Marco Rubio has credit card problems: when he improperly used the Florida Republican Party’s credit card for personal expenses, he was giving up rewards. He wasted $22,000 in personal charges, neither using it to meet minimum spend for a lucrative credit card signup bonus nor earning category bonuses (and it was largely travel spend!).

Wisconsin Governor Scott Walker can’t handle a credit card either, paying over 27% interest on significant credit card debt (including on a Sears card) rather than balance transferring to a 0% card with no balance transfer fee.

Now we learn that the nation’s 10th Justice can’t handle basic personal finance issues wisely, either.

The Solicitor General of the United States is often referred to as the 10th Justice (the Supreme Court is made up of 9 justices — 8 associates and a Chief Justice) because the federal government’s representative before the Court argues before the court more than any other, uniquely does not have to ask the Court’s permission to file an amicus brief, and is often even asked to do so by the Court so that they may benefit from the S.G.’s perspective on a case.

Donald Verrilli, Jr. replaced Elena Kagan as Solicitor General after she was elevated to the Court itself. And via Above the Law he’s been paying interest on credit card debt for years — despite assets which would easily allow him to pay off his cards.

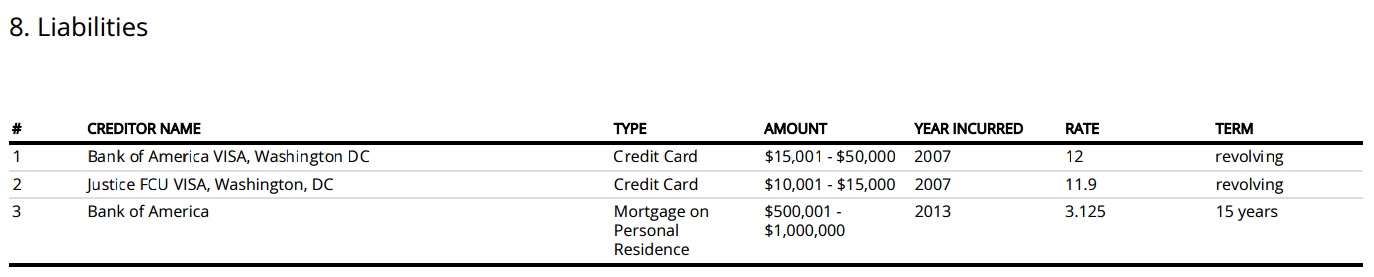

His 2015 financial disclosure form (.pdf) shows ‘$25,000 – $65,000’ in revolving credit card debt incurred in 2007. (We do not know from the form what the balance on each card was between 2007 and 2015.)

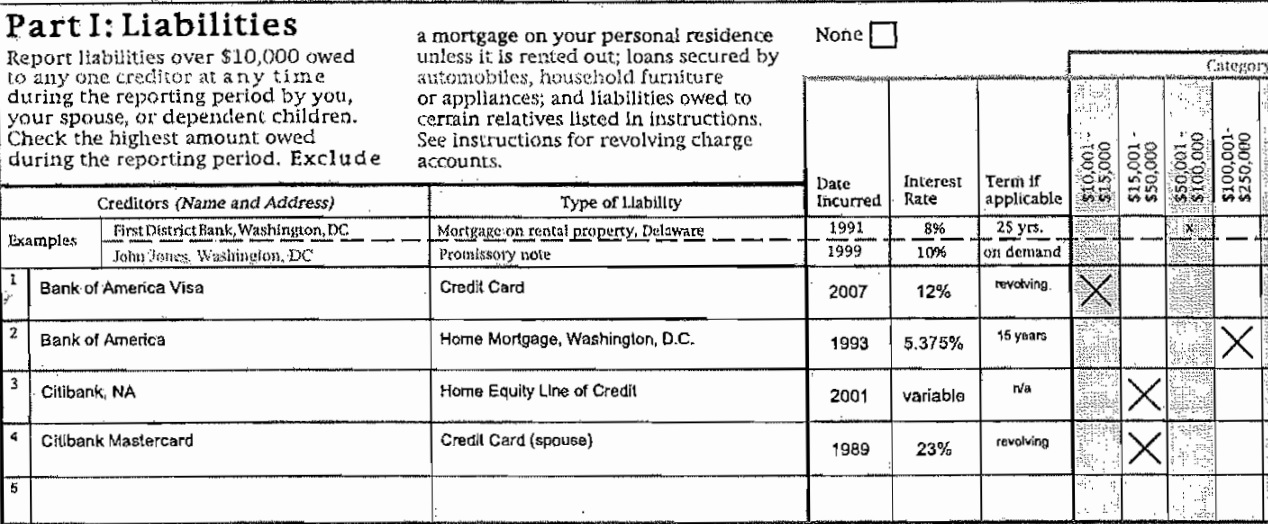

He does appear to be making progress, though, because his 2012 form (.pdf) showed a revolving balance on a Citibank-issued card at 23%.

This isn’t just someone caught in a difficult financial situation, using credit cards as their best available means of accessing short term cash that they need. When he was confirmed as solicitor general in 2011 his disclosed net worth was in excess of $4 million.

Paying off this debt would give him an effective risk-free return on those assets of about 12%, something very few investors can accomplish any other way.

As Above the Law notes, “The members of the Supreme Court like to “CVSG” — “Call for the View of the Solicitor General” — but they might want to ignore him when it comes to personal finance.”

The Court might choose to read up on blogs and forums instead.

Verrilli will be stepping down June 24. We’ll be watching to see whether the next Solicitor General handles credit cards more effectively than the 10th Justice — or Justice Sotomayor, who carried $15,000 in credit card debt at the time of her appointment despite savings which could have paid off her cards.

Is it possible these are simply “high balances,” rather than true longer term debt? I’d imagine that technically if I charge $30k to a credit card, even if I intend to pay it by the due date, it is still a liability of $30k and would technically need to be reported.

i suspect that they are just reporting the highest balance due on any monthly bill, rather than a outstanding balance that they were actually incurring the credit card interest on. It would still be a liability until you pay the bill…

Since there are only eight justices now (and apparently until next year), shouldn’t we call him the 9th justice?

A personal financial statement is a snapshot of a moment in time. When the credit card statement comes due, I’m sure he pays it in full from his ample cash and income. I usually have a high credit card balance but never incur fees because I pay the full statement balance when due. I don’t see anything in what you reported above that suggests that the SG payed any fees or interest.

Don’t you have anything better to worry about? Creepy

What sticks out to me is the home equity loan wasn’t disclosed in 2007 even tho the debt was incurred in 2001.

What else is he hiding?

Like the revolving credit card snapshot, the home equity loan might be a secured line of credit, with no balance due until drawn on, so no debt outstanding in 2007.

Sonia does not sound like a Wise Latina to me.

I used to report on the same form, and consistent with advice from my ethics counsel reported the balance I had in the account at the time the form reflected. this did not mean that I had a long term balance–I paid off my monthly balance without fail. I suspect the same is true of Verrellli. At the very least you can’t determine whether he keeps a balance from the forms itself. I am mystified by GringoLoco’s comment. The form in question only has to be filled out if you are a senior government official (very, very senior–presidential appointees), and Verrelli did not start government service until 2009. No filing was required in 2007.

And this is your business how? And how does this relate to travel? I’m confused, Gary. And I could care less about the credit card balances of the AG. Also, I don’t mean to offend but I’m not looking for this type of info on view from the boarding area. Please stick to the subject matter at hand. Thanks