Activist investor Elliott Capital Management took a nearly $2 billion stake in Southwest Airlines, representing over 11% ownership. They released a plan to fix the airline, and it’s a big old mess.

Southwest Airlines Faces Real Challenges

Southwest Airlines is struggling financially, but is still heavily prized by the market relative to its economic performance. The market seems to think the carrier’s fortunes will turn around already and it’s not clear what changes this investor could push for to improve outcomes that the carrier isn’t already undertaking. Indeed, some of the changes under consideration – such as more ‘basic’-style fare products and more premium legroom offerings – could alienate customers.

Fundamentally Southwest’s issues come down to,

- rising costs

- not growing enough at low marginal cost to spread out those costs

- or growing revenue enough

Southwest only flies Boeing 737s. They haven’t squeezed more seats into those 737s, to get more seats without increased cost while (hopefully) not losing revenue along the way and they haven’t added larger planes (which would come with fleet complexity and cost but on some routes could allow them to fill more seats at lower cost per seat).

Southwest doesn’t offer premium products. They have some more expensive fares, that come with benefits like earlier boarding, free wifi and a cocktail. But they don’t offer a premium experience that people will pay more for, and have been losing out on the recent premium leisure trend.

They haven’t taken steps to hold cost per seat down, or drive premium revenue, as wages and other costs have risen. They pay like a full legacy airline, more or less (their recent flight attendants deal is top of the industry), but don’t generate revenue through long haul international business class ticket sales or even premium economy long haul or domestic first class. They aren’t a low cost carrier anymore.

The airline has, however, managed to maintain a truly unique culture even as they’ve grown and matured. Their people still have fun, seem to enjoy their jobs, and that usually makes them a pleasure to fly – even as in many ways their operation has deferred technology investment for decades.

Elliott Capital Management Has No Idea How To Solve Southwest’s Challenges

Elliott Management’s deck on turning around Southwest begins with ‘the airline faces challenges’ with reduced financial performance and share price and concludes that the strategy must be bad (without analyzing the airline’s strategic shifts that the market still prizes relative to peers).

Then it talks about the assets that Southwest has in its strong balance sheet, domestic network, and Rapid Rewards program as well as strong labor relations and employee culture.

They want new board members, new Chairman and CEO, and a new business plan that mirrors that of legacy carriers.

The Elliott deck is correct but non-specific that the airline has taken a slow, incrementalist approach to change. While they highlight Southwest’s December 2022 meltdown, they do not mention the deferred and slow-rolled technology investments that were a significant driver of the magnitude of that event. Fixing this, already underway (slowly) at the airline, requires greater investment and they want a free ride. They don’t want to talk added spending while complaining about rising costs. Ironically they talk about higher labor costs as a positive in this context.

What’s bizarre is that the proposed solution is checked bag fees, basic economy, premium products and charging for seats. And it’s bizarre on several levels.

- Southwest is already looking at basic economy, premium products, and going along with premium dedicated paid seats.

- Checked bag fees aren’t drivers of revenue per se, but Southwest is leaving tax arbitrage savings on the table by not breaking optional services out from ticket price.

- However Southwest’s contention is lack of bag fees is a key driver of ticket purchases. Their data shows that customers purchase their tickets because of this differentiator. If several airlines didn’t charge bag fees, this equilibrium might not hold. But adding bag fees could cost the airline substantial revenue.

This is the original Wall Street where Charlie Sheen’s Bud Fox, who spent summers as a baggage loader, presents a three-point plan to turn around the airline as its President. The leveraged buy out deal ends in a plan for liquidation of the gates, slots, hangars and planes.

Walking away from their unique selling proposition, trying to become like legacy airlines just a little less, is that path that has gotten JetBlue in trouble. Making Dallas-based Southwest Airlines more like Dallas-based American Airlines isn’t a recipe for financial success. Southwest can’t be turned into Delta or United, either.

In Wall Street, Fox’s father – the union rep – refuses to go along, while the rest of the union signs on with wage cuts to save the airline in exchange for equity. That’s not going to happen here. One thing about Southwest’s culture, combined with top of industry wages (a problem for the airline since it lacks the revenue to service the pay), is that the unions aren’t going to sign on with such an outside plan. Elliott may wind up pressuring Southwest management to become more like the rest of the industry, but it won’t be because they have union backing.

