There’s a counterfactual where American Airlines is the best airline in the country right now, far outpacing Delta. If they paid more attention to the details of their product, focused on giving employees a mission and clear sense of what they’re trying to achieve (not just managers yelling at them on the jet bridge about pushing back two minutes late), and if their strategic partnerships had worked out better they’d be the airline to beat.

American Airlines has an enviable domestic route network. Their weakness in New York was being addressed by a close JetBlue partnership, approved by the Trump administration and then beaten in court by the Biden administration, and if Alaska were performing better in San Francisco and Los Angeles it would mitigate American’s weakness on the West Coast.

What they lack is – in some sense – fixable by a management who sweats the small stuff to deliver an outstanding customer experience and who articulates a vision that aligns employees with a shared goal to deliver on that experience.

There are (13) things that I believe about American Airlines, from customer experience to business strategy, and they help explain both the outsized potential of this airline to be great and the decisions holding them back.

- Not enough extra legroom seats. American Airlines limits the number of rows of extra legroom coach on aircraft, which lets them squeeze in an extra row of regular seats. But that means there aren’t enough extra legroom coach seats to sell, or to make available to elite frequent flyers.

An American Airlines Boeing 737-800 has just 3 rows of extra legroom coach, apart from exit rows, versus 6-7 rows on United and Delta for similar aircraft.

- Not enough attention to detail. When American Airlines developed its new standard domestic economy product, they didn’t bother to build a mockup of it first. That led to all sort of problems with how it worked in practice, from uncomfortable first class seats without underseat storage, to problems in the lavatory (doors that opened into each other) and galley. They wound up having to retrofit planes they’d just retrofitted in a penny wise, pound foolish move.

The airline’s then-CEO didn’t even bother to try the main product he was selling to customers until it was in the market for nine months because the experience of the product just didn’t matter. Seats were items on a spreadsheet with quantities and cost, so it shouldn’t surprise that the airline didn’t get the best seat experience possible for the money.

It’s often not about spending more money, but sweating the details to get the most for the money you’re spending. I’m always surprised but shouldn’t be when I see three salads on a first class meal tray. Nobody is thinking about how the pieces interact, which is what you get when worrying about those details isn’t valued by top management and rewarded.

The contents of the American Airlines premium economy, business class, and first class amenity kits are nearly identical. That’s just checking the box for an amenity kit. And oh by the way food in first class is the same as business, differentiated only by the addition of a soup course.

Premium economy amenity kit

Flagship First Class amenity kitBut I know it’s possible for the airline to sweat the small stuff, because I see what sort of care went into the design of their Denver, Newark, and Washington National E Concourse lounges. I’m not sure how that ‘happened’ since it’s so out of sample for American, but they can deliver a really exceptional product.

And though the dedicated business class Flagship lounges aren’t as nice (but accessible to more passengers) compared to United Polaris lounges and the new Delta One lounge at New York JFK, neither United nor Delta has anything on American’s Flagship First Dining in Dallas and Miami (sadly Los Angeles was never re-opened with the de-emphasis on international there, and New York became the Chelsea lounge which isn’t as good). There’s no question what sort of product American Airlines is capable of.

Flagship First Dining Dallas – Fort Worth

I’m similarly looking forward to seeing the new business class suites and premium first row, because renderings make it appear as though a lot more attention was paid to the detail of those than to the nuances of cabin design with earlier business products overseen by current management (when dividers between middle seats in business class kept getting stuck, they just locked them in place up or down – and started ordering business class seats without dividers at all!).

American Airlines Business Class Coming To New Delivery Boeing 787-9s - Sells upgrades cheap.. too cheap? American Airlines has a good international business seat, and considering how bad the food is on Delta and United theirs is more than serviceable. It’s also very accessible, since they sell upgrades online very aggressively. But they frequently sell upgrades for less than the cash co-pay on a mileage upgrade award while not making mileage upgrade award seats available. That’s bad for the mileage program, and even for short-term revenue!

- AAdvantage is a good redemption program, but almost exclusively for travel on partners. American AAdvantage still has award charts for travel on partners. Unfortunately many partners have stopped making award seats available to American or at least discriminate in offering less space than they do to their own members (e.g. British Airways, Qatar, Qantas) or making seats available only close to departure (e.g. Etihad).

And ever since American introduced dynamic award pricing and journey control to their own flights, they’ve scared agents into thinking it applies to all awards (including awards that include partner airlines when it doesn’t) and now most agents are unwilling to make allowable changes to partner awards.

The biggest problem American AAdvantage faces is that it isn’t a good program for redeeming on American because revenue management doesn’t make enough seats available on their own airline at reasonable prices in premium cabins for long haul travel. This problem is exacerbated by the limited number of partners American has relative to Star Alliance programs and to Star programs like Air Canada Aeroplan which also aggressively court partnerships out of their alliance. You can get where you’re going more easily through those.

- AAdvantage is a good elite program, but missing key pieces. American was really innovative in making high margin activity like earning status through credit card use and online shopping count towards status – that activity is more profitable to the airline than flying! – but there are too many elites to deliver key benefits like upgrades (since they sell remaining seats so cheap) and extra legroom seats (since they jam in too many seats into their planes and don’t offer enough with extra legroom to book). Their lifetime elite program is also uncompetitive.

- Not enough long haul international flights. For the ostensibly ‘world’s largest airline’ they don’t take you many places beyond London across the Atlantic except during the summertime, and very few places in Asia. Their strategy is to fly to joint venture partner hubs (such as London, Tokyo and Sydney) and rely on a limited number of partners beyond that while focusing on their domestic route network.

They haven’t been able to capitalize on the boom in international travel because they retired too many planes during the pandemic (Boeing 757s, 767s, and Airbus A330s as well as their largest Embraer jets which operated shorter flights).

That compounds the problem of limited availability of elite benefits, since in most cases the best ones – confirmed upgrades – are available primarily on their own flights. You can’t use a confirmed upgrade to a place American Airlines doesn’t fly!

- Operation has been much better than when they were at their worst, but doesn’t rival Delta – and even United is more proactive and flexible. For an airline that believes it just needs to operate reliability in order to succeed, it doesn’t come close to being the most reliable.

Indeed, while American Airlines says their operations are improved, and they’ve become a much more reliable airline, the data they report to the government does not bear this out. In fact, if passengers are getting delayed, cancelled, and diverted – and if their bags are lost, or they’re turned away from flying completely despite having a ticket – Department of Transportation reports shows that it’s probably happening on American Airlines.

