Mergers frequently don’t work, failing to generate anticipated synergies. The winner in any merger is usually the one willing to pay the most, and that frequently means overpaying. This is known as the winner’s curse. Assuming that each bidder has the same information and values something the same, for one bidder to win it means they’re paying more than similarly-situated bidders were willing to. And there’s a strong likelihood that means paying too much.

In the case of Marriott, they weren’t necessarily the high bidder for Starwood, Hyatt’s bid was deemed to complicated because of the chain’s multiple share classes.

Marriott Seattle Airport Atrium

But Chinese insurance conglomerate Anbang came in with a higher bid than Marriott’s, and Marriott then topped Anbang. Their original offer may have been too high, the new offer was 15% higher. I argued they were paying too much.

The deal hasn’t closed yet, with Chinese regulators taking more time to review the transaction. This is presumably sour grapes from Anbang, the deal will eventually get approval but at the end of the review process the Chinese will have to ask for something — divestiture of a handful of hotels from the combined management portfolio most likely. It will be the kind of deal that allows the Chinese to say they’ve extracted something but isn’t so onerous that under normal circumstances Marriott would walk away.

SkyCity Marriott, Hong Kong Airport

A very lightly sourced piece in the New York Post suggests that Marriott has buyer’s remorse over the deal.

The $12 billion hotel megamerger is taking longer to close — thanks to Chinese authorities extending their review — and is turning out to be less enticing than Marriott had envisioned, according to sources.

“There is a notion of remorse,” said one source close to the deal.

The concerns are:

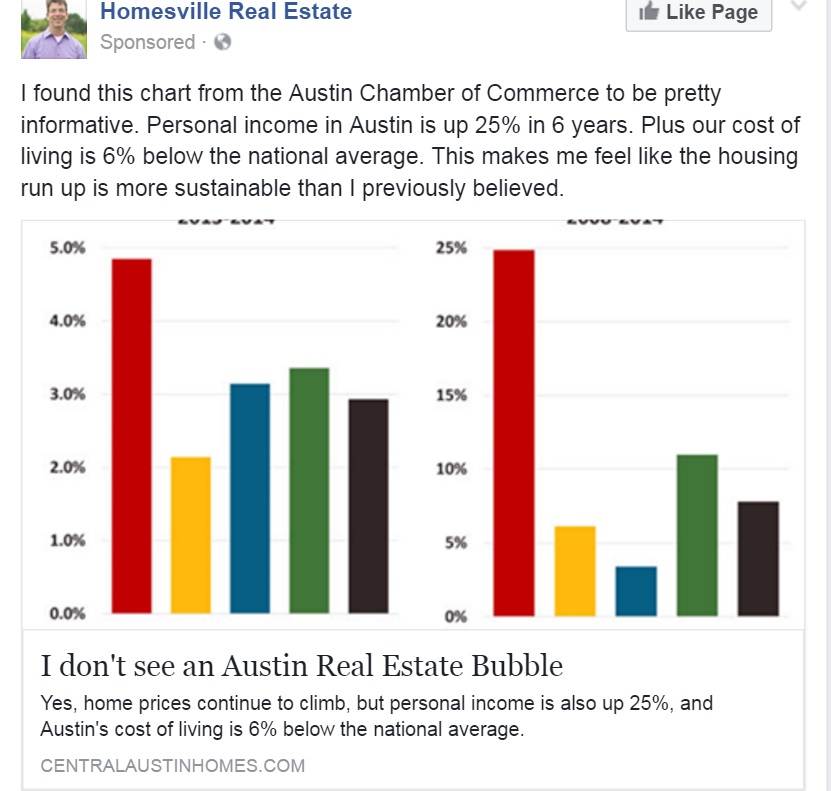

- That a delay in closing the deal means a delay in selling off Starwood real estate holdings, and could mean trying to sell properties in a less favorable market. There’s economic risk generally, and real estate risk in particular. I’m seeing Facebook ads trying to convince me that my home city of Austin isn’t a real estate bubble, something that I regard as prima facie evidence of a bubble. (That and the sale of the Andaz 5th Avenue for $1.2 million a key.)

- There are concerns integrating Starwood Preferred Guest into Marriott Rewards.

While it sounds great on paper, there’s growing unease at Marriott about the integration with Starwood. In particular, Marriott execs are concerned about the compatibility of combining Starwood’s loyalty-rewards program with its own, said one source.

..“This isn’t exactly what they thought they were buying,” said the source.

One analyst described not getting Chinese regulatory approval as “a good emergency exit for Marriott” however it seems unlikely the conditions for divestiture in the Chinese market will be onerous enough to give Marriott that fig leaf — regardless of the language of the deal between the companies, and with Starwood already shedding people.

When I sat down with Marriott’s CEO Arne Sorenson several months ago he described loyalty as being more important than ever and his desire to ensure that Starwood’s customers would be happy with their plans moving forward as genuine.

