There are all kinds of deals to listen to timeshare pitches. You might be offered free or discounted room nights, and even airfare credit, if you’ll hear out the pitch and consider a purchase. When you check into your resort booked with cash, if they have a timeshare, the timeshare pitch desk may start calling you. There’s big money in selling timeshares, with outstanding timeshares having sold for over $100 billion.

When I was a kid I remember my mother attending a timeshare pitch in Florida. I don’t know what she got for it, but they supposedly had video games for the kids to play during the presentation. It turned out they didn’t.

I spend my hotel points on vacation. I don’t want to book a year or more in advance. I want to stay at different places. I already own my vacation, I don’t have to take out a mortgage in order to achieve vacation ownership. However in case you’d ever think about purchasing a timeshare, here are (7) reasons to reconsider.

- It’s not just the purchase price. Taxes and maintenance fees go up, and you often have no control over those or special assessment.

- And the interest expense! “54% of [Marriott Vacations] timeshare buyers used financing with an average loan of $28,400, an average term of 12 years and an average interest rate of 13.4%.” If you have to finance your future vacation lodging, should you really be prepaying for it?

- You may have difficulty using the timeshare. You may not be guaranteed a specific set of days at a particular property, and instead might have points. Those points come with limited inventory and fine print. If you can’t book your stay a year in advance or more, there might not be any availability for a stay that you want.

- Your life circumstances change. A fixed week, or points, for a family stay each year might sound good when you’re buying. But then the kids grow up and you don’t need the bedrooms. And then your health declines and you don’t travel as much. But you’re still paying the taxes and fees each year whether you use it or not.

- Program terms change. You may be able to swap points between your home property and other locations, and even across other networks. But what happens when the parent company sells off some of those locations, or the partner network gets acquired by a rival and you lose the ability to use those locations too?

You’ll get big promises to get you to commit, and then there are armies of lawyers looking for ways to reduce corporate expenses after you’ve handed over your money… like extra fees for services that may have once been included.

- They aren’t worth as much as you think. Check the resale market for what you’re considering buying. Developers may restrict certain benefits to new owners, but that usually doesn’t explain the difference. Sometimes similar bundles are available at 90% off, or even for $1 with the seller paying closing and transfer costs. They just want you to take the obligation off of their hands. That means the one you buy isn’t a great asset, since you can’t resell it without significant loss.

- You may get scammed trying to unload the timeshare later. There are all sorts of timeshare exit businesses, that say they’ll help you get rid of your timeshare obligations. Often those businesses are scams, too, requiring payment up front and not delivering an exit.

I’m not saying there can’t be edge cases where timeshares make sense. I know people who buy Disney Vacation points and resell them at a profit, though not without some effort and risk. One even managed to get the contract written with their LLC, and they told me they’d “just bankrupt the LLC if it didn’t work out.” Smart! But having to plan for your unconventional exit strategy when signing the contract underscores just how risky a proposition a timeshare can be. And Disney is one of the best you can own.

You’re better off with a big name brand than an independent, because they offer greater coverage, they’re easier to resell, and they have a brand they want to protect. That hasn’t stopped big name timeshare brands from devaluing their programs. You pay up front, they have your money, and you’re often at their mercy. Even the ability to exchange points may change. Forever is a long commitment, and much changes with time. Deals you’ve purchased in the past almost never get better.

However if you want to go to a timeshare presentation for the perks, you’re probably someone who enjoys spending an afternoon at the dentist, then have your fool proof story ready. You’re single and with bad credit. You plan to vacation in the continuous permafrost regions of the Siberian and Ural Mountains. And your brother – who isn’t present on property, or even reachable today – has power of attorney over your financial affairs.

Have you ever purchased a timeshare? I’d love to hear your story, whether it worked out well for you or not.