Delta is far more reliable. United, at least, gives you much greater flexibility making same day flight changes (what’s the point of American’s largest domestic network if you aren’t allowed to use its various hubs to get where you’re going?) and holding planes for connecting passengers (‘ConnectionSaver‘).

Meanwhile, like their confirmed change policy problems, too many policies fail to start with the customer.

- They won’t through-check bags on separate tickets, even two of their own tickets or partner tickets. Sometimes you book an AAdvantage award on a partner like Etihad or Air Tahiti Nui, but no connecting space was available on American AIrlines so you spend more to buy that flight – the reward for that being having to collect your bags and re-check them.

- And now they won’t let gate agents add most customers to a standby list, and they give away seats of customers they predict won’t make their connection. Passengers run to make it, find their seats are already gone, and can’t get on the next flight 30 minutes later because they’re locked out from standing by.

- Fast, more expensive wifi. American charges more for wifi than anyone else. I’ve seen as much as $31 per flight, while Delta and JetBlue are free and United, Alaska and Southwest are $8. But American’s wifi usually is much faster than United and Southwest! (United’s retrofits have proceeded too slowly.) I’ll actually take this tradeoff, and it isn’t a deal-killer for me. I pay $49.95 for monthly internet.

Delta uses its wifi to sign customers up for SkyMiles, feeding the top of the funnel where they convert members into co-brand American Express cardholders. They report that 30% of active members hold the Amex product, which means they need to find more members to market to. American charges for wifi use, rather than leveraging it for lucrative permission marketing.

On the one hand that’s great for someone like me since wifi uptake is lower on American, and the fast connection isn’t spread across as many passengers trying to use it. But it’s less good for customers in general, and for customers who want to stay connected during travel makes American Airlines the more expensive alternative even when fares are the same.

- Inferior lounge food. American’s newest lounges (Washington National E, Denver, Newark) are aesthetically among my favorite U.S. lounges, but though they’ve ‘upgraded’ their lounge food it doesn’t just trail Delta but even United. Despite more limited food, they use tiny plates that make a big mess to save on food cost.

And even American’s dedicated business class lounges lag United and the new Delta offerings (for all the Delta One JFK lounge’s flaws). While American doesn’t offer sit-down dining in its business lounges, many more customers have access.

Philadelphia Flagship will have the new design template. But they aren’t retrofitting old lounges to be more appealing, or opening up new lounges. The 2018-era design is awful, and existing lounges in places like Charlotte and Philadelphia a disaster.

- Employees are unhappy. And this isn’t just a function of an open contract for flight attendants. It’s been true for two decades. American used to say that they were going to ‘take care of employees, who would then take care of customers, and this would become a competitive advantage’ so that passengers preferred – and would pay more to fly – American. They don’t say this anymore.

Labor relations at American soured long before current management as missteps in previous regimes, trying to avoid bankruptcy while peers went through restructuring, built resentments. Labor gave back wages while management appeared to do well.

Of course, labor relations at US Airways were even worse – so bad that seven and a half years after acquiring America West the two airlines still operated separately, since the labor groups never integrated.

Without being given a clear mission, or clear vision for what employees are trying to achieve (they often don’t know whether they’re trying to be a premium airline or compete primarily with ultra-low cost carriers) they don’t know what level of service to aim for. Without a product they’re frequently proud of, or a mission they’ve been sent on larger than themselves, unhappiness festers.

Flight attendants at American Airlines were deeply embarrassed by the post-merger product – job satisfaction and customer service isn’t just about pay, or even just about giving employees the tools to do their jobs, it’s about giving them a product that makes them proud to come to work every day. Delta employees are proud, in a way that American employees aren’t.

One FBI special agent at a major hub just through her own experience tells me how happy Delta and Southwest employees seem, how perennially grumpy most people at American always are, and that United is most frustrating to deal with because they never want law enforcement on their aircraft (seven years after David Dao).

- Not enough premium seats. I’ve already discussed the lack of extra legroom seats, where I often can’t find them to book because with just a handful they can be gone months in advance (so I will just book another airline). An even bigger problem in not having the product to sell that customers want to buy is the lack of premium cabin seats.

Back in 2018 then-Vice President of Planning Vasu Raja complained that their widebody aircraft didn’t have enough premium seats. Their Boeing 787-8s have just 20 business class seats (and they can often only sell just 19). They removed premium seats from Boeing Boeing 777-200s even as coach was made far tighter.

They’ll be adding a row of first class to their Airbus A319 narrowbodies though they’ve been talking about the obvious need for years. And their new Boeing 787-9s will be premium-heavy. They’re moving slowly towards more premium seats, while densifying coach. But for now they don’t have good enough premium cabin seats, or enough of them.

- Haven’t invested in their hubs. Legacy American Airlines hubs overall are relatively nice, though Miami is more part of Latin America than the United States and reflects that. US Airways never invested in its hubs and US Airways management didn’t change that once taking over American.

Charlotte airport is a terrible place to connect. The airport’s hub status rests not just on its geography but also its low costs, which passengers experience in interminable walks and crowded corridors.

Philadelphia is known as “Filthadelphia” for a reason. And Phoenix, an incredibly mid facility, suffers from the same too-short connecting schedules that afflict American in Charlotte, too.

While it’s easy to overinvest in airport facilities, American overall doesn’t rival Delta in places like New York and Los Angeles or even Minneapolis and Detroit.

And where they’re making terminal investments, they do so on the cheap – scaled back renovations to a 50-year old terminal C at DFW, and a new terminal F that lacks a head house – no check-in or baggage claim facilities so all local passengers departing and arriving that terminal will have to take a train in and out of the airport, which is an inferior experience to all other concourses. Cheaper that way!

DFW Airport unveils the interior renderings for its new Terminal F.

Glass jetbridges? pic.twitter.com/sYwN8xiP4x

— Ishrion Aviation (@IshrionA) October 2, 2023

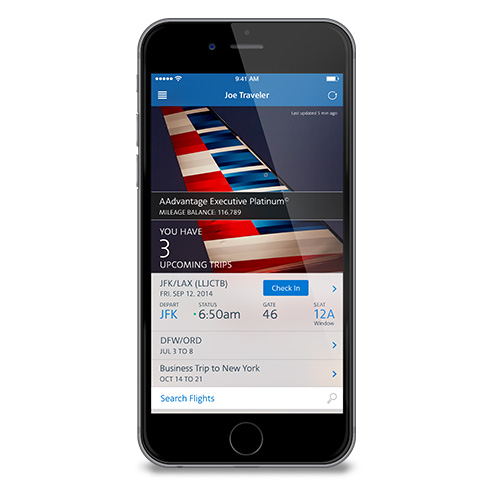

- Digital experience is lacking. Often award travel involving American Airlines and partner airlines both will show up online, and error out – it can’t be booked without a phone call. You cannot process a confirmed upgrade online or using their mobile app. After years of neglect, American began investing in digital products – with an aim towards reducing staffing at gates and reducing support that had been provided to managed business travel. But the role of airline CFO has been one so focused on denying resources to digital upgrades that the basic customer-facing tech stack simply lacks the features and functionality that United and even Delta deliver to passengers.