Elliott Capital Management’s case comes down to (1) Southwest Airlines is complacent, and (2) should be more like everyone else. That’s silly. Delta Air Lines trades at 6.5 earnings. Southwest trades at 50 times earnings. And Southwest is not in a position to execute a me-too strategy as I’ll explain.

Southwest Airlines Responds

Southwest put out a milquetoast statement that they’re willing to meet and talk strategy, but they are confident of their course.

We are focused on restoring our industry-leading financial performance, the successful execution of our multi-faceted Tactical Action Plan to improve operational performance announced in first quarter 2023, alongside recent technology investments and operational resiliency programs that led to the operation of 99% of scheduled flights in first quarter 2024.

Our ongoing effort to optimize our network is addressing underperforming markets to better align capacity with observed passenger demand. We recently implemented a new revenue management system which, combined with our ongoing review of transformational initiatives, such as enhancing the Customer onboard experience, represent tangible steps toward achieving improvements in our financial and operational performance and positioning us for sustainable success in an evolving marketplace.

The Company looks forward to sharing additional detail on our plan at Investor Day in September.

They defend their board, which is “confident in our CEO and Leadership Team” of course when that statement gets put out it’s never a good sign. They say they’ve sought directors with airline experience and diverse skills and backgrounds, with “the appointment of seven new independent Directors to the Board in the past three years.”

It’s not as though other airlines have boards that have extensive airline experience and hold management accountable. The board that then-American Airlines Chairman Doug Parker built lacked airline experience.

Turning Southwest Into A Legacy Carrier, Without Legacy Government Advantages, Will Fail

Management owns its operating and financial performance, and resulting lower share price. They haven’t made the investments or improvements that they need to quickly enough. CEO Gary Kelly, now Executive Chairman, shoulders a lot of this blame.

But the Elliott deck fails to understand why Southwest’s performance has lagged, or what they could do to change this. Maybe they have such a plan and strategically chose to release a plan that makes them look clueless?

But doing what Delta, American and United do is not an option or likely to succeed. It did not work for JetBlue. An undifferentiated strategy within an industry whose returns are low overall relative to its cost of capital and whose stock multiples trail even industrial companies is a path to disaster.

If Southwest were to try to make themselves into a ‘Legacy Lite’ they would do so without the assets that Delta, American and United have in international route networks and slots, in congested airport gates and slots, or the subsidies they received through the bankruptcy process to shed costs (including labor costs) while retaining losses to avoid having to pay taxes for years.

Elliott even lumps all of the legacies together in their comparison without differentiating Delta margins from American margins.

- Delta gained the most in its bankruptcy process – American went last and cut short that process as a result of US Airways willingness to overpay for the carrier while still in bankruptcy.

- Delta executed a number of strategic plays, taking US Airways to the cleaners on New York slots, investing in better employee relations and branding.

- United is a worldwide widebody airline, and Delta has the next-biggest international network among legacies, while Southwest doesn’t operate to Europe, Asia or South American.

Southwest isn’t in a position to participate in a long haul anti-trust immunized joint venture.

There’s probably value in bringing in outside management talent, to work alongside company veterans, but tossing top leadership – and the company culture with it – would be a mistake. If they want outside experience from a legacy, Chief Commercial Officer Vasu Raja of American is suddenly available and already lives in Dallas.

When a new hire class at Southwest Airlines completes training, the whole company comes out into the corridors of headquarters to welcome them and cheer them with music blasting as they walk a red carpet.

Front line people from gate agents to flight attendants at Southwest Airlines usually seem to like their jobs, which can be a contrast from other carriers. And it’s notable in the context of being heavily unionized.

But imposing legacy processes, products, and culture on Southwest Airlines employees will eliminate the actual advantages that Southwest holds.

Do you even spell check your posts? Good grief.