(HT: @crucker)

Bought a Worldmark membership with SIL just about the time Wyndham bought them from Jeld-Wen. Wyndham sold memberships much faster than they built properties, so it got trickier and trickier to get a room. There was EXTREME pressure to attend a sales pitch on every visit, which usually took 4-6 hours out of a vacation day. The last straw was when they made it impossible for us to book rooms for nonmembers–in our case, our kids. We just gave our half back to SIL and walked away.

Oh, BTW, as they sold more memberships the new members got rowdier and rowdier. Awakened by parties several times. Front Desk always said there was nothing they could do.

Timeshares work for perhaps 2% of people. For the other 98%, they will be better off using the standard model of regular hotel reservations, Airbnb, Vrbo, etc.

Most people don’t realize that there are countless timeshares available for $1 from people trying to get out of them.

People need to consider that if timeshares are so great and such a wonderful investment, why are so many timeshare owners trying to get out of them?

“you’re probably someone who enjoys spending an afternoon at the dentist, then have your fool proof story ready. You’re single and with bad credit. You plan to vacation in the continuous permafrost regions of the Siberian and Ural Mountains. And your brother – who isn’t present on property, or even reachable today – has power of attorney over your financial affairs.”

Bro why are you putting my personal life on blast for your readers

I might add that NEVER buy a Mexican timeshare. I was a professional buyer and I was taken as well. Mexican contracts are written in pigeon English and are loose translations of the Spanish language actual contract which most people never see. I’ve seen them and it is a deliberate scam. Mexican developers often change ownership umbrellas to void TS contracts. When a complaint is made to PROFECO (the Mexican consumer protection agency) the developer just bribes (mordita) the inspector and that closes the case. US credit card companies are not very supportive even within the 5 day rescission period.

I’ve warned family members that if they buy a TS I’ll take them out of our will.

The US embassy is useless in a dispute and lets the extortion of Americans go on.

My solution is to tax remittances to Mexico and set up a reimbursement fund but that will never happen.

BUYER BEWARE Don’t buy anything in Mexico you cant take home with you or flush down the toilet.

I went to pitches several times. Used car salesmen are more honest.

I totally disagree with your basic premise. We owned a timeshare, four fixed weeks, on Sint Maarten for 9 years. It was perfect for us Northerners, end of January to beginning of February. We were able to select what we thought at the time, and never looked back, a great location in the complex. We generally used 2 weeks there and rented the other two weeks. The two week rental kept us in the black for the whole time we owned them. Even though we eventually sold for less than we paid, between rental income, depreciation and having a wonderful time on the island, we came out way ahead.

I can’t emphasize enough how important it is to select a well-managed timeshare on an attractive location with fixed weeks rather than points.

We have Disney and have been very happy with it. But the agent who sold us our first contract was very honest and said that we should ONLY buy if we’re serious about visiting Disney *alot* (we were, we are, and we do).

She literally told us DON’T DO IT if we were planning to regularly exchange our Disney points with other time share companies — it’s not worth it.

Mexico has changed the name from timeshare to Vacation Club due to the negative connotations associated with timeshare. I warn any first time visitors to absolutely not sign up for a presentation. Email the resort ahead of time and tell them you don’t want to be approached by the vacation club staff. Sometimes they will still try and hand you off and if they do be absolutely rude as hell. I yelled at one in the lobby that refused to issue my room key until I signed up. I got everyone’s attention and they couldn’t get me my key fast enough and out of the lobby. I also tell everyone when you exit customs in Mexico don’t stop walking until sunshine hits you in the face. Beyond customs, unless they are uniformed police, they are salespeople who will say anything to get you to stop. I usually speak German to them which confuses them.

Bought three weeks of timeshare in Delray Beach, Florida in 1995. The original intended use was to house our 4 children, my wife and I, when visiting my parents at the end of the year. We bought fixed weeks — weeks 51, 52 and 1, in a 2 bedroom unit large enough to house all of us.

I still own it. Now we use it when my oldest daughter and her children come down to visit at the end of the year, as the timeshare is less than 10 miles from our home. Still a favorable purchase.

