The indispensable Airline Weekly ran stats this week on airline profitability over the most recent 12 months reported. The results are interesting.

It’s a paid subscription publication, so I won’t reproduce full charts, just a few snippets of the most profitable airlines.

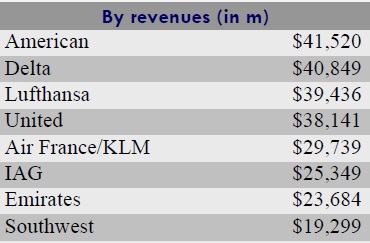

Here are the airlines with the greatest revenue. Note that American and Delta have brought in over $40 billion each in the last year. And by revenue Lufthansa Group (which includes several airlines) is actually bigger than United.

Air France KLM is larger than British Airways (IAG, which also includes Iberia et al) but not nearly worth as much because the former is a money loser while the latter is profitable.

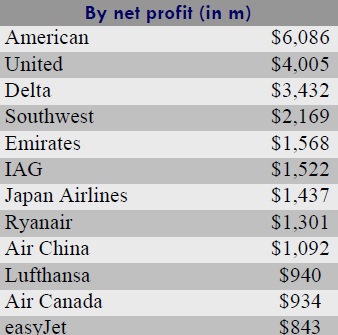

The four most profitable airlines in the world? The four largest U.S. airlines. North America dominates profits, I’m skeptical of Air China’s numbers, and Ryanair and easyJet are striking.

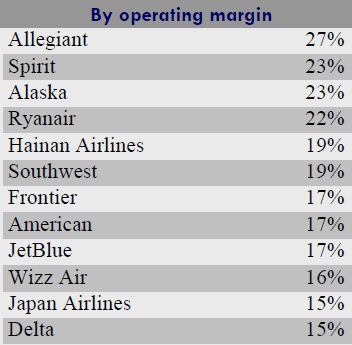

In terms of operating margin, it’s not surprising that low cost carriers do well — Spirit, Allegiant, Ryanair, Frontier. Delta, American, and Southwest are all putting up very strong numbers here. Alaska — despite massive pressure from Delta in their home base of Seattle — continues to put up some of the most impressive numbers in the world.

While US airlines are highly profitable, the clear threat to US and European airlines seems to be coming from these low cost carriers. And yet that’s not where they aim most of their fire.

Indeed the bulk of the world’s airline profits are being made by the big U.S. airlines. Yet Delta, American, and United would have you believe they’re beleaguered underdog’s being unfairly beaten up on by Emirates, Etihad, and Qatar.

Those US airlines claim the Middle East airlines aren’t running real businesses, that’s the crux of their argument (though they faked part of their white paper making that case). Yet Emirates is a highly profitable business.

Emirates Airbus A380 Onboard Bar

Given the strength of US airlines there’s no ‘infant industries’ argument possible here for protectionism. It makes no sense to stick it to consumers by limiting flight choices and limiting fare discounts as Delta is asking the government to do.

Alaska has true loyalty, not transactional loyalty — which gets eroded with devaluations of benefits. That means a lot and can sustain a smaller operation…

Great post and analysis, Gary.

In addition to what you noted, it also seems that the big Middle East carriers actually compete with each other. In contrast, the post-merger US carriers seem comfortable with their cash cow domestic oligopoly and the de facto subsidies they receive from the US Government (e.g., the Fly America Act).

The idea that Emirates is “a highly profitable airline” is absurd. When they become a publicly traded company and have to open their books to real outside review, let me know. I think all the Middle East airlines claim to be “profitable.” When you’re 100% owned by an absolute dictatorship, and most of what you buy are from other gov’t owned enterprises, it’s pretty easy to show “a profit” if you want to. Do you believe the tooth fairy is real, too?

It is most certainly true that the USA airlines — which are real businesses — are raking it in now with the collapse of oil prices. But does that mean they have no right to complain about foreign competitors who are being massively subsidized by their governments? It would be like if the Chinese gov’t were to spend tens of billions to create a clone of Apple: would Apple have no right to complain if that company were dumping smartphones in the USA for 50 bucks? That argument makes zero logical sense.

For those curious, this article shows how Emirates can make a “profit” despite doing many things that are insanely unprofitable.

http://www.huffingtonpost.com/rob-britton/why-emirates-is-not-a-rea_b_8116510.html

Gary,

I certainly believe you when you say that the federal and state governments subsidize US airlines as much as UAE subsidizes Emirates (and good for Emirates to continue to draw alleged subsidies when it is otherwise profitable – a great job if you can get it).