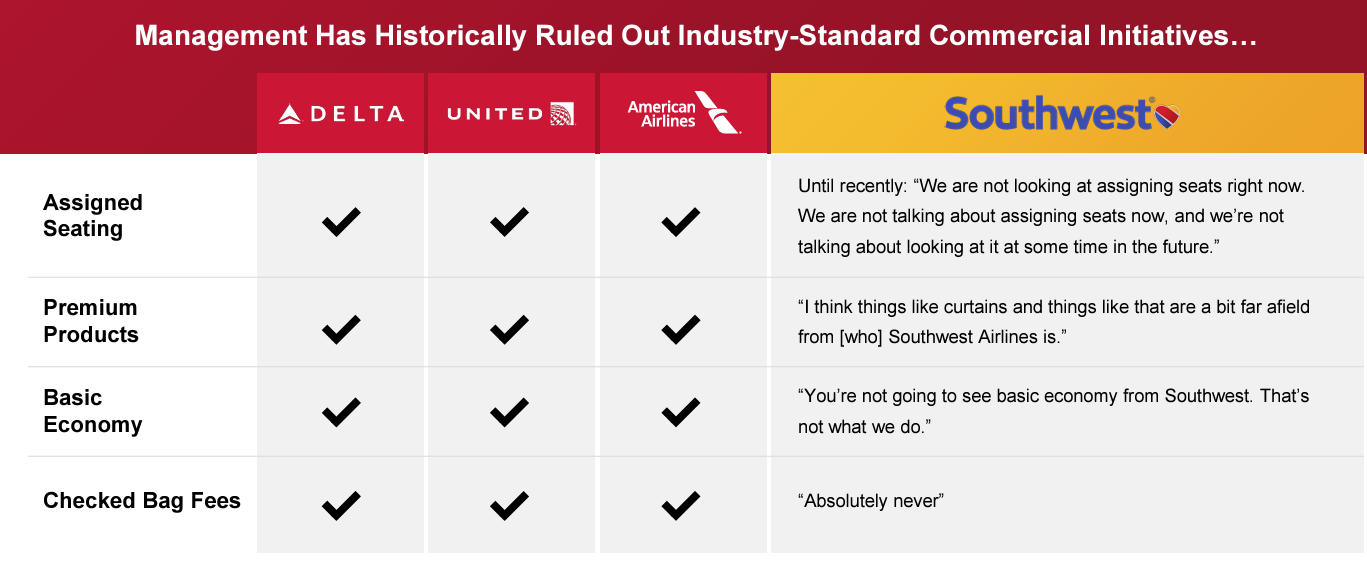

That aside, which seems basic, you should actually slow down and read the proposal – they are not demanding basic econ or bag fees – just stating that current management has been opposed to these things as examples in the past. Which is fair. They are not saying these things must be implemented but rather that something should rather than BAU.

@Tom – they identify all of the gaps as differences between Southwest and legacies. Those are the only specifics Elliott offers.

USAirways DID NOT BUY American Airlines! By Doug Parker’s own admission, USAirways was at death’s door and needed a MERGER to survive. American Airlines was it’s own debtor in possession during its bankruptcy and was running it’s own business. It would have come out a small and distant number three without the merger. I think the confusion lies in the fact that the former USAirways management team did take over running the new entity due to the wild promises DUI Dougie made to the unions.

Elliot with probably do the slash and pump method to temporary increase the bottom line then bail out to leave Southwest to the bankruptcy vultures.

Look out if they start selling Southwest property (or FF program) then leasing it back at a premium to it’s value which starts the death spiral.

When you can’t make money the hard way you can always make money in management fees.

Gary FYI there is a free browser extension that is called Grammarly and will catch any spell-check issues.

@Gary, your take reminds me of Eddie Rickenbacker’s days at Eastern. He felt that passenger jets were just a fad and stubbornly refused to change. As you acknowledge, the flying public – after many years – is finally realizing that you get what you pay for when it comes to air travel. Want more room? Pony up. And it seems more and more pax are willing to do just that. Except on WN, where you can’t. All pax are cattle, from the cattle line and its accompanying bothersome boarding bingo (where you get to accost strangers and ask, “Are you A 13? I’m A 12!”), to the chaotic festival seating (and accompanying seat savers, miracle wheelchair boarders, etc.), to the fact that if you’re paying a last-minute fare (usually the highest), you’ll likely end up with the dreaded C boarding group and likely, a middle seat.