While I take him at his word, and we’ve seen Marriott adding benefits like 4pm late checkout for Golds and Platinums, events like SPG Moments, and trialing an Ambassador service to match the service provided to Starwood’s 100 night members, the original analysis of the deal was scale — that growing Marriott’s footprint made them a tougher competitor better able to drive down costs especially with online travel agencies (Hyatt’s CEO was openly skeptical of this argument though of course Hyatt was a losing bidder).

I’ve argued that smaller programs have to work harder to attract loyal customers, it’s easy to fall into any city and wind up at a Marriott or a Hilton but it takes effort to choose Hyatt or Starwood. Growing Marriott’s footprint only exacerbates that effect.

While there are thorny issues in integration to be sure, and I think that the loyalty program component of the deal was initially an afterthought — and the strong reaction of Starwood’s members caught Marriott management by surprise — Sorenson suggested that Starwood’s customers were a key consideration in the deal.

W Doha

A deal almost never looks as good as it does the day it’s announced. The longer it takes to close, the more naysayers, the more critical analysis, and more tarnished details emerge. There’s more opportunity for buyer’s remorse, and for conditions which suggested a merger was a good idea to change. United was set to acquire US Airways in 2000, but by 2001 had soured on the deal in the face of an economic downturn so when the Department of Justice announced opposition they walked away rather than fighting to close.

There’s little at this point to suggest a similar fate for Marriott-Starwood. In fact I’d guess that concerns over what Chinese regulators will extract are overblown — although they will be a tax, and a delay, and both of those will make the deal somewhat less desirable and the deal was probably more expensive than it was worth to begin with.

And the Post piece, while giving comfort to some Starwood elites perhaps, appears to cite a single anonymous source without giving a sense even of how reliable their information might be. So I wouldn’t get too excited.

This merger is trying to occur due to massive real estate debt and previous stock buybacks caused by Central Banks printing money that these businesses won’t be able to pay back. I hope the deal collapses and some properties sold off.

I also hope US Airways leaves American Airlines…..well, too much wishful thinking for that thought, of course.

As an SPG Plat I stopped staying at Starwood properties this year and instead took my 60 annual days and 6 to 8 annual meetings to Hyatt.

Hyatt is more or less as convinient for me so absent a significant incentive to join Marriot, I will not contribute to paying off the acquisition premium they paid.

Hyatt Starwood would have been great.

Feel like this title is a bit misleading…there may be “buyers remorse”, not uncommon when having to raise an offer to complete M&A activity, but I didn’t see a single thing in the article about “hoping to back out” of it.

@UA-NYC hoping Chinese regulators kill it means hoping there are conditions imposed on the deal that allows them to back away.

However my argument is that this is highly unlikely to happen.

I agree with UA-NYC, there is not one credible fact in your article pointing to Marriott wanting to back out. Most mainstream reporter’s would have found a second source to back up their headlines. I wonder what would have happened if a reporter had written this for the WSJ and placed your lead on the front page?

I highly doubt that this merger will not close. Over the long haul this will be a winner. And Marriott plays for the long haul.

Now I also think mergers are not over with, there is Hyatt, IHG sitting out there.

@Ghostrider5408 that’s the entire point of my post. That the NY Post’s report isn’t credible. And I explain why.

lousy article. no analysis

Is the W picture W Doha? It looks really likw W Bangkok. Maybe they have very similar designs

@Eric yep, W Doha lobby

@woooo – the Post’s or mine?? 😀

I’d say the blog post waited too long to get to the conclusion at the end. The title was misleading and only by the time I got to the end did I understand that you really think the article was not substantiated. It would have been better if your title mentioned that the Post says … And in the lead paragraph state that you think their article is unsubstantiated. Then you could still go on to go through all the points pointing to your previous posts and opinions.

It’s definitely the W Doha, stayed there in May and I recognized the picture immediately.

@David maybe that’s fair, but what you’re saying is you had to wait for me to develop my argument and then reach through to the conclusion to know what my conclusion is. I realize it’s very un-internety of me. No intention to hide the ball though.

Please God…..please help this merger fall apart.

I’m a Lifetime SPG Platinum (and yearly 60+ nights at SPG hotels…..)….but since this merger was announced, I’ve been shifting much of my leisure and business travel to Hyatt (and a bit to Club Carlson—these international Radisson Blu hotels are great!).

I’ll hit 50 nights at SPG almost accidentally….but I’ve been intentionally moving away from SPG until there’s some clarity about what loyalty will look like under the “new SPG/Marriott” program will look like….and I have NO confidence this merger will be good for SPG-loyal members.

Any bad news with regard to this merger is good news in my opinion…..

Yep – I will also confirm as an SPG Plat I’ve already moved the majority of my stays to Hyatt. Wonder how many of us have/are doing the same and whether this is obvious to Marriott ? I’m not waiting around for the eventual-inevitable butchering of the program. Marriott can buy whatever they want but they aren’t buying me ….

