United Airlines flies the most seat miles – they fly a lot of widebodies great distances around the world. Delta Air Lines produces the most revenue. They get paid.

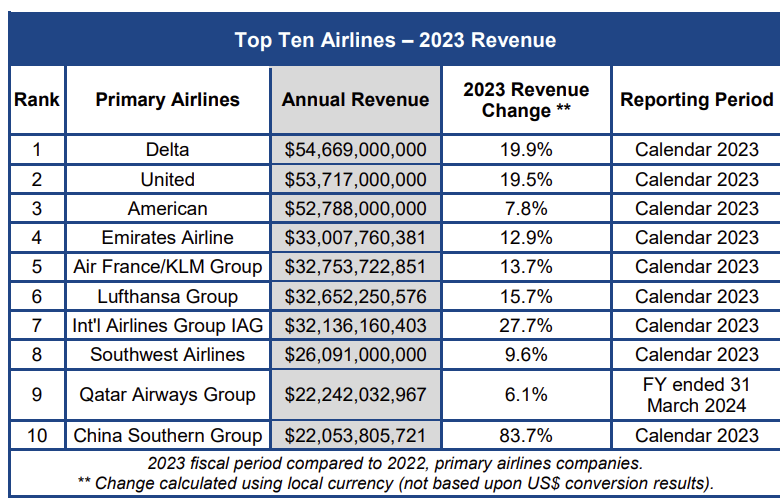

Jay Sorensen’s IdeaWorks “2024 Big Book of Airline Data” is out and it looks at numbers from airlines all over the world. That takes time to get reported out, so we’re looking at 2023 numbers. But here are the airlines with the most revenue:

Credit: IdeaWorks

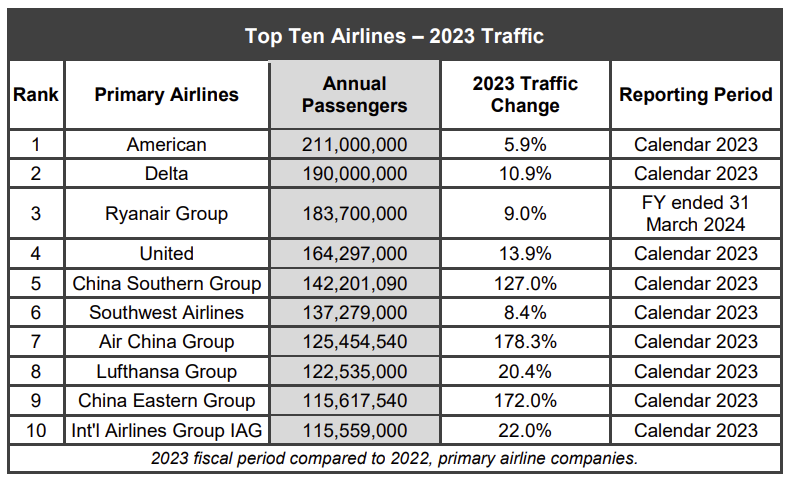

American Airlines, though, flies the most passengers. Of course it’s El Paso to Dallas, Charlotte to Savannah and Phoenix to Reno. Internationally, their focus is flying to their closest partners’ hubs, and adding in seasonal summer flights to Europe.

Credit: IdeaWorks

Fiji Airways carried just 2.2 million passengers in 2023, which is fewer than Starlux and Breeze. EgyptAir carried just 2.8 million passengers – they seem larger because of their Star Alliance membership and flights to the United States. They actually carried fewer passengers than Wideroe and fewer than Bangkok Airways.

At 5 million passengers, Kenya Airways carried less traffic than El Al and Pakistan International Airlines. Finnair, EVA Air, and Thai each carried around 10 million. So did LOT Polish. That’s only a quarter the number of passengers that Alaska and Spirit each carried.

