Yesterday I wrote about American Airlines earning its entire pre-tax profit from its frequent flyer program, and that for the last quarter and for the nine months ended September 30 they would have lost money without third party mileage sales.

The implication of course is that they are losing money on the part of their business which involves flying passengers.

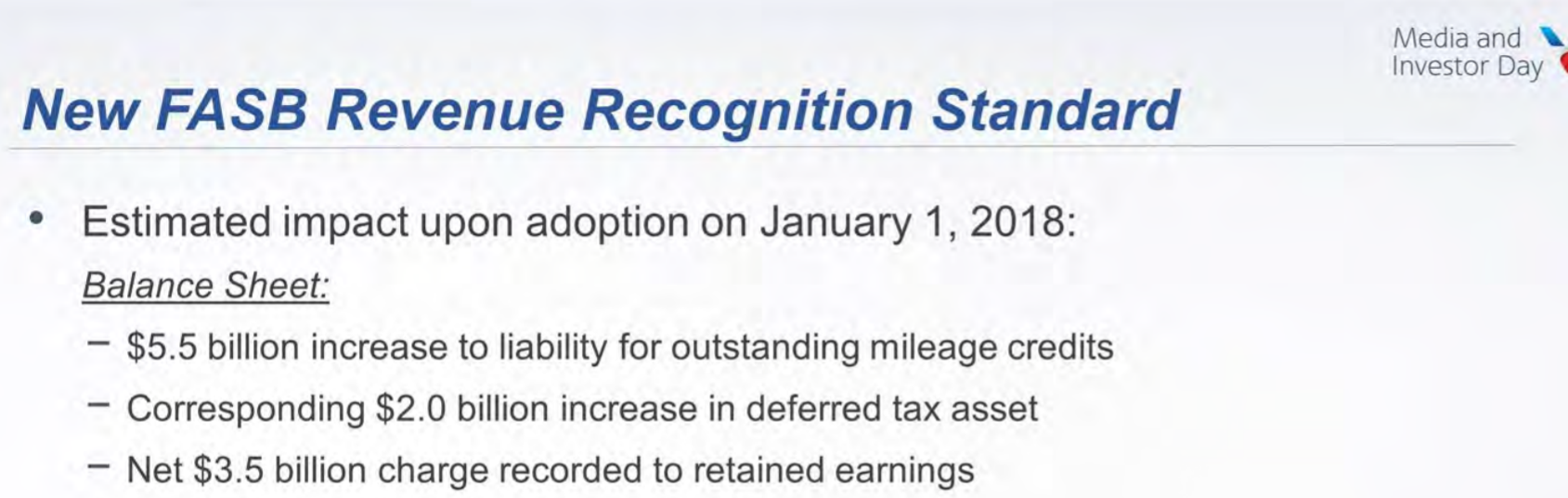

It turns out that American’s passenger operation would look even worse by a couple hundred million dollars if it hadn’t been for an accounting rules change (ASC 606) that the airline had to adopt effective January 1, 2018. This increased the airline’s liability for frequent flyer miles issued for passenger travel in the past, and increased the amount of new revenue they recognize today when passengers redeem their miles.

- When the airline sells a ticket they are providing travel, and also providing miles which can be used for future travel

- That future travel has a value, and American is on the hook (not really) — even though they control how and when the miles can be used and at what cost.

- The new accounting rules require them to split the funds between those two buckets at a fair value for those future travel obligations, and that meant adjusting financials retroactively for this as well.

- American used to just book the incremental cost of carrying an additional passenger as that liability, perhaps $17 or $20 one way.

- Under the new standard the amounts involved are substantially greater than they used to be, in fact they’re about 10 times as much.

At investor day in September 2017 American announced that the new revenue recognition standards would mean a $5.5 billion increase on the balance sheet to account for those outstanding mileage credits from past travel.

Effectively American was moving money recognized from sold travel in prior years onto the balance sheet, to be recognized as revenue in future years when miles are redeemed instead.