American Airlines is almost great in many ways, but is too cheap, and doesn’t seem to reward attention to detail in most elements of its product.

Current leadership of the airline believes that the only thing that matters is operational reliability. They ruthlessly track exact on-time departures (‘D0’) when arrivals matter more, but more fundamentally when operational reliability is table stakes. You won’t succeed as an airline without it, but it isn’t enough to succeed.

As a high cost airline they need customers to choose them over others, and paid more to do so, but for that they need to offer a better product. Former Chief Commercial Officer Vasu Raja believed that a better product was simply better connections (schedules).

In fact, it’s friendlier staff, more flexible policies, and paying attention to the details in a way that this airline hasn’t rewarded. And they’ve been way too penny wise and pound foolish (‘don’t spend a dollar you don’t have to‘ in the words of their CEO) that costs haven’t been contained but experience has been short-changed.

Ultimately no airline has more potential to be better than it is today but that has been true for many years and legacy US Airways management has failed to make things better. With more debt than any other airline – $40 billion as of the end of the first quarter – and while financially underperforming their largest competitors, some expect another chapter 11 filing.

I don’t expect that without a significant economic downturn or major spike in oil prices, because they seem able to service their debt. But the airline’s fundamental challenge is an operation that doesn’t earn a revenue premium commensurate to its costs – and that’s about how the airline is run, not about legacy costs.

Their poor employee relations is #1-10 and, in a service industry, if the employees aren’t engaged, the product will never be leading.

and because they don’t have an a direct competitor competitive product, which includes operational metrics, they can’t compete for the best revenue in the most competitive markets such as LAX and NYC and CHI – which then leads to high costs and low profits which results in a lack of investment in the hubs they do have.

and the NEA was counter to US law regardless of the party of the administration. DOT and DOJ law at least for aviation is fairly consistent and is not near as partisan as for other industries.

There is no pathway to fix what ails them – or least no current management or any in the past 25 years – has developed a plan.

#6 AA doesn’t fly to enough places internationally. We want to see more destinations!

AA lacks free TV like Delta has. I agree that they also need free internet as well.

Add suspending AA90 this winter to the list of failures. American is the only airline that fly daytime eastbound transatlantic to London out of Chicago but this weekend they have retimed it to a late night departure starting October. I fly this route every few weeks and am loyal to AA only because of this route. The decision to end AA’s USP on that route doesn’t make sense. What AA actually does do great is their schedules flying from the Midwest. That seems to now fall short.

An emotionally exhausting read, but correct on every point.

Even their obsession with D0 is so ham handed and fundamentally unsuccessful.

This outstanding article gives me “last year of Eastern” flashbacks.

Spot on analysis of what American Airlines is, what it could be, and where it does excel and where it falls short.

1. Garbage entitled union employees who think unskilled labor should be paid like pilots. If AA was a non union company, that would solve 90% of their problems.

2. Operationally, it’s stupid to incentivize based on inputs rather than outcomes. Certainly you want to track on time departure, but making it the end all be all is beyond stupid. They should be incentivized based on something like % of passengers who arrive at destination on time, among other customer service metrics.

3. Stop the death spiral cutting of routes. A route doesn’t have to be profitable, it just has to have a positive effect on contribution margin.

Everything else is unimportant in the grand scheme of things.

Gary, thank you for a comprehensive, well-written article. Customer service often is an issue and FAs on long haul international flights. The best customer service by far at American is the X crew. Transparency and information is an issue as well. AA is notorious for late notifications on delays, even when obvious (I assume this stems from the whole D0 emphasis). I learned something today that I never knew (and I imagine it is in the fine print somewhere, but it was not clear). The helpful phone agent learned it as well. Recently, I was overseas and had to return early. I was having trouble with changing the return, so I just cancelled and booked a new flight. I was sent an email that my travel credit would be in my account. But it was not and I eventually told it would not be there, but I had to keep the ticket info. The reason was not known. Well, I tried to use that today on a domestic flight booking and the agent found out that in fact I can only use that credit on an international flight. I don’t know how or why that makes sense, but it took several communications to get a straight answer on that.

Nice article except about the amenity kits. I value them mostly for the case. I don’t care if the contents are similar.

I do like lip balm and a toothbrush is handy as a spare or replacement.

At the turn of the century I was a die-hard CO flier. To me, Gordon Bethune was god. Employees were happy, 9/11 happened (I’m NYC based and was them “commuting” to Tokyo every 2-6 weeks) in 2000-2001. He invited everyone in the area who was Platinum (75k) or above and/or corporate travel to a rubber chicken lunch at Grand Hyatt Grand Central — thanked us for our business, gave us hotlines and assigned us staff to “help us through the period.” If we had any concerns or suggestions, he said he had our backs and work with us… the one time I did, he DID! I have never gone out of the way to give an airline as much of my own (or then corporate) business – premium or otherwise — as I did then. We were effectively partners. It feels so quaint now.

Bethune from the NYT in 2006 sums it up — “You need to control your costs, but you can’t let cost-cutting take over your business. You need to gain the trust of your employees. You need to treat your customers well. Other guys always wanted to talk about market share. They’d lose your bags but they’d show great movies. We always focused on the fundamentals: get Joe Nocera to New York, on time, with his underwear. There’s no secret formula for this #%&*.” — Imagine this today!

I agree with all of this. The general feeling of discontentment from the employees percolates through everything they do. AA mostly sucks for long-haul, they just can’t compete with the carriers from Asia and the middle east, and even Europe these days.

Flagship dining at DFW is not a patch on what it as pre-pandemic. We had a meal in there in late 2019 that was excellent, like, truly exceptional, complete with vintage Dom. The same experience this year had a menu that was half ‘sold out’, the actual food was better than plane food, but average overall. Champagne was Piper Heidsieck cuvee 1785 ($50 a bottle) which was fine, but it’s no Dom.