Unsurprisingly, Star Alliance generates more revenue than the other global alliances – about 40% more. I did not realize that oneworld and SkyTeam were so close – less than $650 million apart for 2023 – with both coming in at around $154 billion.

Sorensen also does some interesting things with the data. Here’s revenue per employee for the top 10 airlines. The average for 105 airlines disclosing revenue and employee numbers was $463,337. Of course some airlines outsource a lot of their work, that lowers the denominator and drives up their number.

Google employees generate $1.67 million per employee. At Facebook it’s $2 million, and Apple 20% over that. But did you know that the average airline employee generates revenue that’s not far off of Mastercard? Airlines generate a lot of revenue… but their margins aren’t great.

these numbers aren’t too surprising esp. for US and EU airlines that are publicly traded.

As I have noted, UA has the breadth of its network but not near as much depth esp. domestically that AAL and DAL have, DAL is by far the most efficient at generating revenues and profits, while AAL has a deep domestic network strategy but only in certain parts of the country, hoping to fill in their weaknesses with domestic partnerships.

Asia/Pacific airlines are back and, yes, the strongest everywhere are getting stronger while the weak are struggling to survive.

United has really closed the gap in revenue with Delta in this 2023 report. It will be interesting to see if they overtake DL in 2024 (when Q4 numbers are out). UA has a stronger domestic aircraft delivery schedule than both DL and AA to correct their acknowledged domestic deficit. Just a matter of time. As many have noted, it is now a 2 horse race with AA falling behind.

Fascinating report, thanks for posting the link, Gary !!! It’s amazing that this 107-page research report is downloadable for free, although I assume that’s because it’s a close to a year old. Lots of insights, the 3 China Airlines are stronger than I had realized, although I assume that the 2024 data would show a bit more weakness. As for Margin, yes, it’s low for airlines. That said, for those that took an MBA, you learn how a low margin business can deliver nice cash flow if it has high turnover (they tend to call it the Grocery Store Model). Unfortunately for the airlines, this model struggles somewhat when considering the massive capitalization they need to service their customers. Not a business for the faint of heart.

TJ,

the biggest reason DL gets so much more revenue than AA or UA is because of the rich Amex contract. that revenue is higher margin than transportation revenue.

AA now has a credit card contract that could rival DL’s although I believe DL’s stronger presence in NYC and LAX will keep DL at an advantage.

UA will be the last of the big 3 to get a rich credit card contract. They are trying to compensate by being large in NYC, ORD and LAX but int’l revenue is much less valuable to a US based credit card issuer than domestic revenue.

How does Isom and Team Tempe still have a job with such lackluster financial performance?

GullAir

The notion that UA would add a significantly larger amount of domestic capacity than any other airline has been and still is a pipe dream.

1. UA might succeed in getting a bunch more aircraft but they have the oldest fleet in the US. They will have to use some of their older aircraft for fleet replacement or see their operating costs go higher and higher. UA retired only about 10 A320 family aircraft early in 2024 and then stopped retiring later in the year because of Boeing’s delivery delays with both the MAX and 787. AA retired few aircraft while WN retired a fair number compared to its new deliveries. DL retired more than half of the number of new deliveries it received including A320 family, 757s and 767-300ERs.

2. It is unrealistic for UA to think it can add a bunch of domestic capacity without tanking revenue performance in its own hubs. AA, DL and WN are simply not going to give up share in all of the O&Ds that are not to/from UA hubs and are where UA is generally not the largest carrier.

3. It is far more likely that DL will grow its international network – esp. Asia/Pacific where UA has a wide advantage – than that UA will succeed in taking substantial share from any or all of AA, DL and WN.

It is likely that UA will grow its domestic system and replace RJs with mainline aircraft but UA has a 7 year history – about as long as Kirby has been at the top – of making grandiose pronouncements of what it will do only to take much longer to accomplish even a part of its original goal.

I’m only seeing revenue and passenger counts in your tables and in the report. Where are you getting “United Flies Farther” and “United Airlines flies the most seat miles”? From another data source?

