I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Premium credit cards offer a dizzying array of benefits you probably didn’t even realize you had — or if you knew at one point, you probably forget when there’s an opportunity to use them.

Break a new electronic device, smash your rental car, run into a merchant who won’t take a return… or the price of something you recently bought drops after you already bought and started using it… there’s something that your credit card company can often do and you get started with a simple phone call.

Was your flight delayed by weather, you didn’t make your connection, and you were stuck paying for a hotel and meals out? Let your credit card company pay you back!

The funny thing is that’s precisely what makes these rich benefits possible — breakage. Since so few people use them, they aren’t that costly to offer, even though for the people who benefit there’s substantial extra real cash in their pockets.

The card whose benefits I’m most familiar with — and that’s paid off for me in the past with real cash — is Chase Sapphire Preferred.

You know it as the first premium points card you should sign up for because of:

- Signup bonus: 40,000 bonus points after $4000 in spending within 3 months, plus 5000 more points for adding an authorized user to the account and making a purchase.

- Fast earning: double points on all travel and dining: not just air and not just hotels, but both and cars and taxis and tolls, plus meals on the road.

- Valuable points: that transfer to your choice of airline (United, Korean, British Airways, Singapore, Virgin Atlantic, Southwest) covering all the major alliances and more plus several hotel programs (Hyatt, Marriott, Ritz-Carlton, IHG Rewards Club) and Amtrak.

Singapore Airlines A380 Suites Class

But it’s also a great card that covers your purchases and your travels when things go wrong.

Here are the key benefits to know:

Trip Delay and Baggage Delay Coverage

Whenever travel throws you a curve ball, it may cost you time but may not cost you money.

Charge your tickets to Chase Sapphire Preferred Card and then if your travel airline travel is delayed more than 12 hours or requires an overnight stay (get in late, depart early morning) they’ll cover unreimbursed expenses like hotel and meals up to $500 per ticket.

If your checked bags are delayed more than 6 hours they’ll reimburse you for things like toileteries and clothing you need to buy, up to $100 a day for 5 days (or until your bags are delivered, if less).

And if your checked or carry-on bags are damaged or lost permanently, they extend coverage up to $3,000 per passenger.

Trip Cancellation Coverage

They’ll reimburse you up to $10,000 if your travels are cut short or cancelled due to illness, severe weather or similar covered situations. That way prepaid non-refundable expenses like airline tickets, hotels, and tours can be paid back to you even if you didn’t buy separate travel insurance.

Primary Car Rental Collision

Most premium credit cards offer ‘secondary’ coverage when you rent a car. That means they’ll cover expenses your own insurance doesn’t, which is usually your insurance deductible (perhaps $500).

Chase Sapphire Preferred – like United Explorer and Diners Club – offers primary coverage. In many cases if you ding a rental car, your own insurance won’t even have to know. That means if there’s $10,000 in damage, it’s Sapphire Preferred’s coverage which is handling that — not yours.

To be covered automatically you just charge the full rental to your Sapphire Preferred Card (you can’t split the bill on another card, for instance) and don’t take the rental company’s collision coverage.

Another thing great about this benefit is that while many cards exclude coverage in several countries, Sapphire Preferred’s coverage is broad (but if you plan to rent anything that may be exotic or antique car or a large van or bigger you’re going to want to confirm coverage in advance).

Seriously, You Aren’t Going to Need This One…

You used to see boxes at the airport selling life insurance policies. Lloyds of London wrote the first policy in 1911 but quickly ran into heavy losses and got out of the business the next year. Aviation insurance came back in the late 20s and became generally available in the 40s.

Families of victims of the Germanwings crash may only have been offered 75,000 euros.

The card actually offers coverage in the case of accidental death or dismemberment in conjunction with airline, bus, train and cruise travel up to $500,000.

Protecting the Stuff You Buy

If you buy something and the merchant won’t take it back and it’s within 90 days of your purchase, they can pay you back instead up to $500 (maximum $1000 per year).

If your item is damaged (or stolen) within 120 days of purchase, they’ll cover it up to $500 ($50,000 cumulative for the account).