I know the WN fanboys love threatening to leave if things like assigned seats premium cabins, etc. are adopted, but let’s be honest – where are they going to go? AA? Don’t think so. It’s either adapt or die.

It would be hilarious for Southwest to hire Vasu Raja so they should totally do it.

@Ricport – I’ve written that Southwest is missing out on premium revenue, not offering customers a product they want to buy. They are working on this, but not moving fast enough. There’s no defense of status quo on my end, see the section of this post about the problems Southwest faces.

Jeez folks complaining about grammar, what are you complaining about my lack of commas where you’d use them? Not using a hyphen in buy-out? I write the way I speak. If that offends you, that is your right I guess!

@Tom: When writing “spell check” as two words, should a hyphen be used to connect the word spell to check, such as spell-check? Or do you prefer I write “spellcheck” as one word but not two?

Cranky nailed it that the best strategy that WN could adapt is Delta’s successful Keep Delta My Delta strategy which successfully ended US’ attempt to fix US’ problems by decimating DL.

The root of WN’s problems can be laid at Boeing’s feet and their inability to certify the MAX 7 and deliver even MAX 8s which WN has said are too large for many of WN’s route network as a heavily point to point carrier.

as for the characterization of UA’s international network, it is massive but far less profitable than DL’s. The UA fan club loves to tell us how great UA’s network is but they can’t or don’t explain why UA made less than 60% of the profits that DL made in 2023 even at a system level.

If Elliott is going after WN for underperformance, then UA is fair game.

I think Southwest is an amazing success story and would hate to see any major changes They have consistently provided a better product and service in my opinion than the majors. When they were all charging change fees, Southwest wasn’t. This allowed flexibility for my family of 3 to travel without paying Delta’s $600 in change fee, which would basically be throwing the tickets away. I think going to assigned seats would be a positive since so many people don’t like the boarding process. Hopefully they’ll do that and then they can charge more for the seats up front and possible make more than today’s early bird fees.

@ Gary — Noise. Who cares abut Southwest? They’ve gotten what they gotten what they deserve by not investing in IT for 30 years. They don’t exist in my world, and probably won’t anytime soon. They are a perfect example of why Delta shouldn’t get too comfy thinking they will alwys be mostest premiumiest. Southwest was the most profitable airline for a couple decades, and now they are a complete disasater.

@Gary the legacies have moved into LCC/ULCC territory with offering basic economy tickets and reducing seat pitch. No reason Southwest can’t be successful moving to a more premium product. WN can do more to attract business fares by blocking a middle seat or offering domestic F seats (2×2) found on most airlines.

WN can do a much better job promoting its credit card and driving more revenue. The legacy airline credit cards offer early boarding and baggage allowance. If WN charges for bags, you can avoid it with their CC. With a premium CC offering, southwest could offer boarding spots after early bird but before general boarding as a tradeoff for a higher annual fee.

Southwest can levage its position to generate more cash without radically altering the culture of the airline. The current management cant adjust to the current competitive landscape. Bringing in a former airline CEO as chairman may help infuse new ideas into Southwest without radically altering the airline.

Gary – your views (and frankly those of the vast majority of people on here) absolutely don’t matter. The key is stock performance. If there is a plan that could goose the stock price it will get voted in by shareholders. Personally I don’t fly SW (largely because I have lifetime status on all 3 majors and prefer both assigned extra legroom seats and the occasional upgrade). However, my recent experience on SW with the cattle car boarding (that worked for Herb in the 80s or 90s but is not working today), abuse of preboarding and seat saving is a huge negative.

My thoughts is SW should:

1. Immediately go to assigned seats and charge for premium ones like all other carriers.

2. Implement extra legroom seats (at a higher fee) as new configurations are deployed

3. Don’t change the “free bag” status since it has some marketing value for the clueless infrequent flyer who doesn’t understand they can get “free bags” with the 3 majors easily via status or a credit card. It is leaving money on the table but you are correct it may also result in some people not flying SW.

