News and notes from around the interweb:

- The seemingly-random collection of airlines that Hainan Airlines’ parent company has invested in

- Details of American’s technology project to get legacy American and US Airways aircraft and crew onto a single system

- The April 11 issue of Airline Weekly reported American Airlines President Scott Kirby’s comments at the World Travel & Tourism Council about the airline’s need to continue pitching a fit about how unfair it is for the most profitable airline in the world to have to compete against less profitable airlines that they partner with from scary Middle East countries.

Kirby cited a New York-to-Mumbai ticket on Etihad with a base fare of just $48, or $680 including all taxes and surcharges. There’s no way, he asserted, an airline could charge that price without huge government subsidies.

Which of course means that United airlines, which had a base fare of $36 and no fuel surcharges from Melbourne to Los Angeles is massively subsidized.

Just like his boss Doug Parker, he’s focusing on the wrong this for the future of his airline.

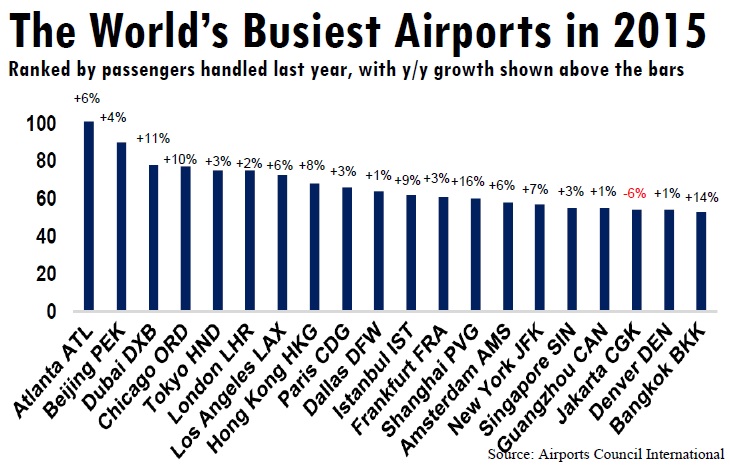

- Also from Airline Weekly these are the world’s busiest airports in 2015, and their percentage of passenger growth in 2015: >

- American Airlines wants to limit the amount of extra fuel carried by its regional airlines (although to an amount still above FAA minimums). Having had to divert last month when an American flight I was on ran low on fuel, from a passenger perspective I like having extra fuel onboard. But that costs money, and the need to divert is rare.

- John Oliver takes on credit scores. Of course you can kvetch as Oliver does or learn how to manage your credit score (and here’s some data on what scores get approved for credit cards).

Gary, I wholeheartedly agree with you that the US legacy carriers should stop bitching about the ME3. That being said, when you refer to American as “the most profitable airline in the world” are you doing so on the basis of their gross profit? Or their ROE? Because if the former I think that’s a little misleading (I could start an airline with $100 billion of cash, invest in corporate bonds and one plane and be the most profitable airline by gross profit). I think profit margin is a more apt figure for making that argument than gross profit.

Note that Kirby’s speech also dealt with low cost carriers like Spirit and Frontier. While these airlines are troublesome for AA — since the majority of travelers buy their tickets on price alone — Kirby ACCEPTS the fair competition from them because they are actual for-profit businesses that operate without gov’t subsidy. No matter what nonsense you spout, it cannot be plausibly argued that the Middle East airlines operate without massive, unprecedented subsidy. No for-profit company can compete with such enterprises. The US airlines are largely shielded from this problem by geography — the Middle East is an entirely illogical connecting point for most int’l flights headed to the USA — which is a luxury panel-participant Lufthansa doesn’t have. BTW, I assume even you might reluctantly acknowledge that the Middle East airlines don’t have 85% of Middle East to Europe traffic simply because they offer a better product, right? I think any sentient human being might understand that the tens of billions in subsidies might also have something to do with this.

One of the America West minions is getting really worked up over the ME3 again…

Once again, John Oliver is full of shit. His arguments are almost always based entirely on logical fallacies. It’s amazing that anyone takes him seriously.