Delta has suspended share buybacks and is reducing pension contributions. They have instituted a hiring freeze and are offering voluntary leave to employees with an eye towards reducing staff count through retirement. They are “[p]arking aircraft, and evaluating early retirements of older aircraft.”

They’re also starting to implement $500 million in capital expense reductions. (This will not affect LaGuardia or LAX). Delta notes that this is just after 10 days and if things get worse they’ll go deeper. Presumably this means looking at deferring aircraft orders.

During the financial crisis and Great Recession airlines pre-sold large volumes of miles to their credit card issuing banks (depending on the airline $500 million to a billion). Delta hasn’t considered that yet.

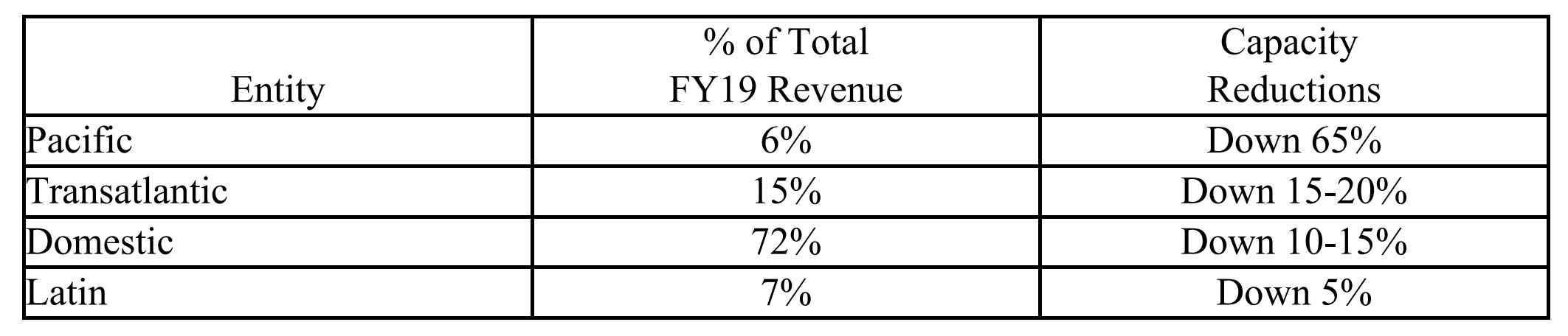

Internatioanl flight capacity is being reduced “20-25%” which skews even greater than the 20% number United has already disclosed. They’re reducing domestic capacity by “10-15%” which is greater than the 10% United has disclosed.

Here is how it breaks down by region:

Delta describes the drop in demand so far as regional, domestically centered on the coasts. Demand isn’t down as much for Latin America.

The airline points to $20 billion in assets, and a $40 billion baseline for revenue, they don’t see issues holding $5 billion in cash and liquidity risk.

65% capacity reduction to the pacific? Holy hell, is that right? Any reference?

Since the CDC is recommended those 60 and above, I think you will pilots approaching 60 and those above retire. I predict 50 percent of the world’s airlines will collapse.

How you I see what Delta / KLM as reducing flights between Atlanta and Amsterdam in August or lower fares?

I fly to Amsterdam 3 times a year!

During the financial crisis and Great Recession, award miles were not gutted as they are now.

So, good luck selling large volumes of miles to their credit card issuing banks. Banks are not that stupid.

The world is experiencing what 9/11 did to US airlines. Expect Delta, United and Southwest share prices to take big hits

“During the financial crisis and Great Recession airlines pre-sold large volumes of miles to their credit card issuing banks (depending on the airline $500 million to a billion).”

The banks bought miles from partner airlines to help those airlines through the tough times and it was really helpful to the airlines. When times got better, the airlines responded to the help by putting the squeeze on the same banks that had helped them when times were tough. Even though the banks didn’t do this out of altruism but as a prudent way to help a partner, they got screwed in return. If those airlines now go back for help again, I hope the banks renegotiate the terms to be a lot less skewed than they are currently.

During the 2008 financial crisis it was the financial system itself which was the cause of the issue. In that environment, discounts and promotions were somewhat effective at filling otherwise empty seats/beds.

This current slowdown driven by the virus will not be as receptive to similar tactics. It’s people’s concern about contagion which is driving the slowdown in travel. There are arguably few worse places to be when concerned about a virus pandemic than in an airplane or a hotel.

It seems to me the airlines and hotels will have a much harder time weathering this storm than the previous.

Hotels esp those in the Bay area will take a BIG HIT as the Princess cruise ship people are being taken to local hotels and motels vs AIR FORCE BASES for quarantine??? NUTS