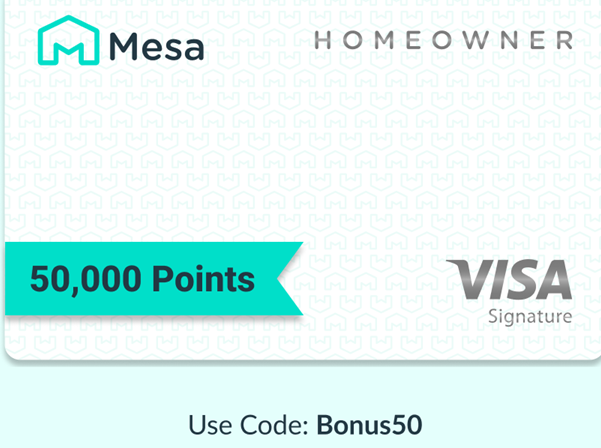

There’s now a 50,000 point initial bonus offer for the Mesa Homeowners Card after $5,000 in purchases within 3 months. Use code Bonus50 when applying.

Previously, the best you could do was 5,000 points using a referral link for the card that gives you transferable points for your mortgage.

The key with this card is you don’t change how you pay your mortgage to earn points. This isn’t ‘charge your mortgage to the card and they cut a check to your bank’. Instead, you just tell them how much your mortgage is, and they award the points for it once you spend $1,000 on the card each month. That also means you can earn points for paying your mortgage with other cards, too (like Bilt Rewards as soon as the feature rolls out).

I got the card and missed out on this 50,000 point offer, but I’m already making money on this new no annual fee card. They’ve got the ‘coupon book’ model down that American Express pioneered and Chase is copying, but they aren’t using it to justify an annual fee.

I got my $65 annual Costco membership fee rebated pretty much immediately (you can also choose BJ’s or Sam’s Club for this). And I’m getting $10 a month back on the dog food my wife buys anyway.

Here’s the coupon book:

- $30 per quarter statement credit with Lowe’s

- $65 big box membership statement credit annually (Sam’s Club, BJs, Costco);

- $200 home maintenance credit with Thumbtack (also can be used for house cleaning or Christmas tree removal)

- $100 statement credit on Armadillo home warranty purchases

- $10 per month statement credit with Wag!

- $10 per month statement credit with Farmer’s Dog dog food

Points can be spent at up to 1.3 cent apiece through their travel portal; at $0.008 apiece towards gift cards; or at $0.006 apiece as credit card statement credits. They also offer redemptions for closing costs on mortgages obtained though their marketplace.

Here are their points transfer partners so far – they say they are adding more:

| Partner | Program | Transfer Rate |

| Accor | Accor Live Limitless | 1.5 : 1 |

| Air India | Maharaja Club | 1:1 |

| Finnair | Finnair Plus | 1:1 |

| Hainan Airlines | Fortune Wings Club | 1:1 |

| Thai Airways | Royal Orchid Plus | 1:1 |

| Vietnam Airlines | LotusMiles | 1:1 |

A 50,000 point offer is huge. It was sent out by Mesa to people on their email list (presumably who have not yet gotten the card). But the offer is promo code driven, and appears to be available to anyone. Without an up front bonus you needed a big mortgage to make this worthwhile, and since you earn on that every year it would take time to exceed the value of a bonus (still, nice on a no annual fee card). With a bonus, how could you not I guess?

Are you able to get points for Home Equity loans as well?

I downloaded the app and created an account but was procrastinating on applying for the card. They sent me the 50k offer 8 days and about 1-2 hours after setting up my account in the app.

Do you have to prove your mortgage amount?

“on this new annual fee card.”

I assume this is “no” annual fee card? Big difference…

Thank you Gary!

Looks like the code no longer works, bummer. Was just going to apply!