Not a surprise that of the big 3, American lags in revenue per passenger, but kind of surprising to me that United is ahead of Delta by so much. Not very premium.

Delta $287.73

American $250.18

United $326.95

mantis,

UA generates more revenue per passenger because it flies longer stage lengths as a result of more international flights.

Unit statistics including both revenue per passenger MILE and even more, revenue per passenger mile on a mileage adjusted basis (since different airlines have different lengths they carry passengers), DL still generates the highest UNIT revenues.

DL actually flies the least amount of seat MILES of the big 3 which shows how much more efficient it is at generating revenue.

and then you have to look at the costs to generate each of those types of revenue.

And DL still generates the most revenue and revenue per seat mile.

Tim, I’m not sure why UA adding a lot of domestic capacity is a pipe dream. The majority of the new planes are for domestic operations.

The amount of mainline capacity UA has added to DEN and ORD alone is huge, most of that domestic. Hundreds of new domestic planes are coming online over the next few years.

Also, with UA being the last of the US3 to get a rich credit card revenue contract, the implication is that UA has a huge revenue bump in its future, whereas AA and DL have already seen theirs. UA has hubs in major business centers, will continue to see Mileage Plus membership rise, and they have the potential to monetize their information even further with their Kinective Media strategy.

I’m also not sure why average fleet age is always mentioned. Those figures are cyclical. DL used to have the oldest fleet with DC-9s and MD-90s. Then the oldest planes were retired.

AA had the youngest fleet with two or fleet renewal in the 2010s and UA’s fleet was slightly older than DL’s.

UA has been decreasing fleet age through hundreds of new aircraft deliveries and the retirement of older planes. So it will soon have the youngest fleet until the cycle continues.

As long as the planes are well-maintained and have customer-friendly amenities, an average fleet age difference of a few years doesn’t really matter.

AA generates 1.5 cents in profit for every $1 in revenue. Those are razor thin margins. I suspect Delta’s and United’s margins are slightly better.

@ Tim — United is still a better experience than DL for customers.

Mark,

every route on UA’s network is to/from a hub.

UA cannot add a bunch of capacity from XYZ (MSY for instance) to a UA hub without another carrier losing its share of the MSY market.

You and Kirby seems to think that AA, DL and WN will all just sit by and allow to grow their network at all of these non-hub cities that it will take for UA to add and not match that growth or add their own new flights to UA hubs. If you don’t understand the concept of airlines protecting their market share, I can’t help you – but the notion that UA can just add a bunch of new flights from non-hub cities and everyone else will just roll over and do nothing IS a pipe dream.

and fleet age NOW does matter. what happened in the past doesn’t. Newer aircraft are more fuel and maintenance efficient and UA will not get all of the benefit of the new aircraft unless they get rid of older aircraft.

as for the amenities, UA announced how many years ago that they would be adding AVOD to all of their fleet as part of NEXT and I can assure you that it will take longer for UA to get AVOD on every mainline aircraft than it took for the 7 year rollout of Polars. I can also assure you that there are aircraft in UA’s fleet that UA will not spend the money to add AVOD because they are too old and have too little life left in them. You solve that problem by retiring older aircraft or you fly old inefficient aircraft and spend money on systems on aircraft that will still run out of time in a couple years. Planes don’t last forever unless you spend enormous amounts of money on them.

and, yes, UA might have more revenue upside with a new deal – but you have no idea what DL will do when its deal w/ Amex comes up for renewal.

And DL is tapping new revenue sources such as through engine overhaul revenue that UA and AA can’t match. The reason why that revenue is not stronger is because the engine makers can’t make enough parts. but DL has said that its MRO operations could add $5 billion in revenue per year and $1 billion in profits.

