I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Last year Chase offered 100,000 points for a home mortgage. That offer was stackable with a fee rebate that required signing up for automatic monthly payments, and Chase Private Client customer discounts also.

The branch used to be how Chase would get additional business, if you opened your checking account there you might also take a credit card and a mortgage from the place you did your financial business. A lot of banking is online now, and they’re viewing credit cards and points as a platform for cross-selling customers.

Apparently incentivizing mortgages with points makes Chase twice as likely to get a mortgage from cardmembers. So they’ve brought back points offers.

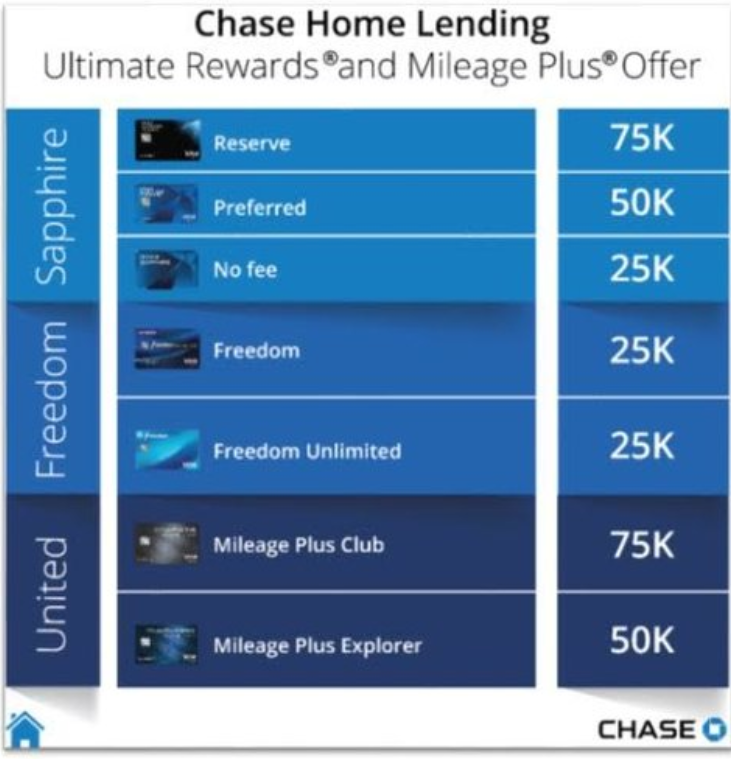

Here are the offers:

- Chase Sapphire Reserve cardmembers can earn 75,000 points.

- Chase Sapphire Preferred cardmembers can earn 50,000 points.

- No annual fee Sapphire, Freedom, and Freedom Unlimited offers are to earn 25,000 points.

- United cardmembers can earn 50,000 miles and those with the Club card can earn 75,000.

One thing we learn about the Chase Sapphire Reserve cardmember population — in addition to average credit scores (785) and annual income ($180,000) Chase has shared before — is that “[t]he average Reserve customer has … more than $800,000 in deposits and investments.” So they figure a down payment shouldn’t be a problem.

(HT: Doctor of Credit)

Too bad I won’t likely be able to stack these being that between my wife and I we hold most all of these cards 🙂