I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

The rumors of a new Hyatt small business card are true, there’s a new World of Hyatt Business Credit Card. I use The World Of Hyatt Credit Card quite a lot, so I was looking forward to seeing what they developed for a small business card.

The Hyatt program is smaller than many of Chase’s co-brand partners, but it hits above its weight because it’s a good program and members know it. A small business card is going to be a small slice of the smaller program pie. But Chase has been willing to do smaller portfolios – we’ll be seeing the Air Canada U.S. credit card soon, they are introducing an Instacart card.

By narrowcasting it’s possible to really target what a small group of consumers want, delivering things that group values without spending to build a card that delivers well for everyone. In other words it should be possible to deliver greater subjective value at lower cost. That was my frame as I walked into an event Chase and Hyatt hosted to announce the card.

Hyatt Senior Vice President Amy Weinberg and Chase President of Co-Brand Cards Ed Olebe

Hyatt Small Business Card Initial Bonus

The World of Hyatt Business Credit Card has the biggest points-based initial bonus offer I’ve seen for a Hyatt card: 75,000 points after $7500 spend within 3 three months from account opening.

In addition cardmembers who apply by December 31, 2021 receive a complimentary one-year Headspace mindfulness and meditation subscription ($69.99/yr value). Not my thing (I last closed by eyes and just sat for a few minutes in September 1996) but will be valuable to some.

Small business cards often have bigger up front bonuses – with bigger up front spend requirements to earn those bonuses – because businesses do often spend more, and acquiring a business that uses the card is valuable and worth the up front investment. And 75,000 points is similar to the Chase offer on the Ink Business Unlimited® Credit Card and Ink Business Cash® Credit Card.

Hyatt Small Business Card Points-Earning

The card offers 4 points per dollar on Hyatt spend, 2 points for fitness club and gym memberships, and an “adaptive accelerator” where additional 2 point categories change each quarter to match where you’re spending the most.

Through December 31, 2022 the card will earn 2 points per dollar in the top 3 of 8 categories you spend the most in each quarter: dining; airline tickets purchased directly with the airline; car rental agencies; local transit and commuting; gas stations; internet, cable and phone services; social media and search engine advertising; and shipping.

Starting in 2023 the card will award 2 points per dollar in the top 2 of those 8 categories. So you might think of the third bonus category as part of the initial bonus category, or additional up front investment they’re making to build out the customer base from zero. Hyatt Senior Vice President Amy Weinberg mentioned we might expect them to layer additional promotions later as the third bonus category falls away.

The Hyatt small business card earns just two points per dollar in these categories versus four points with Amex, but doesn’t cap earning (Amex awards bonus points on the first $150,000 in eligible spend).

Elite Status

The card does not come with any elite nights automatically. However it does come with the first tier of status in World of Hyatt (Discoverist) as well as the ability to gift up to 5 Discoverist statuses (status recipients do not need to be authorized cardmembers on the account).

Discoverist status primarily gets you a 10% bonus on points-earning with Hyatt; MGM M Life Pearl status match (free self-parking, buffet line); 2 p.m. late checkout outside of resorts. One of Hyatt’s two major weaknesses in my view is that, while top tier Globalist is the best broadly-available hotel elite status, its levels below that aren’t competitive. Discoverist really just means modestly late check out.

Spending on the card for elite status is more lucrative than with The World Of Hyatt Credit Card, though (which earns 2 elite night credits for each $5000 spent): the World of Hyatt Business Credit Card earns 5 elite qualifying nights with each $10,000 in spend on the card in a calendar year. That’s 25% more elite credit per $10,000 spent, though of course you may strand more spend reaching for it than when elite nights are awarded in $5000 spend increments.

Additional Key Benefits

Each anniversary year cardmembers receive $100 in Hyatt credit in the form of two $50 statement credits (spend $50+ at a Hyatt property and receive a $50 statement credit up to two times each anniversary year).

Spending $50,000 or more on the card in a calendar year entitles cardmembers to receive a 10% rebate on points redeemed for the rest of that calendar year. I asked Amy Weinberg how this rebate will play with the unofficial annual redemption rebate offers Hyatt has run for the past half dozen years, and they’ll stack. Moreover don’t expect this to replace those as she offered we’d “continue to see annual points back offers.”

This is going to really incentivizing putting spend on the card early in the year, whereas it often makes sense to put spend for elite status on a card later (once you know how many elite nights you’re short for status). That’s because only stays consumed after your $50,000 spend posts, but before the end of the year, are entitled to the rebate, up to 20,000 points per year.