But there are caveats —

— NEVER buy from the developer. We bought in a built-out building in the secondary market. Someone else took the hit on the depreciation. If you want to buy, look in the secondary market – where existing owners are trying to sell their units. And see what the going rate is for the resale..

— Will your children want it when you are gone? Are you prepared to surrender it for no money to the management when you can’t (or don’t want to) may the yearly maintenance?

— Will you want to go there year after year? What about the political situation? We sat through a pitch for a beautiful timeshare in Mazatlan, Sinaloa, Mexico. Mazatlan is a beautiful colonial city, but I do not feel comfortable going there due to the current drug wars involving the Sinaloa cartel. There were numerous timeshares on Isla Margareta in Venezuela when we visited there before Chavez took control. I don’t even see exchanges listed in RCI or Interval for that area of the world.

— The yearly maintenance WILL GO UP. Insurance is very pricy here in Florida, and state law does not allow the Board of Directors to “go bare” (without insurance). Hurricane Ian really put a damper on insurance.

— After Hurricane Wilma, our timeshare development (although not our unit) suffered significant damage. You are responsible for special assessments needed to make those kinds of repairs – inclluding the installation of hurricane impact doors and windows when we needed to do so after Wilma. And your Board of Directors will make the decisions on how to remediate damages — not you.

— Note also that it is not unique to timeshares that your maintenance or fees will go up every year. More than half of all Floridians live in a condo, a coop or an HOA. All of these have the same issue — you do not have control over your yearly costs (but you don’t with a home, either — you always have the taxes and insurance adjusting your escrow payment).

— If you say no to the first pitch in a timeshare sales pitch, the sales staff will turn you over to another team, with more pressure and a lower price. The price will keep going down the more you say “no”. What does that tell you?

So, like everything else in life, there are trade offs. Rent before you buy. See if you like the facility without paying attention to the sales pitch. Figure out the long term and run the numbers. Like everything else in life — where you stand depends on where you sit.

Add to the fact that in my case I bought via Marriott and not only gas the point exchange changed but the also watered down the Marriott Rewards program several times. The sales process and resale process is almost criminal too.

A lot of timeshare scams, both via phone and in person, center around Vallarta Gardens in Cancun, Mexico.

As to Vallarta Gardens, it’s a resort that exists just to run scam sales operations.

https://medium.com/swlh/from-amazon-returns-to-extended-auto-warranties-how-not-to-get-scammed-when-your-phone-rings-46327b8e149d?sk=fa6db19b3967bcfa68af20320fd6183e

Gas should have been gut.

One of, if not the worst decision I ever made!

DON’T DO IT!

It’s a SCAM!

In 2007 we bought a deeded week at the Marriott Canyon Villas at Desert Ridge in Phoenix. We paid $28,000, I seem to remember, and we never bought into the point program that Marriott Vacations later introduced. At the time our kids were in middle school, and Phoenix was a great way to escape the Chicago weather during spring break. We used the time share as a family every year until the pandemic. During that time the annual assessment slowly rose from about $600 to about $1,500. When we occasionally had difficulty getting a reservation at our home resort, we would trade for another Marriott property in Palm Springs or Las Vegas. We greatly enjoyed these family vacations in these comfortable, well-kept properties. By 2020 our circumstances had changed; we moved to the Phoenix area and our children were married, working adults who didn’t want us to gift this property to them. And my wife and I didn’t really want to vacation that way any longer, a fact that we never envisioned when we purchased the place. We sold the deeded unit back through Marriott in 2022 for $11,000, but Marriott took a 50% commission on that. At the end of the day our prepaid vacations through this time share investment weren’t the greatest financial decision, we broke even at best, but the timeshare was a great lifestyle decision for our family.

I smelled something Rotten in Denmark from the first presentation many years ago

I attended in Orlando. When Starwood was alive and well and far from becoming poisoned by Marriott.Came in with an open mind but new after one conversation it was a no for me Dawg.The upside some Starpoints for my pain of the scam presentation/pitch

For those that took the bullet often try and justify these dodgy purchases.

