I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Back in the fall Chase added Iberia and Aer Lingus as transfer partners for the Chase Sapphire Preferred Card.

.

Chase also introduced an Iberia card last month and we learned that there would be an Aer Lingus card coming, too.

These are both Avios programs, and you already could transfer from Chase to British Airways and from British Airways to Iberia or Aer Lingus, however to do so your Iberia or Aer Lingus account had to:

- Have been open for 90 days

- Have had some points-earning activity

Chase’s move to add both Iberia and Aer Club means you no longer have these restrictions. I haven’t found Aer Lingus Aer Club to have usefulness beyond what British Airways and Iberia offers, it seems like they built Aer Club to eventually just be folded into a broader Avios program. However there are real sweet spots in the Iberia program.

- Low fuel surcharges redeeming on Iberia flights. If you use British Airways Avios for Chicago – Madrid roundtrip you’ll pay $956 in fuel surcharges. Using Iberia points instead it’s under $150.

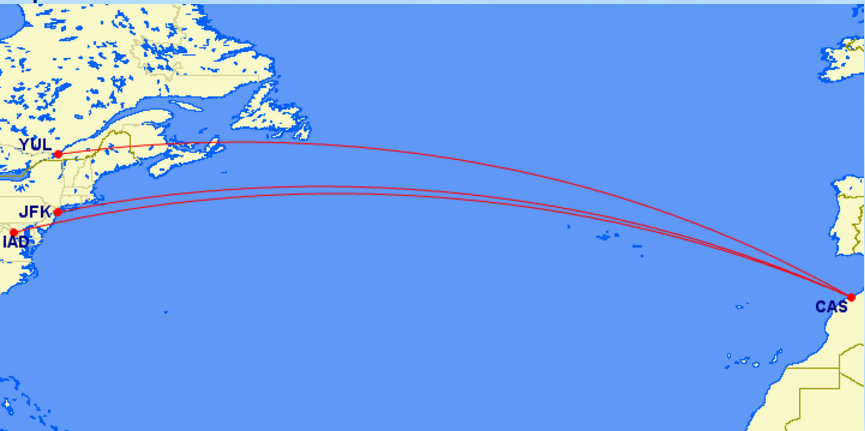

- Cheaper awards. Boston and New York – Madrid costs just 34,000 points each way in business class outside peak season using Iberia. Miami costs just a bit more. You save miles and money booking through Iberia.

