United says they’re going to double the profits of MileagePlus by 2030. Selling miles to Chase is currently the bulk of United’s profit.

I wrote about some of the things we can expect:

- More money from Chase post-2029

- Have to get the credit card to get decent value out of points

- Greater monetization of members through ads, partners

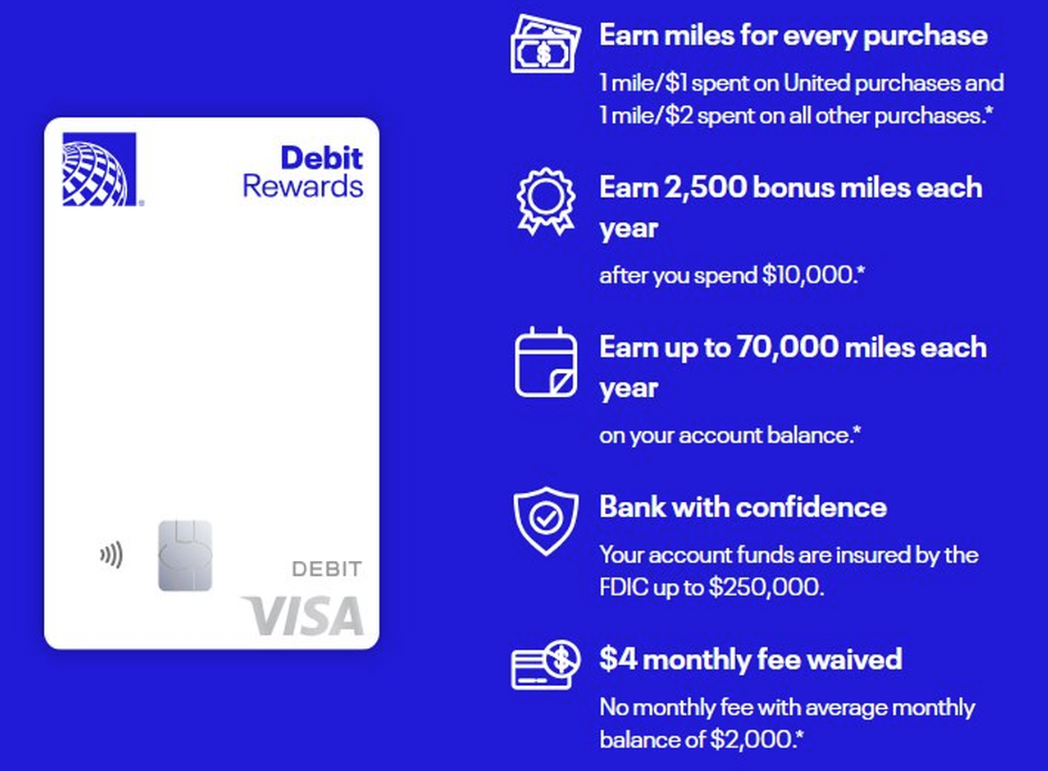

Another thing they appear to have up their sleeve is a mileage-earning debit card. Everything old is new again. Southwest is introducing one of those as well.

Loyalty Lobby wonders, “Is it possible that so many people in the US are ineligible for Chase credit card products that launching a debit card makes sense?”

In fact, there are far more transactions via debit card in the U.S. than there are using credit cards! 2022 data:

| # transactions (billions) | Total value ($Trillions) | Share of transactions | Share of spend | |

| Debit (incl. general prepaid) | 98 | 4.34 | 63.90% | 44.50% |

| Credit | 55.3 | 5.42 | 36.10% | 55.50% |

| Total | 153.3 | 9.76 | 100% | 100% |

The Durbin Amendment to Dodd-Frank Financial Reform legislation that came out of the Great Recession basically made it illegal to earn a profit on debit card transactions. That was a gift to retail merchants, and had little to do with the financial crisis.

As a result, it no longer made sense for banks to pay to market and incentivize debit transactions, and co-brand debit cards (mostly) came to an end. However, the cap on debit interchange didn’t apply to all issuers and products!

- Small‑issuer exemption: banks with less than $10 billion in assets could still earn higher interchange.

- Certain prepaid and government program cards: Even for large issuers, transactions with reloadable general‑use prepaid and government‑administered program cards are exempt from the cap.

A Durbin‑exempt bank typically earns 0.80% plus $0.15 on a card-present Visa transaction compared to 0.05% plus $0.21 for a regulated transaction. Variance is a little greater with Mastercard I believe (~ 0.70% – 1.05%) for unregulated.

Across all networks and transactions you’ll see effective rates of around 1.16% for exempt debit and 0.53% – 0.55% for regulated debit.

In October 2023 the Federal Reserve proposed lowering the regulated cap to 0.04% + 14.4 cents per transaction (plus 1.3 cents for fraud adjustment, available to qualifying banks) but that’s been tied up in the courts.

For comparison, card‑present retail typically starts at ~1.5% – 2.3%, higher for premium card tiers.

- Regulated debit pays little to nothing back to the customer

- Unregulated debit can pay 1 mile per $2 usually

- Compared to 1 mile per dollar or more for credit

As a consumer you should use credit if you can! It’s not just about processing transactions, and extending credit, although it’s important that the money doesn’t come out of your account right away – both because you’re the one earning on the float that way but more importantly because in the event of fraud you don’t have to fight to get your money back.

Consumer protections are simply different with credit compared to debit. Government rules say your responsibility for unauthorized charges caps at $50 if you report it within 2 days of learning of the loss, and $500 if within 60 days of the statement (potentially unlimited after that).

With credit cards you have strong billing‑error rights. You can withhold payment of the disputed amount while a charge is under investigation. While banks have to investigate promptly and provide provisional credit within 10 days (longer for new accounts and foreign point‑of‑sale) there’s no statutory right to withhold payment to a merchant for non‑delivery. Any chargeback‑like rights come from voluntary payment network rules, not statute.

Oh, so the Recession is real, after all.

Let’s go after the B paper consumers. I’m sure nothing can go bad with that- Maybe the unbanked next?

@paul — But, but… TravelBank…

Meh, I can earn one Amex MR point per $2 spent if I wanted to use a debit card.

Not only are the points more valuable but an Amex checking account counts as an MR account to store MR points if one doesn’t have an MR-earning card.

As well, with an Amex checking account, Amex gives account holders a subset of their transfer partners so one gets much more utility than they would by earning United points.

Roughly 2 out of 3 people that app,y for credit are ineligible. Credit is way better for the 1/3rd.

Credit is also great if you pay it off every month so you don’t incur interest charges. Only 45% of credit card holders do that. So, for the other 45%, every swipe costs them, what, somewhere between 15%-29% more than the actual price.

That does not seem like smart financial behavior to me.

@Parker — Those numbers are wild. Wouldn’t touch credit if couldn’t pay it off. +20% interest is usury. If I wanted to deal with loan sharks, I’d skip the middlemen and give myself ‘cement shoes.’ At least the Intracoastal is probably warmer than the Hudson.

I hope credit card fee capping is next. While I do enjoy the points, the current system literally means charging everyone more and only sending benefits to the card companies and the richer few that can qualify for a card