I bet if they offered their complete money back with interest most everyone would take the refund as fast as they could and runnnnnnnnnnn.

How do you say NEVER!

Watch out for anyone trying to offer free anything (we were offered free dolphin swim) when exiting Cancun airport. A trap to get into this kind of presentation.

Watch out at all-inclusives (including a lot of higher end chain ones, like Hyatt’s AMResorts brands Secrets/Zoetry) as they have the Travel Clubs that are “totally not a timeshare”, but instead it is almost worse. Except for a handful of one-time use free weeks you might negotiate, you pay 5 figures upfront for a 20-40% discount and some other mild benefits, generally with a bunch of levels that scale up the benefits.

The biggest red flags are that they don’t let you read the contract outside the sales area, they don’t let you send it to a lawyer to review it, and there is an NDA that you can’t tell others what you paid for it.

The worst part: Travel Clubs are usually set up separate from the resort chain and have language that they can be shut down at any time with no compensation due to the members. They also make most of their revenue on the contract signing, then deal with costs on the backend as members start using it. So, if AMResorts sees dwindling signups for their Unlimited Vacation Club while the costs of existing members gets higher and higher, they can legally shut it down, and cancel all member contracts. The next day they can start up Ultimate Getaway Club with similar tiers and benefits, but no previous member costs and no compensation due to the prior club members.

I agree with Barry S. Glassman…

I too have a timeshare on Sint Maarten and couldn’t be happier. We have 2 weeks in December and we are guaranteed our weeks. It’s rate the #1 timeshare on Sint Maarten and we’ve had it for 20 years. It’s run by a German family and if there is an increase in the maintenance it’s been only minimal to cover their increased costs. There have been years with no increase at all. If we just walked away from it, we still would have gotten our money’s worth.

Time shares make wind and solar energy look like a good investment.

Given their awful reputation, I remain surprised that the timeshare business even survives.

I am sure there are angles where you can come out ahead in this game — most of them by buying cheap resales — but it’s a game I’ve never wanted to play. There are so many easy ways to play the loyalty points game to get cheap vacations with no risk, that timeshare knowledge never seemed like a productive use of time or money.

To anyone with young kids: they try to pitch you on the convenience of having a full kitchen, washer/dryer, separate bedrooms, etc. Once your kids are able to sit in a restaurant, you probably won’t want to spend vacations cooking, cleaning up after cooking, and doing laundry. If you regularly read this blog, you should have elite status that gets you free breakfast anyway, and possibly on-property credit to use for other meals or lounge/club access. You will be better off booking two hotel rooms that someone else cleans for you. I do not own a timeshare myself but have relatives who do and regret it. Point transfers are next to impossible to get value with, fee increases are unpredictable and unregulated, and you need to commit to vacation time at least 11 months out if you do not have fixed dates. You can also be screwed if a natural disaster disrupts your planned dates.

There is a lot of truth to many of those criticisms, especially relating to the honesty/reliability of timeshare salespersons, annual maintenance fees and the fact that they should not be bought for their resale value. Also, if you have to borrow the money to buy one, it is probably not a good idea to be buying.

What you are buying is a vacation, not real estate. If you recognize that fact, it can make all the difference in the world. We bought into Vistana (formerly Westin, now part of Marriott) about 10 years ago in Cancun and have made great use of it. We receive a number of points (called Options) each year that can be used at any Vistana or (now) Marriott timeshare property, converted to Marriott points or rolled over for use in future years. But we LOVE the Westin Lagunamar in Cancun, which we visit every year. It is a beautiful hotel right on the ocean and every room has an ocean view balcony. Plus, we love having a full bedroom plus den plus kitchen plus washer/dryer all in the unit. In other words, it is MUCH better than an ordinary hotel room.