If nothing else, whenever I use DCA, I marvel that my sometime $100 ticket gets me not only a plane, airline staff and fuel, but use of a fantastic facility on what would otherwise be fantastic real estate. I know I share it with 21,000,000 other passengers per year, but, if nothing else, the foregone opportunity associated with those close in 733 riverfront acres must be colossal.

Is there an authoritative study which makes a fully integrated effort at identifying the full extent of public subsidies (including the cost of such foregone opportunities) which American carriers enjoy, either pocketing such subsidies or making them available to their disproportionately upper middle class clientelle through reduced ticket prices?

Two terrible extremes – an oligarchy of main US carriers with no bigger goal than meeting shareholder expectations and a large bottom line with customer satisfaction ranking near the bottom. Luckily the low oil prices at least means they have spent some money towards upgrading some majorly out-of-date aircraft. Otherwise they have divided up the loot and we are a pretty captive audience. On the other hand, keep in mind that the gulf states are absolute dictatorships that have built glossy cities on the back on imported slave labor. The gulf carriers are notorious for some of the most abusive labor practices, particularly among flight crew. So frankly, I don’t think I can bring myself to root for either – they are both the products of very ugly systems.

@jfhscott – the Congressional Research Service tried to quantify subsidies to US airlines in a 1999 paper.

https://file.wikileaks.org/file/crs/RL30050.pdf

They found $150 billion in support of aviation between 1918 and 1998.

This includes capital expenditures on airports and air traffic control. US airlines are criticizing not just direct support of the big 3 Gulf carriers, but also the subsidies to their capital operations in the UAE and Qatar as well. That’s not how the argument is usually portrayed but it’s how they come up with big subsidies in their white paper.

I didn’t just re-read the paper, I looked at it 9 months or so ago, I do not believe it accounts for state-level fuel tax subsidies… for American’s initial major aircraft purchase which was backed by the Reconstruction Finance Corporation.. etc.

And the paper was written before the round of bankruptcies in which US Airways, Delta, and United offloaded ~ $21 billion in pension obligations onto the Pension Benefit Guaranty Corporation through bankruptcy.

In each of these cases there are debates to be had over what should be counted and what shouldn’t be counted, but it’s hardly the case that “Gulf airlines subsidized, US airlines compete in unfettered free market.”

While I agree I’d be skeptical about Chinese airline numbers (save for Cathay/Dragonair), I disagree about your conclusion about Gulf emirate airlines. Their accounting is very different from that of western airlines, so what constitutes a profit becomes speculative at best. When an airline can finance its debt the way these sovereign entities do, you can make up just about any number to be your profitability.

As for the earnings of the big three US legacies,, don’t forget all of them and their antecedent airlines (but for DL) have been through bankruptcy proceedings (some twice), representing many times more “forgone” billions than they are now posting as profits…not to mention a majority of years seldom if ever making a profit since deregulation. Not to mention the pension obligations most of them had jettisoned onto a government agency…and the wage cuts staff have taken over the years.

I suggest those who want to complain about higher fares and these profits should go out and buy some stock in AA, UA or DL. It’s like complaining about the oil companies, you’ll never beat them, so buy in and enjoy the filthy lucre! My personal travel last year was paid for by the increase in share prices and dividends paid by the airline stocks I hold. Let the good times roll on!

@Justin:

That operating margin list is dominated by LCCs who don’t use the traditional “we’ll let you fly in first class with Dom and caviar for supercheap as a bribe to stay with us” model.

I think that points to the limited value of structuring your frequent flyer program as a premium class arbitrage vehicle for people who read boardingarea.com blogs. You can clearly succeed with simply making your incentives transactional and based on “we kick you back some stuff based on what you spend”.

@DavidB I am skeptical of Etihad’s claims of (very modest) profitability. You can question Emirates’ numbers but I am quite confident they are profitable. Qatar? Not so much.

@DavidB while US airlines have been very profitable, that was pretty much baked into their share price a year ago and major airline stocks overall haven’t performed well over the past 12 months

What does the Leff crystal ball show for the major airline stocks in the next few years? The last year has certainly been a disappointment as non oil factors seem to off set gains in the pricing side.

@Michael I invest in low cost index funds. 😉

I’d say that oil should continue to be weak though on reduced Chinese demand