Exactly right, Gary. Concise and to the point. Do you know if anyone in AAs C-suite reads your blog? The last time we flew AA, the Envoy employees were more helpful and friendly than the mainline was. That says a lot.

I really didn’t want to, but we have to fly AA over the Thanksgiving week. We booked full fare F because there wasn’t that unreasonable a fare difference from their full Y fares. (Family at other end kept changing plans and I finally lost my patience and booked what there was out of here.) I’m dreading this trip anyway, having worked 20 Thanksgivings in my career.

If things go sideways in either direction, it will be interesting(?) to see how they handle full fare F passengers. I’m not getting my hopes up after reading about AA the last several months.

Why not point out the fact that it requires more lead time to book and ticket a reservation than any other major airline, even the crappy low cost ones. How about the fact that it requires more check-in lead time, more baggage check time and is just generally uncompetitive from an efficiency standpoint. Southwest will let you check in and drop a bag 1 minute before departure. There’s no reason why American shouldn’t let you do the same. Especially when flights are delayed!

Hopefully You will wake up one day and realize that AA is not an airline for You. Your consistent diatribes on how they do everything wrong is tiresome and makes you appear to be a petulant whiney Bitch. There I said it. If a business doesn’t meet your standards then maybe you need to take it elsewhere. For years all we hear about is how AA fails at every juncture. Pathetic, absolutely pathetic. Time you move on and find another Airline and I highly doubt AA or it’s employees would miss You.

The loyalty program is designed for people who use their credit card and don’t fly a lot, thus it never feels very premium. I often pay for domestic first class as I fly across country ans business class, but AA does not value these customers. After years at ep I status matched 2 years ago to united and won’t go back. The difference is massive.

@Clayton Agreed on the heartache of losing AA90 in the morning this winter. I also take it several times a year, and it felt like the last of the LAA routes that “meant business in Chicago.”

I just flew two domestic first trips: one on United, one on American. They were almost the same. American had dramatically better catering. The rest was the same. The crew were friendly on both, WiFi was decent, seat comfort was the same. The United flights had old seat back monitors (LiveTV), so they didn’t have much of an edge for entertainment.

The apps worked, and I had no trouble with ticket purchases or boarding passes.

The United Club and Admirals Clubs were the same: crowded, a bit dirty, unimpressive food. The espresso machines were broken in both. They staff were far friendlier at the Admiral’s Club.

I think the difference is in longhaul premium markets. United has a much more extensive route network, and I’ve found it easier to get partner awards due to the size of the Star Alliance.

The Polaris lounges are great, but the Flagship First lounges are just as nice.

In my experience, the food is unthinkably bad in Polaris; much more tolerable on American.

I’m happy with the seat on both carriers.

American’s premium economy is terrific, especially compared with United.

The crews on both carriers are variable, but generally nicer (usually younger) on domestic flights. I brace for the worst on United flights to/from Newark and American to/from Miami.

As for networks, they each have avoidable hubs (Newark, Charlotte), some terrifyingly miserable economy class seats, but I don’t see them as drastically better or worse than the other. As for Delta, I do think that they often seem happier, and the food is better than United but not necessarily better than American. And Delta has sad 767s in Delta One.

Three major points in American’s favour:

– American has their own ground staff in more outstations (São Paulo in particular.)

– American’s Five Star Service is not cheap, but they do an exceptionally good job. I’ve never had a bad experience. United’s Signature Service is outsourced, and it doesn’t even come close to Five Star. The “Signature” agent was friendly but she had no clue about a gate change, United’s boarding process, and she used a what appeared to be a faux boarding pass to get through security.

– American limits announcements during boarding. It makes for a much calmer experience. Even with noise-cancelling headsets, United’s required announcements are extensive and repetitive. American has done a great job of keeping it a bit simpler.

And one for United:

– I like that I can purchase WiFi in advance.

Bottom line: sure, American can make improvements, but I think they’re pretty damn close to United and Delta.

@ Gary — You should have titled this post “13 ways to give Tim Dunn hand cramps and a stroke.”

Good list but you only touched on one that deserves more emphasis. Poorly trained employees . They deliberately evicerated their call center of knowledgeable agents.

That every elite knows what HUCA is a damning comment. I often have to HUCA 4-5 times for things that are within policy.

@Tim Dunn:

“and the NEA was counter to US law regardless of the party of the administration. DOT and DOJ law at least for aviation is fairly consistent and is not near as partisan as for other industries.”

Agree that DOT / DOJ is generally non-partisan when it comes to aviation (USAirways / United merger was blocked under Bush II).

But stop playing armchair lawyer. The trial court got it wrong. The NEA was not counter to anti-trust law, despite your statements that it has never been allowed before. The standard that the court should have applied to the merger is tha same standard that is applied to a merger analysis, so your JV point holds no water. AA will win the appeal. You read it here first.

Admiral’s Club is getting far too expensive for what you get…perhaps they just wanted to get rid of some customers, and if so that is a terrible way to do business. If not, their squeezing more money out of people is another downward spiral.

I really do hope that someone at AA reads this, and actually takes action. But I’m not holding my breath.

My American flight from DFW to Heathrow was delayed multiple times last month. I was almost ready to give up. They said they were waiting for an airplane.

After >30 years of business flights, many millions of miles and mostly on American (my company’s preference), this article leaves me sad. American has been so good and yet has declined so far.

I remember the classy old commercial where the business traveler finishes his business trip and returns to the airport in a far-off foreign land, and when he sees the American gate he realizes he is “almost home”. That’s still how I think of American… although the reality is hurting.

I agree with pretty much everything you wrote, but sadly feel like it’s a total lost cause. Current management just doesn’t have the vision (or the desire) to improve the airline to where it can actually compete on product and service… they seem to be relegated to just serving hub captives and competing on schedule for everyone else.

I’m a long time AA flyer based on NY who status matched and decamped to DL last year… and I feel like I was one of the last ones out.

Oct

If the DOT had applied merger analysis to the NEA, it most certainly would have been shot down. AA and B6 both bragged that they would end up larger than either DL and UA, which meant a concentration of the market and elimination of a low fare carrier, which is exactly what Was the problem from a legal and antitrust perspective with the NEA

Oct

And you continue to want to blame everybody else except for AA and their own decisions for the need to even have an NEA. AA was headquartered in New York City for years and was the largest airline at LaGuardia and JFK until they quit trying and competitors took advantage of the weakness

@ Gary — $49.95 for monthly internet? That is so 2014. Just switch to T-Mobile. You get free unlimited wifi on ALL United flights globally (when it works), all Alaska flights, all Delta dlights, and almost all American flights. Including the 24-months of required payments for a top-of-the line phone upgrade, unlimited worldwide data, free NetFlix standard, free AppleTV+, and one year of free AAA, our phones for two cost about $145 per month. That will drop to <$120 after two years. Surely this is a way better deal than $50 + your current phone.