Let’s see: I’ve traded M&A deals for 18 years, and I was admittedly wrong about US Air/ AA, but I love betting against positive and negative merger rumors that come out of the NY Post , or FT (and particularly their Alphaville blog). I also like betting against merger rumors that occur on certain days of the year, namely the day before and after Thanksgiving, or another lightly traded day. Very few people get convicted of insider trading outside the US, and planting stories has become a cottage industry.

The real question is , “How tight is the merger?”

Under various conditions the termination fee could be $0 or $400,000,000.

Unless WSJ or Bloomberg or , in particular David Faber run news like this, I’ll listen. Especially Faber.

If this merger arb widens tomorrow I’ll take the other side.

If you like to read merger agreements, here is the filing. https://www.sec.gov/Archives/edgar/data/316206/000119312515377594/d52885dex21.htm

sorry, that’s not the final agreement.

It’s 0-$450 million.

I’m wondering if the idiots at Marriott are considering the SPG program continue as a subsidiary. They kept Ritz Carlton frequent stay program after they acquired them. Why NOT SPG ?

Gary, you’re getting a bit beaten up by the peanut gallery. I won’t join in, because I’m happy anytime I get to read an entire posting that never mentions Chase Sapphire!!

However, you did take a sketchy, unsourced report in the Post and turn it into an entire webblog entry. As another commenter mentioned, The Post? This would never in a million years get printed in the Wall Street Journal.

@Cedric Sure they kept the Ritz’s program, but over time they have turned into a near clone of Marriott Rewards. There is no chance that SPG will survive as anything that is meaningfully different than Marriott Rewards.

The best we can hope for is that Marriott will adopt some of SPG’s best features, like guaranteed late checkout. I’m checking out of a Courtyard today, and I’m enjoying my guaranteed late checkout right now. 🙂

I always get amused when I read all these gushing words about Starwood’s elite program. All the benefits must be exclusive to Platinum as SPG Gold is about as useless as Hyatt plat. The only thing I ever seem to get from my SPG Gold is free internet and their staff acts like I should be excited about this generous elite benefit…free wireless is something I get from the other chains for booking direct…if I even need to work that hard. Midtier Marriott and Hilton are both better than SPG… But I guess Marriott Gold will loose it’s free continental breakfast with this merger and make it as worthless as SPG Gold.

I don’t think that Marriott will shed any more tears than the airlines have in gutting their reward programs post-merger. The notion that they’re so concerned about the extra costs of making the SPG folks happy… Well I’d be shocked if they even care. Merger synergies amount to: If you don’t like our changes, where ya going to go?

Gary I hear you. As a lifetime PLT with Marriott and current Diamond with Hyatt I am looking forward to the merger, there are many Westin’s in Europe worth staying at ! Especially Florence.

Next up will be seeing what Hyatt does as well as IHG. Which the latter is slowly but steadily falling behind. IMO

@ Cedric: they acquired Ritz-Carlton in the 1990s. Ritz-Carlton rewards wasn’t launched until mid-2010 following the downturn to boost occupancy and acquire new guests. Until RC Rewards launched one could redeem Marriott Rewards, however it was generally regarded to be a weak value and required a paper certificate.

Please change “to complicated” to “too complicated”.

The title of this post is both a clickbait and partially @Gary’s wishful thinking.

The merger will be consumed. The poorly sourced NY Post piece was quite likely quoting a former SPG loyalist expressing her wish that the merger would fall apart (were you the source, Gary?) 🙂

Anyway, the merger won’t fall apart based on the reason cited because Chinese regulators have no power to kill this deal, which has “already received regulatory clearances from more than 40 countries, including the USA, the European Union, Canada, India, Japan, Colombia, Mexico, Saudi Arabia, South Korea, and Turkey.” Considering the relatively large presence of Marriott and SPG in China, there is no way China does not clear the merger, lest they further exacerbate their already weakened economy performance…

BTW, although Marriott had expected the Chinese review process to be over by August 10, they agreed to an extension that could take up to 60 additional days, which does not sound to me like a company that’s itching to get out of the deal…

@TOM, yes, we’re talking “elite” of SPG, meaning plat, plat 50, plat75 or plat100. Gold is too easy to get. And YES, it still is the best programme out there, which is why I really really still keep my fingers crossed for a failure of this merger.

Marriott really lacks so much that Starwood has and I don’t look forward to Starwood properties being invaded by those courtyard and Marriott folks. Hyatt would have been fine if they were so desperately in need of cash. If I don’t see credible action by Marriott to ensure spg will be kept apart and with its own benefits I will also shift to Carlson and Hyatt.

I understand why foreign countries want to purchase hotels and real estate on US soil, but I do not understand why US companies are selling to foreign countries. Can anyone, with working M&A experience explain it to a layperson? Thank you.