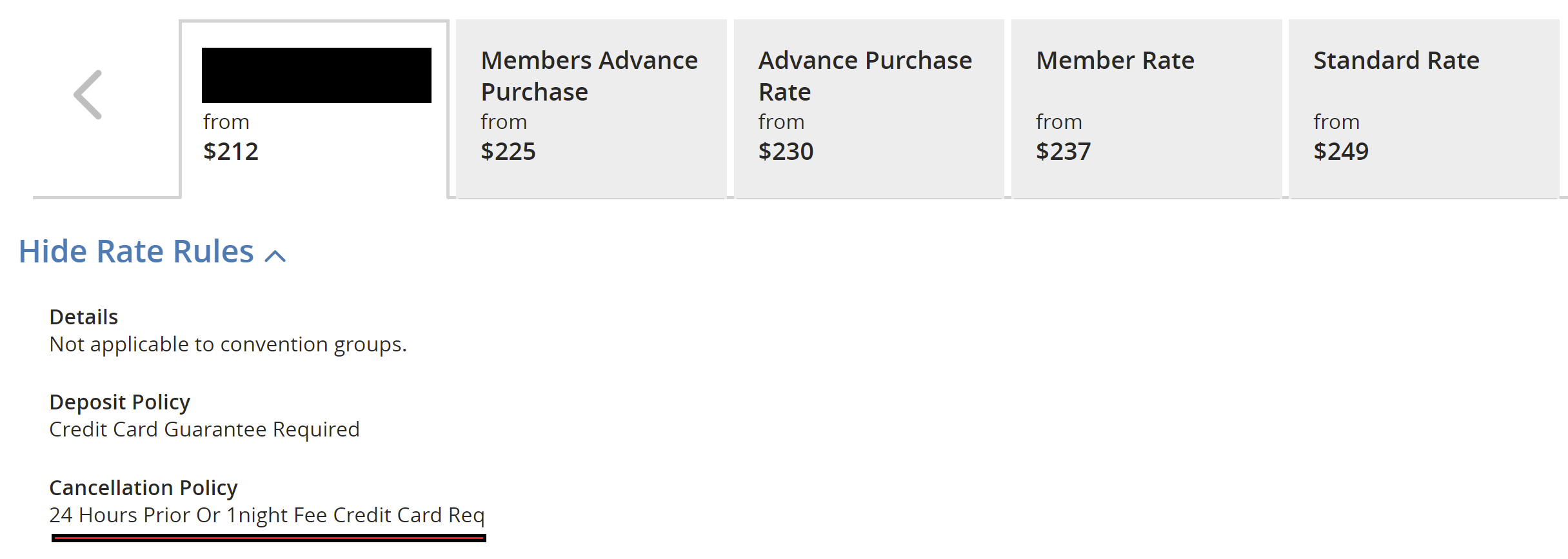

The Hyatt Leverage program is a small business room discount program that provides legitimate savings on stays (can be cheaper than member advance purchase rate or AAA rate without advance purchase), and its terms say you need to credit 50 nights a year to remain in the program so having the card is a great way to access it at lower volume since the 50 night requirement is waived for cardmembers.

Unlike many Citi and Barclays products, premium Chase cards still come with strong protections and this one has:

- Primary rental car collision damage waiver and complimentary roadside dispatch

- Purchase protection and extended warranty protection

- Trip cancellation/travel interruption insurance, travel and emergency assistance services

Naturally there are no foreign transaction fees. Chase learned a long time ago that travelers go abroad and don’t use cards with foreign transaction fees. Then when consumers return to the U.S. those cards tend not to return to top of wallet.

Is The Hyatt Small Business Card Worth It?

This is a well-rounded small business card with a lot of value. And of course there’s no question the card is worth getting, the initial bonus offer alone is surely worth $1000.

Although I like to think in terms of for whom is this the best possible product choice and that is going to be someone looking to use credit card spend to earn Hyatt status, since the card earns elite nights faster than the consumer co-brand does.

The card has a $199 annual fee. There are no annual category 1-4 free nights to make the card worth keeping on their own. But for a Hyatt customer the $100 in statement credits each anniversary year goes about halfway towards covering the second year’s fee and beyond. Those spending for status will also likely earn the 10% rebate on redemptions, and if you redeem 71,000 Hyatt points and get 7100 points back you cover the other half based on my last valuation of Hyatt points.

Staying in the Leverage program alone can drive real savings to small businesses that use Hyatt. For overall points-earning though Chase’s own Ultimate Rewards cards will frequently generate more points for your spend, and points from their premium cards can be transferred to Hyatt or other program partners.

Expect Chase only to approve folks who have had fewer than 5 new cards in the past 24 months but that getting approved for this card shouldn’t add to your “5/24” total.

Gary — how does it earn status more quickly if it takes $10k to earn 2 nights but the consumer card is $5k?

I second Larry’s question. Based on the information in the article, the headline about elite status makes no sense.

I think Gary meant to say five instead of two. Which makes sense since it would be 25% quicker

It should read

For every $10K you spend in a calendar year you’ll earn 5 tier qualifying night credits

Weak in my opinion. Will stick to a 2 point/ $1 spend spark card for general spending and AMEX gold for 4/$1 categories. Hard pass.

Gary – did they mention anything about 2022 status requirements or a Q4 promo?