Great assessment Gary. Mostly spot on in my opinion.

I’d really like to see an equally thoughtful article discussing why Qatar and Qantas have stopped making J/F partner awards available to AA, from/to US points of departure.

This has been going on for quite a while now, and I have yet to see any of the airline bloggers discuss the possible “whys” in a meaningful or extensive way.

This applies also to BA to some extent, but they’re a different animal anyway (due to the surcharges).

@Tim Dunn,

It’s not CHI it’s ORD., but as a third rate contributor to a pump and dump site like Seeking Alpha……It’s hard for you, I get it.

I tend to agree with the critiques of American Airlines on this page and this critique is generally no exception. I just hate the anti-worker sentiment coming from the ghouls who regularly post here [if you think I’m talking about you, you’re probably right]. I also disagree with the anti-US Airways position here.

I work as a flight attendant for the airline, legacy US Airways [LUS]. And I must say that during the US Airways days we had a much more timely and efficient operation at least.

You could always depend on our flights arriving EARLY. We went out on time. Flight attendants were happier too. We didn’t have endless aircraft swaps and hours of airport sit time.

Since merging with American we have many, many more delays and cancellations. I feel as if we are operating more flights than we actually have the capacity for. This is probably because of the aforementioned aircraft retirements, as you mentioned.

If the company’s favorite excuse for the endless delAAys now is due to weather… I think we obviously need to re-evaluate the majority of our flights being concentrated at DFW. We can’t change the weather. But we can change the origins and destinations of our flights. This is becoming a daily occurrence which, at US Air, was rare.

The second favorite excuse is mechanicals. Even mechanicals were rare back during LUS. Perhaps maintenance was ran better back then.

Somebody, somewhere in DFW is screwing up and I believe that having LUS come back run the logistics would be beneficial for the new American. But yes… I agree employees too would love to see much more exciting destinations. We all agree with that. More exotic destinations, for sure.

Anyway! Both LAA and LUS F/As agree that we should have a better product. We all want seatback screens. We have advocated for better snacks and better coffee.

But as long as flights remain full, the company doesn’t care. Capitalism at its finest! We will keep suggesting the return of seatback screens to the company. They keep insisting that nobody wants seatback screens anymore because you prefer to watch movies on your tablets. Laughable, I know. But this is what they have said for years. The proof? Full flights.

I don’t have confidence in this company until there are changes at the top. This sentiment is universal amongst every employee I speak to.

Exhausting read yes but a good one. Two things though

1) Baggage midhandling. FIX IT. AA is by far the worse and I have no idea why/how they won’t fix. If I need to check a bag I won’t fly AA period.

2) The app/website. Awful. It’s so slow and useless that I refuse to use it. As a result I don’t fly AA.

See how much money American is losing out on with just this one customer?

Outstanding overall analysis.

Very much on point. As a lifetime Gold and now leisure-only traveler, I find very few benefits of status and diminished satisfaction with AA each year. Bring back the 50% off MCE seats (for Gold) and make premium awards more affordable on long distance flights. And if you want to compete with Delta and United, rethink the elimination of IFE on narrow-body aircraft. Travelers shouldn’t have to invest in tablets or laptops for everyone in their party in order to access entertainment while traveling.

pilot

CHI is the entire market = just like NYC.

AA is irrelevant in both.

A220

UA’s baggage mishandling rate is just as bad as AA’s.

AA just happens to carry more passengers so this mishandle more bags than UA – but don’t you dare act like AA is the worst in the industry – they are tied in that regard with United

I generally agree with most of your assessment. Here’s my thoughts:

> Remove a row of seats from 737-800/8 and increase MCE now 166 verses 172

> Drop the A320s

> They are adding a row to A319 of FC and would drop a row of MC 128 to 124?

> XLR will go a long way for better Trans con and expanding Europe and SA routes

> 77W getting refit (yay), now 787-8/9 get refit, not high J like the new 787-9 but an additional row or two of Flagship Suites and two more row of PE on the 787-9s. As for the 772 – drop the older ones as the 787-9 come in, and keep the Flagship forward facing pod versions as is

> Remodel ALL louges, food is better, service always great, just need them to look like DEN or DCA

>Bring back the mattress pads and socks for Flagship Business and just treat FF and FB the same until the refits are done.

> NEW UNIFORMS, they are worst then Soviet era Aeroflot!

> WIFI – Free for Platium or higher, half off for Gold, everyone else can pay or watch an ad

> Partner with Panera for BOB food for MC and remember to give EXP their free food!!!

> Don’t become DL, no horrible TV screen or bad food.

> CLT, LAX, MIA and ORD are being remodeled, Updates coming to JFK; LGA, DCA, DFW, PHX are fine just needs tweaks. Make BOS a hub.

AA has a lot of positives but fix half the list it will be a better AA world for everyone.

From what it sounds like in these articles is that some airline companies need major over-hauls in the way they do business and also with how they treat there customers as well because there seems to be a lot of bad shit that has been going on with certain airline couriers these days and it’s not good at all.

@ Tim Dunn – AA has 23% market share at ORD — you consider that irrelevant?

He has finally lost it, this is his latest meltdown on OMAAT

“There is no community.

There is ONE egotistical person that thinks they speak for everyone – but in fact, they speak for themselves and, just as was the case in every one of their fact checks, were proven wrong over and over again.

The east coast doesn’t consist just of ATL and MIA.

DL ON ITS OWN METAL carries more passengers from ATL, NYC and BOS than AA does from MIA, CLT, PHL, NYC and BOS.

Trying to throw in codeshare partners to overcome AA’s weakness doesn’t change reality.

Do you even know when leadership 7.5 was?

You spout so much crAAp of which you know nothing but the only fact is that you can’t stand for someone to point out that Delta has managed to take billions of dollars in revenue because of AA’s mismanagement.

Gary gets it… he has an article today. Why aren’t you trashing him and telling him he was fired from American?

American has been a 20 year case study in failure and it isn’t over yet.”

American has no style. The airplanes are Ohio themed. Ultra basic.

