At Alaska Airlines Investor Day, executives laid out some details on their Mileage Plan loyalty program as part of making the case that their acquisition of Hawaiian Airlines and plan for integration will drive profit.

Mileage Plan has 11 million active members, over 3 million cobrand cardmembers, and over 600,000 elite members. They value their program at over $12 billion, which seems high. When American borrowed $5 billion from from the federal government in a subsidized loan backed by the future income stream of AAdvantage, they reported a valuation of $18 – $30 billion.

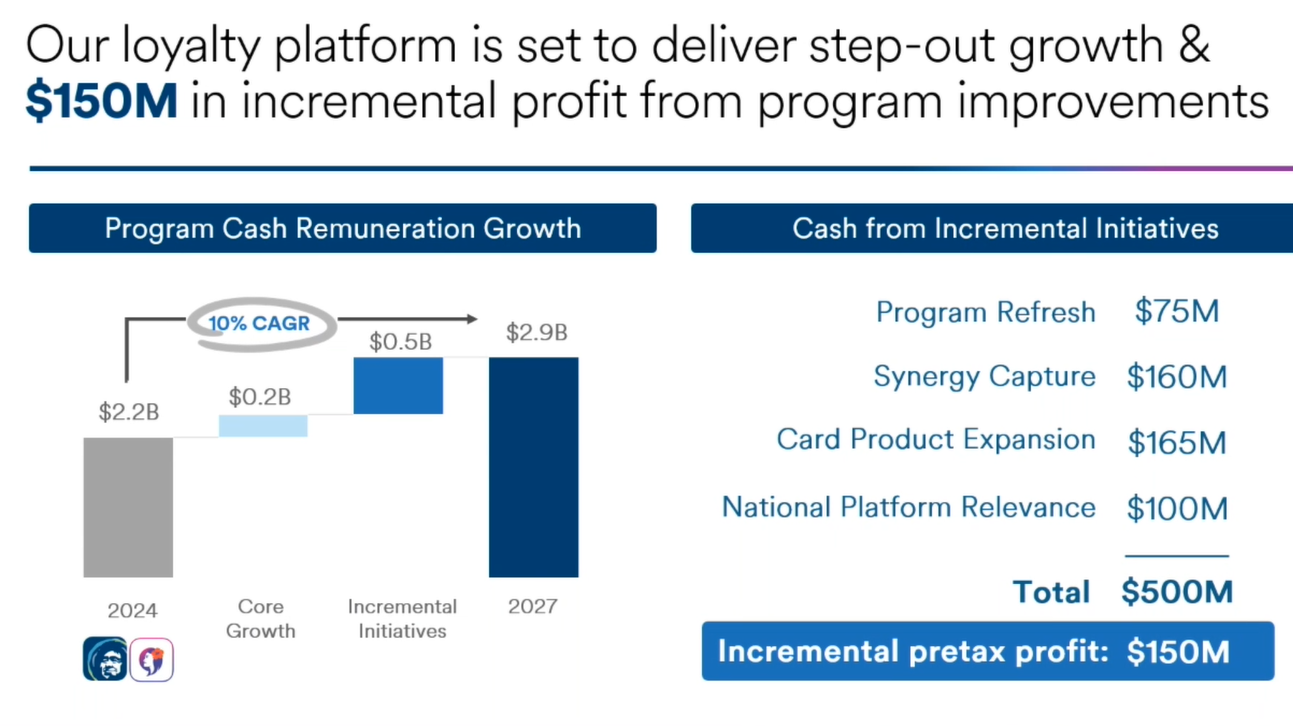

They expect program changes stemming from the Hawaiian Airlines acquisition to contribute $150 million in incremental profit.

Of their 11 million active members – and it’s active members that matters, not the usual number of people who have ever been added to a program’s database – 4 million are outside the West Coast. They’re projecting annual growth in the “high single digits” for loyalty.