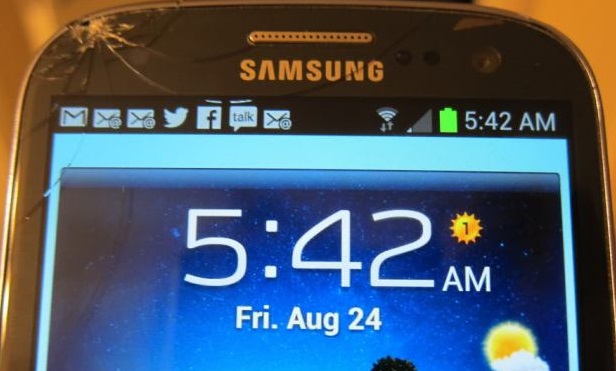

When I dropped my Android phone on the sidewalk two months after I bought it, I smashed the glass screen — and I wound up with a check for $314.99.

If a manufacturer’s warranty lasts a year, they’ll cover a second year. If it lasts two years, they’ll cover a third year. So if your stuff breaks don’t just throw it away, call Chase and get the ball rolling on their provider sending you a check.

If you buy something in the US and you find a lower published price within 90 days you can get back the difference up to $500 (maximum of $2500 per year, not bad for a $95 annual fee card that’s $0 the first year).

AAA-Lite

I buy AAA membership — mostly just for the hotel discount code, even though they send out membership cards that haven’t been paid for. But here’s the details on their roadside dispatch which can help with towing, changing a tire, jump starts, out of gas, and when you’ve locked yourself out of your car.

They’ll also provide you with legal and medical referrals when you’re traveling.

I thought the AF increased to $125

Do the travel protections work when you use miles for a ticket and pay for the taxes with the card?

nice post!

Does it work with award tickets if you charge the taxes and fees?

Annual fee $95. And when I am back on my computer I will dig up the post on how travel coverage works with awards.

Does the buyers protection/extended warranty work on items purchased overseas?

Hmm, it was $95 when I signed up, at the one year anniversary it went up to (and I was charged) $125. Pretty sure about that. When did it drop back down to $95??? Don’t remember seeing an article about that…

All true, but how many will use most of those benefits. CSP was the king of its day, but now the 7% is gone, they’re chipping away at other bennies like 3x Friday, and many other cards now offer what was once a major CSP plus-no forex fee.

Add in that many who read this blog will not be able to get this card due to current Chase policies.

@italdesign there was a brief time when new cardmembers could sign up for an offer that was $125, I warned about that here on the blog but never offered such a link. I believe they were just testing it.

Great article and reminder Gary. Question, what qualifies as sickness and do they cover the change fees or the while ticket? Last year I got sick on an int’l J ticket and paid $500 to change it. Would a Doctor note suffice?

Are these benefits only offered on the CSP and not the no-fee version? I downgraded to no fee several years ago as my ink business had more benefits I used regularly and allowed all my chase accounts to be transferable to UA, SW, Hyatt, etc

Gary, have you ever filed for Trip Cancellation Coverage via the Chase Sapphire Card? If yes, how easy was Chase to work with and how promptly was your claim processed?

Thanks!

@TxPepper I have not..

@Daniel – yes the coverage still works when you use miles and pay for the taxes. The T&C specifically states “when you pay for a portion of the flight…” and I have used it to get reimbursed for an overnight hotel stay on a $5.60 taxes paid miles booked flight from PHX to DTW that was delayed and I used the baggage delay to pay for a $30 taxes paid miles booked flight from DTW to LHR

Hi Gary – If I have Chase Sapphire and I get a card for my wife does she get the rental coverage or does she have to have her own account?

@Basil the collision coverage extends to authorized cardmembers on the account.

I used the trip delay benefit this year. My flight was cancelled and couldn’t get out until the next day. United comp’d me the hotel but my spouse and I ate a nice dinner with wine at the hotel and a good breakfast. Got $200+ back from Chase.

@Paul – NICE

@Paul…thanks for posting about your trip-delay compensation experience. I really hate having too many credit cards in the mix, but I may have to change my mind about getting this one.

I used this card to pay for the taxes of an award flight and ended up having to buy a hotel room due to a snow storm. They did not reimburse me as they said I used awards….

I wanted to upgrade from the Chase Sapphire to the Chase Sapphire Preferred. I called the number on the back of the card and was informed that if you want to get the first year fee waived and the 40,000 points for $4,000 spent in 3 months, it has to be a new account and NOT an upgrade of an existing card. I had $29,500 limit on the Chase Sapphire and was curious what they would do for a new account; meaning I’ll have both cards. Maybe I’ll get turned down because I already have a chase sapphire card. On line approval in 30 seconds for the CSP for $25,900. I called and was told that if the old chase sapphire was paid up, they would transfer the limit to the CSP and cancel the old card (called a merger of the accounts). Or I could just keep both since there is no charge on the regular card anyway. Combined limit of over $55,000. Thanks Chase.