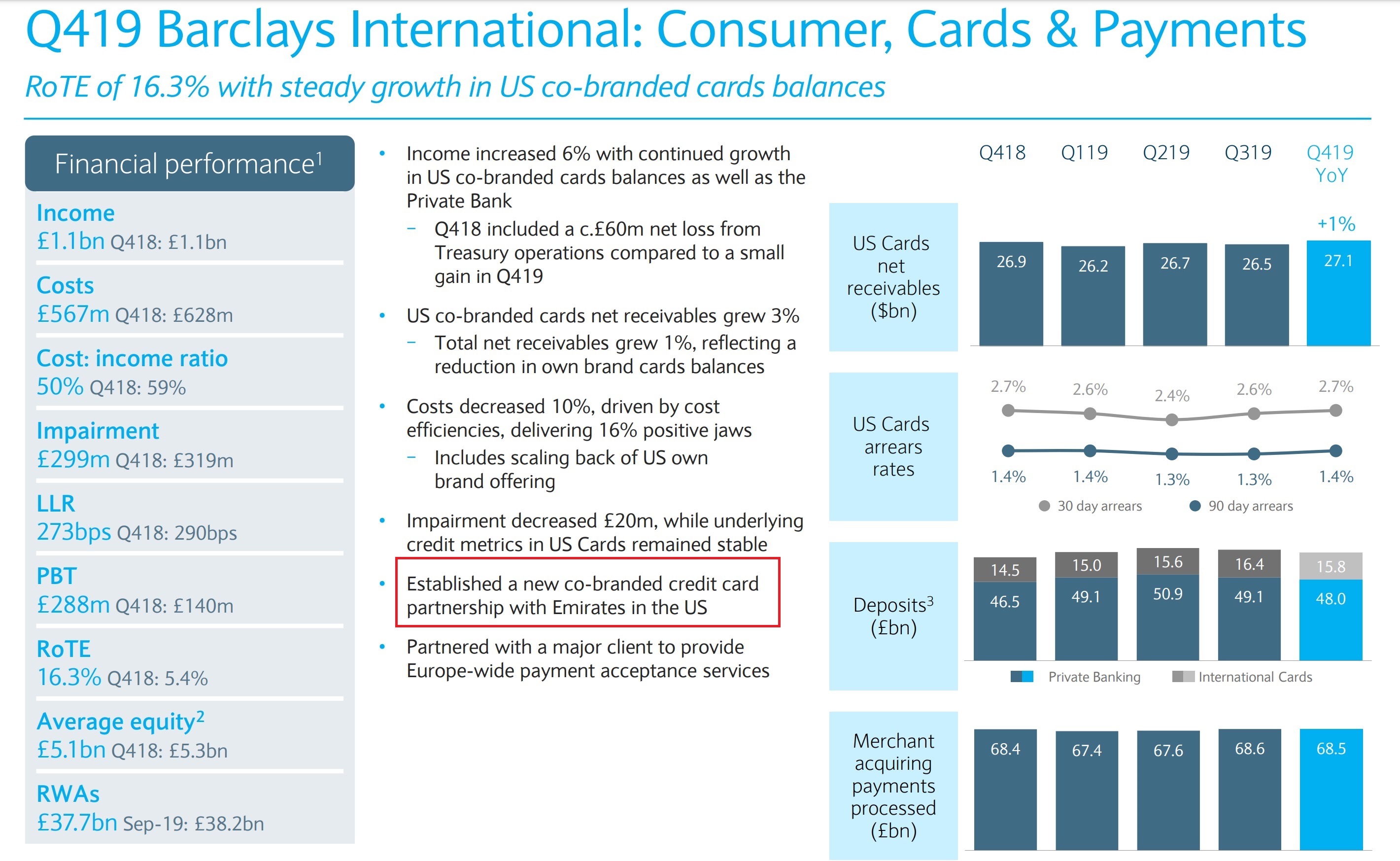

Barclays shared in its fourth quarter earnings call that they’ve launched a U.S. co-brand credit card partnership with Emirates. They haven’t released details of the card, but we should see applications starting this year.

Emirates Skywards is a transfer partner of American Express Membership Rewards, Chase Ultimate Rewards, and Capital One. That means, in order to be attractive, an Emirates card from Barclays would need to:

- Offer faster earning on Emirates than customers can get taking a Chase or American Express card and transferring points to Emirates. Even at the same level of earn, a more flexible currency makes sense to accumulate because you can transfer to Emirates or somewhere else.

- Offer valuable Emirates travel benefits that goes beyond priority check-in and boarding. There have been rumors of potential lounge access benefits, but again to be attractive card perks need to extend beyond giving cardmembers something that they can only exercise while flying economy.

A simple “3-2-1” value proposition that’s become in vogue – 3% back on the brand, 2% in a related category designed to get customers to use the card every day, and 1% on other purchases – will be insufficient to make this card top of wallet even for those who want to accumulate Emirates miles since other bank cards will earn Emirates miles faster as well as offering greater flexibility.

Emirates itself offers great award availability from a variety of U.S. destinations, however fuel surcharges (which depend on the destination flown) are often very expensive and premium cabin awards are priced at 2x coach for business class and 3x coach for first class.

Take for instance New York JFK – Bangkok (via Dubai).

- 95,000 miles roundtrip for economy plus $738 in taxes and fees

- 190,000 miles roundtrip for business class plus $1736 in taxes and fees

- 285,000 miles roundtrip for first class plus $1736 in taxes and fees

The airline offers a great product. They have some interesting airline partnerships. And they serve a number of U.S. gateways. To make a U.S. co-brand attractive they could take a lesson from the Chase British Airways card and offer a statement credit towards taxes and fees on redemptions each year, as well as offer fast mileage-earning and progress towards elite status along with upgrades on the airline.

Having miles not expire would also be a nice perk.

Not buying it. The fuel surcharge should be the same for all classes.

@Kirk – that’s not how it works, it’s also called a carrier-imposed surcharge not a fuel surcharge… but if it were fuel… premium cabin seats take up more real estate on the plane and you’d apportion more fuel as a result.

What’s wrong with carrier imposed fees is that fees for redemptions are higher than fess for cash seat on same flight. It’s a simple devaluation of the award and dishonest

Man… I wish someone would do a Shangri-La credit card in the US. C’mon AMEX.

Monster carrier imposed scamcharges? I’ll pass on this one.

Unless the card at least waives/credits the high cash surcharges to use Emirates miles on Emirates flights or grants discounted and easy upgrades on Emirates flights, I doubt that I would see any reason to get this card in the current environment.