Iberia Business Class

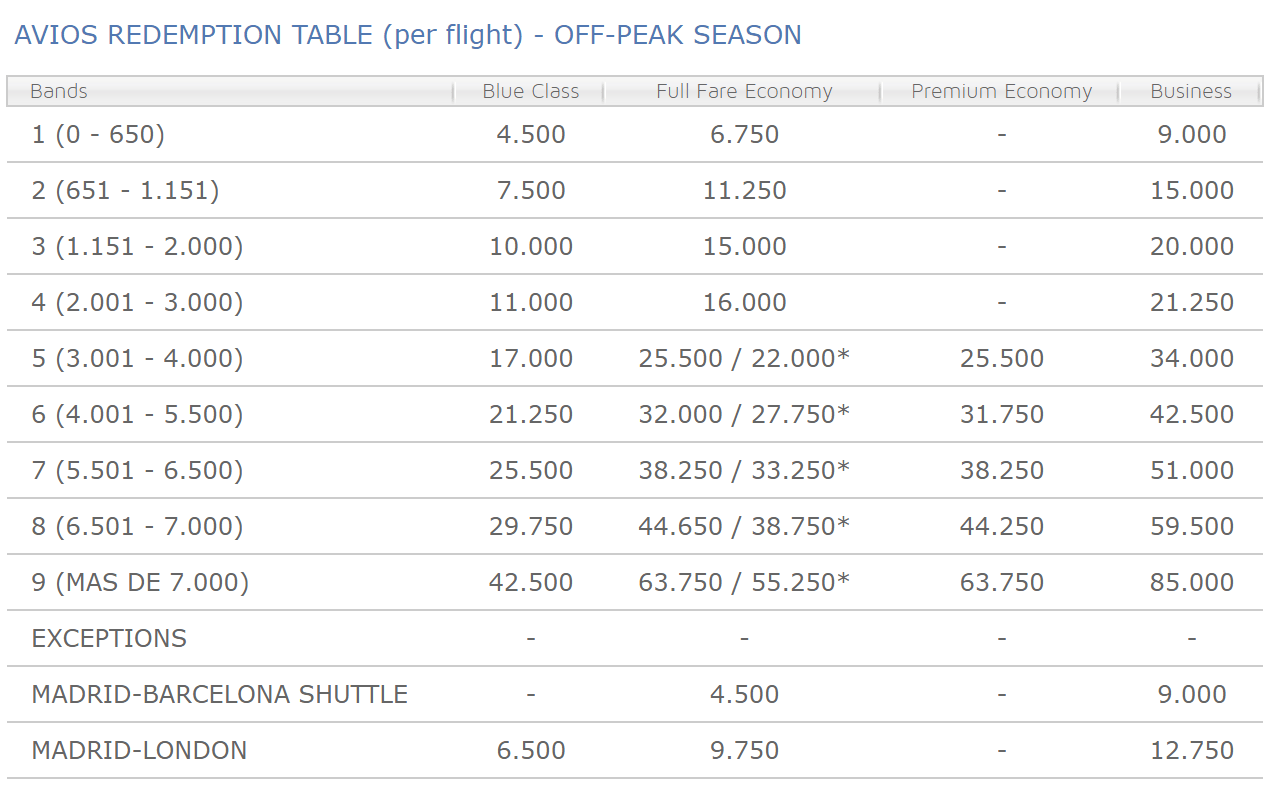

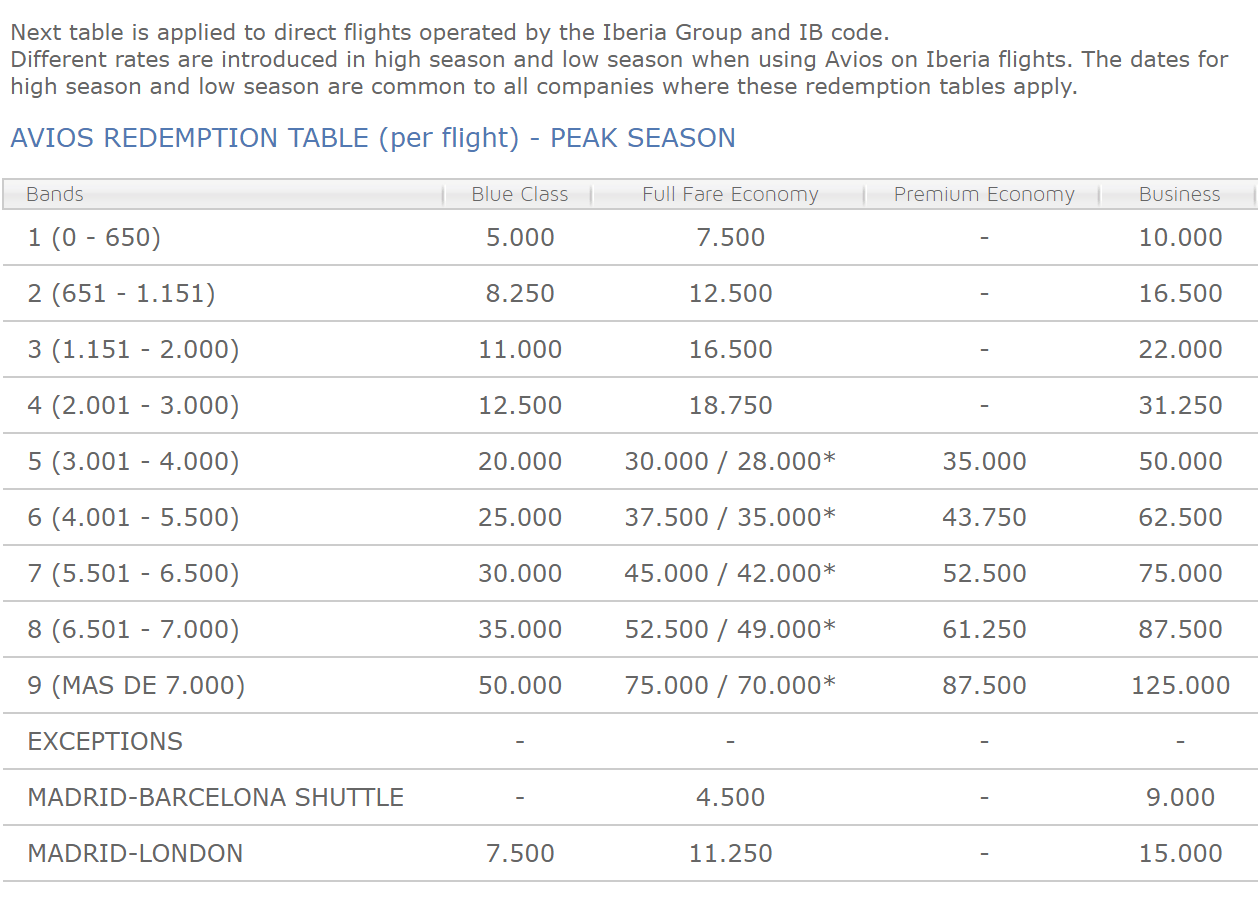

Here are the Iberia metal off-peak and peak award chart prices:

I’ve had great success using Iberia Avios to redeem business class travel on Royal Air Maroc for 94,500 miles roundtrip.

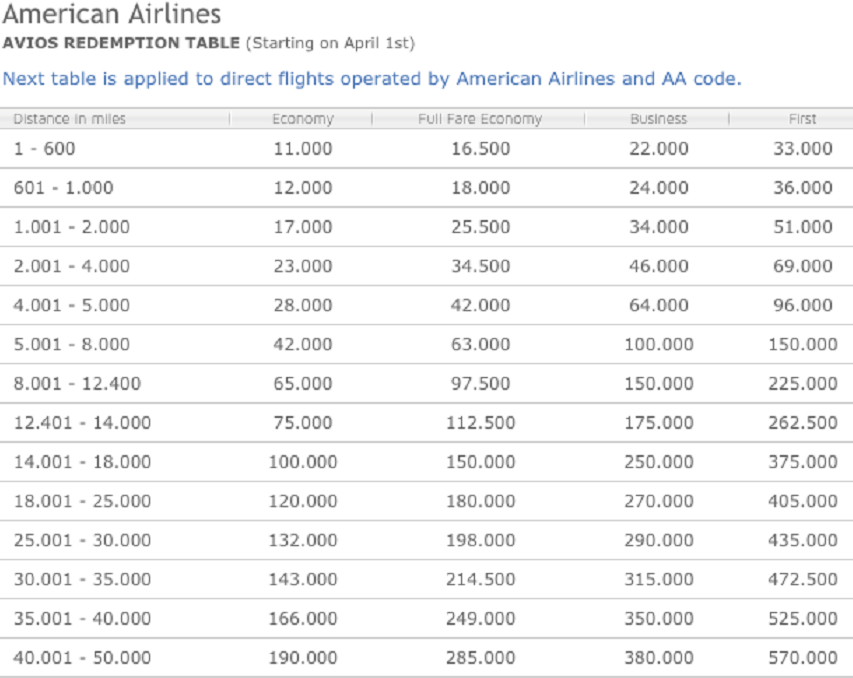

I find their American Airlines redemption chart useful as well. Here’s the pricing:

Both the Iberia Visa Signature Card and Aer Lingus Visa Signature Card are offering big initial bonuses and are $95 annual fee cards. (Neither one is my referral link, information about the products is neither provided nor reviewed by their issuer.)

50,000 Bonus Avios after $3,000 spend within first 3 months plus 25,000 Bonus Avios after $10,000 spend within your first year. Plus a further 25,000 Bonus Avios after you spend $20,000 total on purchases within your first year from account opening.

These are good bonuses from new cards, but you’ll earn more points for your ongoing spend — even if you want points in these specific programs — by using other Chase cards.

Now you have AS on the horizon! Which could work to reach parts of Europe and Dublin clears US Custom there ! As of now AS FF options to get to Europe are slim to none reasonably and AA forget anything but coach

Do you think that it might be the ethical thing to do to mention that Chase is now vastly more likely to close every cardholder account if they look at a new application and decide that the person is just a bit too risky?

Christian you are questioning Gary’s ethics because what, exactly? An edge case where you open a Chase account, the bank looks more closely at your business, and notices your transactions make you look like a money launderer or you’re paying off your cards frequently mid-cycle to generate spend beyond your credit limit (and what Chase believes to be your means)? Seems like the ethics in question there should be those of the cardmember (you?)

Wtf Gary is probably the most ethical of the titans, and the question was meant as it was asked. With Chase implementing new shut down policies, the right thing to do is to warn people who otherwise might make a costly decision. For instance, I have 9 Chase cards between business and personal. I engage in no shady practices but given the number of accounts, I’m still not interested in being reviewed by some auditor.