When an airline seems to consider collecting your money their only business or concern, you have problems from the top down. The employees, despite their best efforts, are only empowered to deliver what doesn’t cost the airline money and often times left without sufficient tools to deliver proper results.

Not only is AA inconsistent and undependable, they almost laugh at you when you expect an apology or some sort of compensation for the loss of time and systemwide upgrades that expired with the flight.

The flight in question was a 77W Miami transcon delayed 8 1/2 hours and downgraded to 737Max with no notice of any delays until check in 4 hours before and then creeping delays until the following morning.

My hope when flying AA is the flight be inconsequential.

@ Jim — Thank you for saving me the trouble of researching this information about CHI. The airline that is irrelevant in CHI is Delta, with 4% market share.

Maybe Tim just made a typo.

@Tim Dunn, let me destroy your argument. And you can’t blame all this on Eagle either

https://www.transportation.gov/sites/dot.gov/files/2024-03/February%202024%20ATCR.pdf

page 40

**drops the mic**

To the Galley Llama,

Being legacy AA, during the merge and post merge to current times, management is USAir. American went from top of the mark to trailer park since this merger and has currently shuffled off into the gutter. Unfortunate. The one thing that has stuck like a disease is the USAir attitude which has and always will be nasty.

You can dress it up anyway you want, lipstick even, but USAir was always the turd the you couldn’t flush down.

@The Galley Llama

You LUS people are a rare and dying (literally?) bunch.

US Airways did get the basics right. They had on time planes, they tried to fix the baggage mishandling issue, they had PDBs.

What’s up with that btw? Are the LAA FAs that much lazier that they still don’t do PDBs?

Do your colleagues hold similar views to you in regards to AA ruining a good company?

I flew AA international first class on a near 17 hr trip earlier this year. The FA forgot to serve me breakfast, eventthough I was awake.

I don’t expect Emirates or Etihad like F service on AA, but how does one forget to serve breakfast in an 8 seat FC, only 3 of whom were awake on a 16+ hr flight?

On the plus side, I took AA domestic first class from PHL t Boston also. Very short hop, but it was a very comfortable FC cabin.

A220,

and yet the DOT’s MOST RECENT baggage data is for Jan through March 2024 and AA and UA BOTH have a rate of 0.77 bags per 100 enplaned.

For 2023, UA was 9 out of 10 and AA was 10 out of 10 for mishandled baggage rate, separated by just 3/100.

AA and UA’s baggage mishandling is similar if not identical.

My statement is absolutely correct.

The “community note” over at OMAAT is just a single anonymous coward AA employee that can’t stand to admit the reality that not just Gary but his readers here know which is that AA has made decades of strategic mistakes, many of which are the result of Doug Parker’s bowing down to labor in order to take over AA during chapter 11 from an independent AMR and the result has been one disaster after another that has left Delta far richer and American far poorer – and AA nothing more than a glorified Spirit (and maybe not even that glorified) with a much smaller international route system with Latin America the only region that works – and DL is circling there with its Latam JV and ownership that is the result of yet another strAAtegic failure.

For those telling us about how relevant AA is in Chicago, tell us what AA’s share was just 5 years ago and what UA’s was then and is now.

DL hasn’t been a major player in Chicago for years – but they do fly to both airports. DL has more revenue share in AA hubs than the other way around. Yet another uncomfortable fact that the anonymous AA employees don’t want to admit.

AA’s role is to provide OneWorld coverage throughout the USA. It has conceded that it won’t compete with international carriers, so why bother with anything more than the most obvious international routes?

AA needs to walk the line between Oneworld quality and Domestic-USA competiveness (it’s most of their business, after all). This is why they seem confused and/or contradictory.

@Gary – a spot on analysis- thank you . It’s amazing that AA doesn’t even address the low hanging fruit such as the woefully uncompetitive million miler program or the lounge food .

I finally gave up on AA a couple of years ago when it became apparent that they weren’t going to address their deficiencies. I am quite happy at UA .

@Tim Dunn — you wrote “For those telling us about how relevant AA is in Chicago, tell us what AA’s share was just 5 years ago and what UA’s was then and is now.”

Tim, this is why you don’t have any credibility around here. You wrote that “AA is irrelevant” in Chicago — YOUR WORDS. That is objectively false. They have 20+% market share in the largest airport. Your statement is absolutely incorrect.

But instead of correcting the record, you did a Tim Trick of throwing a sideshow out there to deflect from the fact that your statement was incorrect. You weren’t discussing market share 5 years ago when you made your incorrect statement. And that’s not what the string is about. You might as well talk about Alaska’s load factor in the Caribbean.

Credibility comes from being right most of the time, and correcting yourself when you’re not. You’re neither right most of the time, nor willing to correct yourself when you misspeak.

You can solve problems 1-10 by hiring my son!

jim,

the only person that has no credibility is someone that refuses to note what AA’s share was 20 or even 5 years ago in Chicago and what UA has gained as a result.

Even though DL has been the biggest beneficiary of AA’s strategic and execution mistakes in LAX and NYC, UA has benefitted at ORD.

I can remember when AA and UA had identical shares and at brief times, AA had slight share advantages. I also remember when AA had a dozen or more flights to Europe from ORD and other times when they had multiple flights to Asia.

Not any more.

The airline industry is highly competitive and anytime ANYONE slips up, others will step in and take share.

AA has retreated to its massive southern hubs including CLT and DFW which are very poorly designed for large connecting operations, degrading customer service, as well as DCA where it has a monopolistic advantage and MIA where it is the only US legacy carrier to most of Latin America.

And yet, WN is certain to expand in N. Texas next year, DL is already seeing revenue gains because of the Latam JV including in MIA, and UA is continuing to gain share in Chicago.

So, while Gary might not have the order of the reasons completely right in terms of the most important, AA’s inability to compete for traffic in the largest and most competitive markets has helped DL the most but UA has also benefitted.

and if you actually bothered to post share changes, it would be clear that AA’s relevance in Chicago has fallen as much as it has in NYC and is happening at LAX where AA and UA now have almost identical shares behind DL.

AA is not sustainable if it cannot figure out how to win in major competitive markets and stuff like the distribution strategy failure only compound to AA’s problems.