I get that you have an incessant need to think that UA will dominate and everything it does will be better than anything anyone else does, but the competition doesn’t sit still. It is precisely because UA has been so vocal about its strategies that competitors have had more than enough time to refine their own.

and, Mark, wait for the domestic growth rates from each of the big 4 but so far in 2024, UA has NOT led the industry in domestic growth. DL reports its 4th quarter earnings – including traffic data – this Friday and then UA will follow, as it usually does on most things

and despite Kirby endlessly touting that UA would take out the ultra low cost carriers, AA and DL have more overlap with Spirit than UA does.

FFS get your own blog you blowhard. If brevity is the soul of wit, you are witless.

I’m just here to burst the balloons of the UA fan kiddies that are fixated on touting their #1ness now and forever into the future.

the world is big enough for everyone to be good at something and to accept that you can’t be the best at everything

All you do is troll and constantly reaffirm how little you know, tim. You throw around terms and random stats without having any idea what they mean

Don’t kid yourself

@ Tim — “Competition doesn’t sit still”. This is precisely why UA has pulled ahead of DL!

Tim, UA has been increasing market in share in cities all around the country. Many line stations have gone from UAX to several mainline a day. UA has hundreds more mainline departures out of their hubs, compared to what they had just a few years ago.

The other airlines don’t have the fleet growth to take on UA’s network plans, even if they wanted to.

Regarding fleet age, if what happened in the past doesn’t matter, why do you always talk about airline industry dynamics from 10, 20, even 30 years ago. One of your favorite talking points is UA performance in the Pacific from 2016-2019.

At the end of 2023, UA was within a couple of years of the average DL fleet age. Between 2024 and 2026, they will have close to 300 brand new planes delivered while retiring close to 100 planes that are 30+ years old. You really don’t think that will change UA’s position in the fleet age dynamic?

@ Tim — You are hilarious. Delta’s next AMEX deal probably won’t be as great as you imagine, given the pathetic value of SkyMiles these days.

mark,

1. all of the big 4 are massive companies. Picking out share change at a couple airports here and there doesn’t matter. Look at domestic industry share data for all airlines and tell us the changes – who has gained and who has lost share. As much as you want to believe otherwise, other airlines are not sitting still so UA can grow unfettered and fix in a couple of years its domestic network size problems which was the result of years of strategic decisions. If UA can succeed at adding a bunch of domestic capacity and do so profitability, other airlines will too.

2. Other airlines do have aircraft on order as well. Why you can’t understand that UA cannot use a high percentage of its order book for growth and reduce its fleet age unless it also retires aircraft. Average aircraft age will fall the fastest as UA gets rid of older aircraft at the same time as it takes delivery of new aircraft.

3. the age of aircraft doesn’t matter; fleet efficiency does for fuel, labor, and maintenance efficiency. UA spends 6% more on fuel than DL to generate less revenue and by flying more ASMs. DL’s fleet burns less fuel than AA and UA’s – including regional jets – and also generates more revenue at a faster rate. Neither AA or UA will address their fleet underperformance relative to DL until they get rid of a lot more regional jets AND get rid of their least efficient mainline aircraft types. The 767-300 is no more efficient for UA than it is for DL. the A330CEO is more efficient for DL than the 777-200ER is for UA and yet they fly 90% of the same types of routes.

4. AA, DL and WN have hundreds of airplanes on order AND option and can get as many airplanes as they need. Scott Kirby fixated on a couple of massive aircraft orders – which now can’t be delivered as the contracts with Boeing specified, and UA will place no big orders. Their current order book stretches out for years. Every other US airline sees no need to place massive orders 7 years in advance because they can and have converted options to orders and placed follow-on orders that both Airbus and Boeing can accept.

and the reason I continue to push back on you is because you represent the UA fans that can’t accept that UA has done a remarkable turnaround, has cut the gap with DL but still trails DL in most metrics other than the number of ASMs generated and the size of UA’s international network, but other airlines have strategies that succeed as well if not better at the metrics that matter to them – and they will continue to deploy and refine their strategies while UA has largely copied DL’s strategies from 10 years or more ago and thinks that UA can do in 3 years what it took DL years or more to achieve.