4. Review near term international options. They won’t fly to Europe or Asia without a first class (or J) product but could extend more into Canada, the Caribbean and Central America.

5. Evaluate route network and try to optimize turns while also avoiding, to the extent possible, direct competition with majors or ULLCs.

6. Review all cost components to see where savings could be realized. This would likely be outsourcing some back off functions, cutting non-union costs and looking at technology deployment for productivity gains.

7. Look for ways to better monetize Rapid Rewards or extend their credit card offerings.

Just a thought from my years of airline consulting while with a Big 6 (at the time) firm and around 8 million miles of travel over the last 40 years.

See? My daddy LUV’s to comment on other airlines’ performances by bringing up the world’s #1 PREMIUM airline that all airlines should just stop trying to aspire towards…because they will never get there!

see, you can’t stand to admit that everyone that follows the industry EXCEPT you and your ilk understand that DL is the best run US airline.

The fact that AA and UA incessantly talk about how great they are but make billions less than DL while flying more seat miles confirms the leadership role DL plays.

CF gets it. You don’t.

WN’s turnaround will be on WN’s terms but they are as certain to take pages out of DL’s playbook – just as Scott Kirby says that he has learned from DL.

get lost, you faceless coward

Goodness this is a feisty comment section. I’m no expert but I can tell you all this. I know MANY folks who live within 2-3 miles of Love Field who regularly drive 30-45 minutes out to DFW because of (a.) genuine domestic first class, (b.) seat assignments, and (c.) premium lounges. Bring those three elements to WN and it’ll be a game changer — and not only in the DFW market.

Mike- Interesting to see how it would pan out; We also see people driving out to Love or MDW for SW flights despite other airports being closer.

I do wonder if it would be closer to their DNA to have a “European business” setup where you could buy an empty middle seat (and expand/ contract the “business” section as needed). If you priced it at 50% more, it would breakeven- so why not 66% or 100% more?

Tim Dunn- I personally don’t always “appreciate” your take or attitudes, but see no reason to attack you personally like some of the fools on here (I prefer the “attack the ideas, not the person” philosophy). I also have little tolerance for those types, but please, stop feeding the idiot trolls. You’re just giving them the attention they crave.

@ Tim — IS does not equal WAS. Things change in life. Delta will not always be the most profitable. PIty for you you are an anlyst for such a pathetic industry, with such poor performance that even Warren Buffet realized it was time to exit long ago.

Three things have painfully hurt SWA:

1. Boeing. Behind schedule and with quality issues, so some aren’t flying Boeing planes and those who do can’t do it on the new planes which haven’t been delivered yet – with plugs and more overhead bin space. Meanwhile routes are cut due to lack of planes. I don’t know how to fix this – as having one plane helps efficiency with maintenance costs and training. Boeing has to get its act together! Fast. So activist investors, please pick on them and leave SWA alone!!

2. Cheaters and passenger violence. Post COVID cheating is beyond belief. Egregious seat saving, fraudulent preboarding aliments protected by law, both combined with flight attendants unable to enforce rules due to the possibility of passenger violence causing delays and bad social media PR (and social media applauding bad acts!). One big fix is for the government to require showing your handicap parking certificate (not the plaque itself since it’s not named). Additionally, any threats to flight crew should have the same penalties as those against TSA in addition to being taken off the plane. (Pete B – are you listening??)

3. Government fines and regulations following the Xmas meltdown. SWA went above and beyond making customers whole after that episode. For me, they refunded my flight (for credit) and paid for my 1st class ticket on Alaska – the only seat class available. Yet, on top of that, the government fined them heavily without regard for what it cost them for trying to make it up to passengers. With regulations saying what they need to pay for what delays is now resulting in less Luv dollars than before (anecdotally). I know I got LUV dollars before and not for similar situations this year. Perhaps it’s new management – but perhaps it’s because the government now defines what and when, but a layer of SWA kindness has been shed. The government should have explicitly recognized SWA for all that they did voluntarily and discounted the fine based on what they already spent. Additionally, if airlines go above and beyond recommendations, they should get some sort of credit be it tax or carbon or something to incent customer service.