When they sell tickets they record a liability for the miles issued that’s greater than before, and then they record the revenue when the miles are redeemed. American’s 10-Q shows this that for the first 9 months of 2018 they have recognized $263 million more in revenue for award travel redeemed than they’ve recorded in liabilities from miles issued for tickets.

The revaluation of American’s liabilities resulting from new revenue recognition standards accounts for roughly 90% of that $263 million figure. In other words, American’s passenger revenue looks $235 million higher than it would have without the new accounting rules that the airline adopted in January (which they were required to do).

I’ve already contended that American is losing money outside of its business selling miles to third parties, mostly banks. Their business of flying passengers would look nearly a quarter billion dollars worse during the first 9 months of 2018 if American hadn’t been required to make adjustments to their accounting.

The accounting rules change of course may be the best possible way to reflect the costs associated with issuing miles. It also has the effect of moving a quarter billion dollars of passenger revenue out of past years and into the present, making the present look better than it otherwise would have as a result.

I suspect this accounting change have and will create two changes in behaviors by the airlines (the first one has been seen – the second is TBD):

1) Airlines will lower the awarding of miles commiserate with the cash revenue taken in – as they have to accrue a liability on the books for the value of the points awarded (this has already happened with the tying of points awarded to revenue about 2 years ago)

2) Airlines should be much more willing to release award seats over time as the differential in economic value on their books is more closely aligned between cash tickets and award seats from a revenue perspective (this one is a more nuanced view and may take time for folks in the revenue management areas to understand)

This report is absolutely fantastic by pulling back the curtain on American’s ‘Wizard of Oz.’ As I commented in your initial revelation on 26 October, at what point does AA’s Board of Directors assume their role to protect shareholders and employees? Destroying the airline by making it less competitive and only profitable due to the sale of miles is not a viable business model!

Or, is AA’s Board whiffing and complicit with management’s deception, just as with the Board at Amtrak and Wells Fargo?

Interestingly, Amtrak’s Board endorses management’s obfuscation of financials by deliberately avoiding GAAP (Generally Acceptable Accounting Principles).to deceive the public into believing the Northeast Corridor is profitable.

What was fee revenue?

@Mike;

Good thoughts, but not sure I agree. They already lowered miles due to flying. But if they lower miles that they sell to banks, it’s lower future revenue. All that changed was the timing of the recognition of the income.

I also thought redemption opportunities would improve, but they persist in restricting saver awards. I wonder if there is a lot of redemption at non-saver awards -certainly that’s what they are hoping for. I bet the lack of award availability hurts the sale of miles to banks, especially with the changes to AA Executive citi card and Barclay Aviator card.

Gary, any idea how the income of a $1 from a sale of miles to a bank splits between immediate revenue (the marketing component) and the delayed revenue (i.e., the liability associated with the miles)

I think we’re at the peak of the credit card rewards extravaganza. Soon expanded use of contactless payments, technology improvements in mobile payments, etc will mean lower interchange fees for issuers. Merchants will not be willing to give up 2-3% of their sales if a better mousetrap exists.

In turn, banks will be willing to spend much less on frequent flier miles because, obviously, giving those miles to customers in exchange for interchange fees extracted from merchants will not be profitable at the same level.

All this adds up to me really questioning Mr. Parker’s assertion that they’ll never lose money again…

Doug is a real Porker.

@Justin

I agree. If you travel a lot you see those wheels already spinning in other countries. In Australia it is normal to see a 1-3% fee tacked on to your purchase if you want to use a CC. In the Netherlands I came across many stores (including some larger ones such as grocery stores) that would accept only local debit card flavors (VPay/Mastro).

I don’t think it is too long before more US companies wise up and the end of 3, 4 or 5x reward categories dries up.

The upcoming leasing standard (ASC 842) is likely going to hurt their ratios quite a bit.

Doug Parker is a loser.

In some sports such as volleyball, hitting the ball foul or out of bounds (OOB) is called “borking” it.

So Parker –> porker –> borker 😉 !