Even earning 5 elite nights per $10,000, the business card is worse at earning elite status until you reach $50,000 of spend, since it doesn’t give 5 elite nights like the personal card does. At $50,000 they’re equal and at $60,000, the business card inches ahead.

I don’t see a downside here as anything that makes hitting 60 night a year easier or earns Hyatt points/ nights is good enough for me. We’ve been Diamond/Globalist for 6 years and we’re beyond hooked. Have to be creative and game the system to get there each and every year, but so worth it. Redemptions are a fraction of other chains and the upgrades, service and perks are unbeatable.

Did I misread this or is there a type here: “Spending on the card for elite status is more lucrative than with The World Of Hyatt Credit Card, though (which earns 2 elite night credits for each $5000 spent).

The World of Hyatt Business Credit Card earns 2 elite qualifying nights with each $10,000 in spend on the card in a calendar year. That’s 25% more elite credit per $10,000 spent, though of course you may strand more spend reaching for it than when elite nights are awarded in $5000 spend increments.”

I feel like you mean to stay the Business version offers 5 elite qualifying nights per $10k.

Also, while there may be a small business segment this card is made for, a premium Hyatt card ($450+) would have been much more exciting. I was holding out to see if that was on the horizon, but I think I’ll get the Marriott Brilliant for current bonus.

Ah — five nights for $10k spend. Makes sense. Yeah, so the break even on elite nights versus the consumer card is $60k to get ahead. For someone who wanted to spend all the way to globalist, this card would require $120,000 and the consumer card $137,500 (though if you need 60 nights with spend why do you want Globalist?) I think this card likely would earn more points along the way given the 2x categories. For me, I think the higher annual fee and no category 1-4 cert annually or for spend make the consumer card better for me. Not counting toward 5/24 is certainly a nice feature, and I think Gary has the calculation right — if you can get to $50k fast in the year and have people to give Discoverist to it is worth it.

So if I have the personal card which comes with 5 nights and get this card, will spending $10k for 5 nights give me 10 towards elite status?

@ Gary — Mark me unimpressed, although I do like having another business card for which to apply without adding to my 5/24 counter.

For the personal card 10K spend gets you 4 tier credits, this one gets you 5 for the same spend. The 75K bonus is fine. Overall this card makes sense if you have a business and use Hyatt. You can still hold the personal card. Its not a hard pass for me because overall the value is fine. As many want to maintain status as we come out of Covid this can be helpful. No tier credits from holding the card is a little weird.

Meh. I have a lot of Chase business cards and love Hyatt but don’t see this as compelling. There’s just too many caveats, like the 10% rebate. That sounds great until you read the fine print about spend, non-retroactive, and very low rebate limit. They offer something then go out of their way to make it much less worthwhile.

So, here’s a question. I have nights booked on points for next spring (Hopefully covid will not preclude us from going).

If I get the Hyatt business card and put 50k spend on before we stay in the Hyatt on points will I be eligible for the 10% rebate? We’re talking about 25000 points here, so it’s interesting.

.

Any chance a nugget about Q4 promo and/or 2022 status was to be found or was this strictly a plastic pimping event?

Limit on 10% points rebate makes this a pass for me. The other marginal benefits aren’t there. 12k net points after offsetting annual fee is basically the same as cat 1-4 cert on the personal card. The marginal benefit of 1 extra elite credit night per 10k spend isn’t going to move the needle in a meaningful way.

Maybe if I was an actual business owner and not just a sole proprietor hustler. 🙂

I agree with others they needed a card to go after the Premium

Amex bonvoid Brilliant crowd

Hyatt is lost here out of it.Not in touch at all

This is a sign up offer deal and then move on in year 2

My 49 dollar a year ihg chase card gives me a 10 % rebate on points without spending

One dollar a year let alone 50 k lol WTF

And a 200 dollar fee

Business card equals the new WOH dud card

Note that with consumer $95 fee card you will be getting 2 Category 1-4 certificates (equivalent to 30K in points) and 11 qualifying nights. With the business one you will be still at 5 qualifying nights and no additional certificates/points. Even if you you hit $50K in spending for the year your 10% redemption rebate is capped by 20K points, i.e., $10K short of the value of the two certificates you receive with the consumer card. Finally, qualifying nights with the Business card come in 5 night increments vs. 2 night for the consumer. So one can “fine tune” the spending with the consumer card better.

When you apply for this card, one of the certifications state that ALL expenses must be for the business and not for personal and/or household expenses. Not sure how they would know the difference, but I am not interested in certifying to that when many of my expenses would need to be personal in order to hit the $7500 spend in 3 months.

I can’t get this card because I don’t have a business. Anybody in PHL want to open a business with me?

Boring. Chase mentality these days is to give nothing in return for AF (see Chase CSR) which is opposite of Amex coupon-book strategy. This is obvious when Gary can’t justify the AF unless you redeem a lot of points.

I give this card a D+