These 3 have nothing to do with management – except perhaps they haven’t gotten Pete B’s ear in changing the federal rules regarding preboarding and penalties regarding threats on flight crew.

If WN refuses to get with the times regarding assigned seating, then they should have a special wheelchair boarding section at the back of the plane- say last three rows and force them to de plane last after the able bodies egress- that would cut down on the gamesmanship and in the unlikely event of an emergency, they would be closest to rear exits.

The same would apply to a family boarding section- perhaps reserve three-five more rows in the back for family seating.

It gets old reading how ignorant ass country bumpkin hillbillies think they can really game a budget airline’s seating policy post-Covid.

Many retail businesses have been ruined by hedge funds coming in and using them for short term gain. My worry is that this may happen for Southwest.

If one has A-List on Southwest, they get almost guaranteed to not have a middle seat with open seating, despite making same day flight changes, booking at the last minute, etc. Because of this, I find the open seating preferable and do not understand why others do not get this.

+1 for AC’s comment.

That comment offers a very actionable list of suggestions that could still preserve SWA’s customer-friendly, “airline of the people” image, largely by keeping free bag check.

Free bag check has the added benefit of streamlining the boarding process were assigned seating to be added–perhaps especially helpful given that LUV is trying to overcome problems of post-covid pax rudeness.

I wonder if LUV has good post-covid survey data about potential pax preferences RE assigned seats. My guess is a solid majority would be happy to revert to assigned seats. And many flyers I know would be far more inclined to try them if they came with this expected feature.

Gene,

if you read half of what I write, you would know that I view ALL investments as opportunistic. Too many investors write off airlines and miss the opportunity to make good money.

Never have I assumed that DAL will stay at the top of the heap -and I am betting neither do they. But AA and UA have made enormous strategic mistakes while DL has repeatedly outsmarted them.

And DL and WN were neck in neck for years as the two best airlines – with different business models. Ryanair was the European version.

It shouldn’t take a rocket scientist to realize that LUV and RYAAY are both hurting because of Boeing while DAL somehow steered clear of Boeing over a decade ago other than the 737-900ER purchase (which was replacement order for the cxld NW 787s) and DAL is able to keep going while other airlines struggle.

DL’s success is in generating revenue that other airlines only dream about; it is the revenue story that will turn WN around too. They just have to figure out how to make it work.

and Buffett got out of the airline industry in part so the government would support them during covid.

Hee hee…stop it daddy. You forgot to take your meds this morning! Nurse Ed B. will be along shortly to administer them.

blue horseshoe says luv is short

@Tim Dunn, Delta just ordered 100 MAX 10’s, they aren’t some mystical savant with a crystal ball for the future. They are still reliant on Boeing for planes and growth.

Less legroom, checked bag fees, basic economy, premium products and charging for seats are all the things that killed jetBlue’s profitability (by plummeting customer satisfaction and destroying customers price insensitivity and willingness to pay more to fly jetBlue, aka brand value).

They’re going to do the same for Southwest, long term. Of course Elliott is in for a very short pop, and they may actually succeed in making money by ruining an airline (like Doug Parker & Co. did with AA and their outsize total compensation on a sinking stock price).

Stop blaming COVID for bad behaviour; only in USA have people turned to treating each other in uncivilised ways.

It’s all driven by the divide to conquer political narrative that you shouldn’t care about others (masking to protect the elderly, distancing, etc) — it’s all a “personal choice”. This is exactly what you get, as people predicted you would.

Nothing Eliott ever touches has resulted in improvements for workers or consumers. I personally would be happy if these hedge funds were taxes 90% on their earnings instead of 0%. Then the idiots who manage them could find something useful to do.

The primary requirement to work at Eliot is to demonstrate total ineptitude in running and growing a business. Their plan is a simple pump and dump. Spike the stock price by selling and leasing back any aircraft WN owns, take loans against any other assets like RR, and then spend it all on a stock buy back. Note their attention to the strong balance sheet at WN, that’s the mismanagement they see, money is being mostly effectively used to run the business when it should be dumped out to the shareholders for.a one time gain

I don’t get the people being like, “I’ve got it: WN should drop all of its unique selling propositions and watch the money rolllll in!” What are your other ideas– that Olive Garden should goose revenue by getting rid of salad and breadsticks? That IKEA should sell high-priced, assembled furniture (and ditch the Swedish meatballs)?

