned about 36,000 ThankYou points.

I know some people may be thinking “an engagement ring from Costco?” Do some research about Costco jewelry. Costco actually uses very high quality diamonds that appraise for well more than what they sell for (versus Tiffany which usually appraises for less).

Engagement rings are –terrible– “investments.” I’m getting married in December and I paid a fraction of what you’re paying. That’s a down payment on a house.

Sort of like a car, they lose ~50% once they leave the store. Sure, there’s some value but the reality of it is that you’re paying retail markup etc.

I won’t say the amount I spent but it was within 25% of what this gentleman had spent. My finacee’s reaction? “It’s perfect.”

With that all being said… there are some good suggestions here. Specifically, ordering it from out of state with no sales tax. I did that and it saved me a few hundred right there.