When other people elsewhere in the industry realize that Scott Kirby is arrogant and loves to talk crap but delivers far less than he promised, my assessment of him and the culture he has created at UA is not wrong. He has calmed down but the UA fandom including people like you still live in a world of pipe dreams.

why can’t you accept that UA will evolve but not at the rate that UA says change will happen? they realize they made a mistake with their domestic system and will address it but you think everyone is just going to stand still while UA is going to be free to grow. UA has announced one initiative after another that has taken years longer to implement than they said and their domestic growth will be no different.

And you can’t seem to accept that DL is far more likely to grow its international network at a faster rate than UA than UA will succeed at taking share from the rest of the big 4.

Gene,

given that UA, like everything else, is modeling its loyalty program and credit card changes on what DL has achieved, why do you not realize that DL could itself come up with more changes or the whole model that DL has used for the past decade could change which could make it impossible for UA to achieve what DL has done?

DL has proven that it is the strategic leader in the industry and there is no reason to believe that will stop being the case. As long as UA keeps copying strategies that DL developed years ago, UA will never catch up with DL.

@ Tim — DLs credit card programs are useless, and people are noticing. The miles earned are a joke. SkyTeam is a joke. Yes, UA has inflated its awards too, but at least they have partner awards available on excellent airlines (ie, NOT SkyTeam airlines).

Gene,

if you can provide data that shows that DL’s loyalty and credit card programs no longer are providing the growth that DL needs to maintain its revenue position, we’ll listen.

Otherwise, there are clearly people that find value in SkyMiles and the DL/Amex arrangement, as hard as it is for you to admit that others can find value that you cannot or do not

40 paragraphs of fluff from a guy delta fired and that has no respectable position of knowledge anywhere in the industry aside from being a well known internet troll and weirdly proud of it

Your ignorance about United’s fleet and relative financial position never ceases to amaze. United is not god’s gift to mankind just like delta is not. But you’d have to be a fool to realize only a credit card makes delta more profitable than united currently.

No surprise

New year. Same Tim. Same Troll

as usual, you and others cannot deal with the truth so you slander the messenger

tell us United’s free cash flow for 2024 (when it is released) along with the number of aircraft they received and then tell me why it was a gift that UA did not receive the aircraft it had on order.

Tell me about AA, DL, UA and WN’s share in NK overlap markets and it will be clear that UA had nothing to do with putting NK in BK, if any other airline did.

Tell us how much share that UA has gained in the industry compared to other players. 2024 is not fully reported but for the decade prior to 3Q2024, DL grew capacity the most of the big 3. UA is not growing capacity on an absolute basis faster than other carriers.

UA has done an incredible improvement to their position which was not at all where it should have been but DL is still the largest airline by revenue worldwide and profits in the US. UA gets credit for flying the most ASMs. If flying the most capacity to get less revenue than your competitor is a mark of success, then, yes, UA is at the top of the heap. Most people, however, don’t see that as the top of the world.

Learn to read, tim

@ Tim — I don’t give a flip about UA’s cash flow. Maybe if they weren’t buying back stock, they would have more cash. For the umpteenth time, PEOPLE HERE DO NOT CARE ABOUT AIRLINE PROFITS.

@ Tim — Why is United superior to Delta — product consistency and crappy J seats. Got switched from A359 Suites to LATAM A359 today. Horrible, and wouldn’t happen on United.

@ Tim — Well, at least, to DLs credit, they allowed us to rebook. Major push back, but mission accomplished. Of course, on UA, that wouldn’t have been necessary since consistent product.

Soon, add another point to UA better than DL, UA market cap to surpass DL, which is only larger in low teens and gap narrowing consistently.

Street looks at the future potential, not past performance