The reasons people fly WN are: free bags, free changes, smaller airports, and a funky, egalitarian spirit. Losing those things would obviously make the airline less compelling to its audience.

Southwest will never be the most convenient airline for transcon or international flights. It will certainly never be the most luxurious airline. If it tries to compete on route network or luxury, it will fail, while losing the things that make it attractive to its customers.

WN probably just needs to do what it’s doing but with greater investments in technology (and while putting the squeeze on Boeing). In any case, given the airline’s assets and operations, the die is cast: if people don’t like what it sells, it will fail– but flailing around trying to change would only hasten its demise.

@Rose states the case why Southwest Airlines works and why following the big three would be a disaster. A few changes could be made. Those who pay extra to board first should be able to board first. Wheelchair people should board after them. Wheelchair people should have seats randomly assigned in the cabin. No special treatment that lets them crowd the front of the airplane. That would kill off a lot of the Jetway Jesus crowd. Anyone boarding with them has to sit near them. Finally limit saving seats to one per passenger. Deplane anyone who does not want to follow the rules.

john,

yes, Delta has MAX 10s on order because the only narrowbody Boeing sells now is the MAX.

Delta has exclusively bought Airbus aircraft for a decade after its order for end of the line 737-900ERs – which was actually a conversion of the cancelled NW 787 order.

The MAX is an economical aircraft as it currently exists. Boeing will get the kinks worked out and the MAX 7 and 10 certified – but it has been a brutally painful process so far.

And DL bought the MAX 10 because 1. Boeing was undoubtedly desperate to get back in the door at Delta and 2. Delta won the engine overhaul maintenance rights from GE for the LEAP engines that power the MAX. In a few years, Delta will be the only US airline that will be authorized to repair MAX engines not just for their own fleet but for other airlines – and DL will make alot of money doing that.

The illegitimate kid can’t grasp that the reason why DL does so well is because it plays the long game and always thinks well beyond what its competitors are thinking about.

WN has a great history of adapting but they are very slow to recognize changing trends and think out of the box – and that trend is getting worse among WN management.

Someone mentioned that Richard Anderson, former NW exec that helped turn DL around, might be interested in a stint at WN. That would shake things up.

Totally agree with ACs suggested 7-point program above.

Value-add comment of the day – thank you!

If WN would just do #1 and #2 on AC’s list, I’d *think* about flying them, but until then it has to be an absolute emergency to get me to even look at them. The majors (UA is my hub carrier) have such a better product and often at a better price than WN. Between the boarding abuse and issues, the crummy seat options even if you’re high in the B group and the lack of extra legroom (I’m tall) all just make WN a nonstarter.

Booking an assigned seat with extra legroom and an orderly boarding process on UA is worth extra $ to me but often costs less so it is a win-win where I get both wins and WN gets none.

@Rose. So, SW, stick to your guns. Look, Olive Garden and IKEA shouldn’t change. Just like Sears was right never moving their mail-order business to the internet. Just like Apple should have stayed concentrated on making computers. Just l>ke Blockbuster shouldn’t buy Netflix. Shall I go on?

@Boraxo. Hedge funds can only pay zero income taxes by acting as a pass-through entity. Thus, the government gets the often higher tax rates from individual taxes than the lower corporate rate. In general, I think we’d be better off with increasing IQs than tax rates. Indeed, I think the the first act would preclude the second.

@Dave W. Huh? Olive Garden and IKEA have focused on their core value propositions, and both of them are thriving. Apple expanded its product offerings, but always within the same niche philosophy of being a consumer-facing, high-quality, end-to-end supplier. Sears and Blockbuster, on the other hand, flailed around, trying to become some sort of low-cost retailer and “Netflix w/brick & mortar,” respectively, and both went bankrupt. Not sure what point you think you’re making…

I think Elliott has Vasu Taka on back pocket to start all this, high time to fire Gary Kelly immediately .