We have also used our timeshare points to visit Cabo, St. Johns, Palm Springs, Maui, Kauai, Myrtle Beach and, this year, St. Kitts. These are all beautiful properties and would have cost us many thousands of dollars if we had to pay for them individually. People say that it takes about 10 years to break even on the upfront purchase price plus maintenance fees, and I wouldn’t disagree with that. But we have absolutely gotten our money’s worth from it and plan to continue doing so for years to come.

And while it is also true that there are timeshare exit company scammers galore, you don’t need to deal with them if you want to unload your timeshare. Most legitimate timeshare companies will simply let you turn in your timeshare for no cost….assuming your kids don’t want to continue using it when you are no longer able to. For them, it’s an even better deal because they don’t have any upfront cost, just the annual maintenance fees.

Of course, you really need to stick with the major hotel companies that have desirable resorts in desirable locations and are generally trustworthy, like Marriott, Hilton, Disney and Hyatt. And for the reasons stated in the first paragraph, timeshares clearly aren’t for everyone. But if you go into this with eyes open, knowing that you are buying perpetual vacations (along with annual maintenance fees) and NOT a real estate investment that will appreciate over time, you may just find that it is a pretty good deal after all. It clearly was–and is–for us.

One final point: I LOVE the timeshare “update” (actually, sales) talks we get when we visit them. Why? Because we are not the least bit tempted to buy any additional timeshare options (we’ve got all we need) and we collect many Marriott (or Hilton, depending on who owns the property) points for spending 60-90 minutes of time with them. In Cancun, we are getting 150,000 Marriott points for listening to the “the talk” and that alone is worth about 3 free nights at many Marriott properties. If you are not easily tempted by sales pitches, this can be a real bargain.

I’ve been to dozens of timeshare presentations in the past three decades. My current wife even signs us up for them now that she understands there is zero chance of ever selling me. I love all the freebies – often now worth $500 and up – and my 60-120 minutes are well spent to gain them. We only go to locations we consider a vacation anyway. I’m intrigued by the bogus math and projected values applied in the presentation and I enjoy talking them through with my immigrant wife so she understands the power of salespeople to persuade people to buy nearly anything. My wife learned to distrust information she didn’t gather independently on her own. I’ve sat through presentations with many brands: Marriott, Hilton, Hyatt, IHG, Starwood, and Wyndham, among others. Nearly always, the salespeople and their sales manager run out of gas and simply sign over the benefits before I’m even done asking questions. Sometimes I have to remind them of some of the additional sweeteners I was offered to get everything I was promised, but they have always delivered.

That said, I’ve visited timeshare resale offices several times and talked more seriously about buying resale timeshares for pennies on the dollar. Unfortunately, those offices don’t have any nice freebies. I don’t have any interest in the $1 units I’ve been offered because they are never worth that much. Mostly, I’ve considered two-bedroom resales in Hawaii in nice developments with moderate maintenance costs. Even then, though, the hassle factor – when and how to use them, how to get rid of them, and the like – have always won out for me.

Since I now have a family with two young children, I would still consider resales as having possible value, but I’ll do my “research” at the developer’s expense.

@JS, I still see value in having laundry washer/dryer in the room even if get free elite breakfast as it can help reduce the amount of packing needed for a big trip by needing less clothes to carry. But kitchen, not so much except for small things if have particular need not easily available elsewhere such as making a particular kind of tea.

Agree with Luke, except that we find the kitchen very useful for breakfast and lunch. We generally only go out for dinner when staying at a timeshare, and that too saves us a lot of money that we would otherwise have to spend on restaurants. We just go to the grocery store on the first day we get there and we are good for the week after that. The washer/dryer means packing fewer clothes, as Luke noted, and the extra room is great when one of us wants to sleep and the other doesn’t. At Cabo, we even have two bathrooms in a one BR unit!