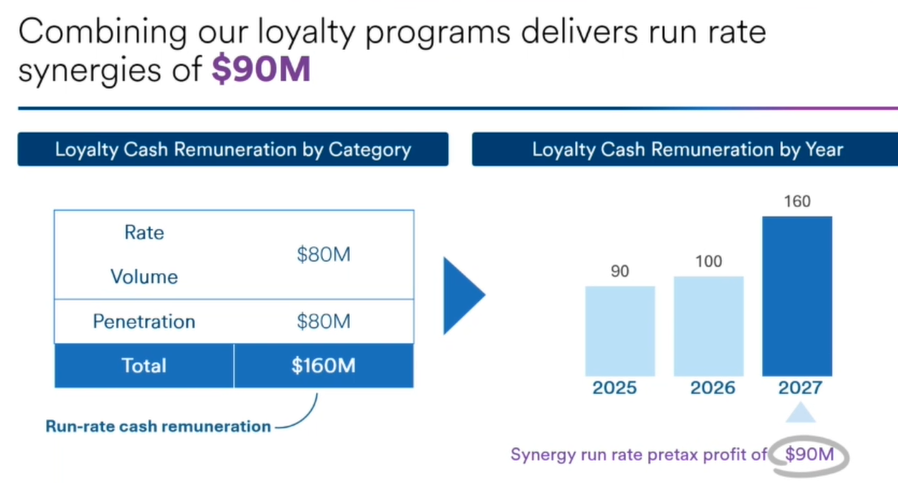

- HawaiianMiles only drove 9% of Hawaiian Airlines revenue vs 17% for Alaska.

- So Alaska suggests the acquisition drives revenue just by transitioning to a single loyalty program, and moving Hawaiian’s performance up to Alaska’s level.

That’s probably true in part, since the Alaska program is better and more likely to drive customer behavior, but the Alaska customer in Seattle and California is also probably more value than the legacy Hawaii customer.