Maybe its just me but I always dread checking in with American as the terminal staff are slow have attitudes and very unhappy. All the while seeing the adjacent carriers check in move 4X faster. And there lounges? …… Thank goodness for Priority Pass and AMEX

Maybe its just me but I always dread checking in with American as the terminal staff are slow have attitudes and very unhappy. All the while seeing the adjacent carriers check in move 4X faster. And there lounges? …… Thank goodness for Priority Pass and AMEX

You are completely correct about AA. I am a longtime customer (all number AAdvantage number) with CK status. From my perspective it is all about treating your employees with respect, focus them on customer service, and be honest with your customers. AA employees will then provide superior service to customers. This is where AA totally fails! It is about attitude and values. As a sidelight AA flight crews (captain, etc ) can hardly manage a welcome or thanks. They always seem angry with AA. I learned a long time ago of you want a better product listen to your customer facing employees – they know more than any CEO, COO or CFO.

I’m almost a 2 million mile flyer on AA but stopped flying on them for each of the issues you articulate so well. There’s only two ways out this for AA’s Board, get bought by an Airline with real management, not a bunch of cost cutting “cheap” financial weenies from US Airways, or fire the complete management team and fund a cultural transformation top to bottom. Outside of that Delta can count on my $35k a year flying spend for the foreseeable future.

The combination of 4 (limited partners) and 6 (limited long-haul international) is something that’s been bothering me of late. From BOS, the only international destination I can reach nonstop on AA metal is LHR- setting aside that I’d rather go somewhere further afield, Heathrow is a notoriously overcrowded/delayed airport, and award redemptions via London are £££, this leaves me precious few options if I want to stick with American unless I’m willing to extend my kids’ time in a confined metal tube hurtling through the void by connecting somewhere. Clearly AA needs to cater to me personally better.

@Tim Dunn, this is insane. You made a statement that is objectively false (that AA is irrelevant in Chicago). I quoted facts (AA has 23% market share at ORD) that showed that your statement is objectively false. And you just typed 10 paragraphs — 319 words — of absolute comment barf to deflect from that. You’re talking about Delta at LAX. You’re talking about Southwest. You’re talking about JVs. You took a bit of a swipe at Gary’s analysis. None of it is new information, and none of it is a particularly unique bit of analysis. You just regurgitated a bunch of the same arguments you make all over the place.

Tim, we’ve seen you deflect a hundred times. We know the game you play. It doesn’t work anymore.

Jim,

I’m sorry the truth is so hard for you to accept but AA has become irrelevant in the largest and most competitive markets including Chicago – and Delta and Southwest are not the reason in Chicago.

AA has had a 20 plus year inability to compete in major competitive markets and only succeeds in small towns that are connected to its southern hubs and to its monopoly hubs.

Others see it; I’m not sure why it is so hard to see that AA’s financial problems are directly related to the gains that Delta and United have made in major competitive markets.

And Southwest will expand in N. Texas next year which will add to AA’s woes.

@Tim Dunn — are you really doubling down on your statement that American is “irrelevant” in Chicago?

What market share would you consider the minimum to be relevant?

@timdunn

why didn’t you use the Co-Terminal word?

North America

Chicago (CHI): Midway (MDW), O’Hare (ORD)

Dallas: Dallas/Fort Worth (DFW), Love Field (DAL)

Houston: Bush Intercontinental (IAH), Hobby (HOU)

New York (NYC): JFK (JFK), LaGuardia (LGA), Newark (EWR)

South Florida: Fort Lauderdale (FLL), Miami (MIA), West Palm Beach (PBI)

Toronto (YTO): Billy Bishop (YTZ), Hamilton (YHM), Pearson (YYZ)

Washington, DC (WAS): Dulles (IAD), Reagan National (DCA)

South America

Buenos Aires (BUE): Aeroparque (AEP), Ezeiza (EZE)

Rio de Janeiro (RIO): Galeão (GIG), Santos Dumont (SDU)

São Paulo (SAO): Congonhas (CGH), Guarulhos (GRU), Viracopos/Campinas (VCP)

Europe

Istanbul: Istanbul (IST), Sabiha Gökçen (SAW)

London (LON): City (LCY), Gatwick (LGW), Heathrow (LHR), Luton (LTN), Stansted (STN)

Milan (MIL): Bergamo (BGY), Linate (LIN), Malpensa (MXP)

Moscow (MOW): Domodedovo (DME), Sheremetyevo (SVO), Vnukovo (VNO), Zhukovsky (ZIA)

Paris (PAR): Charles de Gaulle (CDG), Orly (ORY)

Stockholm (STO): Arlanda (ARN), Bromma (BMA)

Asia

Beijing (BJS): Capital (PEK), Daxing (PKX)

Jakarta (JKT): Soekarno-Hatta (CGK), Halim Perdanakusama (HLP)

Osaka (OSA): Itami (ITM), Kansai (KIX), Kobe (UKB)

Sapporo (SPK): New Chitose (CTS), Okadama (OKD)

Seoul (SEL): Gimpo (GMP), Incheon (ICN)

Shanghai: Hongqiao (SHA), Pudong (PVG)

Taipei: Songshan (TSA), Taoyuan (TPE)

Tokyo (TYO): Haneda (HND), Narita (NRT)

and your point?

NYC is a co-terminal, so is Chicago.

and a list of global co-terminals means nothing if AA or any o airline serves any more than just one airport.

AA’s dominance of S. Florida is due to its dominance of MIA so co-terminal doesn’t mean anything.

again, the point is that, co-terminal or not, AA has lost share in New York City -esp. LGA and JFK, and Los Angeles (LAX specifically) and ORD (since neither AA or UA serve MDW).

Sigh Tim here we go again

You’re the guy who argues Delta, with less than 5% market at DFW despite being a former hub, is very relevant in Texas.

Yet AA with 23% market share and rising is irrelevant in Chicago?

Between all those DFW, MIA, and CLT flights AA is very relevant in Florida too. DL just has ATL.

where did I say that Delta was relevant or not in Texas?

However Delta is the 2nd largest airline by revenue (at least) at DFW, Love Field, and Hobby and probably tied with AA when traffic stats for this summer come in.

and, again, you REFUSE to tell us the change in AA’s share – because that is far more significant than the absolute share.

and, I have not argued against AA’s relevance in Florida – even outside of MIA.

The point, which you ALSO refuse to admit is that AA’s presence in Chicago looks like it does in NYC and is becoming increasingly that way at LAX – and yet AA was headquartered in NYC, was the largest airline at LGA and JFK for years as well as at LAX with NYC-LAX the once-backbone of AA’s route system.

AA has fled and shrunk from competitive markets to entrench itself in its monopoly hubs – and yet people have the nerve to talk about DL’s monopolistic hubs when it is Delta that has thrived in NYC, BOS, LAX and SEA!