I have a timeshare that is shared catamaran charters, and I still love it. I did my first sailing with them in 2002 through RCI and would have bought then, except it was the wrong time in my life. When I was in a position to buy, I did just that, and I’ve “re-upped” twice. This ownership is time limited, varying from 6-12 years depending on what you sign up for. I’ve sailed with them all over the world: Canary Islands, Thailand to Malaysia, French Polynesia (Bora Bora among other spots!), Maldives, Seychelles, Tobago, St. Maarten, BVIs, St. Vincent & the Grenadines (various islands), Fiji, Antigua, Caribbean discovery cruise island-hopping, and many more destinations. There are absolutely additional fees – annual maintenance fees capped by the number of “points” you have bought, and an all-inclusive fee due on sailing which covers the food & booze. And of course, crew tips.

There is scuba diving included, snorkeling, kayaks, paddle boards, swimming off the back of the boat, various excursions on shore, meals, booze–I think this is one of the rare timeshare purchases that are worthwhile.

While there may be benefits to owning a timeshare, it comes down to this: is there any place a non-timeshare owner can’t get to? Are non-timeshare owners locked out of any location?

And I have yet to find a place where that is so.

Timeshares have their benefits for perhaps 2% of people. The other corresponding risks are simply not worth it for the other 98%.

Ellen, that sounds very cool. It’s not something I would want to do as I like looking at the ocean much more than being in it, but different strokes for different folks. I think together we have shown Mr. Leff that timeshares are not necessarily a bad thing.

There are very few words that qualify as complete turnoffs to educated people, but three of those words are:

Scientology

Astrology

Timeshares

Ben Rothke: You are right–there is nowhere you can’t go if you are willing to pay for it. That’s the nice thing about being a timeshare owner–once you’ve paid the upfront cost, the yearly maintenance fees are a small percentage of what the actual cost of these vacations would otherwise be. Perhaps you are also right that they are only appropriate for 2% of the population (although the number of happy timeshare users in the Timeshare Users Group would seem to suggest otherwise), but if so, I’m glad to be in that 2%.