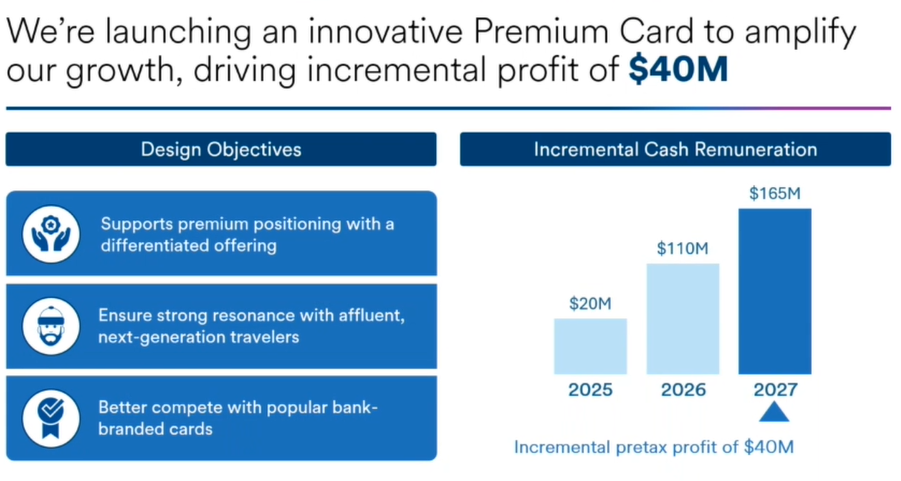

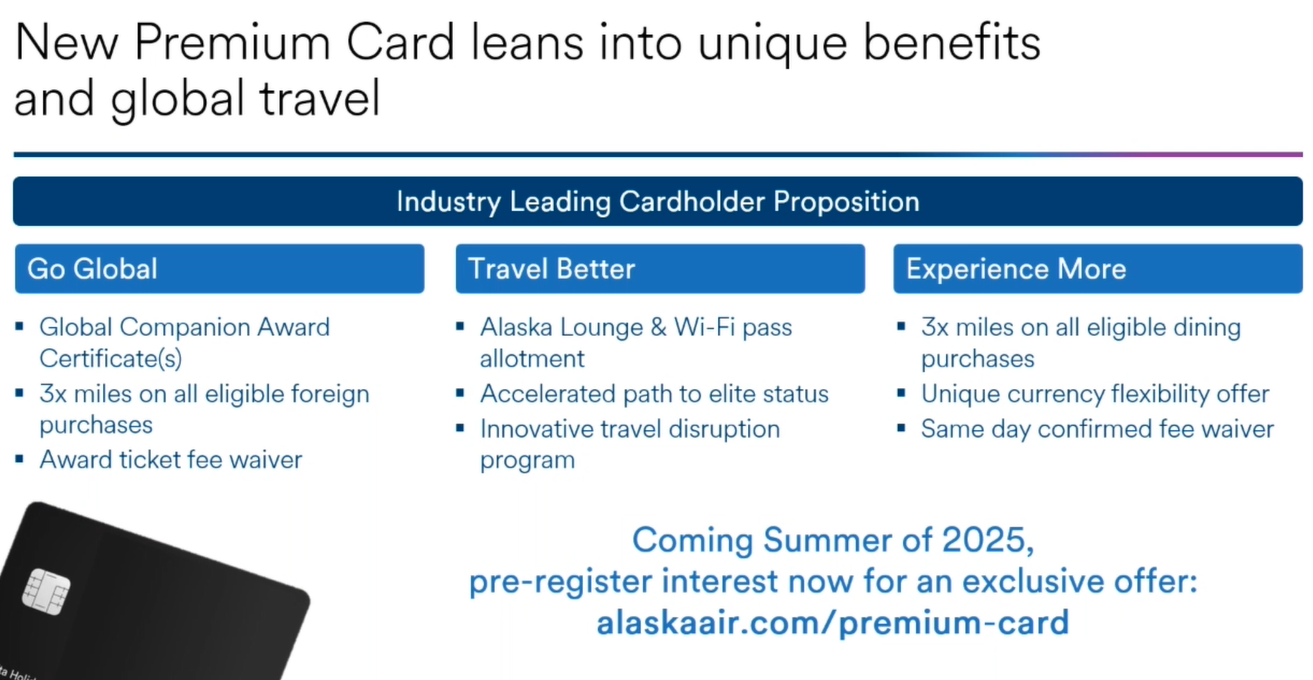

Meanwhile, the introduction of their new premium card with Bank of America is ultimately expected to drive $90 million in incremental profit, with $40 million by 2027.

With a lower $395 annual fee that other airline premium cards, they expect it to be attractive to consumers – but I’d point out that those more expensive cards come with lounge membership and not just lounge passes. Nonetheless, over 10,000 people added themselves to the pre-registration list for the card in the first six hours. Giving away free miles for doing so is powerful is my takeaway from that.

The airline talks about loyalty as crucial to their profitability, and not just in terms of selling miles to Bank of America (by contrast, former American Airlines CEO Doug Parker used to describe the AAdvantage program as ‘the card program’). They speak at an investor conference about winning customer loyalty and their strategy for doing this is premium product and loyalty, along with a nod to employees. That’s all positive in terms of the messaging from the top.

All these loyalty plan valuations are such crap. They are valuable only when connected to the airline. We’ve seen them fail over and over when they try to spin them off and all of a sudden their magic accounting profits become costs.

I’ll believe it when I see it. I’m all for innovation and competition as it can benefit us, the consumers. However, most of the time, it falls flat, just marketing jargon. The ‘big three’ don’t give two-shits about loyalty anymore, so if Alaska is going to take this on, for real, then I applaud them, and will be rooting for all of us.

The new card will not be worth a $1 annual fee if BoA can’t figure out how to approve online international purchases (they can’t now). Their existing card has cost me over $80 this year in foreign transaction fees (used a Chase card for online purchases like train tickets). All a bunch of marketing BS. We’ll see…………

As a former payment facilitator (something that is actually hard to get- it takes a minimum $30 million annual bond as you take on risk), none of this surprises me. The fin-tech industry is still- even today- in its infancy. Gary- look me up on LinkedIn and I can monetize your audience. And the funny thing is- you know I am not kidding.

-Jon

Uhhm, “cash remuneration” is not profit, just plain revenue. And I bet you there’s not much profit in selling miles given load factors exceeding 90%.

The only incremental profit is a measly $40m from squeezing the banks. That doesn’t cover a fraction of the banker’s fees for the acquisition.

This post is pure junk

Yada yada yada… it’s the same speech every big corporation gives when they “acquire” another company. They’re just blowing sunshine and glitter up everyones shorts. They’ll do whatever benefits them (the company and its executives). I understand about cost cutting, but when you take away from the people that makes all those things possible, eventually you’re doing more harm than good. I fly Hawai’ian for the experience as part and parcel of the complete vacation package. You take those unique offerings away, why should I fly Hawai’ian? I’ll just fly Delta at that point, they fly out of my home airport, it’ll be much easier for me.

I find it very odd that nowhere do they say what you earn for spend ON ALASKA AIRLINES! I’m guessing it’s also 3x. That seems like a very strange omission.