For southwest who in right frame pays business select fares for ordinary seats and even they do, they need to sit 10 rows back as all wheel chair guys occupy first 5 rows.

If this happens, then by bye Southwest. The company will be destroyed and everything it was built on, including the high quality employees it hires for a reason. It’ll be a “robot” of an airline and things will change dramatically. Gone will be the days of well rounded big heart employees.

As a former airline employee (Northwest), now a professor of marketing strategy, I particularly enjoy reading these comments. None of that makes me an expert, but here are my main thoughts: WN has differentiated itself with operational efficiency (aircraft type), straightforward passenger service (no frills, ABC boarding), and free bags. They’ve never tried to be full-service, add bigger capacity aircraft, or have a complex FF program. Nobody else can do what WN does, and their most regular flyers love them. Other low-cost carriers have failed for a variety of reasons (remember People Express?) or might have survived but don’t seem to have any kind of loyal fan base (Spirit, JetBlue, Frontier, and Allegiant are all commodity players).

There are some things that Southwest must do: keep the pressure on Boeing to get their act together, upgrade their IT, and figure out a solution for the WC/pre-boarding issue. That’s it. They don’t have to add a premium class, extra legroom options, advance boarding passes, or anything else. To borrow from @Rose’s example, it would be foolish for Olive Garden to start charging even $1 for the salad and breadsticks or to upgrade their wine cellar to offer Dom Perignon, etc.

If Elliott wants to buy a business and transform it to make billions, they should pick another target – WN already outperforms the sector. It reminds me of the old Richard Branson quote “If you want to be a millionaire, start with a billion dollars and launch a new airline.”

I am a WN Fanboy. I will state that upfront. For years, I was required to fly UA out of O’Hare. When WN opened up at MDW, I became a customer. I stayed a customer until I eventually went to work for WN in 2004. I was an IT manager before joining WN and refused to work in the IT department because even then it was…lacking. WN made excellent decisions when it came to fuel hedging, being an early adopter of a single plane 737 strategy and taking care of its workforce. You will find few retired WN employees who will talk bad about it. Federal Regulations (ADA especially) cause as much grief to the employees as it does to the passengers. Most of the complaints about people playing games are seen by WN employees and despise them as much as you do. During my 15 years with the airline alternative seating was tried multiple times and got rejected multiple times – by the passengers. Same with bag charges. It is necessary to upgrade the IT and hold Boeing to the fire and maybe tweak a few things but anything else will destroy the airline. As for mergers, flying to Canada and other suggestions perhaps a good read of Southwest history will explain that those were tried and failed and are the subject of several business studies. It might also explain why many WN employees worked at UA/Delta and other airlines and came to WN – and not just for the salary. Health permitting I would still be working there.

One thing I have not seen mentioned here (or anywhere else that I know of) as a way to increase revenue is modifying the companion pass. I know that takes a lot of flying (or signing up for their credit cards), but if you time it right you’ll have almost 2 YEARS of BOGO flying anywhere WN flies. I got my pass in early 2023 and since then we’ve flow many places for half price. Example: taking advantage of one of their many sales and my pass, we flew r/t DAL-DCA for around $100. Now I have absolutely no clue how many passes are active, nor how many flights were taken or the value of those flights (nor would I try to even guess) … but I bet some bean counter does. If they had a $20 ‘administrative fee’ for each time the pass was used, I’d say we’re talking easily ‘millions and millions’ of new revenue. Now the diehards are going to say hands off (just like free bags) and I’ll go elsewhere if they mess with my companion pass, but I’d pay the fee … hell it would still cheaper than any of the Big 3 … and when I use one of my free upgrades to A1-A15 for having their credit cards, I’m golden (full disclosure, I take the aisle and put my backpack on the window seat for the wife … never an issue since we’re usually no further back than the mid-B group … they’ll glance at the seat but keep on going when they see the bag). And come November 2024, I’ll start the credit card process over again so my wife will get the companion pass early 2025 … but the jury is still out if it’s my name or Enrique the pool guy on the pass.