Dignity, I completely agree with you about Scientology. 🙂

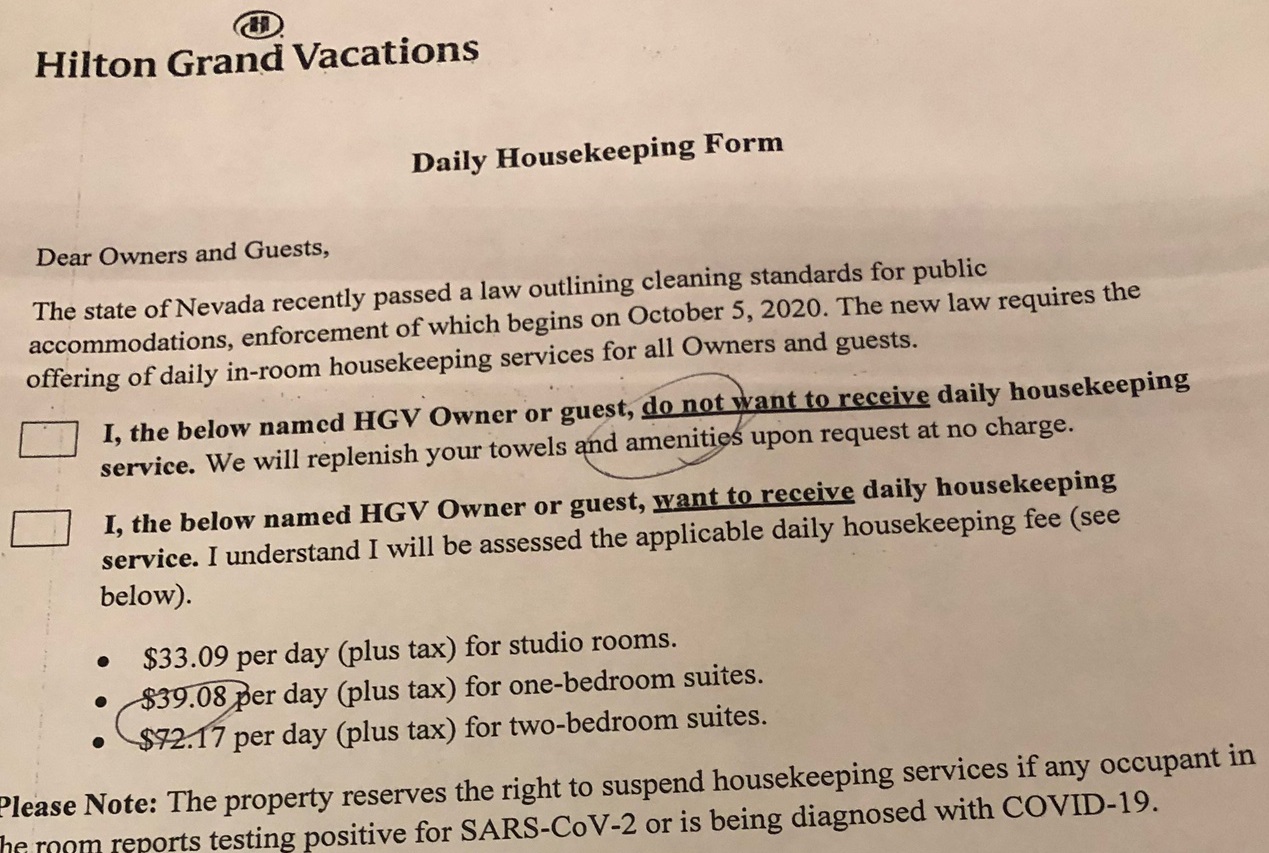

The image you use in point #5 is misleading. I own a Hilton timeshare in Las Vegas. Housekeeping in a Hilton timeshare unit was never a daily thing like at a hotel. If you stay less than 4 nights you won’t get it at all. More than 4 nights and you get a mid week tidy that usually gives new towels and a change of bed linens. After Covid the state of Nevada requires daily housekeeping, but since Hilton timeshares have never offered it, they really aren’t taking anything away from guests. I believe other timeshare companies also do not offer daily housekeeping. In order to adhere to the law, guests have to opt out of the service, which is the image you included. That is not to say that these companies aren’t reducing services, just that the example you used isn’t really reflective of that trend.

Thank you for warning people about timeshares Gary. They work for a very few people but most people tend to have massive buyer’s remorse.

I’ve been to a couple presentations and have gotten some nice stays. But no more at this point. And definitely not Mexico

We own quite a bit at Disney.

In 2098-9 they were giving them away in the resale market.

Bought Grand Californian in 2010 when it came on the market at $100 a point. Now well over $200 plus we’ve used 14 years of stays in rooms that can go up to $1000 a night.

One of the best investments we ever made, and an inflation hedge.

I’m one of the

Timeshare presentations can be a great deal, as long as you know how to say “NO” and are committed to “NO”. We’ve had some great, very cheap vacations by sitting for a presentation for a couple hours. The best one was a Marriott timeshare next to the J.W. Marriott on Phuket (Thailand) – we got a very nice two bedroom place for three nights for a total of $99, and the presentation we had to sit through was only 2.5 hours.

I think, even if you are someone who would love to go to a timeshare in the same set places every year you’d be better off just paying cash but beyond that if you had your heart set on “owning” a piece of paradise I’d think a fractional ownership in a traditional condo or house would be a better investment. To me it’s not even the cost of the timeshare it’s the ever increasing fees and maintenance that is designed to take more and more of your money. It’s like a bad HOA on steroids with for-profit owners controlling it.

Apologies if i missed this in the discussion. What stops from buying a resale at bargain basement prices into a corporation you own or set up for real estate holdings (not a lawyer or accountant, so don’t know which would be best feasible or legal ) that you could walk away from if no longer of use to you for any reason.