@Tim Dunn wrote “when it is Delta that has thrived in NYC, BOS, LAX and SEA!” Let’s note that Delta’s market share in BOS, LAX and SEA is lower than AA’s market share at ORD. And Tim has argued that AA is “irrelevant” in Chicago.

Double standard much, Tim?

again, you don’t get it BECAUSE YOU DON”T WANT TO

Delta has GAINED SHARE in NYC, BOS, LAX and Florida while American has lost share in NYC, LAX, and Chicago.

It couldn’t be any more clear for any rational, well-adjusted person that isn’t paid by and committed to protecting American.

Btw, have you looked at AAL stock recently?

It is down 41% over the past year, 23% since January, and 6% just in the past month.

If you really think that I have the power to move stocks, then I truly do live in your head.

Otherwise, real everyday investors recognize that AAL is a train wreck and for good reasons.

Lufthansa isn’t better – on four Lufthansa flights in June, it was horrible. One flight cancelled, couldn’t reach any Lufthansa rep for SIX hours! Another LH flight late 3.5 hours, another LH flight with a broken toilet, leaking into the aisle! And on another LH flight, I was downgraded from business to premium — still haven’t heard back from Lufthansa about some kind of refund for the downgraded seat.

@ Tim — DAL stock is down 13.50% in 1 month. Best, most premium airline ever, for short sellers.

DAL is up 7% year to date, Gene, but you highlight the problem for airline financials – which does affect everything they do including service and labor negotiations.

United only brings law enforcement on aircraft when it is to harass, physically attack and embarass minorities. Dao and now Terrell Davis.

@Tim Dunn — You wrote “It couldn’t be any more clear for any rational, well-adjusted person that isn’t paid by and committed to protecting American.” So to make it clear — your contention, as you sit here wanting people to take you seriously as an airline analyst, is that I’m being paid by AA? Do you have any evidence of that? Any facts to back your conjecture? In your brain, the fact that I held your feet to the fire and pointed out that AA has 23% market share at ORD and is not irrelevant == being bought and paid for by AA? Or are you just typing nonsense comment barf yet again? To use your own words, let’s stick to facts.

Also – you never answered my question – what level of market share do you think is necessary to make an airline relevant in a market?

It would make far more sense for you to be paid by AA in order to refuse to accept that relevance has far more to do with the share a carrier has gained or lost than the absolute share.

AA has lost share in NYC, Chicago and Los Angeles but you continue to think they are relevant.

Their financials say otherwise and nearly everyone else – except you – recognizes it.

Delta may be gaining market share in LAX, but they aren’t making any money there and the three are so close together it’s a silly argument to make that one is bigger than the other. AA has lost market share in Chicago, LA, and NYC, but AA’s needs for Chicago and NYC are different from what Delta or United need from Chicago and NYC.

And if Southwest expansion in DFW is anything like what they did for IAH or ORD, I don’t think AA is too worried.

I think once the ORD expansion is settled plus we all expect some relationship with B6 (if we get a new President) we’ll see AA become more aggressive and fight back on some shares they’ve lost. But by no means, no matter what, AA shouldn’t be considered irrelevant.

@Tim Dunn, throwing aside the fact that you think that an airline with 23% market share is irrelevant, throwing aside the fact that you’re spouting bonehead conspiracy theories that I’m an AA employee, throwing aside the fact that you think Delta is quite relevant in BOS, SEA and LAX with lower market share than AA at ORD, and throwing aside the fact that you’ve written hundreds of words of comment barf without making a useful point — throwing all that aside — you are now conflating financial performance with relevance. They’re not the same thing and you know it. You can be hugely relevant and lose money. Delta was still relevant even when they were bankrupt.

I’ve never been more glad that I have access to quality financial information through my job and can steer far away from the amateur nonsense at Seeking Alpha.

you STILL refuse to identify AA’s DECLINING market share in all of these key competitive markets – which is the OPPOSITE of DL.

and TD Cowan just downgraded AAL stock, two weeks after I said its stock was going to fall.

the evidence is that I made the right call and THAT is what you can’t stand.

If DL can manage to lose money in LAX, SEA, BOS and NYC as many believe and still generate $2 billion more profits than UA and $3 billion more than UA on top of money-losing equity partners, then DL clearly runs a far better business – and it sure as heck isn’t because of ATL, DTW, MSP and SLC where DL’s average fares are very much in line with average fares in AA and UA hubs.

@Tim Dunn — sure, AA has lost market share in some markets. That’s obvious. That doesn’t mean they’re irrelevant. They’re two different things. If you need me to explain to you that “losing market share” and “irrelevant” aren’t the same thing, there’s not much I can do to help you. It reminds me of the time that I had to remind you that “no net debt” and “positive net worth” are not the same thing while you were pretending that you’re a financial analyst last year. If Delta lost 5 percentage points of market share in Seattle, they’d still be relevant. Less relevant, sure. But still quite relevant. AA runs a hub at ORD, has 23% market share, and is the clear No. 2 at one of the country’s largest airports. They could lose 10 percentage points of market share and still be the No. 2 at ORD. I don’t know any world where that’s not relevant.

You did a Tim Trick of adding a pointless aside while typing out a hundred words of useless comment barf. We’re not talking about stock downgrades. But there you go, tossing in an aside about a downgrade. That has nothing to do with what we’re talking about. You also wandered into Delta and United’s profits. Again, we were talking about AA’s 23% market share in Chicago.

You said that I’m paid for by AA. I’m still waiting for your proof. You tell all of us to stick to facts, but somehow you don’t mind offering bonehead conspiracy theories of your own. Put up or shut up Tim. Where’s your proof?

All our collective experiences make the soup this article attempts to define. I’m a very mixed bag traveler doing short and long, domestic and international, paid and award travel. I’ve encountered all of the points listed at the beginning of this article. American used to have practically hourly service NY-ORD and now is closer to every 2-3 hours with no capacity to move pax if there is a single long delay. I’ve had 12 hour delays with no place to move on AA as there is no more co-terminal switches and without a cancelation, bags won’t be offloaded.

I’ve changed the same award ticket for the same exact flights three times as dynamic pricing has lowered the cost. I can pay $1000 in taxes for an award flight or $2k for travel in C on BA because there are no seats on AA metal. All good examples of bean counting that end up costing more down the line.

well… this got political…

been flying AA since my parents took me across the pond at 2 weeks old… 30 years later i’m surrendering my PP status for MVP 75k.

Alaska just does it better.